Enterprise venture funding continues to be on 🔥 and accelerating again. From the late stage with recent financings of Gong (see below) and Coda to the super early stage, things seem to be moving even faster than a month ago. This, of course, lies in stark contrast to the reality of the world as Covid continues to spread with no signs of slowing down.

This was pre-meet week for YC founders and based on what I’ve seen, it’s going to set up for an interesting demo day in ten days. If you’re an enterprise founder in YC, this is what you’ve most likely been doing all week with VC term sheets.

|

Lots of Tier 1 full stack venture firms are dropping term sheets at record pace with many interesting founders who will all require lots of company building help. And writing $2m checks for a large fund who manages a few billion $ is not the same as a seed firm who does the same. Which leads me to my next point - with so many rounds moving at such a rapid pace, it’s imperative for founders to choose wisely and remember to optimize for the best partner who will be with you for the long run and through the inevitable ups and downs and pivots in the early days. The Zero to One 💪🏼 is so much different than the One to Ten.

As always, 🙏🏼 you listening to my rants and ideas, and have a wonderful weekend during these last few days of summer!

Scaling Startups

👇🏼Must listen with Dev, CEO of MongoDB - “when you marry a great product with a great gototmarket organization, magic happens”

Rippling’s deck for it’s most recent Series B, $145m raised at a $1.35 billion post

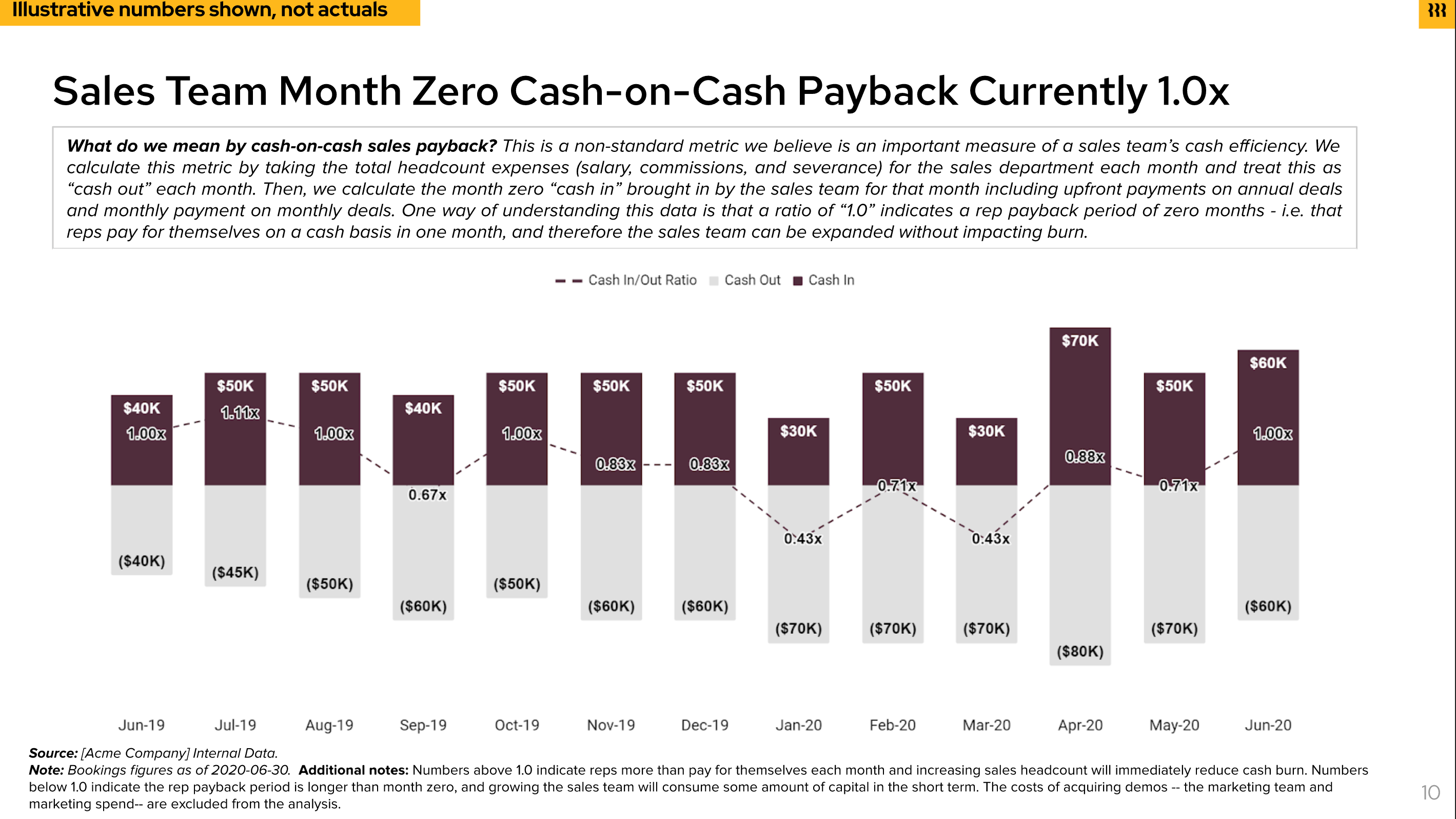

One non-standard metric we created and use at Rippling is the sales team’s month zero cash-on-cash payback. It’s a useful measure of a sales team’s cash efficiency — we describe it in detail in the deck so you can plug in your own numbers.

This is an incredible number - rep payback period is 1.0 meaning they pay for themselves on a cash basis in one month.

Enterprise Tech

Figma launched its community this past week and allows user to create their own plugins or publish files that anyone can duplicate and remix. While in and of itself, it may not be interesting, there are some important lessons for founders.

It takes time to build a platform and the best way to do so is to focus on one user and how you can make their lives 100x better with your software and then without. Then teams and then orgs. Once you have critical mass, its time to truly kick in enterprise moats that are long lasting, unlike features, which are data based or community based or platform based. Here Figma is turning its massive customer base into a community and platform which will create further lock-in on their product. Brilliant execution and sequencing!

Just started reading Nadia Eghbal’s book (head of research Github) about The Making and Maintenance of Open Source Software - some amazing tidbits in there about the true nature of what an open source community is. Devon Zuegel, product lead for GitHub Sponsors breaks it out into more detail if you want to skip the read.

As we’ve settled into our remote world, the sales intelligence stack has gotten 🔥 as Gong recently raised $200m at a $2.2 billion post, 8 mos after closing a Series C.

Gong helps revenue teams make decisions based on data-driven insights. Frustrated with how little companies understood about their customer patterns, CEO Amit Bendov co-founded the company with CTO Eilon Reshef. Too many decisions were driven by anecdotes, he said.

This is on the heels of Chorus.ai, it’s main competitor, raising $45mm in 2 weeks ago!

The pandemic has only accelerated the embrace of AI platforms like Chorus, which had seen its revenue triple and workforce double in 2019. The company said among its over 200 customers — including GitLab, Zoom, Adobe, MongoDB, and Qualtrics — there’s been a “substantial” increase in calls about payment terms and packaging, underlining the need to train reps to navigate critical questions.

Markets

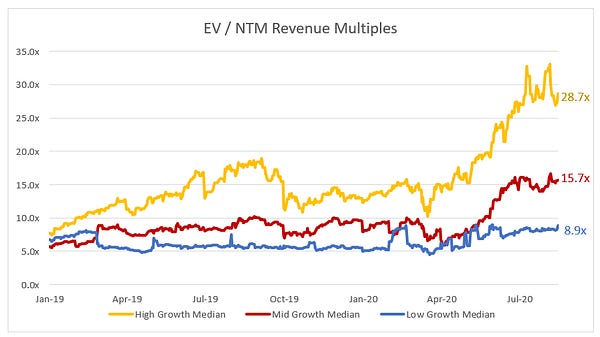

Jamin from Redpoint reminding us where we are from a couple weeks ago - still incredible multiples…

Asana, project management and collaboration software, readying for a direct IPO listing in September (The Information)

As of July, Asana was projecting it would boost revenue to $236 million for the 12 months to January, from $142 million in 2019, according to an investor in the company. Next year, Asana projects revenue will grow 51% to $355 million. The projections underlie a doubling of Asana’s valuation on the secondary market for private tech stocks to $5 billion since January.