Bitcoin fell by 13% after Elon Musk tweeted that its prices "seem high": - **Despite Bill Gates and US Treasury Secretary Janet Yellen** joining Musk in criticizing Bitcoin, the cryptocurrency is up over 80% this year. Founders considering accepting

Bitcoin fell by 13% after Elon Musk tweeted that its prices "seem high":

-

Despite Bill Gates and US Treasury Secretary Janet Yellen joining Musk in criticizing Bitcoin, the cryptocurrency is up over 80% this year. Founders considering accepting crypto payments should know that there is no fraud protection covering the transactions.

-

TikTok and Instagram may be adding affiliate programs which will make it easier for companies to work with influencers. Tracking influencer promotion results has long been a pain point for advertisers, and these programs aim to address that issue.

-

ClickFunnels, a bootstrapped SaaS company for managing sales funnels, just hit 9 figures in annual revenue. No-code sales funnel platforms are blowing up right now, and apps like Drip and Groove Funnels are riding the wave alongside ClickFunnels.

Want to share your ideas with nearly 70K indie hackers? Submit a section for us to include in a future newsletter. —Channing

💸 Bitcoin Prices Decreased by 13% Following Remarks by Musk, Gates

from the Indie Economy newsletter by Bobby Burch

Bitcoin prices decreased by 13% after Elon Musk tweeted that they "seem high." Musk joins Bill Gates and Janet Yellen in directing critical remarks towards the cryptocurrency. Still, Bitcoin is up over 80% this year. But does accepting Bitcoin benefit founders?

What is a cryptocurrency?

Crypto 101: Cryptocurrency is a digital currency created by cryptography. Cryptocurrencies are not physical or issued by a central authority, like a bank. They use a decentralized network and work through a distributed ledger known as a blockchain.

The no-background: Cryptocurrencies across the board have grown alongside Bitcoin's astronomical rise, pushing the total market value of all the world's cryptocurrencies past $1T. Bitcoin's rise represents the trajectory of what is speculated to be the biggest wealth transfer in history.

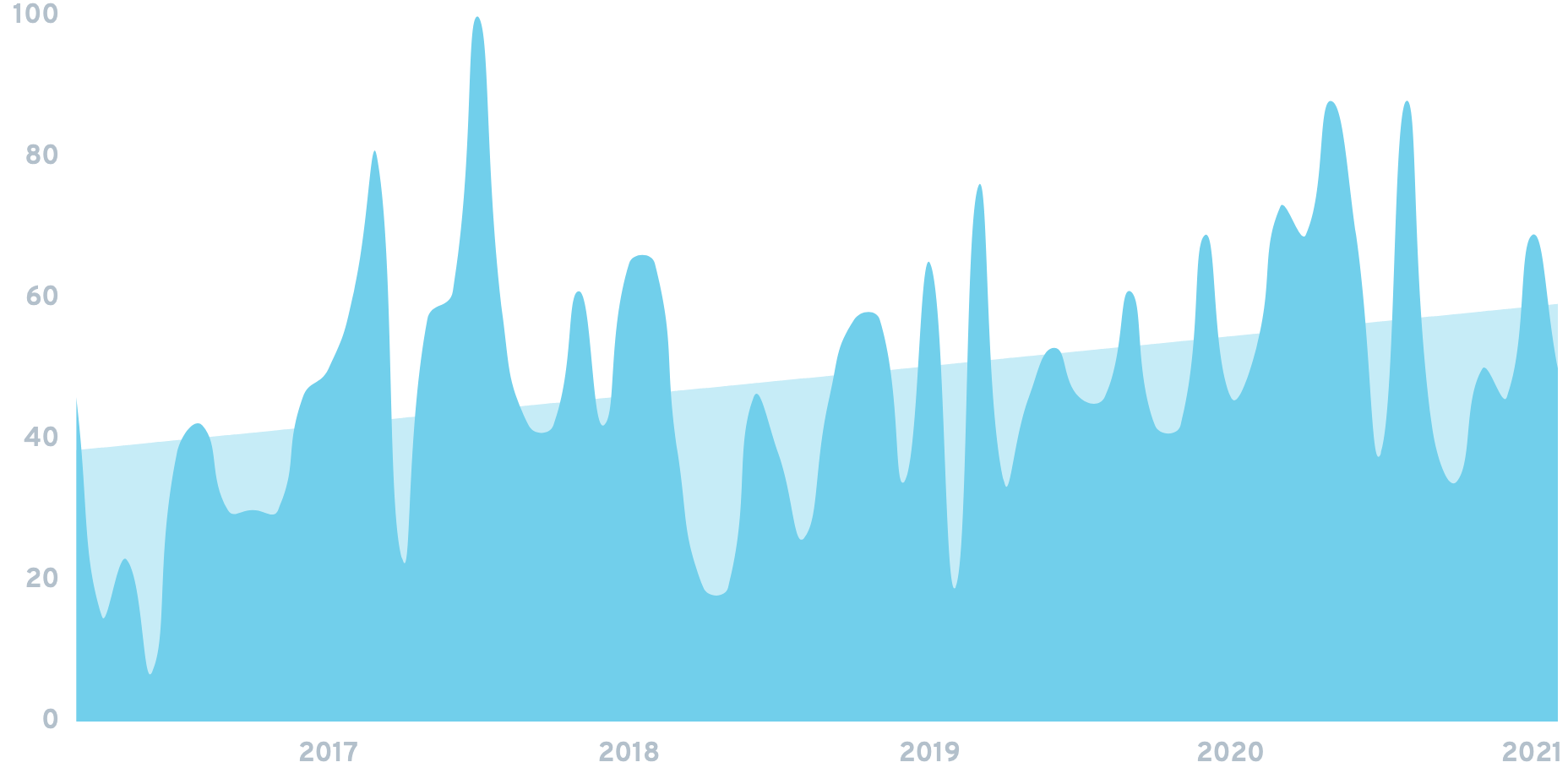

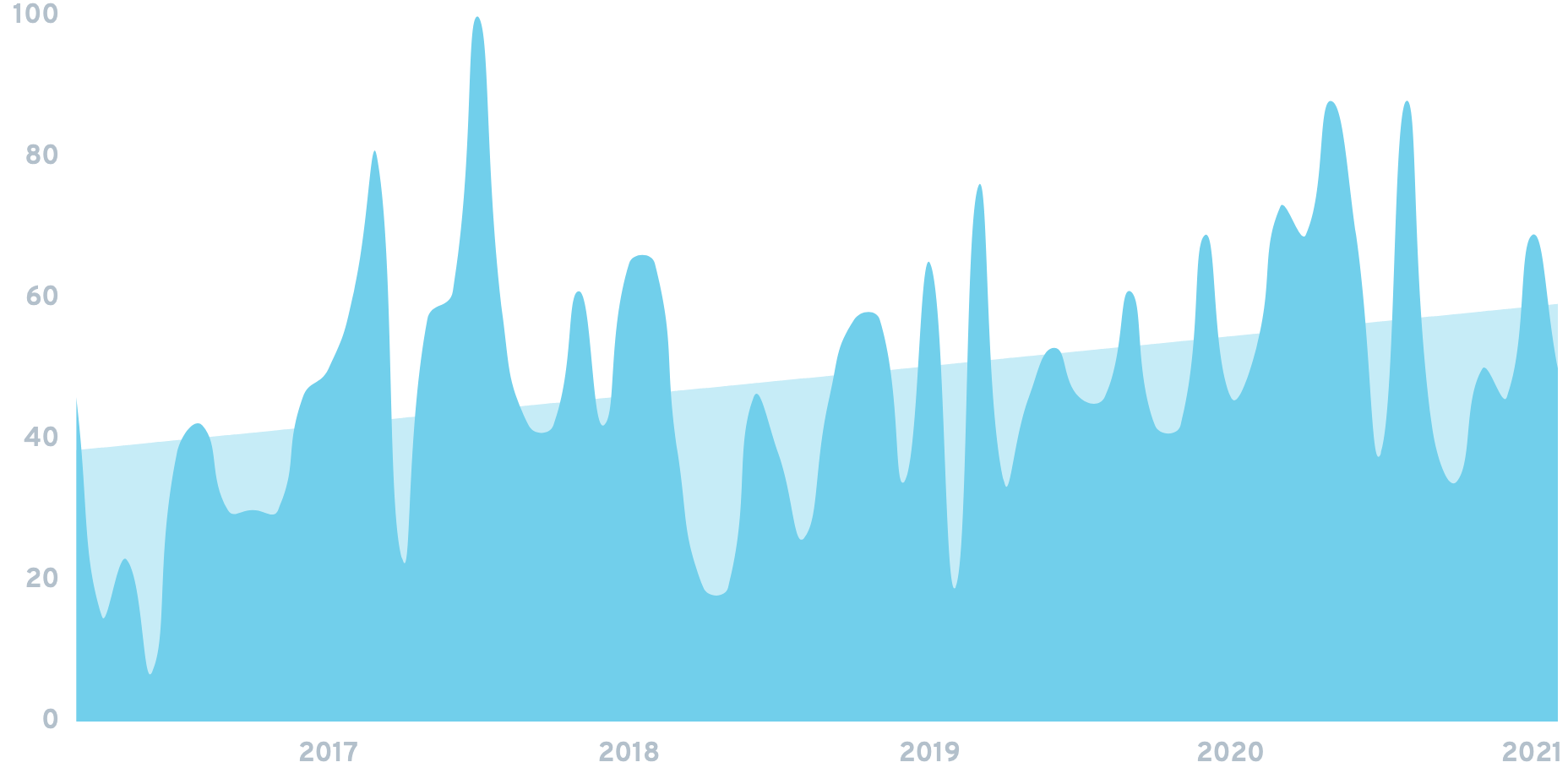

What's new: Bitcoin's value has skyrocketed more than 400% over the last year, reaching an all-time high of over $58K per Bitcoin on February 20. Bitcoin's market cap now sits at about $912B. As Bitcoin and other cryptocurrencies' value soars, mainstream businesses including PayPal, Microsoft, AT&T, and Wikipedia have begun accepting crypto on their platforms.

What can founders gain from accepting Bitcoin?

New customers: Accepting Bitcoin and other cryptocurrencies opens your business up to the burgeoning pool of crypto owners around the world. It's estimated that about 100M people own Bitcoin globally, and about 33M Americans own some form of crypto.

On Shopify, you can set up your checkout to accept payments with cryptocurrency. MasterCard also allows merchants to accept payments in crypto. Coindesk reports that PayPal will offer Bitcoin payment functionality in 2021, and Visa may also add crypto payments in the future.

Attract younger demographics: Demographics on crypto owners are hard to pin down since much of the data skews toward Bitcoin investors, but younger people tend to be more enthusiastic about the digital assets.

About 18% of people aged 18-34 own Bitcoin, according to a recent survey. 55% of those aged 18-34 said they are "very" or "somewhat" likely to purchase Bitcoin in the next five years, compared to 26% of those aged 35+.

Long-term assets: While receiving cash might be initially more appealing, most crypto traders view their cryptocurrency as long-term assets. You can, of course, automatically convert Bitcoin to USD or other national currencies. However, with their finite nature, cryptos have zero risks of inflation.

Lower transaction fees: Platforms like Shopify, Stripe, and PayPal charge anywhere from 2.9%-4.4% per transaction. That can really add up, depending on your revenue. With Coinbase or Bitpay, you can receive customer payments for about 1.49% commission.

The dark side of cryptocurrencies

As mentioned above, many Fortune 500 companies and big banks are warming to crypto. The list includes Microsoft, Overstock, Home Depot, Intuit, and many others.

Crypto exchange Coinbase, though currently a private company, may soon go public at a staggering $100B valuation. If it goes public, it with be the highest initial valuation of a US tech company since Facebook.

Tesla made waves when it bought $1.5B in Bitcoin and announced it would accept crypto as payment. This announcement helped boost the coin's value an additional 20% in the following days.

However, the recent criticism affecting the value of Bitcoin are reminders that cryptocurrencies are highly volatile assets that can drop 15% one day and jump 25% another. Those rapid changes may be too turbulent for some.

Also, many people still associate crypto, specifically Bitcoin, with its connection to funding illegal businesses. While its reputation has improved significantly over time, it could deter some people from doing business with you.

Lastly, and most importantly, there's no buyer protection for crypto transactions. Once you send crypto, it's gone. You can, however, use escrow services like Clearcoin to prolong the transaction until it can be verified, but this is not a guarantee.

Does your business accept payment in cryptocurrencies? Why or why not? Please share your thoughts.

Subscribe to Indie Economy for more.

📰 In the News

from the Volv newsletter by Priyanka Vazirani

🚘 Lyft has added a new feature that will allow riders in Florida to book a ride via phone call. The "Call A Lyft" feature hopes to attract senior citizens and others without access to the app.

🎮 Sony will release a next-generation VR headset for the PS5 soon. The company is also working on a VR controller for the console.

📱 Apple is recruiting engineers to develop 6G wireless connectivity in the race to position itself as a frontrunner in 6G technology.

🔥 Hyundai is recalling 82K electric vehicles after battery defects caused the vehicles to burst into flames. The move will cost Hyundai almost $900M.

⚖️ California won in US federal court with a ruling that the state can enforce its strict net neutrality law. The law forbids internet service providers from throttling traffic and blocking access to websites that don't pay for premium service.

Check out Volv for more 9-second news digests.

🎯 TikTok and Instagram May Offer Integrated Affiliate Programs

from the User Acquisition Channels newsletter by Darko G.

TikTok and Instagram may soon add affiliate programs. This will make it much easier to work with influencers on the platforms, and will take some of the legwork out of the process for brands.

The boost of affiliate programs

There have been clear signs that both TikTok and Instagram are preparing to add affiliate program infrastructure. The goal is for product owners to list products for promotion by creators on the platforms.

The no-background: When working with social media influencers, payment structures are one of the biggest pain points. Should you pay influencers upfront or do a rev-share? If you do a rev-share, how will you track the results? TikTok and Instagram realize that is a tough area to navigate on both ends; brands are sometimes unable to track results, decreasing the likelihood of them taking this path in the future, and influencers may be reluctant to enter agreements if payment frameworks are unclear.

Why get involved? The more brands and influencers that these platforms can attract, the better. If TikTok and Instagram can solve this payment problem, brands will find it more seamless to advertise there.

What this means for you: These two platforms have billions of users and millions of creators, so you can imagine the potential size of their affiliate network. If this happens, ideally, you'd be able to pick a list of suitable influencers, propose to run a small experiment where they promote your product in short video, and continue the relationship if you start getting sales.

Going viral on Twitter isn't worth much

A recent analysis concluded that Twitter exposure did not translate to sales.

Is Twitter overrated? I recently analyzed a study that found that the average engagement rate on a Twitter post was 0.08%. The big question remains: is there any financial ROI from being big on Twitter? In searching Indie Hackers for answers, I only found this post on how Dawid got 17 project inquiries after a popular Twitter figure replied to his tweet.

What this means for you: I've seen instances of people using Twitter successfully, but not as a social network. Instead, they used it as a search engine. Take Referral Rock ($70K MRR), and the road to their first 500 users:

I reached out to marketers or anyone that mentioned "referral programs." I would comment or favorite tweets from the Referral Rock Twitter account which listed a free referral program.

Unfortunately, I haven't seen many such examples where founders had consistent financial ROI results.

Shopify released a list of their acquisition channels

Shopify just published their Q4 financial results for 2020. Check out this interesting graphic from page 8:

These are the channels that Shopify uses to acquire merchants.

Notice how, the lower you go down the list, the more "sales" you see appearing as a channel? This is consistent with my Zero to Users analysis: the bigger the companies you target, the more you switch from marketing to sales.

What this means for you: If you want to target both SMBs and large enterprises, and are not sure about suitable channels for each, study this graphic.

What are your thoughts on these avenues? Have you achieved any ROI on Twitter exposure?

Discuss this story, or subscribe to User Acquisition Channels for more.

🤖 Idea Bot Beep Boop

from IdeasAI by Pieter Levels

Looking for a startup idea? I'm a GPT-3-powered business idea generator built by Pieter Levels. Here are today's top ideas:

To explore more ideas, subscribe to IdeasAI.

🏷 ClickFunnels Hit 9 Figures in ARR as a No-Code Sales Funnel Software

from the Exploding Topics newsletter by Josh Howarth

ClickFunnels, a bootstrapped SaaS company for managing sales funnels, just hit 9 figures in annual revenue. Funnel Software is an emerging field that can open new opportunities for indie hackers.

Automated sales funnels help customers make a purchase

Sales funnels are sets of predefined steps that lead a prospective customer to make a purchase. Funnel software is no-code software for creating these sales funnels.

The current leader in this space, ClickFunnels, is a bootstrapped business that recently hit 9 figures in annual revenue.

ClickFunnels is far from the only funnel software startup out there. Drip and GrooveFunnels are two other examples of growing companies in this space.

What's next: Funnel software is part of the "accessible martech" meta trend. Accessible martech includes marketing SaaS tools that don't require lengthy demos or live sales calls in order to try or buy the product. They also tend to have a relatively simple UI.

Check out the full post to see this week's other exploding topics.

And join Exploding Topics Pro to see trends 6+ months before they take off.

Discuss this story, or subscribe to Exploding Topics for more.

🐦 The Tweetmaster's Pick

by Tweetmaster Flex

I post the tweets indie hackers share the most. Here's today's pick:

🏁 Enjoy This Newsletter?

Forward it to a friend, and let them know they can subscribe here.

Also, you can submit a section for us to include in a future newsletter.

Special thanks to Jay Avery for editing this issue, to Nathalie Zwimpfer for the illustrations, and to Bobby Burch, Priyanka Vazirani, Darko G., and Josh Howarth for contributing posts. —Channing