The subtle limits of quant analysis in micro-acquisitions

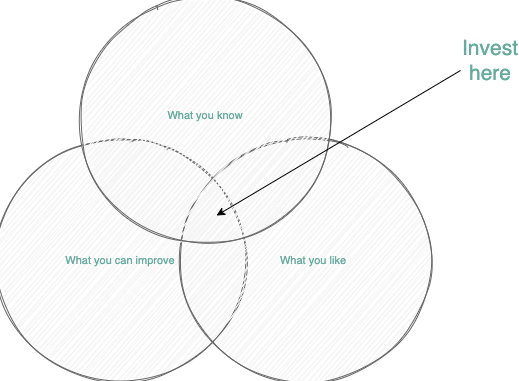

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! Any self-respecting investor drives the majority of their decision-making from the perspective that producing a positive return on their investment is a direct result of quantifiable value generation. For the past few months, I’ve focused much of my work as a microangel towards simplifying that decision-making process relative to the deal-flow I’ve had the chance to analyze. The first qualifier I look for might be product simplicity, but the next 20 are specific benchmarks of key product metrics, ranging from retention to ARPU to LTV and so on… This numbers-first style is a direct result of years operating as a growth engineer and conversion rate specialist, where creating growth feels a lot like implementing variables present in a calculator. As you fail at executing from the gut, you learn to fallback on data you can rely and build upon, which drives a more deliberate strategy and ultimately, a standardized process to unlock growth. But there are limits to quantitatively approaching the investments you intend to make. It can’t all be about numbers. It could, but something tells me it’s not a great idea. In fact, I’d wager it’s less about the numbers than it is about the qualities of the business you, as a unique operator, will be able to leverage to create value-add atop the business you’ve acquired. In the last 100 days, I’ve analyzed 89 deals. That’s nearly 1 deal per day, that’s insane! Never expected to do that, much less in the time I’ve managed to do it. As I look back at the 80+ deals I withdrew from, I feel something was left on the table by focusing too strongly on the quantifiable properties of the products I analyzed. Something that is less tangible and maybe even more important than the health of the business and the metrics that encompass it. Product/Microangel FitWhen I came across the listing for Reconcilely, something deep inside of me awoke and unquestionably recognized that this idea was something I wanted to focus upon. I was at the central intersection of my investor Ikigai circles:

Yet, the vast majority of my due diligence was spent on qualifying historical revenues, getting a strong understanding of what was driving ARPU, the relationship between revenue growth and revenue churn and what role expansion might come to play in between. When it was all said and done, I had spent more time on numbers than on the key characteristics of the business that I’d operate from. This led to a phase of self-learning, inefficiently pulling the seller for information on an ad hoc basis, and struggling to maintain the pace of the business throughout a busy tax season. A product is much more than the sum of its metrics and revenues. No two $50k ARR businesses are the same — even if they’re competitors. A company is people and people do things differently. Software products are the result of the organizational units that build them, and thus different organizations produce different software products by virtue of the DNA upon which the code is written. We write code to productize human processes so that our machines can perform them at scale quicker, more efficiently and reliably than we ever could. Likewise, the operational processes by which we create value for customers differ from product to product. This inherent quality means that the products you purchase come along with specific processes you’ll need to use and leverage to maintain & grow post-acquisition. Don’t discount the importance of these processes in your decision-making process. They could go counter to your nature. The way someone does business might turn you off from an acquisition much in the same way unimpressive numbers might. One of my biggest pet peeves while operating a product is not having an admin interface from which to manage my database entries. It makes no sense to be processing mutation queries on production database environments. It’s extremely dangerous and beyond that, horribly inefficient. Besides, I hate writing SQL by hand. You likely agree with this, but it’s doubtful you look into these types of things when looking at acquisition opportunities. I know I certainly don’t, not nearly enough, which means I could end up buying something that looks great, but is a pain to manage/run. But then there’s also a limit to the minutiae you’d want to deal with. Time is everything in micro-acquisitions, and the faster you can reach a binary decision, the better. This is why you should build an investment thesis that describes your strategy that balances the insights you’ve earned in a specific market that give you an appetite to invest in it. How does one balance the importance of numbers with the nebulous nature of operations? By focusing on fundamental truths. Fundamental truthsAcross the many dozens of deals I’ve looked at over the past 3 months, few exhibited what I describe as fundamental truths. These are clear indicators that describe and confirm a pattern as ongoing and unlikely to stop as a result of the acquisition. It could be something as large as stable L12M traffic numbers or as simple as the existence of an admin panel from which to service existing customers. They are variables that become constants. Fundamental truths exist both in terms of how the business has performed numerically, but also operationally and the paradigm within which you’ll be expected to operate the product. The language and framework used to write the product’s code is a fundamental truth. It doesn’t change, but it has an impact. If I don’t know PHP and am interested in purchasing a product written in PHP, this is a fundamental truth I am choosing to ignore despite the inherent disadvantage it will provide. The deliberate choice to ignore a fundamental truth is made possible by the existing of that truth, and the value of those as an investor is beyond anything you’ll be able to perceive from numbers. The rate of technology adoption is another truth. If you’re buying a product in a commoditized market, your ability to drive customer acquisition will be directly impacted by how your describe and price your value proposition relative the rest of the market. If instead the product is in a hot market, you can rely on the truth that there exists an accessible audience of highly passionate, price inelastic individuals driven by a large force that carries you. The Devil You KnowThe entire point of acquiring a product over building it from scratch is to bypass the painful 0 to 1 phase whereby you figure out your value prop, your model, go to market, and find market fit. In the same way you’d (hopefully) never start something outside of your sphere of knowledge and experience — your Ikigai circles, if you will — ensure you do the same with the properties you acquire. With the amount of leads you can analyze across marketplaces and outreach, it can be tempting to step outside of your zone of comfort in an effort to access an otherwise must-take deal. But in doing so, you’d sign up to operate a business you potentially don’t understand, with fundamental truths you may not know how to interpret, and a market whose pains you haven’t felt or connected with. Don’t do that! I briefly touched upon this in a short podcast featuring Andrew Gazdecki and myself, where we explored MicroAcquire, MicroAngel and the journey of buying software products for freedom and profit.  Healthy side-steppingThere’s likely a healthy margin for microangels to side-step so long as fundamental truths are still present and plentiful. What you want is to cast away any doubts you might have about how to execute your growth plan, and your understanding of the product context is key in reaching that mind state. As an example, I’m focused on Shopify apps for MicroAngel Fund I, but I’ve come across many amazing non-Shopify app deals over the past 3 months. I’ve come close to making offers on many of them, and didn’t on the simple basis that they were not Shopify apps. As I look back, my gut says I limited the fund’s scope too tightly. This perspective only exists after 3+ months of scouting specifically Shopify apps. At the time of this writing, there are only 5,870 apps on the Shopify app store. It’s not a huge market, when you consider how deep down you have to go in order to find good deals

That got me thinking: where do I go from here? What happens if and when I exhaust this entire inventory? Do I wait? Do I build new ones on my own? Do I invest my remaining funds into my existing portfolio? Should I open my investing to Wordpress and BigCommerce apps? What about pure SaaS products? That leads to the healthy margin: it’s obvious I need to side-step, but how much is in pure correlation to my experience and skillset. I’ve spent a solid chunk of my career focused on B2B growth marketing, using cutting edge marketing automation technology to deliver timely, personalized and optimized campaigns that drive customer success and MRR. In doing so, I’ve developed a style and opinion on how to execute marketing automation strategies and the features that I’ve come to expect to execute upon that. Several of the deals I’ve passed on were marketing automation software that were not built for Shopify. I could certainly aim to acquire them and release Shopify plugins, but that is a lot of work that introduces totally new complexities and variables that I wouldn’t want to base my investment upon. But it would be much better to trust and follow the process of buying simple apps that don’t have much support burden and throw off high-margin profits serving a market I know and can reach. In that broader definition, I might focus most of my energy on identifying Shopify apps, while still being open to acquiring something outside of that scope. That should be fine on the merits of the qualities of the business, and how likely I would be to produce 2.7x over 2 years between cashflow and return at exit. This exciting learning means I’ve been going back into deals I’ve withdrawn from and trying to reactivate them in case the sellers are still interested in exiting. But it also means I’ve loosened up my investment scope to better take advantage of the most important element in acquisitions, which is what I’ll do after the purchase, and how well I’ll be able to do it. In that scope, my addressable market amplifies and so too does the number of products I can talk to and consider for acquisition. At the moment, I have a few Shopify apps in the pipeline, but I’m also excited to be exploring an opportunity in marketing automation and another in social analytics. I’ve noticed non-Shopify apps trade at an implicitly lower multiple by the fact they’re not in as ‘hot’ of a market as Shopify apps are. It’s spectacular the speed at which Shopify apps get scooped up. Because of this, I have some confidence that non-Shopify apps might produce equally good paper returns for the fund as Shopify apps whose valuations have been soaring at break-neck speeds. The advantages of Shopify apps are that their valuations grow quickly, but they are expensive due to that nature, and the multiple premium you’d pay to secure them negates future gains… Meanwhile, regular SaaS products trade between 1.5x to 3x on the basis that their growth rates are not as extreme. This makes purchasing strong MRRs more accessible to microangels like us, with the caveat of staying within the boundaries of a greater strategy, armed with fundamental truths. Sharing deal reviewsSomething I’ve been meaning to do more is share deal reviews, but this is very difficult to do within the confines of NDAs I sign. There is some publicly available information from which to build analyses, but I can’t dive too deeply into revenue numbers that are shared and protected under those contracts. I’m curious whether analyzing the publicly available information as I did in my first analysis would still be cool to read. Let me know what you think! Was this a thought-provoking read? Join the newsletter to get more insight on the journey buying apps for freedom & profit.¹ 1 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed & the many other silent sponsors. Include your name in every newsletter as a sponsor (name your price) You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: April 2021

Wednesday, May 5, 2021

Murphy's Law, Reconcilely turnaround, lead flow explosion & more. Closing MRR: $4.8k / $15k (32% to goal)

The math behind Micro-SaaS exits & guaranteed micro-angel returns

Tuesday, April 27, 2021

How to arbitrage micro-acquisition valuations for instant ROI

(Part 2) Lean micro-acquisitions from first-touch to close & asset transfer

Monday, April 19, 2021

Computing cash-on-cash, compiling research into an offer, financing options, LOI submissions & closing the deal

MicroAngel State of the Fund: March 2021

Sunday, April 11, 2021

Bootstrapping Batch, Reconcile.ly + tax season, jittery sellers, and more. Closing MRR: $4.7k / $15k (31% to goal)

Buy, Renovate, Rent, Refinance, Repeat: Micro-SaaS Edition

Wednesday, March 31, 2021

A spin on today's proven real estate investor playbook

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏