The Secret 3-Step Master Plan to Cure Healthcare

The Secret 3-Step Master Plan to Cure HealthcareNexHealth is Raising a $31 Million Series B to Fuel its Ambition

Welcome to the 901 newly Not Boring people who have joined us since Thursday! Join 58,451 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (this afternoon) Today’s Not Boring, the whole thing, is brought to you by… NexHealth NexHealth is on a mission to accelerate innovation in healthcare. Go accelerate with them. Hi friends 👋 , Happy Thursday! After years of avoiding healthcare, both as a patient and as an analyst, I’ve gotten more interested recently. It’s a massive market -- $4 trillion in health spending accounts for 17% of US GDP -- with regulatory tailwinds and the opportunity to positively impact hundreds of millions of lives. Healthcare is not for the faint of heart. Cityblock takes a vertically integrated approach and balance sheet risk to deliver care to the most underserved patients. NexHealth, the focus of today’s post, built an entire SaaS product in order to get the data and integrations required to make it easier for anyone to build healthcare products. Healthcare has always scared me, but the patient (no pun intended), complex strategies required to succeed in healthcare are exactly my jam. For people who are new here, a quick refresher on how Not Boring works:

Today’s post started out as a regular Sponsored Deep Dive conversation, but 30 minutes into my call with NexHealth CEO Alamin Uddin, I was so impressed that I asked if I could invest. So this is a Sponsored Deep Dive x Investment Memo, a format I think will become more common when round timing allows. I said that I only write Sponsored Deep Dives about companies I’d want to invest in (read about the decision process here), and I’m putting my money where my mouth is. This post is about NexHealth, but it’s also about Worldbuilding, ambition, Plaid, why building infrastructure is so hard, and how to execute a multi-step plan over a very long time. It’s full of lessons for entrepreneurs who want to make an impact. Let’s get to it. The Secret 3-Step Master Plan to Cure HealthcareNexHealth Just Raised a $31 Million Series B to Fuel its Ambition When building a startup, ambition is half the battle. Ambition helps you think really, really long-term. Ambition carries you through necessary painful bumps in the short-term. Ambition lets you set an insanely high bar for talent, and not hire until that bar is exceeded. That’s why I’m betting on NexHealth. NexHealth has ambition in spades. That was evident from the first 30 seconds I spoke with NexHealth CEO and co-founder, Alamin Uddin. The first note I took was:

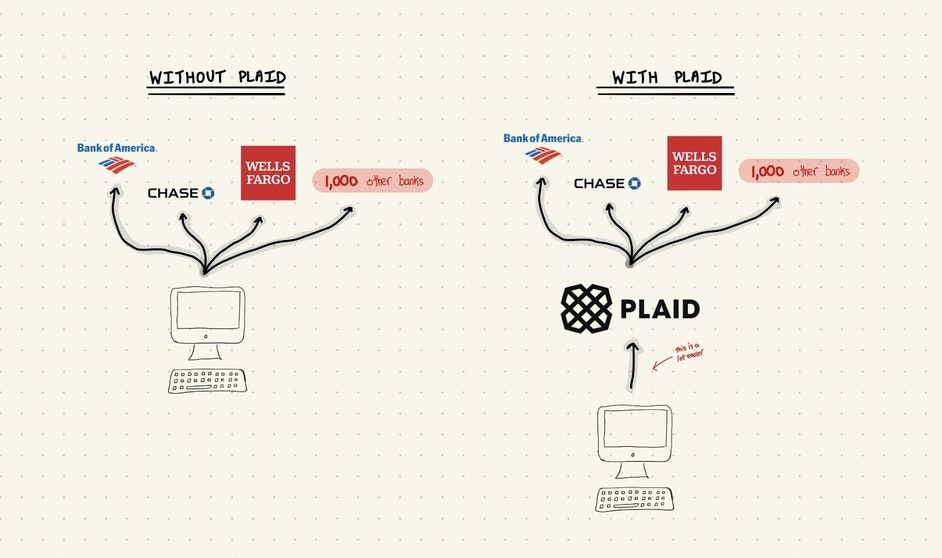

If you just looked at its first product, NexHealth’s ambition wouldn’t be entirely clear. For its first few years, the company has been selling a Shopify-like SaaS product to dentists. That’s a big market, for sure. Already, the company is doing millions in ARR. But the SaaS product alone doesn’t match the company’s ambition. It’s just a necessary first step. To really understand NexHealth, we need to start with the long-term and work backwards. NexHealth’s mission is to accelerate healthcare by connecting patients, doctors, and developers. It wants to do to healthcare what a typhoon of startups, from Stripe to Plaid to Marqeta to Unit and more, have done to fintech: make it easy for any talented developer to build products in what used to be a prohibitively cumbersome industry. If you’ve been reading Not Boring, for a while, or even a few days, you’ve probably picked up a theme: startups that build infrastructure, obscure complexity, and deliver a clean, easy experience to customers will build some of the world’s biggest businesses. Stripe. Scale. Twilio. Agora. These companies don’t just capture value; they grow and change markets in unpredictable ways. They’re some of the biggest and most fascinating companies in tech not just because of what they build, but because of what they enable others to build. Nothing’s free, though, and everything has trade-offs. It’s insanely hard to build infrastructure, particularly in healthcare. Companies have tried the obvious strategies already, and failed. To build the infrastructure layer for healthcare will take a Worldbuilder. Worldbuilders are my favorite companies because they zoom out, see things others don’t, and devised counterintuitive plans to achieve massive goals over a very long time. They have three characteristics:

NexHealth is a Worldbuilder. NexHealth time stamped its vision in the name itself. As Alamin explained:

Vertical SaaS is a full-business-as-a-wedge, the first step in a three-part master plan:

Success is far from guaranteed. That all of this works is implausible.

Fortunately, NexHealth now has the resources to be aggressively patient. It just raised a $31 million Series B at a $431 million post-money valuation. Josh Buckley is leading the round for the second time in a row, and is joined by Seed round lead Point Nine and a murderer’s row of super angels including Rahul Vohra and Todd Goldberg, Scott Belsky (Behance, Adobe), Jeffrey Katzenberg (Dreamworks), Zach Perret and Jean-Denis Greze (Plaid), Sujay Jaswa and Chenli Wang (Dropbox), Connor Theilman and Ershad Jamil (ServiceTitan), Turner Novak (Banana), and me. The NexHealth story to date is a master class in what it takes to build a modern infrastructure company in an outdated industry. Making it easier for others to build is incredibly hard work. To understand what NexHealth is attempting to pull off, we’ll explore:

This isn’t a story about healthcare, really, although that’s part of it. It’s a story about the ambition it takes to tempt the odds and make an impact. The NexHealth StoryNexHealth exists because Alamin realized that he wasn’t going to be von Neumann. See Alamin was good at math in high school, and he went to college wanting to be a mathematician, but he also wanted to make an impact on the world, and he realized that he wasn’t going to be able to make an impact as a mathematician unless he was really good. Like, von Neumann good. And he wasn’t. No one really is. But starting in high school and into college, he started collecting experiences that made him perfectly suited to make an impact in another way. Specifically, he had taught himself to code in high school, switched from math to pre-med in college, and then got a summer job as a receptionist at a health clinic in the Bronx. He unintentionally constructed the perfect NexHealth founder in the lab. His job during the internship was essentially to make calls to labs, pharmacies, insurance providers, other doctors, patients who owed money, and all of the other stakeholders that make a small medical practice tick. That wasn’t particularly stimulating work, and Alamin knew how to code, so he figured he’d just use Twilio, which makes communication APIs, to automate his calls. The process should have been easy:

But it wasn’t that simple, or we wouldn’t be here today. He tried to get API access from the EHR vendor they worked with, but they didn’t have public APIs. It would have cost $40k, multiples of what he was making, to implement the process manually. That set Alamin on a journey on which he’s still just embarking four years later, based on that experience and a couple of realizations:

So he teamed up with Waleed Asif and the duo founded NexHealth in 2017. NexHealth’s three-part, Worldbuilding strategy is what makes NexHealth so fascinating. Alamin, Waleed, and the team they’ve built is what makes it believable. The NexHealth TeamThe NexHealth thesis is centered around the team. The strategy that they devised is ingenious. It’s amazing that they even came up with the plan you’ll read today, and that they’re executing on it, but success isn’t guaranteed. Selling to medical SMBs is very different than selling to developers, which is very different than selling to consumers. To pull off its plan, NexHealth will need to do all three, while fending off competitors with a narrower focus whose entire orientation is around selling to one specific subset of just one of the three groups. A bet on NexHealth is a bet that Alamin and Waleed will be able to convene a team of people who can execute on their wildly ambitious plan. Luckily, according to investors, the team is NexHealth’s strong point. I asked Harry Stebbings, the host of The Twenty Minute VC and NexHealth investor, why he invested. His answer was simple: “Alamin is a machine.” Josh Buckley agrees, telling me:

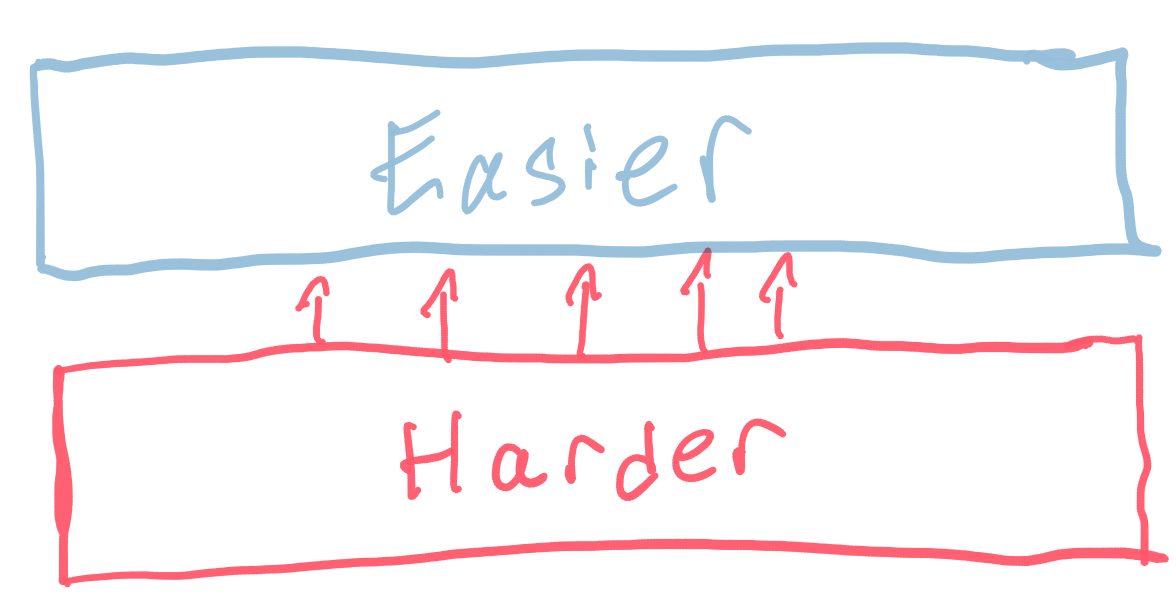

As evidence of that, over the past twelve months, NexHealth has built a leadership team from Netflix, Upwork, Redfin, Marketo, Optimizely, Amplitude, SAP, and more. The leaders they hired from those companies were early -- all except for the SAP and Redfin hires started when the companies were under 30 employees -- and scaled the companies through IPO. Hiring people who’ve scaled from zero to public is a good way to reduce execution risk. Overall, the team grew 6x over the past year, from under 20 to 120 employees. Meanwhile, it grew customers by over 300%. NexHealth is growing fast. Customers love its SaaS product (it has a perfect 5 stars on Capterra). It’s already built out a public-facing API used by small businesses, independent developers, and public companies alike. Month-over-month gross churn is below 0.5% and MoM net retention is over 100%. It has the right team in place. NexHealth exceeds expectations for a startup at its stage. On its current trajectory, the company could well be worth a few billion dollars in the coming years. But that’s not the goal; $100 billion is. To build a $100 billion company that accelerates innovation in healthcare, its team needs to execute on building clean infrastructure for healthcare. Easier and Harder Than EverThere’s an interesting bifurcation happening in software startups. For most startups, it’s never been faster or easier to build a product. That’s largely because of how much good infrastructure has been built over the past decade. In Ramp’s Double-Unicorn Rounds, I wrote:

But for the startups building the software that those other startups get to take off the shelf, it’s never been harder. Infrastructure-via-API has become such an obviously strong position in the value chain that any of the remotely easy spots have been grabbed, leaving only the hardest of the hard. Healthcare infrastructure, which requires integrating with Electronic Health Records (EHRs) and Electronic Medical Records (EMRs) in the thousand places they live today, fits the bill. For the most part, the consumer experience in healthcare sucks. There are plenty of good excuses -- regulation is overly complex, incentives are misaligned, insurance is a racket -- and no one technology company can solve those directly. But technology companies can build infrastructure to unleash the collective energy of thousands of entrepreneurs on the problem. In spaces in which good infrastructure exists, hungry entrepreneurs can snap together different building blocks in the backend, and spend most of their time focusing on a good and differentiated experience on the front-end. In APIs All the Way Down, I described the impact that has:

Without that infrastructure, though, teams waste time and resources reinventing the wheel. Many, daunted or overwhelmed by everything it would take to build even a good enough product skip the space entirely and opt for something smoother. You don’t see a lot of 17-year-olds hacking on healthtech in their bedroom. Specifically, in healthtech, the challenge is that there are thousands of EHRs that are tiny, fragmented, and antiquated, many of which don’t have APIs at all. That means there’s no one System of Record, or source of truth, that anyone building products can tap into to understand everything about a patient. Your dental records may be hidden in one system, primary care records in another, hospital records in another, insurance information elsewhere, and so on. NexHealth exists to fix that. If NexHealth is successful, in a decade or even longer, a new generation of entrepreneurs will be able to build healthtech products as easily as they’re able to build fintech products today. It will do for healthtech what Plaid did for fintech. How Plaid StartedTo understand NexHealth’s strategy, you first need to understand Plaid. Plaid is an API-first company that lets developers connect their apps to peoples’ bank accounts. If you’ve tried to fund an account, like Robinhood or Coinbase, using your bank account, you’ve likely connected via Plaid. If you use an app that pulls all of your financial data into one place, you’ve likely added all of your accounts by logging in via Plaid. Developers love Plaid because instead of having to integrate with thousands of different banks, all with different requirements, and then maintain all of those integrations, they just integrate with Plaid. Plaid does the rest. Today, Plaid partners with nearly every major bank, and many smaller ones, but back in 2013 when Plaid launched, it didn’t. What bank would trust a young startup with its customers’ credentials? So Plaid got creative. Venmo was Plaid’s first big customer, accounting for roughly 40% of its revenue in the first few years. Instead of Venmo integrating with all of the banks itself, it plugged in Plaid via API. When a Venmo user set up an account, they chose their bank and entered their credentials via Plaid, and Plaid logged in on their behalf. Plaid manually scraped, pulling information from the bank account and making transfers to Venmo on users’ behalf. Like the Wizard of Oz, Plaid looked like a fancy, integrated tech product on the front-end, but was really just a screen-scraping man behind the curtain. Some banks tried to stop Plaid, but eventually, Plaid got big enough that banks had no choice but to play ball. If their customers couldn’t use Venmo or any other number of fintech apps because their bank blocked Plaid, that might be a good enough reason to switch to a new bank. Today, Plaid is massive. It partners directly with banks. Visa tried to buy Plaid for $5.3 billion in 2020. The Department of Justice blocked it on antitrust grounds. In seven years, Plaid had become so enmeshed in the financial plumbing that the government thought that Visa owning Plaid would create a monopoly. It worked out well for Plaid, though. In April, Altimeter led a $425 million Series D that valued the company at $13.4 billion. So how do you build Plaid for healthcare? To learn about NexHealth’s three-step master plan to build the Plaid for healthcare, the challenges it faces, and more…Thanks to Josh for introducing me to Alamin, and to Alamin and Aditya for your input. How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Scale: Rational in the Fullness of Time

Monday, June 21, 2021

Meet the Five-Year-Old, $7.3 billion Stripe for AI

The Cooperation Economy 🤝

Friday, June 18, 2021

Or How to Build a Liquid Super Team

Cityblock Health

Friday, June 18, 2021

The Vertically-Integrated, Value-Based Arbitrageur Fixing Healthcare

Zero Knowledge

Friday, June 18, 2021

A Not Boring x Jill Carlson Collab on Moon Math, Privacy, and Hype

A New Day on Earth for Coffee

Friday, June 18, 2021

Cometeer: The Official Coffee of Not Boring

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month