Miners Are Accumulating And Investors Are Removing Bitcoin From Exchanges

To investors, Will Clemente breaks down this week’s bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis: Hope all is well. Here are the high-level takeaways from this week:

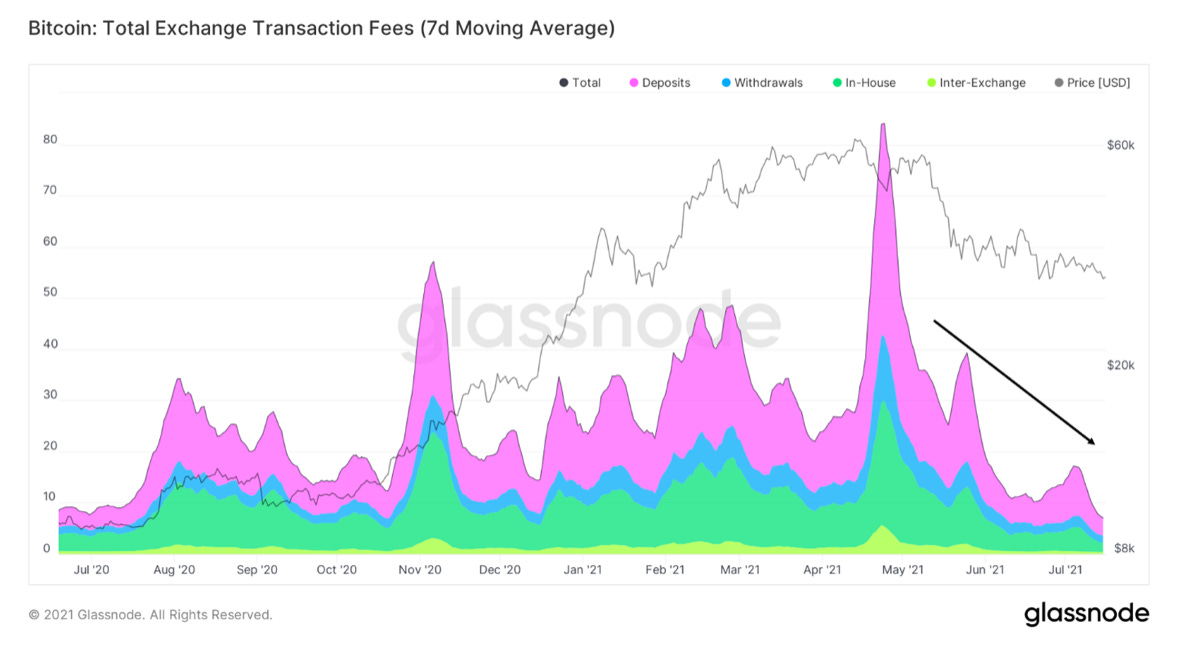

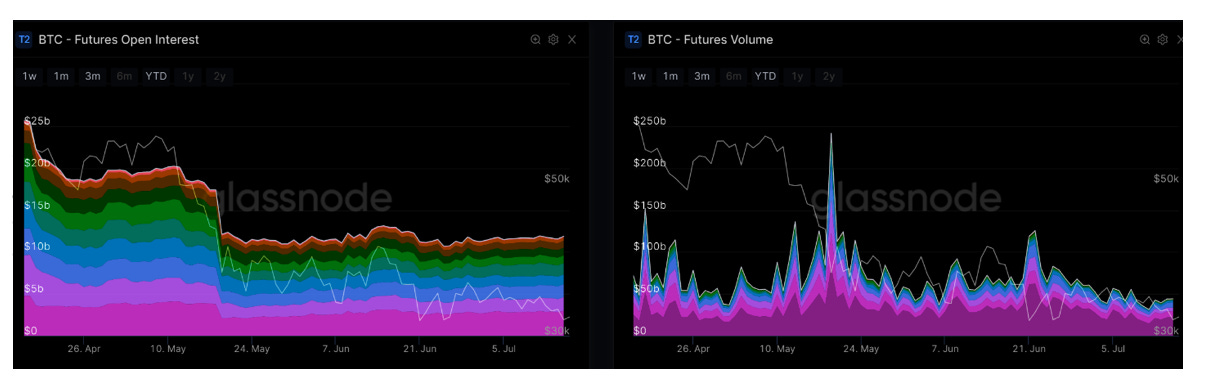

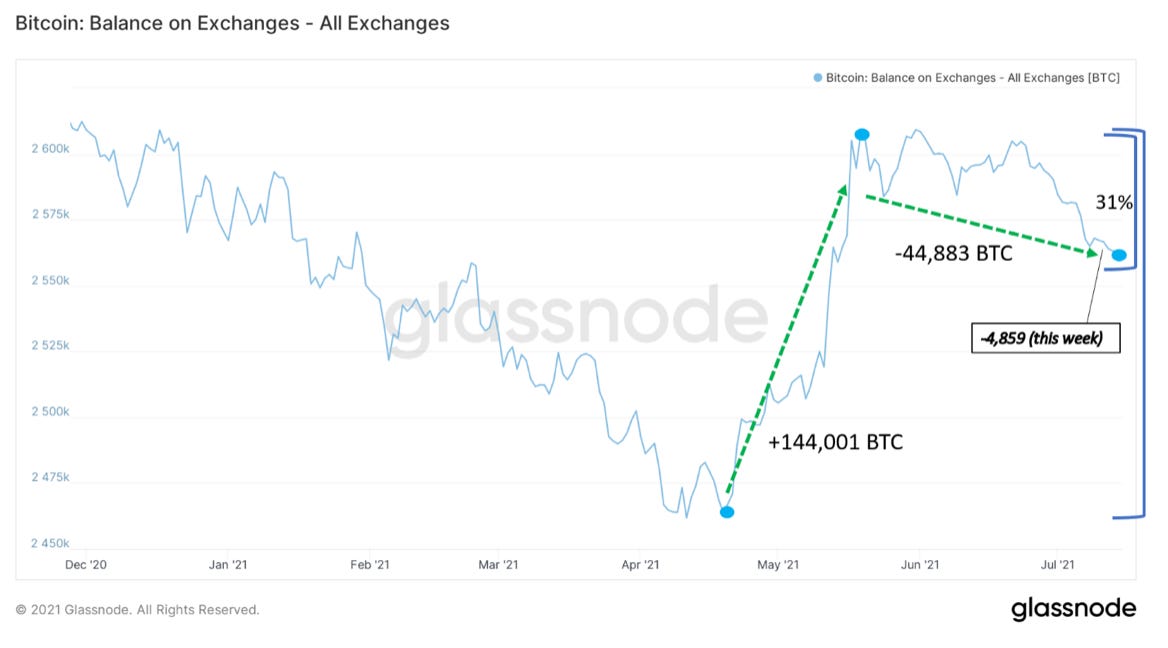

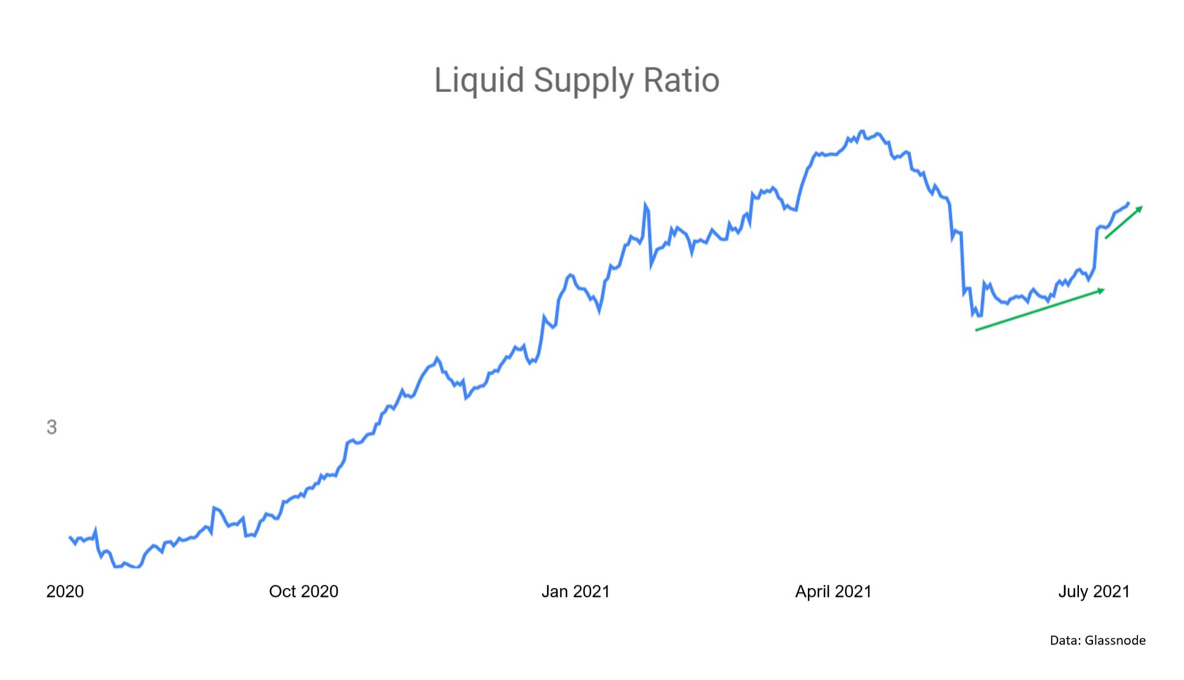

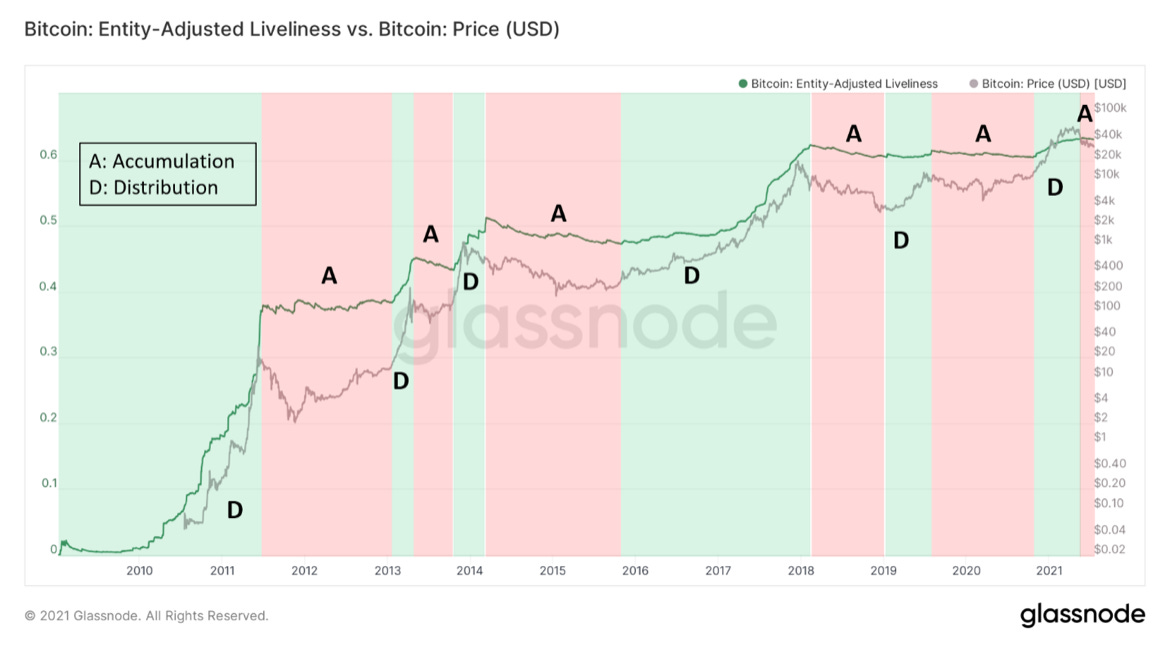

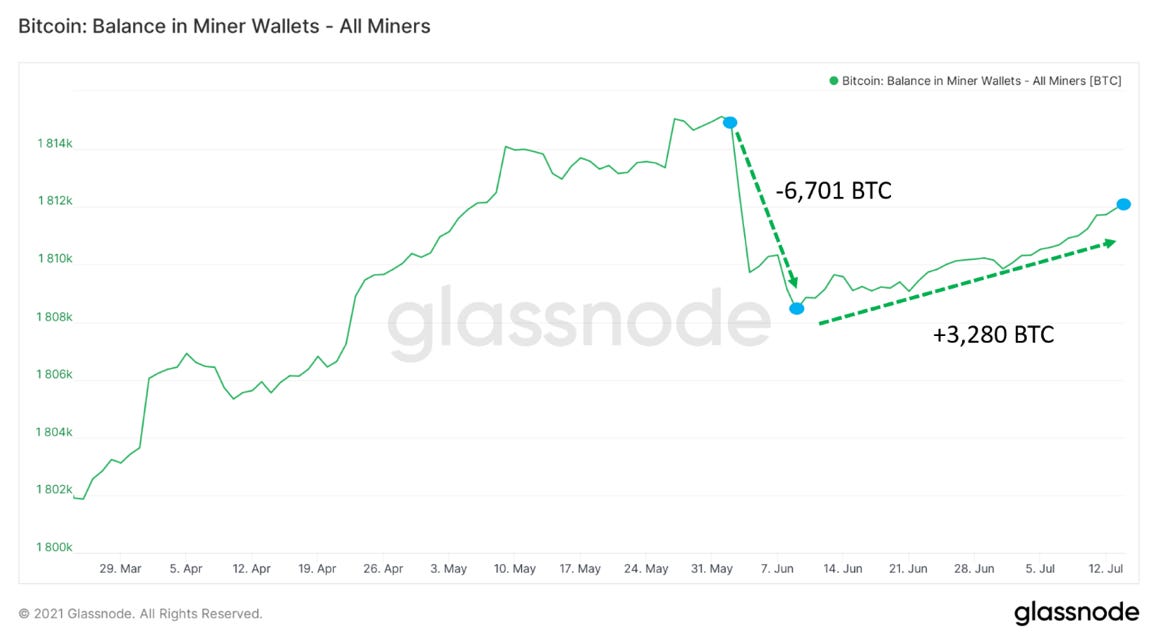

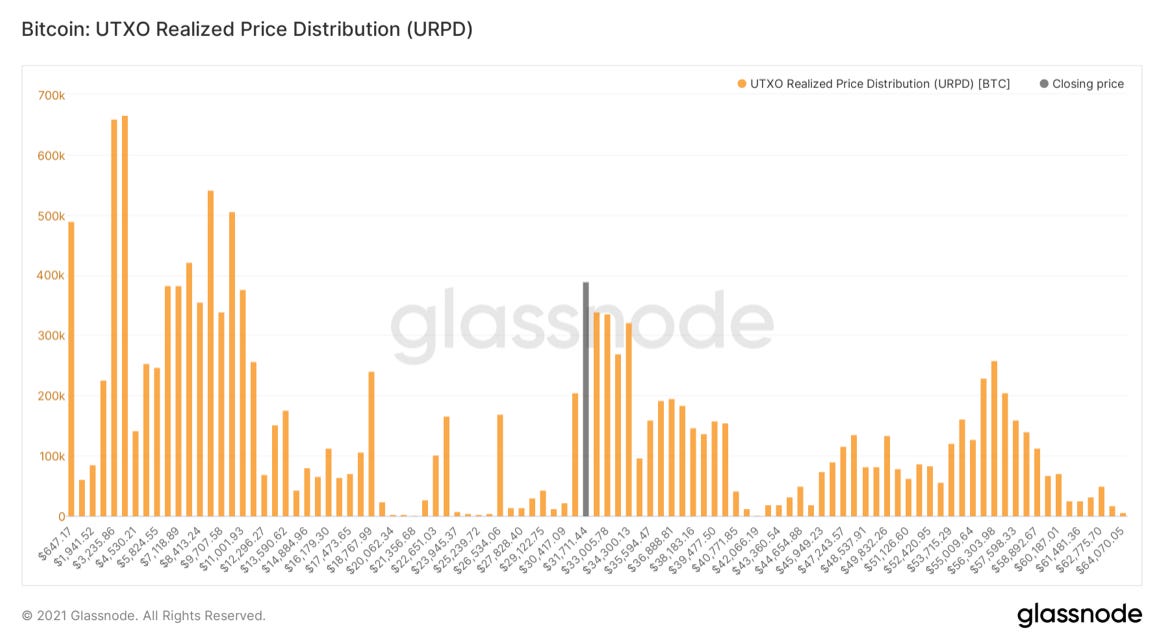

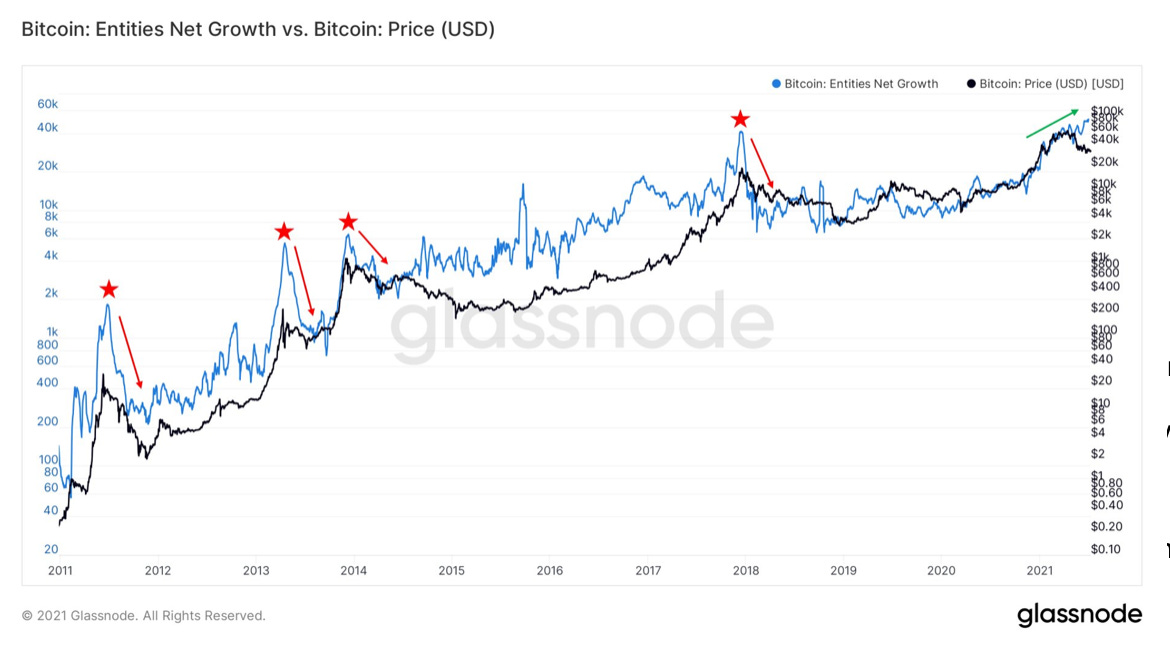

It’s now been 8 weeks of ranging. Volatility and volume have both dried up significantly. Using an indicator to identify volatility squeeze set ups from my good friend John Wick (pseudonym), you can see the Bollinger Bands tightening significantly as well as the orange shading from the indicator. (chart below) This orange shading is telling you that there is a big move coming. The last two of these squeezes occurred during the following times: July 2020 that propelled us to all-time highs, as well as in April 2021 that pushed us back down off all time highs. Each time, these squeezes took 1 to 3 weeks to resolve, so theoretically we could be looking at this big move in the next few days but could take up to those full 3 weeks. (doubt it) So what is there to take away from this? Big move is coming, but this does not give us information on the directionality of the potential move. For that answer, I think on-chain can provide us a lot of clues. To tag on, another chart of the Bitcoin historical volatility index. Vol looks ready to show back up here as well. An on-chain way to monitor exchange activity, transfer fees have gone flat and continue to trend down. Futures volume has been choppy trending downwards, while futures open interest has creeped back up since lows on June 28th by $600M, although general trend has been sideways since May. So, we’re watching for a big move, but what clues can on-chain offer as to the directionality of that move? Let’s first look at exchange flows, which have been a good indicator of broader trend shifts in accumulation behavior. One of the big narratives pushed at the beginning of this bull run was the depletion of coins off exchanges. This reversed from April to mid-May as waves of coins began flowing back onto exchanges to be sold and posted as collateral. Exchange inventories rose by 144,001 BTC in that time. Since May 18th, their collective balance is down by 44,883 BTC, with most of that drop occurring over the last 3 weeks specifically. This is a clear trend that has been going on for almost 2 months now, including this week with exchange inventories down 4,859 BTC. A more qualitative way of looking accumulation, we can analyze the spending behavior of the entities that those coins are flowing into. To do this, for a while we had been looking at Glassnode’s illiquid supply change metric, which is the 30-day change. This is the liquid ratio Willy helped me create(data from Glassnode of course): a bit more reactive and looks at the real time movement of coins to or from illiquid entities. Yet another leg up in the ratio showing even stronger absorption of coins from speculative traders to long term investors over the last week. Supply shock still in play in my opinion. Next up we have liveliness. This is a great metric for identifying broader trends. This looks at a ratio of coin days destroyed to coin days created. Here’s an easy way to think about coin days destroyed: 2 Bitcoins are sent into a wallet and don’t move for 5 days, 5 coin days accumulated. Then they are spent, 5 coin days are now destroyed. Looking at liveliness (ratio between coin days destroyed and coin days created), you can see a downtrend; showing accumulation. This downtrend has occurred during a few different market structures. This has marked the beginning of bear markets post-2011, post 2013, and post 2017. However, this also took place between 2013 double pumps as well as before the bull run began last year. A third way to view accumulation, here is a look into the balances of miners. They continue to add to their BTC holdings again, up 3,280 BTC since lows in June. Here is a distribution profile of UTXOs at different price levels. Between $31K-$35K, 9.94% of Bitcoin’s money supply has moved, whilst in the broader range between 31K-40K, 17.55% of its money supply has moved. A huge base of capital continues to form here at these levels. Lastly, we have net entity growth. This has been grinding to new all time highs, exactly the opposite of what it has occurred (dropping off a cliff) while transitioning from each bull to bear market. A lot of talk lately about active addresses. Yes, that is trending down, because wallets create new addresses when they transact. So, by default, active addresses trends down when on-chain activity is flat. Entities and addresses are not the same thing. Entities uses blockchain forensics and proprietary Algorithms from Glassnode to cluster and identify what appear to be unique users. In conclusion, a divergence of on-chain accumulation behavior just continues to grow stronger against sideways bearish price action. Now 8 weeks into this re-accumulation band, I suspect that we are getting close to this reabsorption of coins completing. That’s also why I’m closely watching the resolution of this volatility squeeze. Recording tomorrow with David Puell for the podcast. I’m extremely excited about this, someone who’s deeply insightful and knowledgeable about on-chain and the Bitcoin market in general. Talk soon, cheers. That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here SPONSORED: Amber Group is a leading global crypto finance service provider operating around the world and around the clock with a presence in Hong Kong, Taipei, Seoul, and Vancouver. Founded in 2017, Amber Group is committed to combining best-in-class technology with sophisticated quantitative research to offer clients a streamlined crypto finance experience. The platform now services over 500 institutions and 100,000+ individual investors across the Amber Pro web platform, the Amber App, as well as their 24/7 trading desk. To date, Amber Group has cumulatively traded more than $330 billion across 100+ electronic exchanges, exceeding $1 billion in assets under management. In 2019, Amber Group raised $28 million in Series A funding led by global crypto heavyweights Paradigm and Pantera Capital, with participation from Polychain Capital, Dragonfly Capital, Blockchain.com. Click here to sign up now. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Stablecoins, Institutions, and DeFi

Tuesday, July 13, 2021

Listen now (4 min) | To investors, I have been doing a deep dive on the stablecoin market, which is quickly becoming an important of the crypto industry. Adoption is occurring across various market

Financial Education Is A National Emergency

Monday, July 12, 2021

Listen now (3 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

Are you prepared for the next Bitcoin bull run?

Saturday, July 10, 2021

Hey! Thanks for being a free subscriber to The Pomp Letter. I really enjoy writing about finance, macroeconomics, Bitcoin, and cryptocurrencies every morning for over 190000 investors. During uncertain

New Whales Entering The Market & Bitcoin Leaving Exchanges

Saturday, July 10, 2021

Listen now (3 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

The World Is So Crazy That Grocery Stores Are Speculating Like Hedge Funds Now

Tuesday, July 6, 2021

Listen now (4 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.