The Pomp Letter - Fix the money, Fix the world

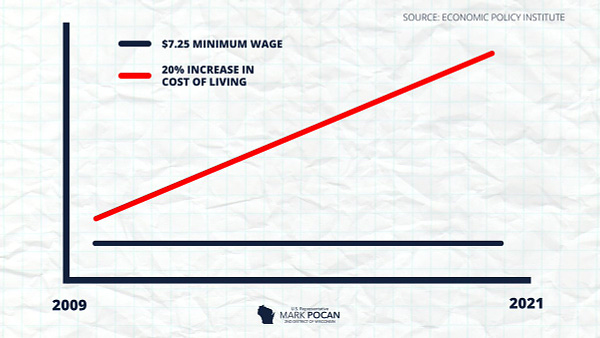

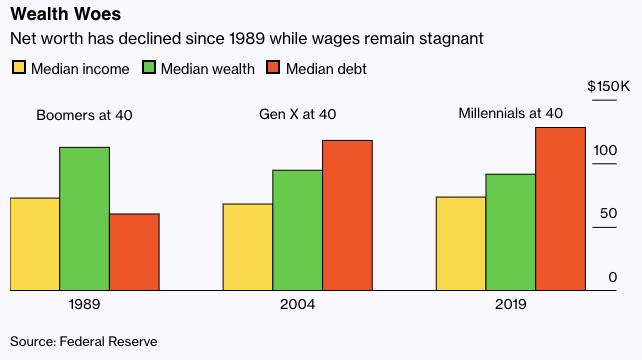

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today. To investors, The highly anticipated virtual bitcoin conference was held yesterday. The opening conversation was between Jack Dorsey, Cathie Wood, and Elon Musk. The moderator was Steve Lee, who did a fantastic job moving the conversation along. Before we dive into the substance of the conversation, it is hard to ignore the fact that we were watching three of the most impressive people in business and finance. Cathie Wood has taken the finance world by storm leveraging actively managed ETFs, which also benefits from a research heavy approach. I’ve had Cathie on the podcast multiple times and each time I am struck by her commitment to transparency and community engagement. Not exactly the standard for a multi-billion dollar money manager. Jack Dorsey is one of the best entrepreneurs ever. He has built two multi-billion dollar companies between Twitter and Square. As if that wasn’t difficult enough, Jack currently runs both businesses as the CEO. These two companies are in completely different industries and require the ability to navigate seemingly different complexities. On top of his executive duties, Jack Dorsey has also become one of the most visible proponents of bitcoin globally. Elon Musk needs no introduction. Similar to Dorsey, he runs multiple multi-billion dollar companies. He spent his early career thinking about payments through the creation of PayPal and has recently become interested in bitcoin and various other cryptocurrencies. The big controversy was Musk’s recent comments about bitcoin’s energy consumption and whether there should be concern over the mix between renewable / non-renewable sources. So what happened yesterday? This was one of the most interesting conversations I have heard in awhile. Each person brought a different perspective. Cathie understands the institutional investment world better than almost anyone. Jack understands the bitcoin ethos, the internet, and potential impact on developing nations from bitcoin. Elon is much more focused on the technical components of the network. When you combine these three different interests, you get a holistic picture of what is being built before our eyes. There was a comment at the end that I think ultimately sums up the opportunity though. Jack Dorsey explicitly stated that “my hope is that [bitcoin] creates world peace.” That is the entire point of this global effort. Earlier in the day, I had explained something similar to Greg Foss in a recorded conversation. Here were my comments: An entire generation is growing up with the awareness that the devaluation of their currency is leading to an inability to get ahead. People feel like they can’t afford the basics. They have to keep taking on more debt to simply enjoy an average lifestyle. This dire situation is attributable to numerous factors. Wages don’t rise at the same pace as inflation. Our parents were taught to save money, rather than shown why they must invest to keep up. Here are two charts that tell the entire story: As you can see, people have less wealth and more debt. The devaluation of fiat currencies has made everything more expensive around us. The promise of bitcoin is that we will usher in a new era of sound money. The currency is outside the system. No one controls it. People will once again be able to simply save their way to financial freedom. The money won’t lose value over time. In fact, the purchasing power will increase. We know that central banks are likely the largest contributor of wealth inequality in the world. Here is Stanley Druckenmiller, one of the best investors on Wall Street over the last 30 years, explicitly stating it: So when Jack Dorsey states that bitcoin has the potential to usher in world peace, he isn’t very far off. If we fix the money, we have a chance to fix the world. We can lift billions of people out of poverty. We can return to free markets where everyone has an opportunity to build a life of wealth, happiness, and freedom. That is what most people want — to simply build a better life for themselves and their families. Fix the money, fix the world. The conversation yesterday pushed us closer to that goal. Watching Jack Dorsey, Cathie Wood, and Elon Musk discussing this technology was incredible. From non-existence 12 years ago to an international stage with the world’s best entrepreneurs and investors. The crazy part? We are all likely underestimating how big this will be. Hope each of you has a great day. I’ll talk to you tomorrow. -Pomp SPONSORED: With the markets swinging wildly this year, the need for diversification has never been more apparent. Vinovest gives investors access to investment grade wines, an asset class that had only been available to the ultra wealthy until now. Vinovest uses an algorithm to select and manage your portfolio, delivering clients 17.8% average returns in 2020. For an investment opportunity uncorrelated to the stock market that has outpaced the S&P 500 over the last twenty years, check out Vinovest to invest today. They are giving Pomp Letter subscribers an exclusive offer to receive a $50 bonus credit if you open and fund an account before August 1, 2021. Click here to get started. THE RUNDOWN:Stellar Foundation Eyes Potential Acquisition of MoneyGram: Stellar Development Foundation has contacted MoneyGram International about a potential purchase of the 81-year-old remittance giant, Bloomberg reported on Wednesday. Stellar is partnering with private equity firm Advent on the possible deal, according to unnamed sources cited in the article. Stellar and Advent could decide not to push forward with the acquisition. Read more. Robinhood Crypto Expects to Pay $30M Fine to NY State Regulatory Body: Zero-fee retail trading platform Robinhood is in hot water with New York regulators, according to its recent S-1 filing. Robinhood Crypto, the crypto trading division of Robinhood, said it expects to pay a $30 million settlement to the New York State Department of Financial Services (NYDFS) after a 2020 investigation “focused primarily on anti-money laundering and cybersecurity-related issues” found the company to be in violation of numerous regulatory requirements. Read more. Tom Brady’s NFT Platform Autograph Partners with Lionsgate, DraftKings: Buccaneers quarterback Tom Brady is beefing up his NFT platform Autograph with deals to launch movie content with Hollywood studio Lionsgate and sports-related tokens with sports betting site Draftkings. The startup is also adding a slew of big-name athletes to its advisory board, including Tiger Woods, Wayne Gretsky, Derek Jeter, Naomi Osaka and Tony Hawk. Read more. Almost Half of Family Offices With Goldman Ties Want to Add Crypto Exposure: Almost half of family offices that do business Goldman Sachs want exposure to cryptocurrencies, Bloomberg said. A survey conducted by the investment bank found that 45% of family offices are interested in investing in cryptocurrencies, Bloomberg reported Wednesday. A further 15% of the more than 150 that responded already do so. Read more. SEC Chair Hints Some Stablecoins Are Securities: Securities and Exchange Commission Chair Gary Gensler said cryptocurrencies whose prices depend on more traditional securities might fall under securities laws. Speaking to the American Bar Association on Tuesday, Gensler said some platforms are offering crypto tokens “that are priced off” securities and resemble derivatives products. In his view, any security-based products will have to comply with trade reporting rules and other laws, he said. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Greg Foss is the CFO and Bitcoin Strategist at Validus Power Corp. He has spent over 30 years of his career in various credit markets, where he has managed hundreds of millions of dollars. In this conversation, Greg and I discuss:

I really enjoyed this conversation with Greg. Hopefully you enjoy it too.  LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Miners Are Accumulating And Investors Are Removing Bitcoin From Exchanges

Friday, July 16, 2021

To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by

Stablecoins, Institutions, and DeFi

Tuesday, July 13, 2021

Listen now (4 min) | To investors, I have been doing a deep dive on the stablecoin market, which is quickly becoming an important of the crypto industry. Adoption is occurring across various market

Financial Education Is A National Emergency

Monday, July 12, 2021

Listen now (3 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

Are you prepared for the next Bitcoin bull run?

Saturday, July 10, 2021

Hey! Thanks for being a free subscriber to The Pomp Letter. I really enjoy writing about finance, macroeconomics, Bitcoin, and cryptocurrencies every morning for over 190000 investors. During uncertain

New Whales Entering The Market & Bitcoin Leaving Exchanges

Saturday, July 10, 2021

Listen now (3 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.