MicroAngel acquires Postcode Shipping, a profitable SaaS producing $200k ARR

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel acquires Postcode Shipping, a profitable SaaS producing $200k ARRAn exclusive look into a six-digit micro-acquisitionI’m really excited to announce that MicroAngel has completed the acquisition of Postcode Shipping, the most sophisticated shipping rates solution available on the Shopify App Store. Happy dance! They say you make your luck, and I suppose that is an accurate depiction of my journey acquiring Micro-SaaS products so far. It’s certainly been a few months in the making up to this point. Back in February, I acquired an APAC darling, Xero app of the Year finalist Reconcile.ly, a Shopify app used by hundreds of Australia- and New Zealand-based merchants who rely on Xero for their accounting needs. I hadn’t considered that my focus for MicroAngel Fund I would end up being concentrated across the APAC region, yet here we are, and I must say I’m super stoked about it mate! There are so many advantages to working with merchants in that region. As I’m sure you’ll agree, my commonwealth counterparts have proven to be incredible problem solvers as far as Shopify apps go. In many ways, Postcode Shipping represents the purest illustration of the power Shopify puts into the hands of merchants across the globe. And that’s exactly why I moved to acquire it. Let’s dive in! Overview

Unit Economics

Postcode Shipping helps you take control over your Shopify store’s shipping rates based on customers’ locations, the contents of their cart and so much more. It allows merchants to set up sophisticated table rates. It’s designed for merchants whose shipping needs are complex and need to differ based on the geographic location of their customers as well the nature of the purchases their customers make. At the heart of the app are two systems that power rate quoting. One is a flexible postcode matching algorithm that allows merchants to target postcode using a variety of rule types. The other is a rate computation and rule system that enables merchants to set up rates that respond to a variety of variables including cart contents. Why does it need to exist? Shopify’s native shipping rate functionality is a notorious lynchpin for merchants. It only offers flat rates, which sacrifices the flexibility that ecommerce brands need when it comes to selling both locally and globally. For example, a London-based merchant who sells to an Irish customer is forced to charge a flat rate for the UK as a whole, despite the cost of sending an item to a London-based customer being very different than that of shipping across a body of water to Ireland. Then, there’s the logistics and cost variance implied in shipping products of various sizes. Shipping mountain bikes is very different — and much more expensive — than shipping shirts. But the native shipping rates offered by Shopify are flat and do not offer enough flexibility to operate a highly efficient and adaptable ecommerce business. When I initially discovered the product, I didn’t quite get how important of a role it played within both the conversion event as well as more broadly within the Shopify ecosystem. Everyone I spoke to about this said shipping is fucking hard. And it really opened my eyes to the Why behind Shopify’s dedication towards its partner ecosystem. Shopify really wants to focus on its core business and relies just as intently on its partners to cover the gaps in support of that core business. Where Shopify is concerned with creating the most efficient and scalable headless ecommerce infrastructure, its aim is to help you sell more — shipping is an entirely different part of the workflow, which is where partners come in handy, whether from a workflow or integration perspective. In this case, Postcode Shipping represents some of the most fundamental ecommerce machinery required to operate a business on the world’s most popular ecommerce platform, and in doing so earns amazing loyalty from customers that have come to rely on the app to deliver and scale with them. In short, it’s business-critical ecommerce technology, and the metrics of the app illustrate this. Both from the perspective of the fund as well as more broadly, I’m very excited to work on the type of improvements that will have a big impact on this product. And perhaps most importantly, this acquisition does two things:

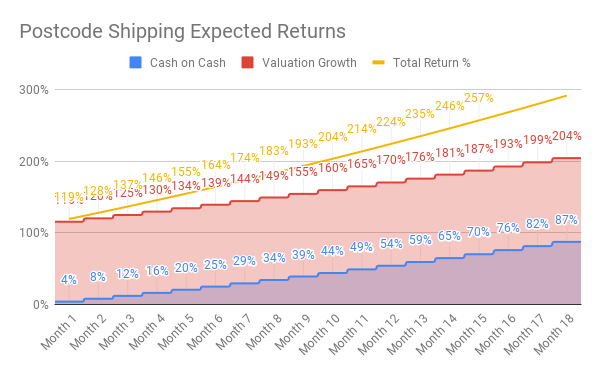

In other words, the portfolio’s value granted a roll-up would represent the ultimate goal of Fund 1, which is to return at least $1m from selling the products. That means it’s time for champagne and also time to move the goal posts. Because I have zero intention to sell either Reconcilely nor Postcode Shipping for the foreseeable future. As I chart the expected progress of the portfolio at its current pace, I’m posting a valuation in February 2023 of nearly $2m. That means I’m going to keep on the same 18 month timeline, but give myself the very real option of sticking to the current fund, and perhaps leverage the equity currently available in the portfolio to secure some debt and acquire a third product. Since I don’t need the additional income provided by the product, I’m going to reroute it towards a Partner-level hire that can join the MicroAngel journey (even on a part-time basis) and help me take it to the next level. As for Postcode Shipping, despite not having any intention to sell it off anytime soon, it’s still important to ensure it will produce as expected in the fund timeline, which at this point is an expected 18 month journey for this product. In that scope, the expected returns for Postcode Shipping are extremely healthy once again thanks to a very favourable buying multiple at the onset, and the immediate liquidity arbitrage created as a result of that. Because I’ve aligned the seller to benefit from the eventual sale of Postcode Shipping, they too are benefiting from the arbitrage. Though they may sacrifice a small bit at today’s valuation, the benefits implied by

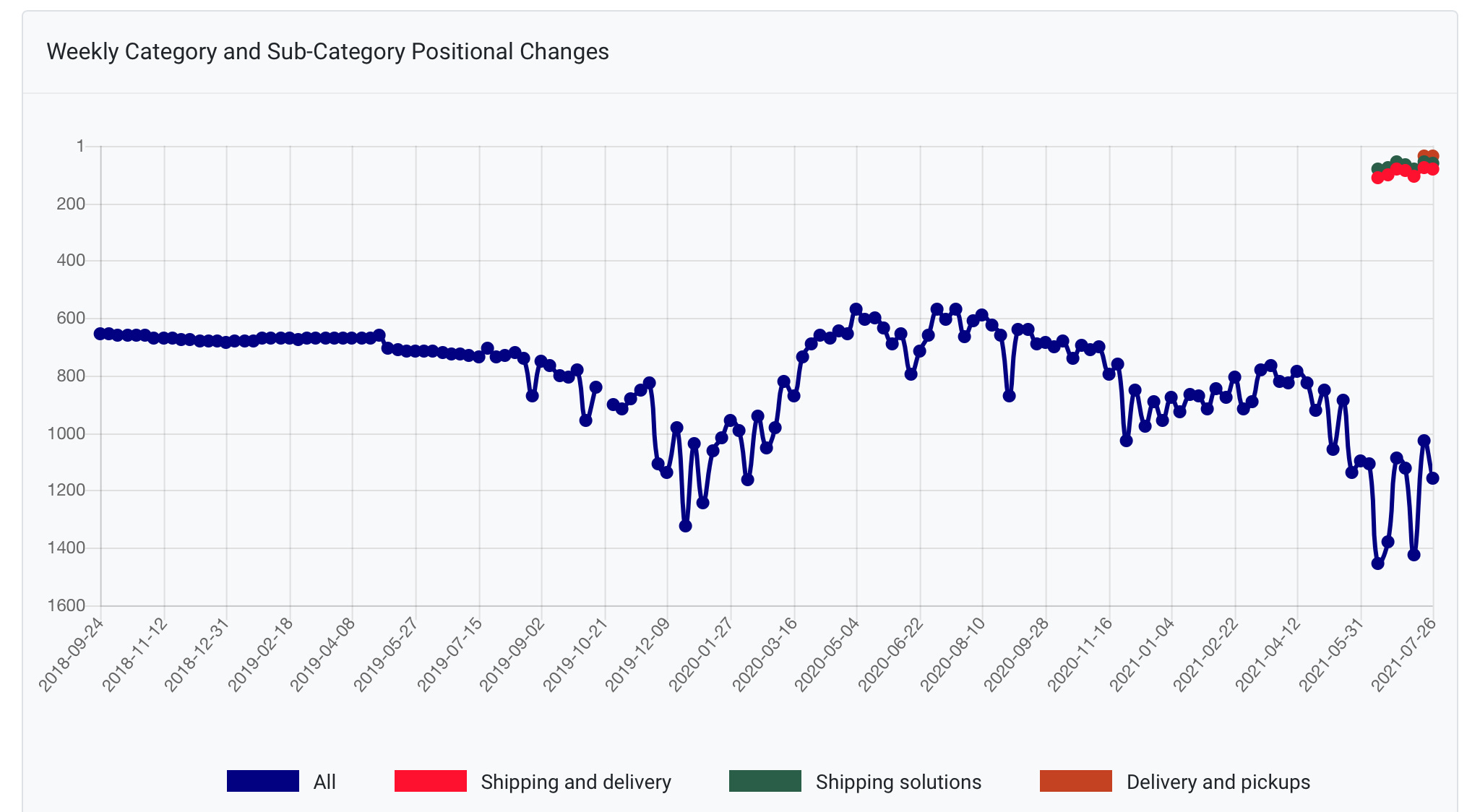

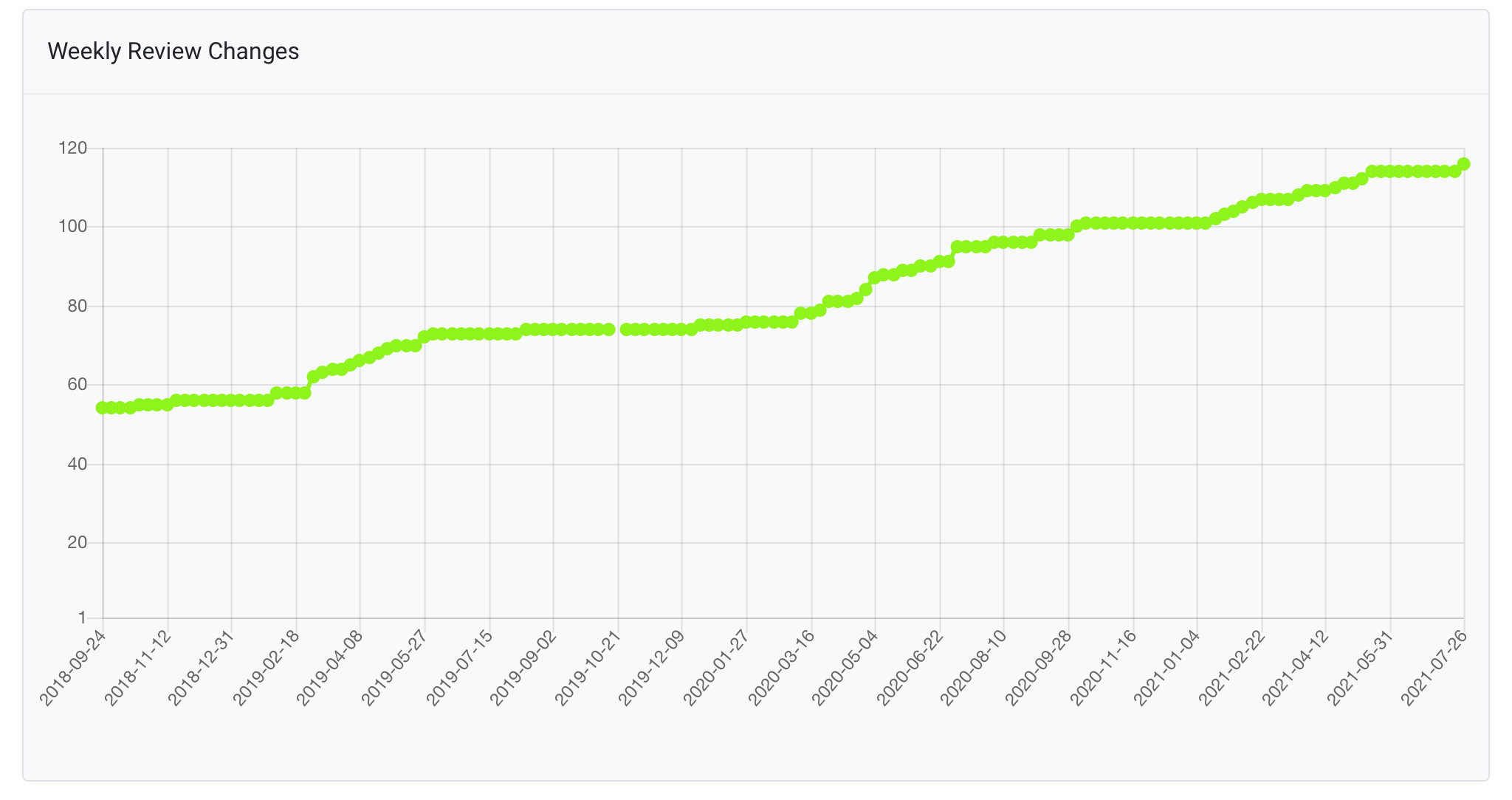

Fundamentals & PotentialAs per usual, I started my analysis of Postcode Shipping by taking in what the product is, how it delivers value, how well it captures value in return, and the general reaction of the market vis-a-vis the solution that they have been offered to their challenge. The app enjoys awesome ranking within the framework of Shopify’s new App Store categories. I will aim to reach a spot in Page 1 ASAP! In general, I found that the app was successful in delivering on its promise to simplify any complex combination of shipping rules based on the size of the products and/or the postal code of the recipient. I also found long-standing customers expressing their satisfaction of the way support is delivered, which is attributable to the priority given to the success of customers using the platform, a staple of product-led growth that I intend to double-down on. This strength has carried the app to the threshold of 100 5-star reviews and beyond, which again is something to not only persist but double-down on. With an average customer lifetime of nearly 2 years and an app history spanning more than 7 years, I found in Postcode Shipping an exception to the rule on the App Store, which seems to define a natural churn rate between 7% and 10% bearing in mind both voluntary (uninstalls) and involuntary churn (stores closing, dunning). Instead, Postcode Shipping posts churn rates in the 3% to 6% range all things considered, which has a dramatic impact on its ability to capture revenue for longer periods of time. The product is in excellent condition from a functionality perspective, but the huge emphasis on functionality was at the cost of UX, which hasn’t followed as quickly. There are many improvements that can be made to accelerate the process of creating and maintaining rules for shipping zones, rates, and products. From there, the sky is the limit where it comes to innovation. Analytics, automation and promotional features can help Postcode Shipping surpass itself beyond its scope to offer new tools that would elevate the ARPU the app can capture. As I constructed the general list of improvements I’d like to perform, it occurred to me that most of the work is through and through growth marketing and experimentation to improve core KPIs. That work would create the uplift needed in some core metrics to open the door for a variety of marketing activities knowing the machine would be as well-oiled as it could be from the mid-funnel down. Improvements include but are not limited to:

In general, because the product is so technically sound and well-tested, the core functionality can be left to do what it does best, and additional value-adds can be created to support a product-led growth strategy beyond the current instrumentation. The knowledge base is a marvel and likely only improvable with video tutorials which can have a big impact. Where a product with depth has huge value, a product with depth that contains sensible defaults and enforces best practices for the less technically inclined will quickly become indispensable. I point to Klaviyo as an example of the demystification of sophisticated email marketing through the productization and templating of proven email marketing playbooks that would otherwise take a lot of time (your own or a consultant’s) to produce. It is a net acceleration towards high-powered operations for merchants that they would otherwise would have no business having access to. That’s the level of power I described earlier represented by Shopify’s role in arming the rebels. It literally arms them to compete against an Amazonian army that was previously believed to represent the only pinnacle of ecommerce innovation. To gain access to such powerful shipping instrumentation technology for just $20 per month, and to be able to plug it into your existing ecommerce stack with just a few clicks while having access to live support from a team dedicated to helping you solve the specific shipping challenges that you might run into… There’s no wonder Shopify is taking over ecommerce. It completely levels the playing field to a speed that answers the immediacy of today’s market demands in a way that empowers independant merchants like never before. If something goes wrong, merchants can rely on the very developers of the solutions they rely on in their stores to deliver value to their customers. It’s the next level. I’m really excited to persist and augment the role of Postcode Shipping within that great ecosystem through the introduction of new tools and technologies to further empower merchants to do ecommerce their way. TrendRevenue vs. 12 months ago: +49.8% Revenue vs. 6 months ago: +15% Revenue vs. 3 months ago: +6% Revenue vs. 2 months ago: +4% Revenue vs. 1 month ago: +25% (thank you Shopify!) Risks & Opportunities

Portfolio Fit✅ Interest/expertise in the nature of the product ❔ Is the visit to install conversion rate healthy

Transaction DetailsI met the seller on Facebook (of all places) and we quickly hit it off. They were looking to transact privately with someone who would actually take on the mantle of improving the product and taking it to the next level. We quickly recognized the value of sticking together to advance the current state of shipping technology for Shopify merchants so when I received the interested offer range from the seller, I saw this was a unique opportunity to make a fabulous acquisition for several reasons.

This rare opportunity paired with a truly awesome seller could have come a little earlier, but in hindsight, nearly every other deal that fell through before lacked many of the unique aspects listed above. That is both luck and/or persistence, depending on how you see things. I choose the latter. The future is very bright for Postcode Shipping:

Looking forward to sharing all of that really soon. See you around the state of the fund!

1 At the time of first conversation, the business MRR was heading to close the month at approximately $13k, but Shopify’s newest rules about removing commissions for developers producing under $1m per year come into effect on August 1st, and represent a 25% increase in MRR through the removal of the commission the app has so far paid. 2 Within the shared P&L, several costs were associated to the business itself, including design, engineering and support resources that could either be reduced or removed entirely by my own involvement. The ‘Buy & Hold’ number turned out to be quite profitable, though the support burden varies from 5-20 tickets per week, with the majority of the year averaging 6-7 weekly. 3 The main costs here were contractors, support staff and then fixed costs like servers, databases and support infrastructure. 4 Last month profit demonstrates the previous point #2 by the removal of non-essential costs and the subsequent increase in profitability in the trialing 12 months This metric could be further improved relative the departure of staff members following the acquisition’s training period. 5 You’re probably wondering — what does this mean? 6 The liquidation participation is an amazing way to decrease the upfront offer while creating a larger total outcome for the seller, while also creating a vested interest and alignment between both parties to collaborate towards the continued growth of the project. If you’re not too greedy and open yourself to this option, it can open many doors. In my case, I recognize that there are buyers out there who could pay 4x-6x to swallow the product into their PE portfolio. This fundamental truth benefits both the seller and myself, as an ability to create or instrument a higher valuation would benefit us both, thanks to the liquidation participation. For a seller who wants to exit after several years in a project, it’s nice to know there will be an additional kicker down the line whenever the project you care about exchanges hands. Kind of like NFT benefits on the product itself. 7 If you develop for Shopify merchants, i18n gives you the ability to release translated app store listings for at least 7 more languages. The reason this is significant is because those app stores serve their markets more naturally - Spanish visitors will visit the Spanish app store etc. The net result can often accelerate daily installs by 50%! You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: July 2021

Thursday, August 5, 2021

T6M Report, New Acquisition, Reaching + Surpassing Fund I Goals & Player 2 Has Joined The Game 💸

MicroAngel State of the Fund: June 2021

Saturday, July 10, 2021

Dissolved + new deals, revenue milestones, challenges bootstrapping Batch. Closing MRR: $5.28k / $15k (35% to goal)

Micro-SaaS Acquisitions as Startup Call Options

Thursday, July 1, 2021

Salty you missed out on GameStop?

The plan to fix Reconcile.ly

Friday, June 11, 2021

First red alert, getting a lay of the land and picking low hanging fruits ahead of improvements + growth

Balancing Revenue Generation & Profit Management to Grow Micro-SaaS Valuations

Friday, June 4, 2021

Every acquisition comes with a built-in opportunity

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved