The Pomp Letter - The Gold Standard - 50 Years Later

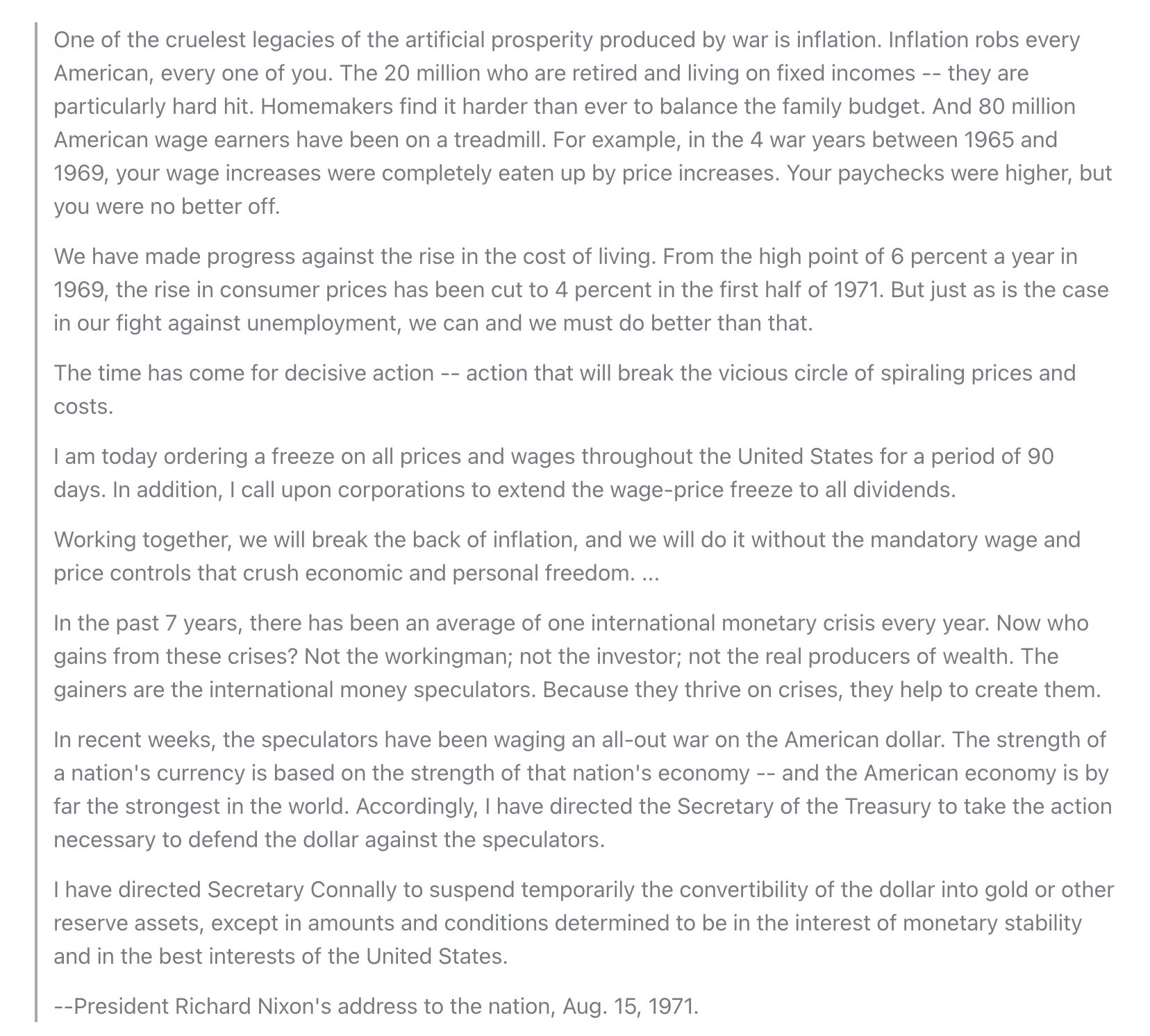

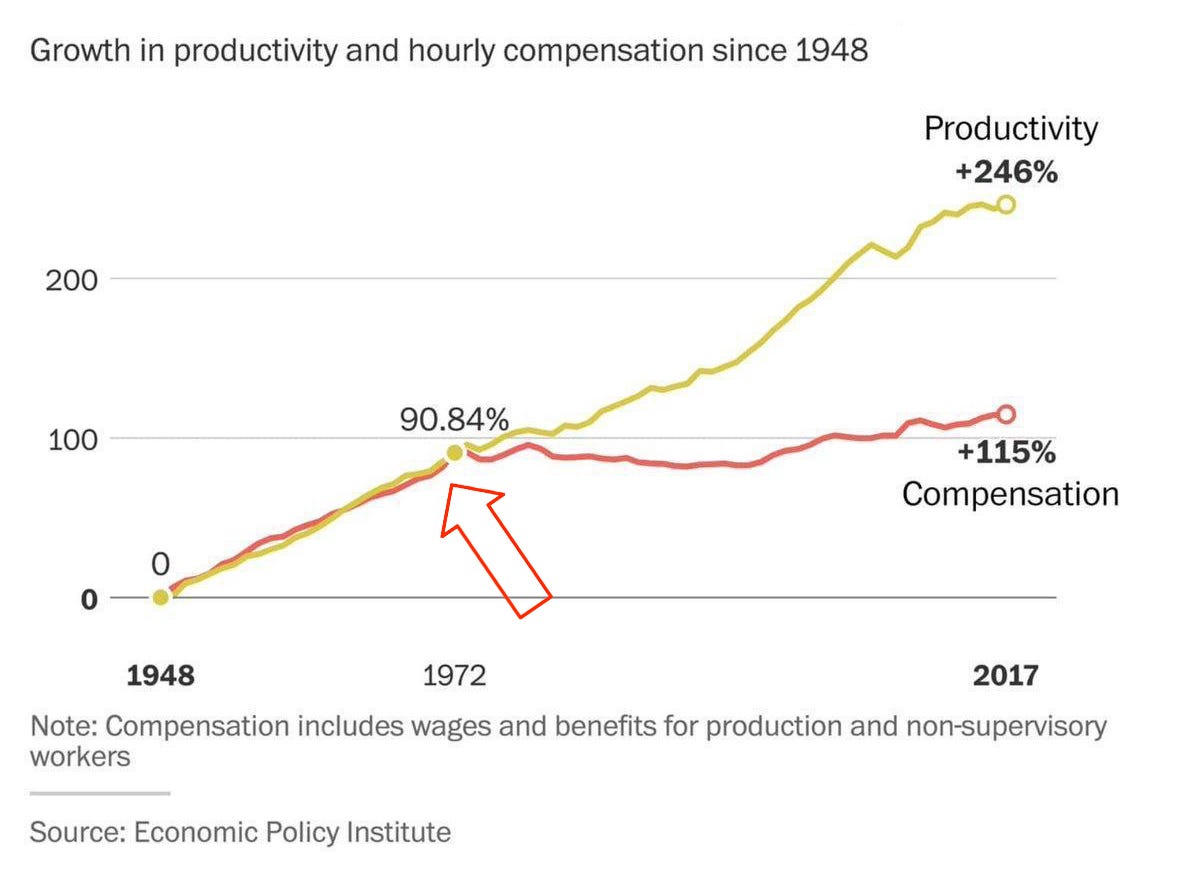

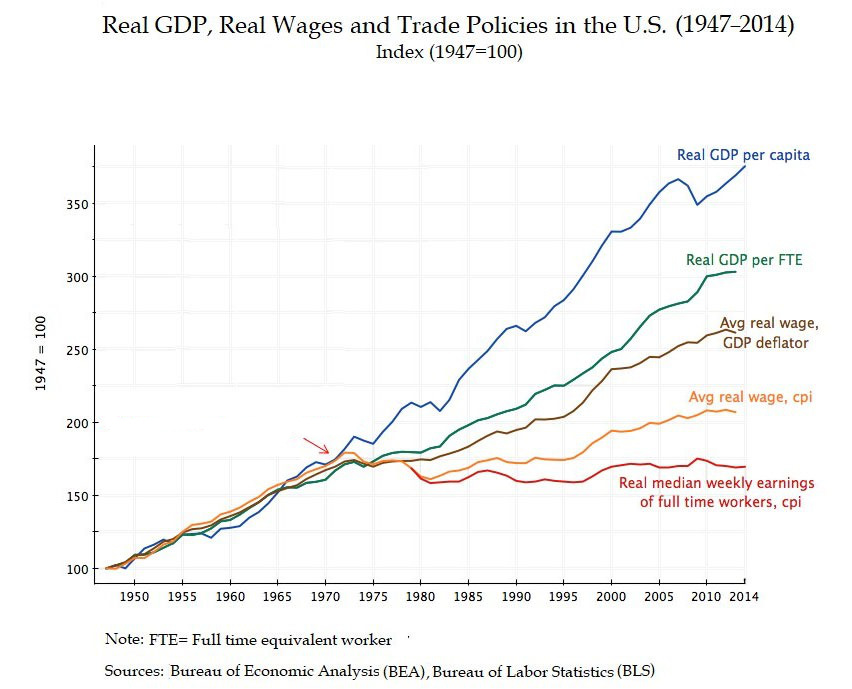

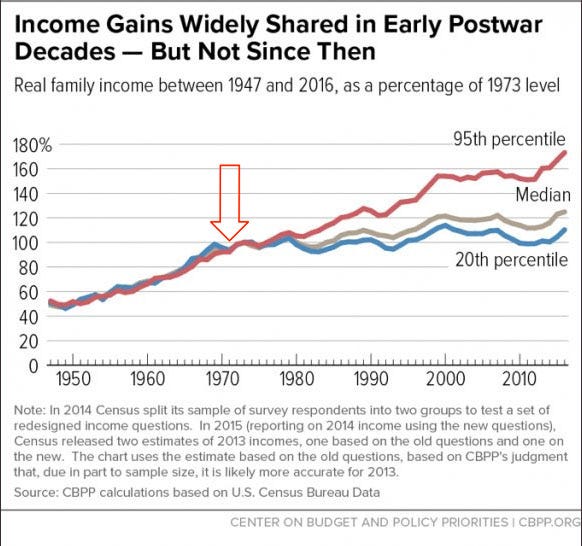

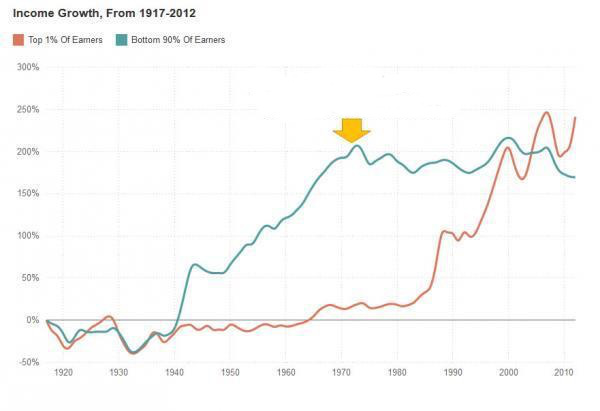

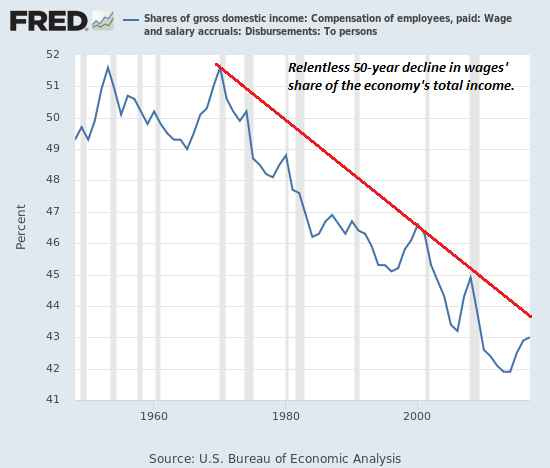

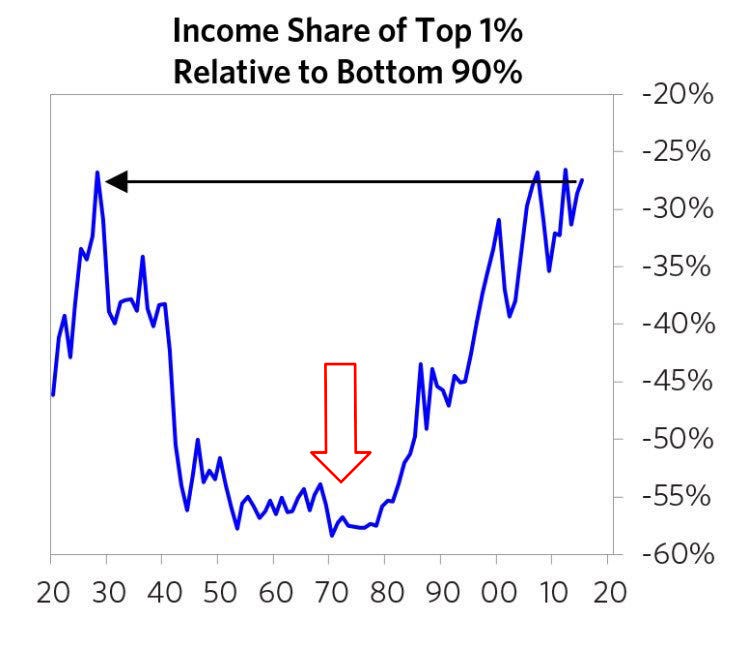

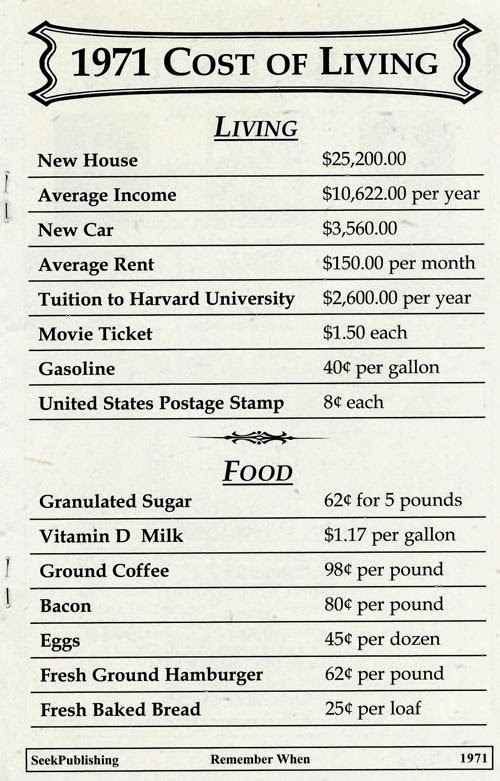

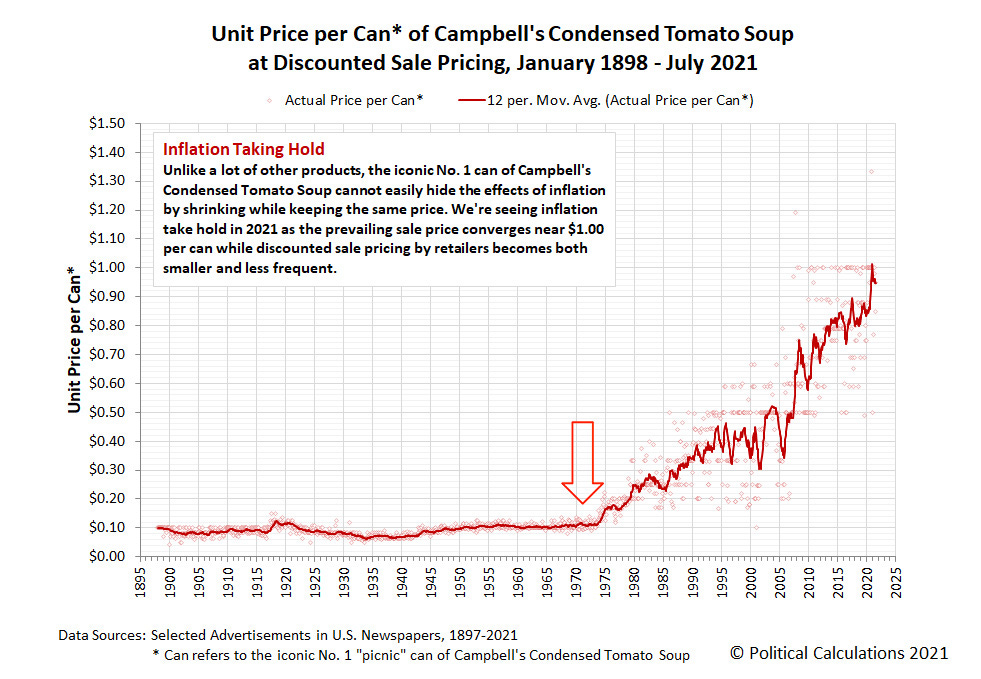

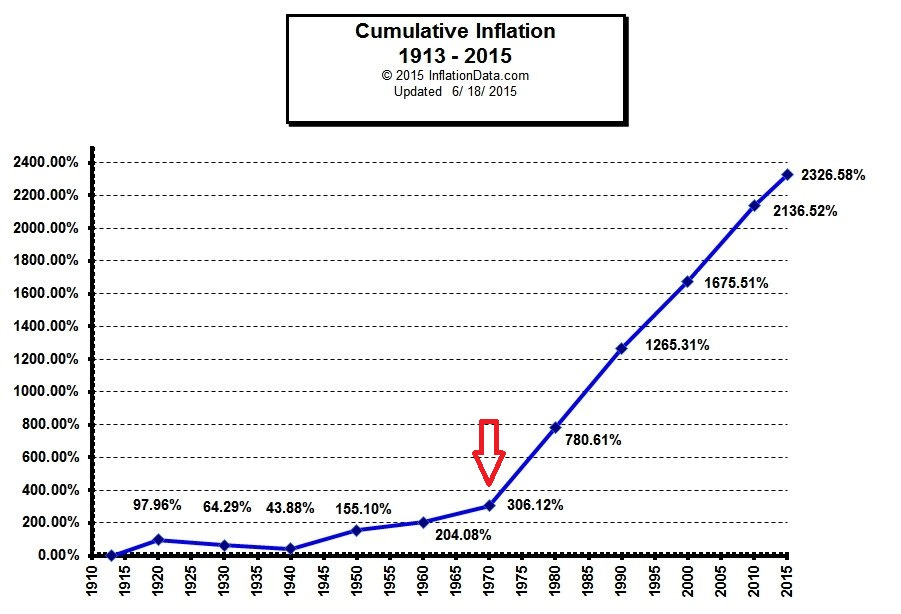

To investors, Yesterday was the 50th anniversary of President Nixon taking the US dollar off the gold standard. While you may be familiar with the basics, there is quite a bit to unpack from that historic moment. First, let’s take a look at what Nixon’s exact comments were when he decided to execute this idea.  You can read more of the speech here: The language used here was important. There was reference to the American economy being the strongest in the world, the importance of defending the US dollar against speculators, the promise of temporary action, and of course - the confirmation that the US dollar would be stable and immune from being devalued. Cute idea, but historically this has been proven to be one of the worst policy decisions in history. Don’t believe me? Our friends over at River have collected a few charts to highlight the impact: Just incredible to see the impact of the United States going off the gold standard. Remember, President Nixon said that “inflation robs every American, every one of you.” That is correct. But while he was referring to pre-1971 conditions, he should have foreseen how destructive his decision would be. It is interesting to look back on the 50 year anniversary and realize that we currently are experiencing 5.4% CPI and 4.3% core inflation numbers. These are basically the highest they have been in decades. There are currently 78% of Americans who live paycheck-to-paycheck and 45% of Americans who hold no investable assets. These are the people who have suffered at the hands of poor policy decisions. While disheartening, the free market appears to have created a brand new global competitor — bitcoin. There is no need to replace the US dollar in the short term, so bitcoin is likely to serve as the global store of value for decades to come. The transparent, programmatic monetary policy of a digital currency that has decentralized infrastructure is too powerful an idea, especially when compared to the backdrop of continued insane monetary and fiscal policy decisions. The legacy organizations are doing just as much to market an alternative store of value as any bitcoiner could dream of. As Niall Ferguson wrote in a Bloomberg Opinion piece this morning, “If we have learned nothing else from the past half-century, it is surely that the best way to win a race with totalitarian rivals is not to copy them, but to out-innovate them. Make the wrong decision at this historic turning point, and we shall be interrupting a much bigger bonanza than Nixon did.” If you have any material amount of wealth, you are not able to preserve it by holding US dollars, bonds, or gold. All are producing negative real rates of return. You essentially are left with bitcoin or equities, which leads you to consider an allocation to bitcoin given the high degree of volatility that will likely serve to outperform equities over a long enough time period. We are living in weird, weird times. President Nixon kicked off the fiat experiment in 1971 and 50 years later, we are watching the global adoption of a potential solution to that problem. There is still a lot of work to do. Plenty more people to educate around the structural disadvantage they have as they pursue financial security in the legacy system. But….slowly we continue to head in the right direction. Stay alert out there. Make sure you are educating yourself as best you can. The uncertainty and chaos of markets can be calmed by further understanding of history. Hope your week is off to a great start. I’ll talk to everyone tomorrow. -Pomp SPONSORED: It's no secret I hold Bitcoin as majority of my portfolio. But even I know you have to diversify into other asset classes like elite investors.

Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Coinbase Beats Expectations & The Future Is Bright

Friday, August 13, 2021

Listen now (4 min) | To investors, Coinbase reported their earnings yesterday and beat Wall Street's expectations on almost every metric. Here is a quick breakdown: Revenue - expected was $1.85

Bitcoin doesn’t need Presidents, but Presidents need Bitcoin

Monday, August 9, 2021

Listen now (9 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 190000 other

Are We Repeating October 2020 Before The Big Bull Run?

Friday, August 6, 2021

Listen now (6 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

The Infrastructure Bill, Bitcoin and Crypto

Thursday, August 5, 2021

Listen now (2 min) | To investors, The infrastructure bill that is currently making its way through the government has a lot of crazy things in it. This isn't exclusive to this specific piece of

The Supply Shock Is Underway

Friday, July 30, 2021

Listen now (5 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.