The Pomp Letter - The Supply Shock Is Underway

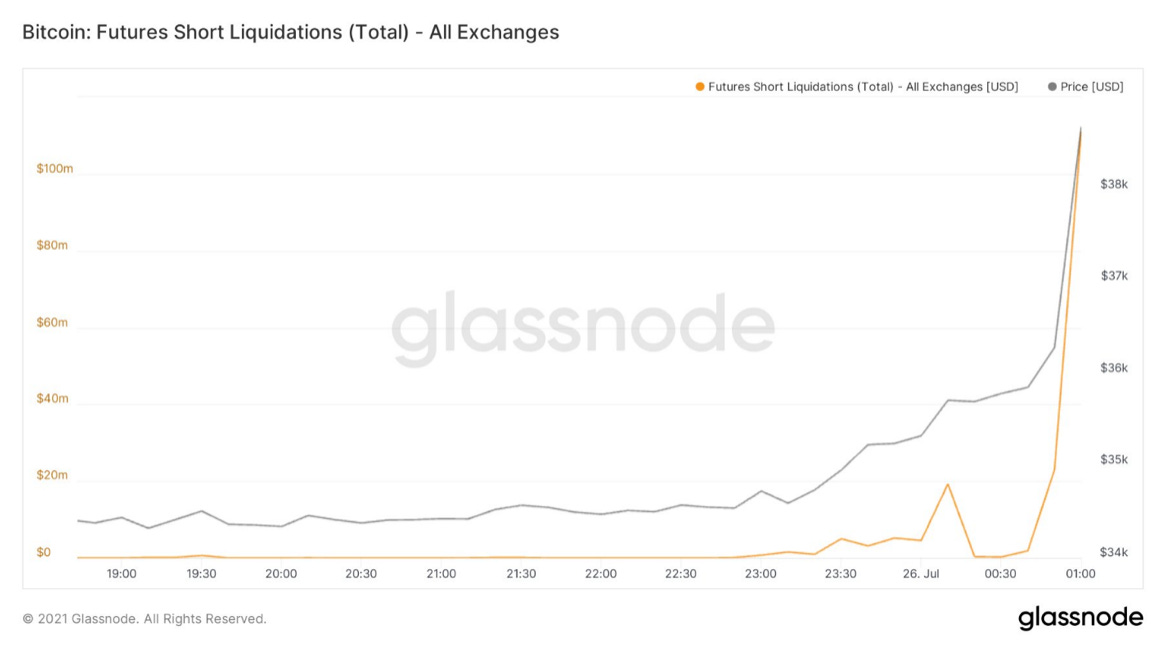

To investors, Will Clemente breaks down this week’s bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis: Hope all is well. After weeks of following the strong divergence between on-chain investor behavior and price, it looks like we are finally starting to see that translation into price action. As we were watching for in last Friday’s letter, we got a short squeeze on Sunday evening that liquidated over $110M in shorts within minutes. This added momentum to a rally that now has given the market 9 straight green daily candles. Let’s dive into some of the developments from this week. As always, here’s some high-level takeaways:

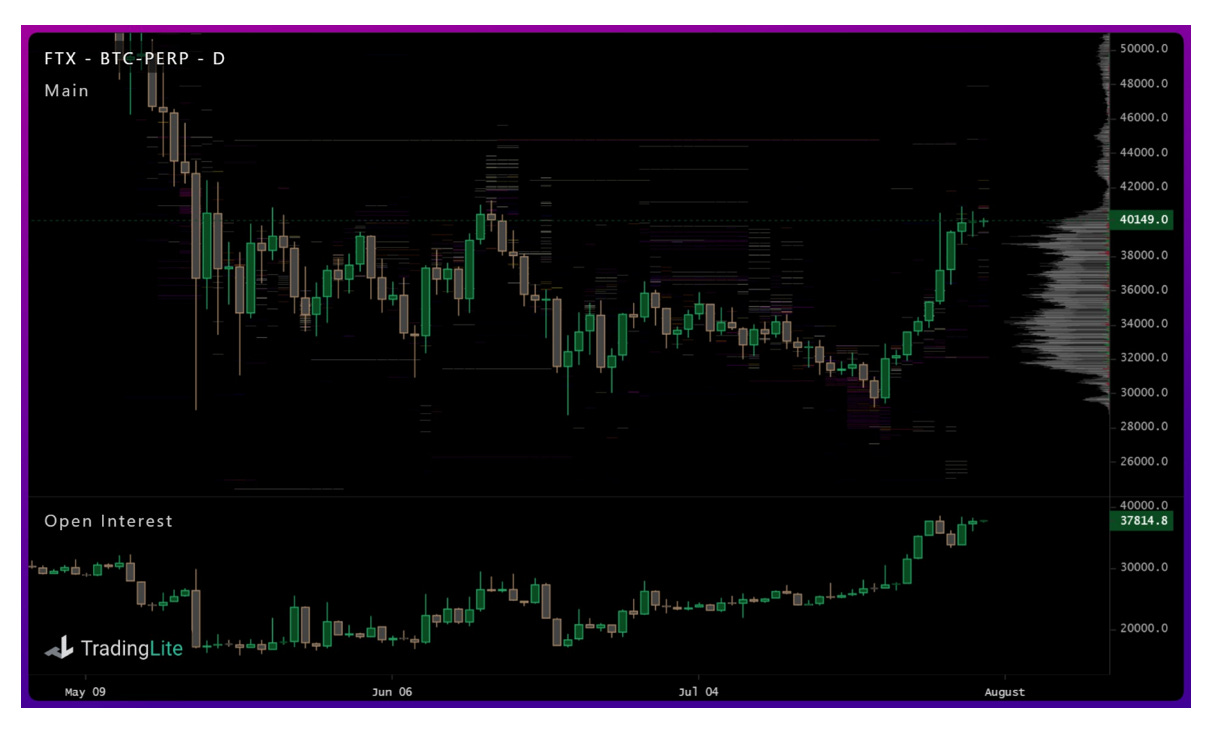

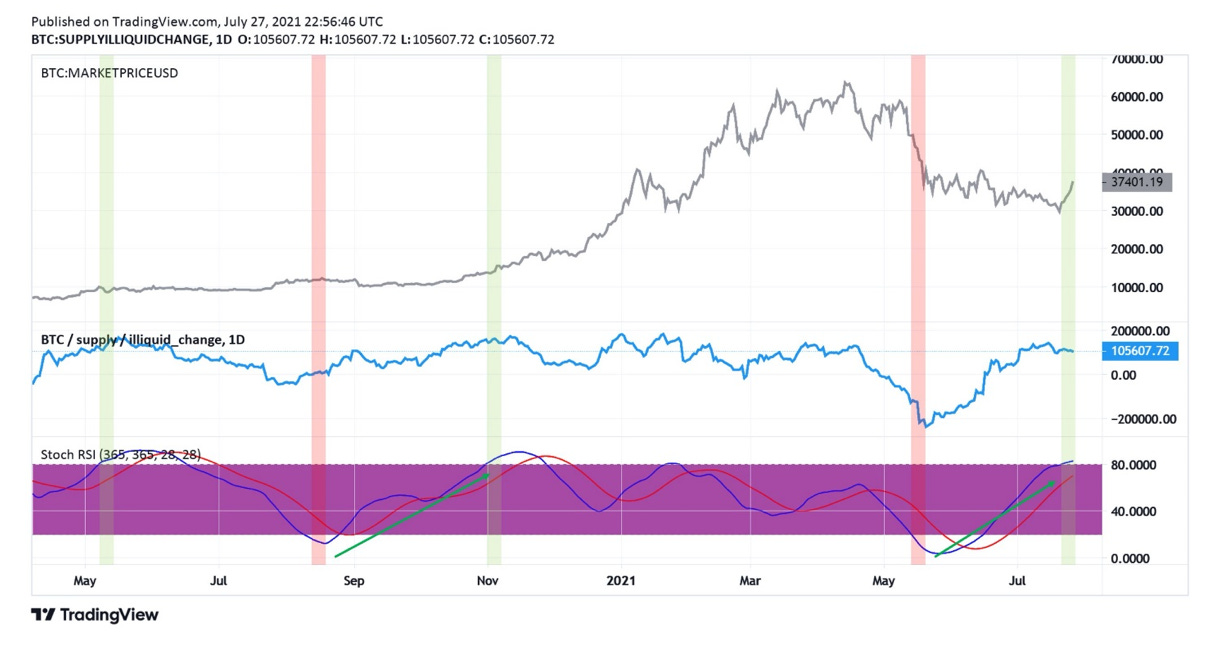

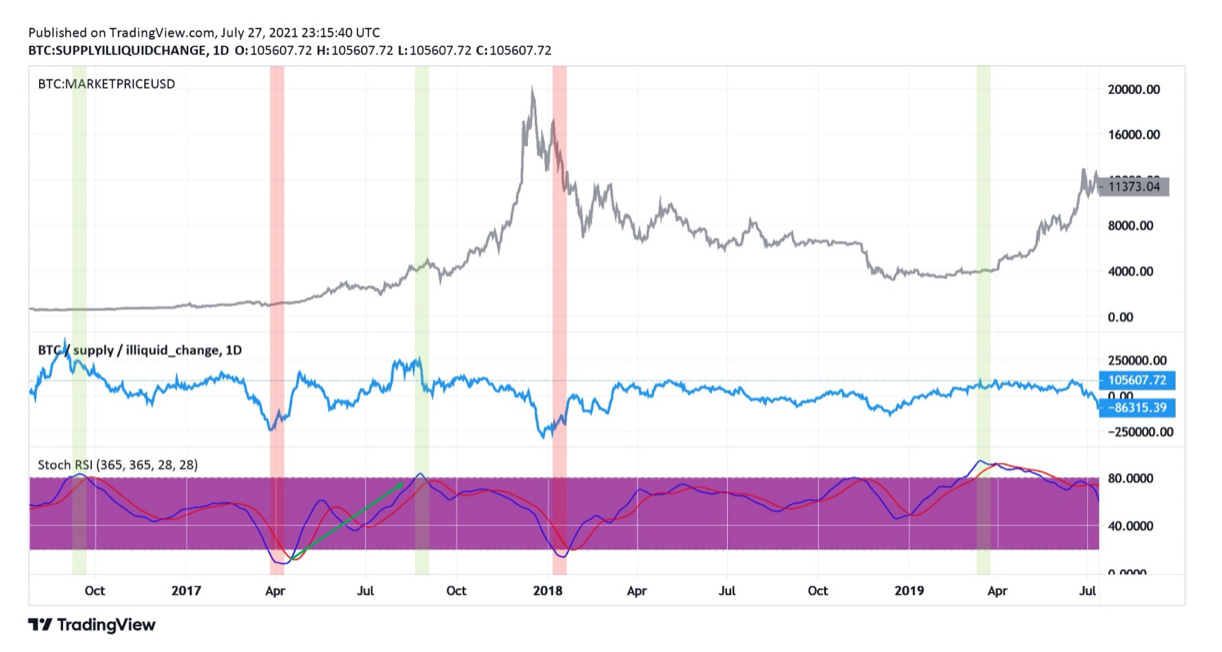

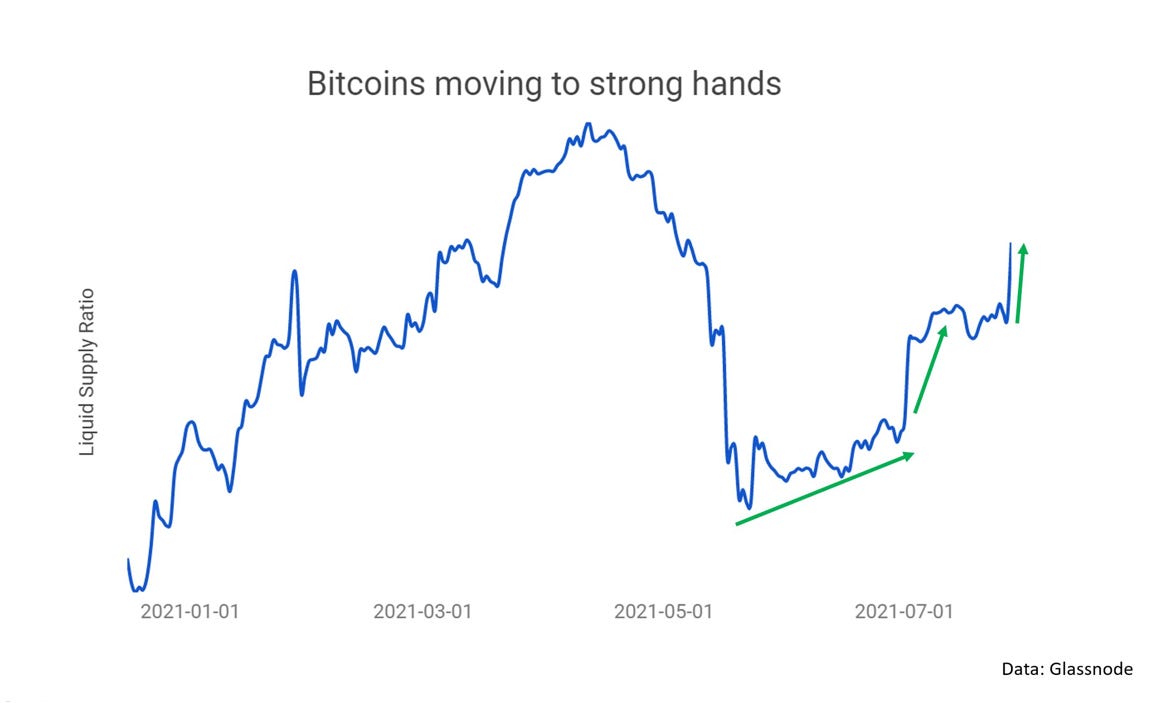

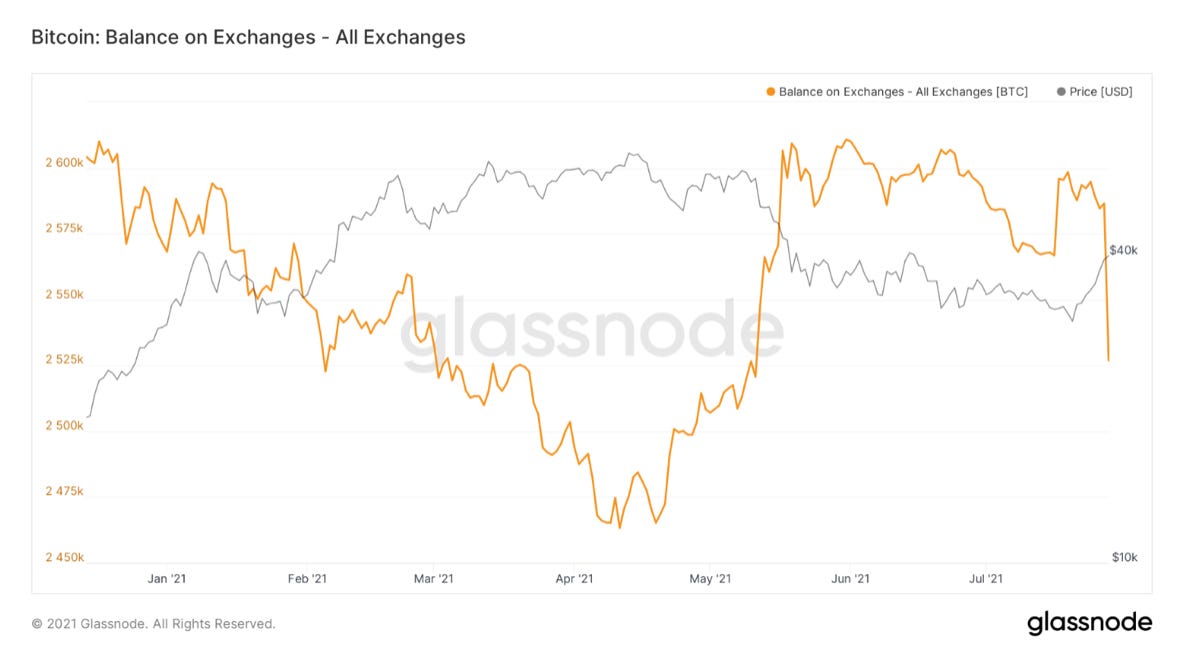

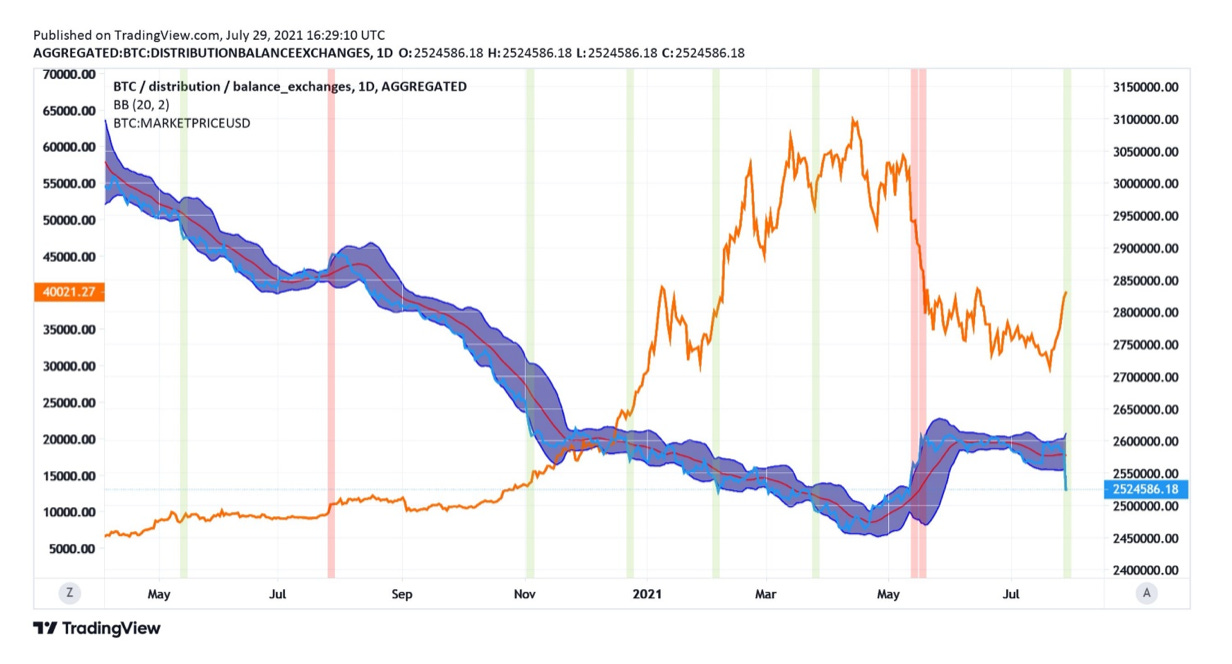

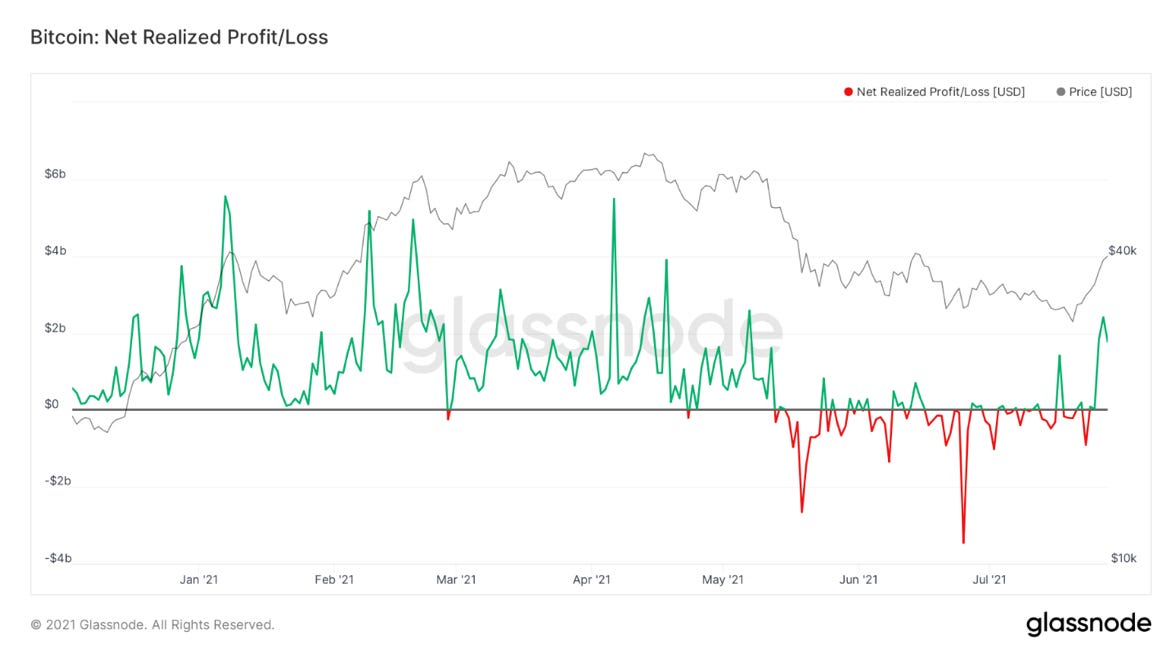

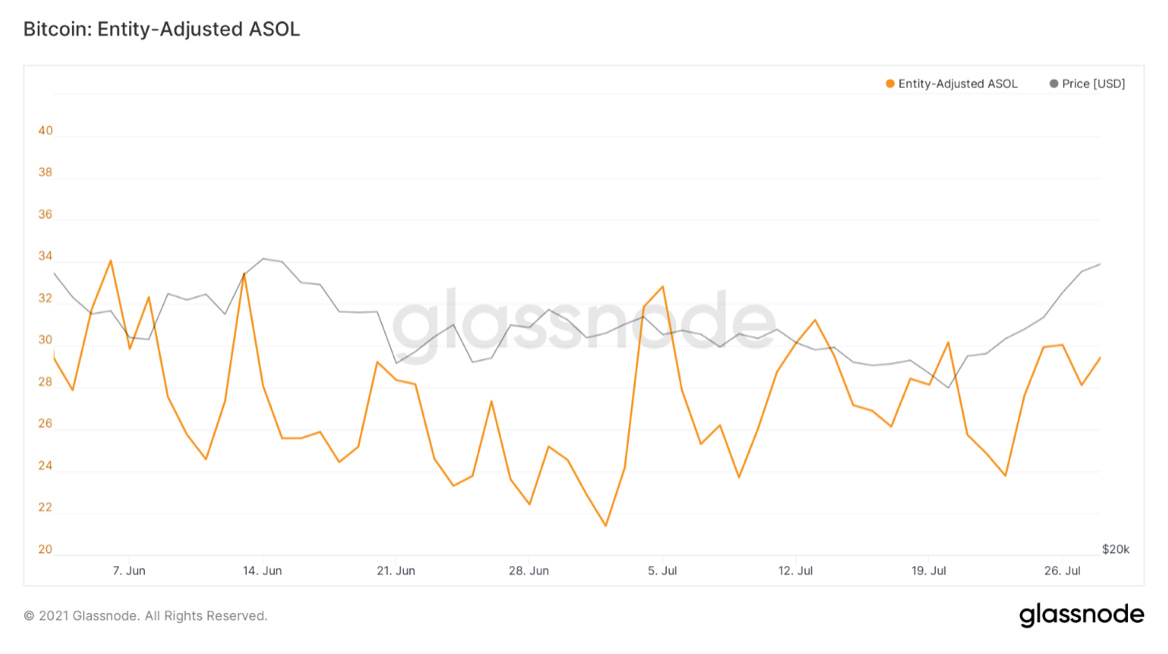

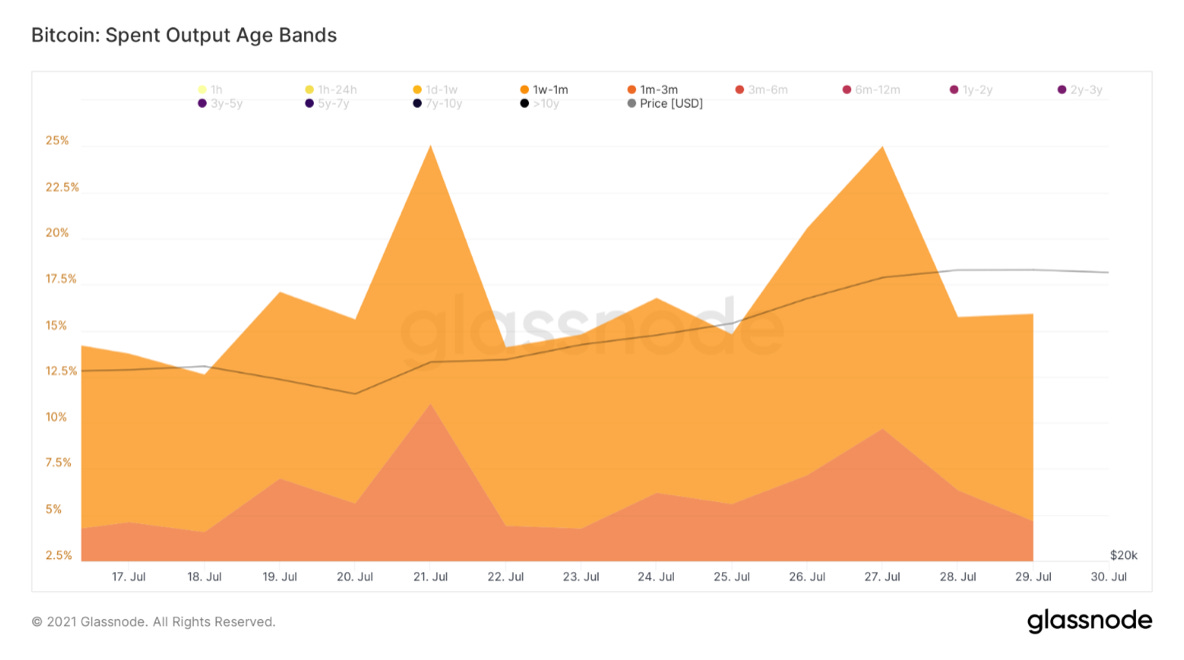

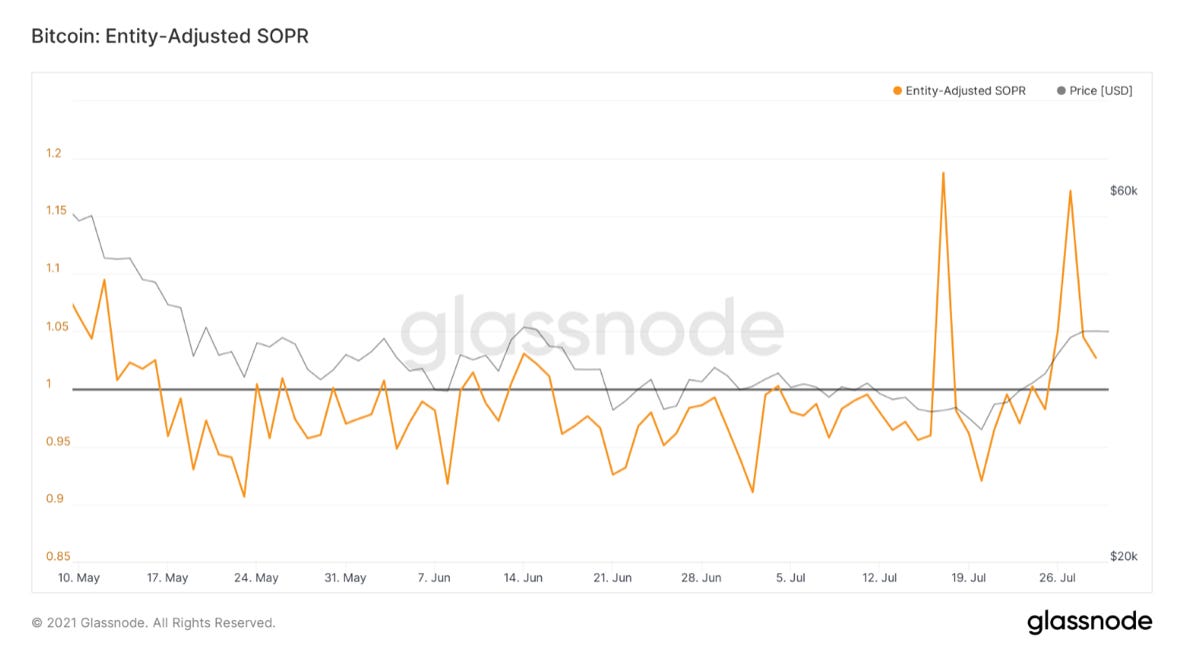

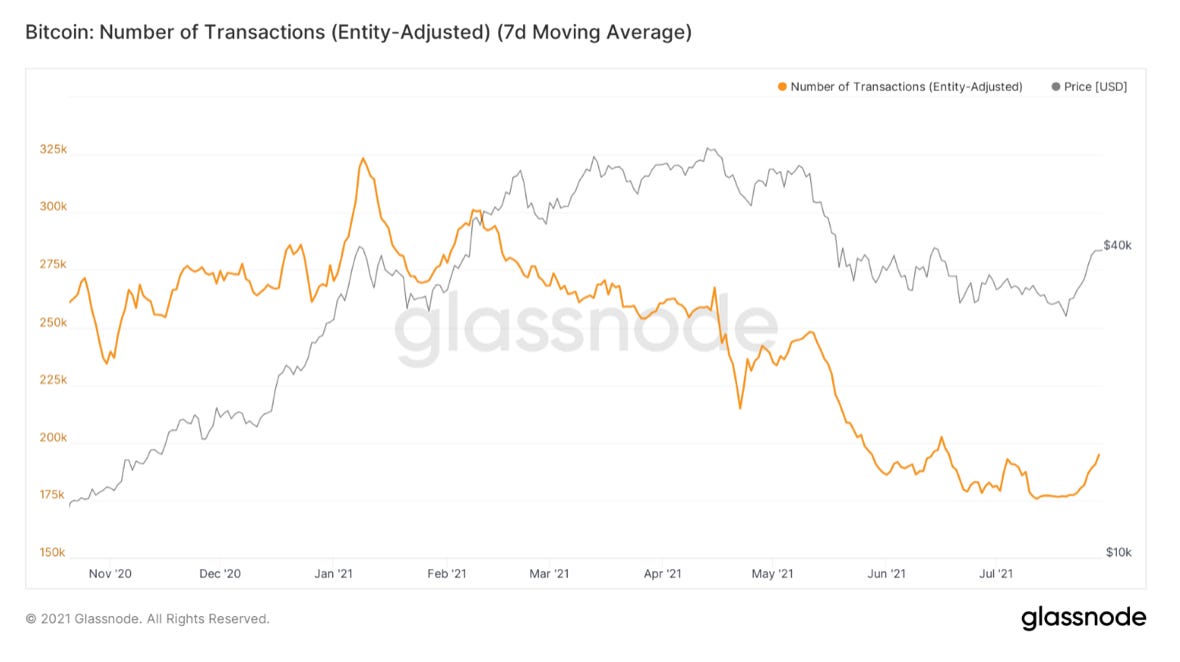

To start, let’s look at a metric that follows the broader context of accumulation in the Bitcoin market. This indicator I created runs a 365-day stoch RSI over the 30-day net change of illiquid supply. 30-day net change meaning the difference between illiquid supply today and this date last month. I use this to follow the wave of “supply shock” brewing underneath the market. You can see in the RSI what I’m referring to by the “wave” of supply shock; highlighted by the green arrow. This supply shock propelled the bull run higher in late 2020. Looking at it now, this has not only started printing a buy signal, but the rate of change from the sell signal in May to now is quite impressive. To me this indicates that the momentum from this wave of supply shock is strong. Just for kicks, here’s the metric back tested in 2017/2018. Buy signals don’t come often, but when they do, they are very accurate in a broader context. Important note: The data used below for illiquid supply, exchange balances, and supply held by different cohorts is all one day old. I have never done this before in the newsletter, but I feel that it’s appropriate because of the following: On Thursday there were massive reported outflows from several exchanges, including over 108K BTC from Kraken; showing their balance has dropped down to 62,859 BTC. I am highly skeptical of these flows, which effect other entity related data including illiquid supply. I suspect it is just end of month routine internal shuffling that will be picked up in a few days by Glassnode’s heuristics. Hope you understand, would rather be on the safe side and not spread data that likely needs to be updated. We’ll have confirmation by the time we speak again next week, as Glassnode is looking deeper into the flows. So, we’ve looked at the supply shock in a broader sense, but now let’s take a more real time look at this movement of coins from “weak” to “strong” hands. To do so we’ll use liquid supply ratio, showing another uptick. After tracking this re-accumulation process since May, it is now almost fully complete. Supply shock is at levels that previous priced Bitcoin at 50K-60K. Exchange balances have taken another drop, once again showing accumulation: down 66,655 BTC this week. As mentioned, this is excluding data from Thursday. This drop in exchange balances has triggered a buy signal in the exchange flow Bollinger bands. This follows large moves in exchange flows: when massive inflows occur selling is assumed, when massive outflows occur accumulation is assumed. With this framework we can create buy/sell signals based on when the metric breaks out of the bands in either direction. The market is taking some profits on this rally though, realizing up to $2.4B in net realized profit on Tuesday. This isn’t alarming imo and is to be expected after we’ve sat at the bottom of a range for weeks. But just to do some further investigation, I find it prudent to look at the age of the coins being sold. If we see strong profit taking from older coins fading every bounce looking for exit liquidity that’s not ideal. So, here’s what can be found upon further investigation. Looking at the average age of the coins being sold, this continues to go sideways, with the broader multi-month trend still clearly down. We actually had a downtick in the age of coins sold on Tuesday, coinciding this with the $2.4B of profit realized means those coins were likely newly bought in this range, not experienced market participants. And to just go a step further, here’s the spike on Tuesday of coins being spent between 1 week and 3 months old. (within this 30k-40k range) No major coinciding spike from older cohorts. On a similar note, this recent rally has increased the percentage of total supply in profit from 65.82% on the 20th to 82.58% at the time of writing. The last time the percentage of supply in profit was this high Bitcoin was priced at nearly $50k. This is inadvertently another way to note how many coins were re-absorbed in this 30k-40k range, as coins had to be last spent at lower prices for that to be true. A last note on profit taking, here’s SOPR (spent output profit ratio), adjusted for Glassnode’s entity clustering. This shows the market is once again trading in a state of net profit. Would like to see this indicator stabilize above 1 (black line) or bounce off 1 on a price correction to get bullish confirmation. Miners continue the heavy accumulation that we’ve been tracking for almost 2 months now. After the drop in hash rate and a massive difficulty adjustment, the miners still on the network are very profitable. This is because the amount of hash competing for block rewards is much less. Lastly, on-chain activity is still overall pretty dead. Would like to see an increase in the number of transactions, size of the mempool, and continued (since Jun 27th) increase in active addresses to gain confidence that network activity is as bullish as accumulation activity seems to be. That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here SPONSORED: Amber Group is a leading global crypto finance service provider operating around the world and around the clock with a presence in Hong Kong, Taipei, Seoul, and Vancouver. Founded in 2017, Amber Group is committed to combining best-in-class technology with sophisticated quantitative research to offer clients a streamlined crypto finance experience. The platform now services over 500 institutions and 100,000+ individual investors across the Amber Pro web platform, the Amber App, as well as their 24/7 trading desk. To date, Amber Group has cumulatively traded more than $330 billion across 100+ electronic exchanges, exceeding $1 billion in assets under management. In 2019, Amber Group raised $28 million in Series A funding led by global crypto heavyweights Paradigm and Pantera Capital, with participation from Polychain Capital, Dragonfly Capital, Blockchain.com. Click here to sign up now. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Is A Short Squeeze Upon Us?

Friday, July 23, 2021

Listen now (5 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

Fix the money, Fix the world

Thursday, July 22, 2021

Listen now (3 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

Miners Are Accumulating And Investors Are Removing Bitcoin From Exchanges

Friday, July 16, 2021

To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by

Stablecoins, Institutions, and DeFi

Tuesday, July 13, 2021

Listen now (4 min) | To investors, I have been doing a deep dive on the stablecoin market, which is quickly becoming an important of the crypto industry. Adoption is occurring across various market

Financial Education Is A National Emergency

Monday, July 12, 2021

Listen now (3 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.