Not Boring by Packy McCormick - Nifty Corporates

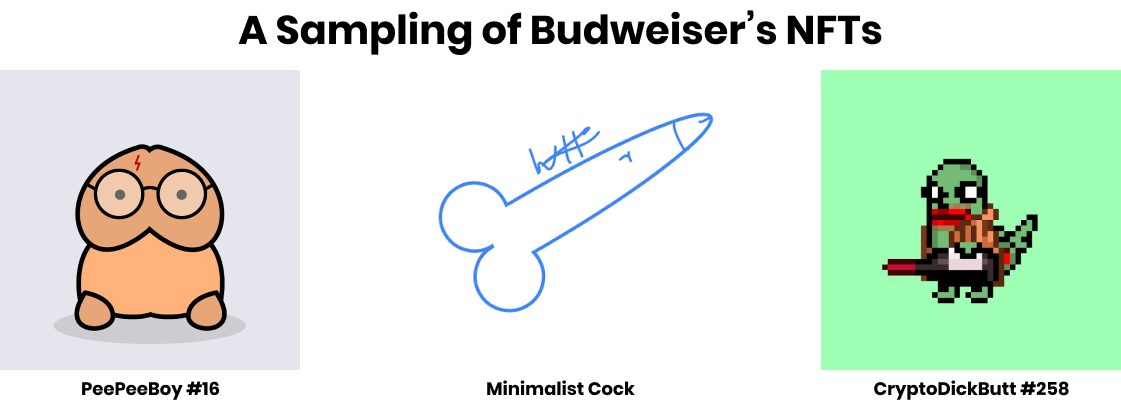

Welcome to the 2,103 newly Not Boring people who have joined us since last Monday! Join 72,599 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) Today’s Not Boring is brought to you by… MarketerHire A world-class marketer is worth their weight in ETH. The VISA marketer who bought a CryptoPunk for $150k generated eye-popping ROI (and bought an asset that nearly tripled in price in a week). It’s moving fast out there, and old channels don’t work like they used to. You need a marketer who can stay ahead. MarketerHire matches your business with expert marketers perfectly suited for the task at hand -- the kind of marketers that you might not be able to find, hire, or afford on your own. Even better? They do the heavy lifting. And it works. MarketerHire’s expert marketers have tripled their customers’ revenue in a matter of months. Just set up a call with MarketerHire, tell them what you’re looking to accomplish, and they’ll match you with the one right marketer for you. Hi friends 👋, Happy Monday! Over the past few weeks, something strange has been happening: the corporates have come for the NFTs. That’s a good thing. Let’s get to it. Nifty CorporatesThe corporates are coming for the NFTs. Last week, VISA’s $150k purchase of a CryptoPunk caught everyone’s attention, but Budweiser’s foray into rare jpegs was much funnier. On Wednesday, Budweiser changed its Twitter profile picture to an Non-Fungible Token (NFT) it purchased for 8 ETH, a Budweiser-themed rocket from Tom Sachs’ Rocket Factory: The 145-year-old brewer also spent 30 ETH to acquire the Ethereum Name Service (ENS) domain beer.eth, which are essentially like domain names except backed by NFTs that are owned, not rented, by the owner. Budweiser is part of a growing wave of brands getting involved in NFTs, and its purchases more than paid for themselves in free marketing value. I’m writing about it right now. I kind of want to drink a Bud. It’s also a lesson that incumbent brands who want to get involved in web3 need to give up a little control and get comfortable with the weird. Because as people checked out Budweiser’s beer.eth wallet, they didn’t just find the Rocket. They also found some dicks. web3 is open and permissionless. When Budweiser let it be known that its wallet was at beer.eth, they opened the floodgates. Anyone can send them anything, and anyone can see what’s in their wallet by searching beer.eth on Rainbow. So of course, people do what they do with any fresh canvas: drew pensises. As a Harry Potter fan, my personal favorite is PeePeeBoy #16. (Budweiser, if you’re reading this, I made you an offer for PeePeeBoy #16 on OpenSea, happy to take it out of your wallet!) It’s all too much fun, playing at the edges of a new frontier. Crypto and web3 more broadly have consumed a ton of my brainspace in 2021. It started with a curiosity about some niche thing happening at the fringes of the internet that might be important in the future, and has evolved into a belief that the transition to web3 will be the next major platform shift. It’s as big as, or potentially bigger than, the internet and mobile. Commercially, if the internet changed how products are sold, web3 changes what products are sold. web3 feels like one of the ones that changes everything. web3 isn’t just crypto, it’s a more decentralized, peer-to-peer, and liquid version of the internet, often but not necessarily powered by crypto. The parallels between the internet’s ascent and web3’s are striking. Just like the internet, web3 started out as Chris Dixon’s thing that “the smartest people do on the weekend.” It’s becoming clearer that it’s “what everyone else will do during the week in (less than) ten years.” The internet started with university researchers (the first transaction facilitated by the internet was a 1972 weed deal between Stanford and MIT researchers via Arpanet) and spread to message boards and chat rooms before going mainstream. By 1999, internet startups were raising at eye-popping valuations and every incumbent company needed a website. Adding “.com” to a corporate name sent stock prices soaring. Similarly, web3 spent its first decade or so as a playground for researchers, coders, and degens. People bought drugs with crypto, too. Last year, corporates started dipping their toes by buying Bitcoin with their balance sheets. Over the past month or so, though, it really feels as if web2 companies are waking up to the fact that they need to figure out their web3 strategy or they’re not gonna make it. In addition to the VISA and Budweiser purchases, in the past month alone:

Those are just a few public examples. Many of the non-crypto startups in the Not Boring portfolio are realizing that web3 lets them do things they couldn’t otherwise. I’m seeing more crypto companies with real-world applications beyond trading coins back and forth. Board rooms around the world are calling in “that shadowy super coder on the eng team who knows about crypto” to get them up to speed. In most of the web3 analysis I’ve done in Not Boring, I’ve focused on new projects, web3-native companies, and web3’s impact on individuals. Now, the corporates are coming. Incumbents are realizing that web3 is no longer just a cute oddity, but a threat and an opportunity. In Who Disrupts the Disrupters? I wrote about how web3 projects might disrupt today’s biggest tech companies. In Status Monkeys, I covered how NFTs scratch the same itch that social networks do, and how that explains their value in the eyes of individuals. This piece is about how corporate incumbents are getting involved with NFTs, and their potential to increase the value of the overall ecosystem, and likely make some hilarious gaffes, in the process. Within the next five years, nearly every consumer company, and many B2B companies, will be web3 companies, just like nearly every company became an internet company in the early 2000s. They’ll use tokens, embedded DeFi, and NFTs to strengthen network effects, increase switching costs, build novel user experiences, improve margins, and turbocharge growth. It’s hard to see now, because it’s so early and NFTs still feel like a toy, but companies are already beginning to play with NFTs for marketing, and they’ll soon make them a core part of their business models. The ability to imbue low marginal cost digital products with the same attributes that make physical products valuable and new capabilities only made possible by web3 is deeply underappreciated. Today, we’ll appreciate, by covering the early corporate moves into NFTs and exploring what they suggest about corporate adoption of NFTs and web3 tech more broadly going forward.

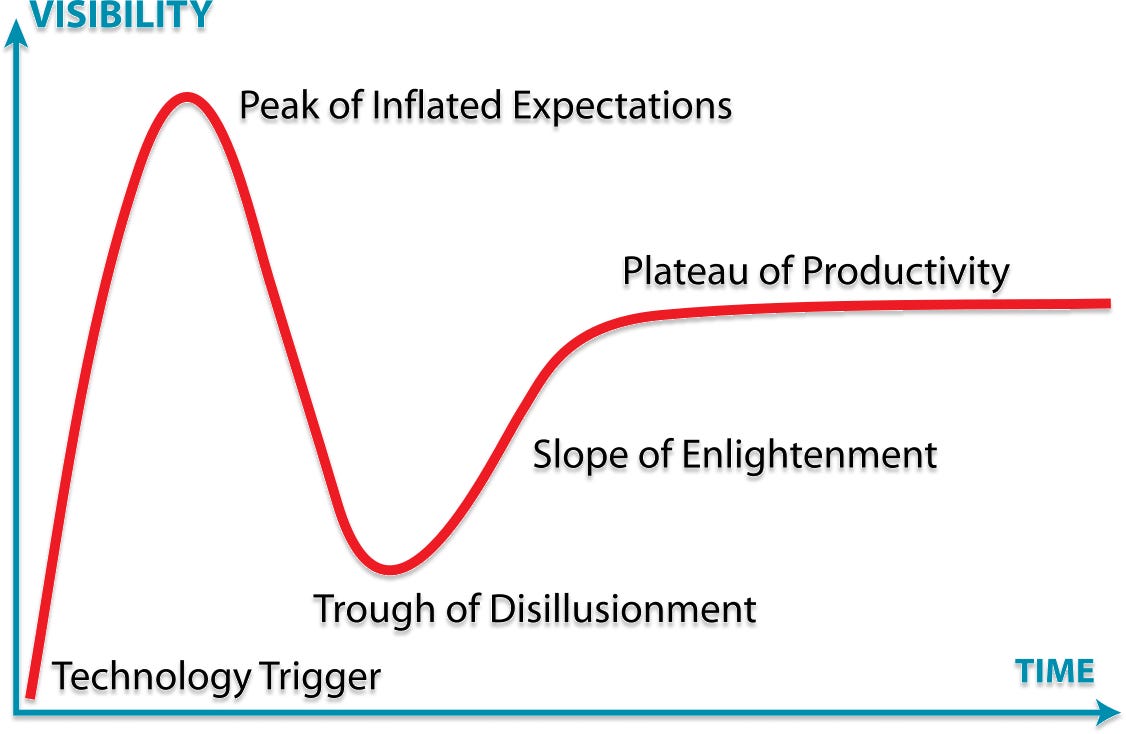

If it feels bubbly, that’s OK. History doesn’t repeat itself, but it rhymes. We’re partying like it’s 1999, and that turned out just fine. Mania, Bubble, or Hype Cycle?It’s easy to dismiss incumbents getting into crypto as just another sign that we’re in a bubble. We’ve seen this movie before. Early web3 mirrors the early commercial internet. In 1999, during the frenzy of the dot com bubble, practically every company built a website, and any company that added “.com” to their name soared in value. One 2001 study in The Journal of Finance found that companies that added “.com,” “.net,” or “Internet” to their name saw their stock prices increase 74% in the days following the name change. It’s fun to look back and make fun of all of the silliness 1999/2000 silliness. Pets.com! Lol. Webvan haha! Internet.com teehee! In the beginning, these shifts feel like bubbles. Internet mania drove the tech-heavy NASDAQ up 3.4x from 1,619 at the beginning of 1998 to a peak of 4,696 in February 2000. It crashed even harder, to a low of 1,172 in September 2002. Oof. But after an early peak and valley, the internet obviously stuck around. The dot com bubble looks like a big blip. Today, the NASDAQ sits at 15,129, 3.2x higher than it’s dot com peak. Internet companies have created trillions of dollars in value. The technology is so ubiquitous that we no longer talk about “dot com” companies or “internet” companies. The most valuable companies were born of, or pivoted hard towards, the internet. Early hype helped fund that shift. NFTs today feel similar. If I had an ETH for every time I’ve seen someone compare NFTs to Tulip Mania, I’d be able to buy up all the CryptoPunks. But I think there’s a key difference: manias like the one that gripped the Dutch in the 17th Century or Beanie Baby collectors in the 1990s were isolated and non-composable. Money thrown at Tulips or Beanie Babies didn’t spur innovation that others could build on. There was no directional arrow. They were time capsules, captured to be revisited and analyzed by future anthropologists. If they are a bubble, NFTs are more like the dot com bubble. They’re a different, more productive sort than Tulips. (Alright alright, except for this $3.2M Tulip NFT). Unlike Tulips, bubbly demand for internet stocks or NFTs brings more money and experimentation, which increases the likelihood of building valuable use cases that gain mainstream adoption. Is there some dumb shit being bid up to incomprehensible prices? Certainly. But in these cases, enthusiasm becomes activation energy, and over time, foolish behavior fades and a new paradigm emerges. The internet and NFTs follow the old Not Boring favorite: the Gartner Hype Cycle. The Gartner Hype Cycle is a useful framework through which to view new technologies, particularly powerful for the fact that nearly every new major technological innovation follows its curve. It’s not that all technologies are the same, or become useful at the same rate; instead, the Hype Cycle is a mirror that reflects humanity’s collective attitude towards new things.

According to Gartner itself:

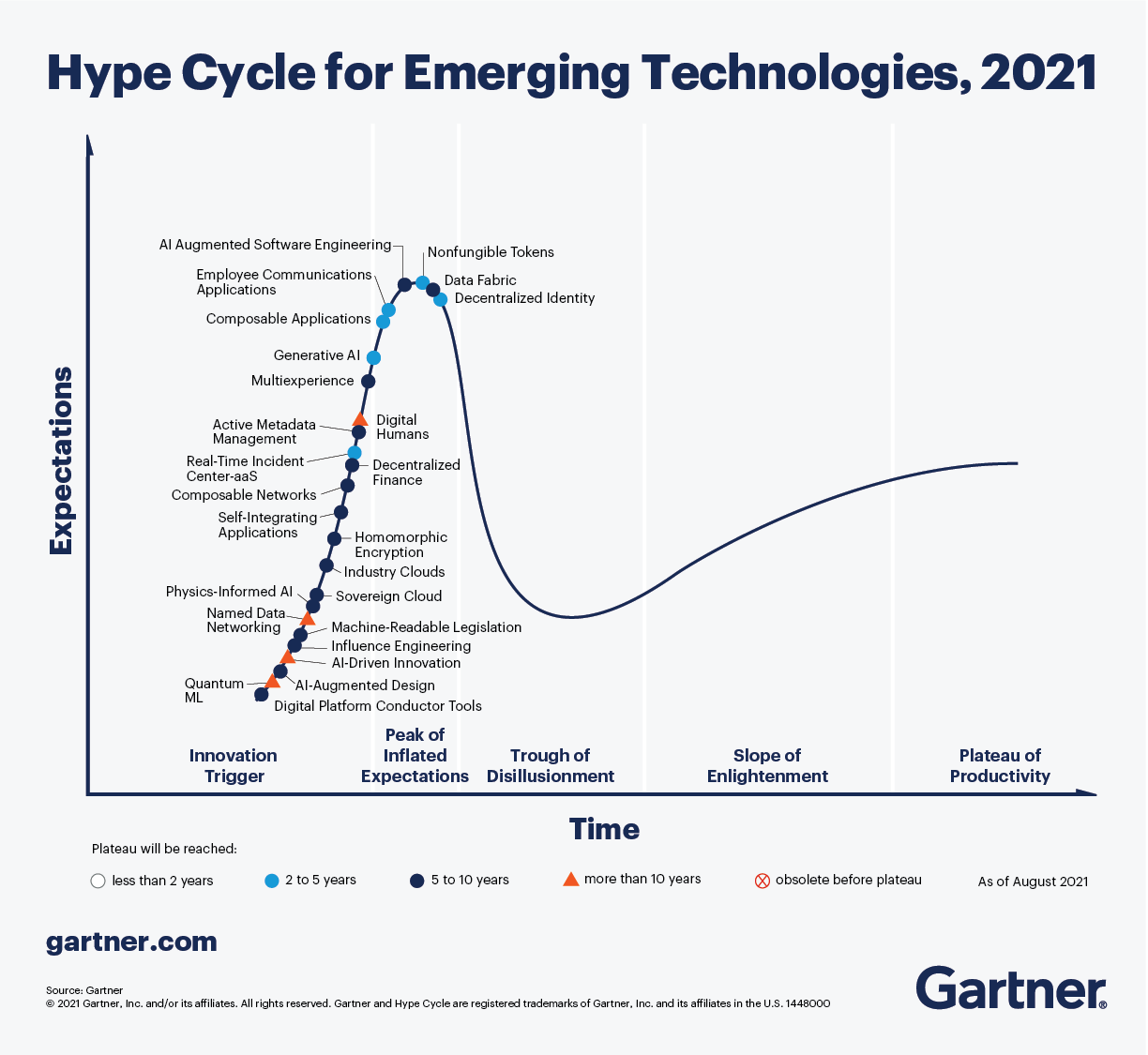

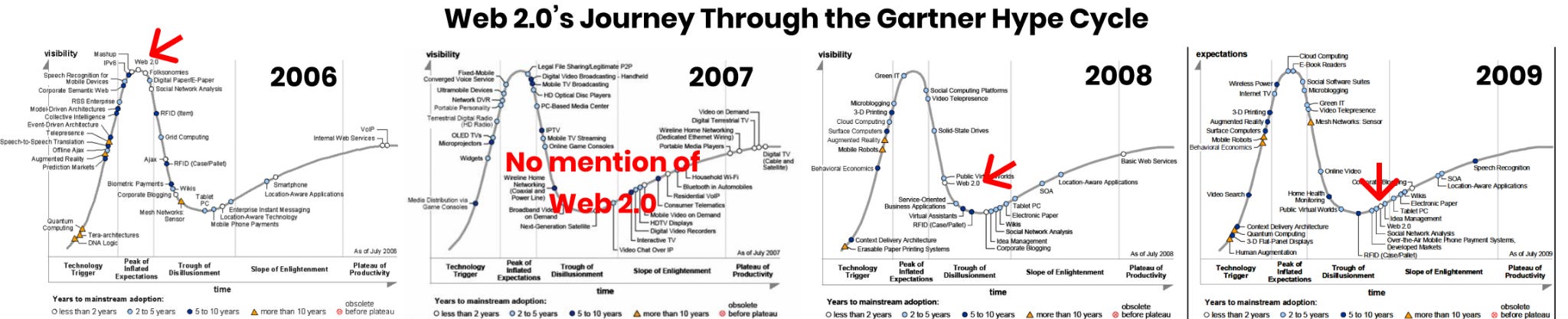

Ultimately, it helps companies think about when to implement a new technology. Each year, Gartner places emerging technologies on the Hype Cycle. Last week, it released the 2021 Hype Cycle. Right at the top of the Peak of Inflated Expectations, of course, are NFTs. Gartner’s customers are companies, not crypto degens. If Gartner is including NFTs on the Hype Cycle, it means that companies are thinking about how to incorporate them. Gartner seems to think that we’re at the Peak of Inflated Expectations for NFTs, the point in the cycle at which, “Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.” NFTs’ placement at the top of the Peak likely contains a little bit of truth and a whole lot of desire to grab headlines. There’s probably an interesting thing that happens when the Gartner team chooses where to place things. They might say, “Which technology could we place at the Peak of Inflated Expectations to drive the most clicks?” and whatever the answer is is probably also the technology that really is at the Peak of Inflated Expectations. Anyway, we’re still early. At this point in the cycle, some companies experiment with the technology, many don’t. A handful of the ones who do are going to drop some embarrassingly harebrained NFTs or acquire NFTs for too much money. We may have the opportunity to look back in a year, from the Trough of Disillusionment, and laugh at the most ill-conceived. But that doesn’t mean we should dismiss NFTs. Au contraire. Technologies that Gartner places at the Peak often go on to create orders of magnitude more value than they’re worth at the time of Peak placement. See, I love the Hype Cycle, but it’s also a bit misleading. With just a glance at the graph, it would seem as if technologies never live up to their initial hype, like investing at the peak would inevitably lead to losses. Even the companies that survive the Trough of Disillusionment can only hope to end up at the dull-sounding “Plateau of Productivity.” But the Y-axis represents “expectations,” not value, and just looking at the chart dramatically undersells the value that mass-adopted technologies create. Take Web 2.0, for example. To learn why NFTs are at the beginning of the S-Curve, how corporates are getting involved today, and what NFT-based business models they might adopt in the future… 💼 Not Boring Jobs 💼To find yourself a Not Boring Job, check them all out here.

How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad We’re off next week for Labor Day — see you in two week! Thanks for reading! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Solana Summer

Monday, August 23, 2021

The $21B Blockchain and the Arrow of Time

Story Time

Monday, August 16, 2021

The Progressive Decentralization of Narrative

Lithic's New Customer

Friday, August 13, 2021

Meet the $800M 💳 🚀 Making Issuing Cards as Easy as Accepting Payments

Status Monkeys

Monday, August 9, 2021

Analyzing NFTs as Social Networks Using the Status-as-a-Service Framework

Compounding Crazy

Monday, August 2, 2021

Everything is moving so fast out there. What if it's just getting started?

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month