Not Boring by Packy McCormick - Status Monkeys

Welcome to the 1,901 newly Not Boring people who have joined us since last Monday! Join 67,713 smart, curious folks by subscribing here: 🎧 I lost my voice a little singing too much at the wedding, audio versions will be back soon. Today’s Not Boring is brought to you by... UserLeap If you read to the bottom of Not Boring essays, you’re already familiar with UserLeap. Over 7,000 of you have given me feedback via the microsurveys I include in every email. It helps me make the newsletter better every week. UserLeap is a product research platform that makes it easy to build and embed microsurveys into your product (or newsletter!) to learn about your customers in real-time. Product teams use UserLeap to gather qualitative insights as easily as they get quantitative ones, and automatically analyze the results so teams can take quick action. Not Boring readers don’t just give me feedback through UserLeap; hundreds of you have started getting feedback from your own customers with UserLeap. We’re in good company. Teams at Square, Loom, and Retool love UserLeap, too. In fact, UserLeap knows that once teams start using the product, they don’t stop, so they’re offering a generous free plan to try it out. Sign up below to start collecting insights today. Hi friends 👋 , Happy Monday! On Saturday, Puja and I went to our first out-of-town wedding since COVID (Congrats, Coop and Liz!). We spent a lot of time in the car driving to Richmond and back, which gave me a lot of time to think up wild ideas. Let’s get to it. Status MonkeysThe DEAD followed me across Twitter all weekend. Not in a Haley Joel Osment way or anything, it’s just that this one avatar kept popping up everywhere: For the uninitiated: that green guy is a CryptoPunk. CryptoPunks are 24 x 24 pixel art NFTs, of which there are, and will only ever be, 10,000. CryptoPunks, created by Larva Labs in June 2017, are OG NFTs. As new NFT projects pop up hourly, CryptoPunks are scarce and valuable by nature of their age. So as NFT values have soared over the past couple of weeks, CryptoPunks have led the charge. The most expensive Punk sold for 4.2k ETH in March. Today it’s worth $7.57 million USD. If you want to buy your very own Punk right now, the cheapest on offer will cost you 51.85 ETH. That’s the “floor price.” You’ll get a more common Punk at that price. To buy a rare Punk, an Ape, Alien, or Zombie, like the one seen above, you’re going to have to fork over a whole lot more ETH. A few other things to know about CryptoPunks:

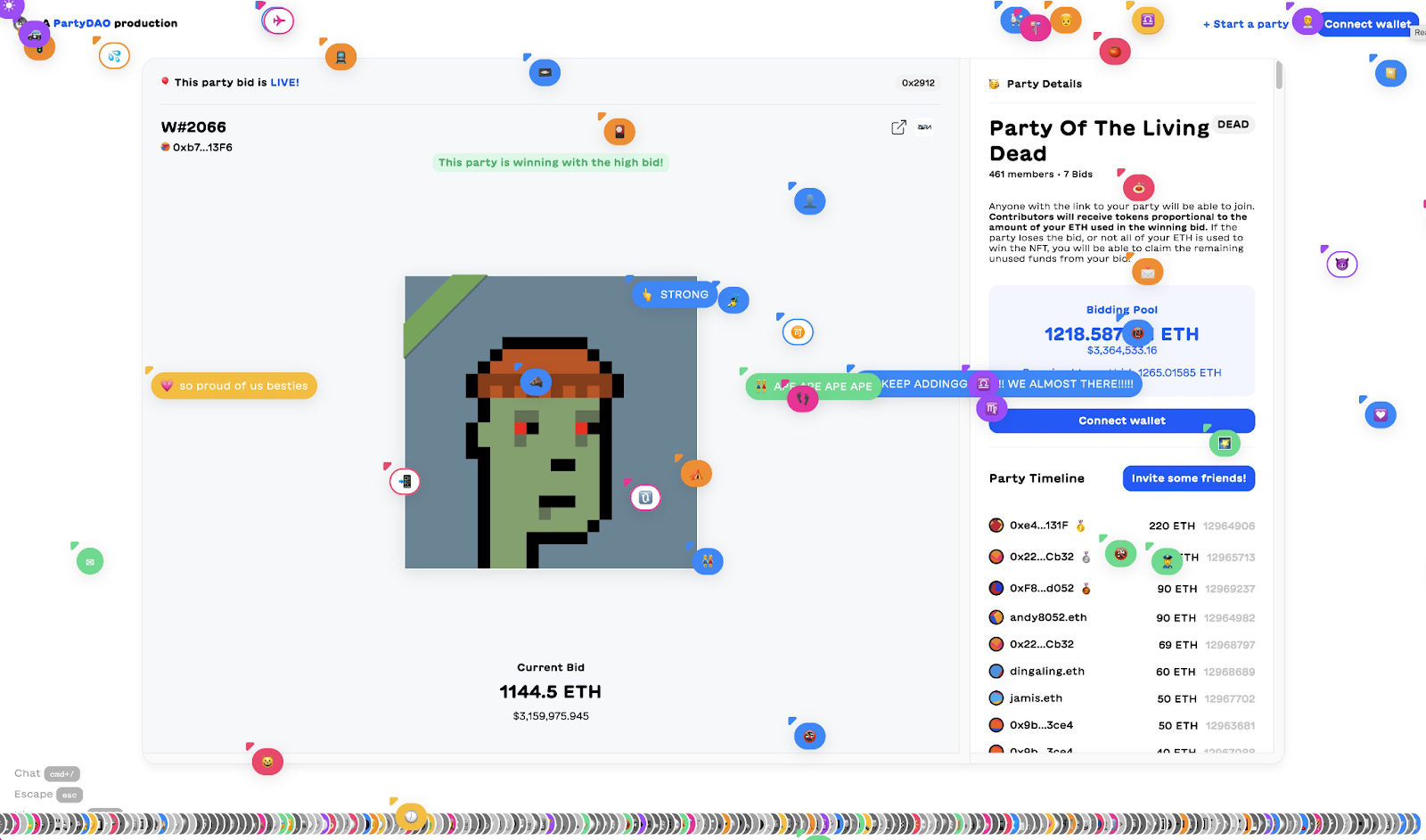

This weekend, hundreds of people changed their profile picture to that one single Zombie Punk, which sold for 1,201.725 ETH ($3.75 million) at auction on Friday. No one frowned upon so many people displaying the Punk, wearing a deconstructed party hat emoji, because they all owned it. For Friday’s auction, 478 people joined forces on PartyBid, a new product created by Anish Agnihotri and the PartyDAO crew that lets people form teams to bid on NFTs, to pool their resources and go after the multi-million dollar Punk against rich whales. They called themselves the Party of the Living Dead. And they won.

PartyBid makes NFTs more social, with a literal party upfront and the opportunity for hundreds of people to buy, own, and manage expensive NFTs together in the back. Its social nature is obvious from its website, which feels as if Figma and Masterworks had a baby, with cursors and comments flying around the site in real-time. As Friday’s auction went on, hundreds of people, represented by moving cursors and emojis, visibly zoomed around the site. It’s hard to describe in words; you can see it in the image above, and you should check it out by visiting yourself. Like a Zombie, NFTs were supposed to be dead. What’s going on? I have a theory. On Thursday night, I went on Sriram Krishnan and Aarthi Ramamurthy’s Good Time Show on Clubhouse to discuss the *Metaverse* with Gabby Dizon (YieldGuild), 3LAU, Donnie Dinch (Bitski), Jarrodd Dicker (The Chernin Group), Jon Lai (a16z), and Jesse Walden (Variant). Not Boring readers will be very familiar with the Metaverse at this point. We’ve been talking about it for months and months. I’m guilty of tying anything that could conceivably be tied to the Metaverse to the Metaverse. Over the past few weeks, the Metaverse has gone mainstream. Matthew Ball published his 9-part series. Satya Nadella talked about the enterprise Metaverse (sounds fun!). Zuck and Co have said “metaverse” a million times over the past couple weeks. Ben Thompson wrote a piece on the Metaverse. NFTs will clearly play a role in the Metaverse. When everything is digital, proving that you own something and being able to bring it with you across the internet will be key. But this isn’t a Metaverse piece. It’s a social network piece. At one point in the Good Time Show conversation, Jarrod Dicker brought up the importance of community and status in web3 and it triggered a high kid thought: NFTs tick a lot of the boxes of a successful social network from Eugene Wei’s Status-as-a-Service. Before the full Metaverse arrives, there’s already something happening that’s bigger than jpegs. NFTs are starting to feel a lot like a new kind of social network that sits above other social networks and communities -- something of a Superverse -- and there’s no better framework to evaluate a social network than the one Wei put forth in Status-as-a-Service (StaaS). Status-as-a-Service(If you’ve read and internalized Status-as-a-Service, you can skip this section.) Eugene Wei, a former product leader at Amazon, Hulu, Flipboard, and Oculus, is one of the best tech essayists on the internet. Practically everything he writes becomes canon, and Status-as-a-Service, which he wrote in February 2019, might be his greatest contribution. The piece makes Not Boring seem short. It comes in at a whopping 19,825 words. If you haven’t read it, I highly recommend that you do so, but for now, I’ll summarize a few of the main points that are relevant to this piece. Wei begins with two principles:

Even though those are uncontroversial statements, Wei argues that we don’t analyze social networks through the dimension of status or social capital. Money is easier -- there are numbers, and what gets measured gets analyzed -- but, he says (emphasis mine):

Less than 1,000 words into his piece and two full years before NFT mania, Wei unknowingly laid the groundwork for analyzing what’s happening. NFTs blur the lines between social and financial capital, and as the media has been quick to point out, buying jpegs for thousands or millions of dollars seems irrational. The mistake that those who dismiss NFTs make is the same that Wei argued people were making in analyzing social networks: missing the importance of social capital. Traditionally, people have used Metcalfe’s Law to explain the network effects powering social networks: “The value of a telecommunications network is proportional to the square of the number of connected users of the system (n^2).” The more users a social network has, according to Metcalfe’s Law, the more valuable it is to every new user. The problem was, Metcalfe’s Law didn’t perfectly explain what was happening in the real world. Metcalfe’s Law alone would predict that whichever network got big first would continue to build up an increasingly insurmountable lead by being the most valuable to each new user. But Facebook took down MySpace, and Instagram and Snapchat stole younger users’ attention from Facebook. People’s preferences aren’t captured so cleanly. It wasn’t that network effects and Metcalfe’s Law were wrong, it was just that they didn’t capture the reasons that someone might use a social network beyond pure utility, so Wei proposed a new framework for analyzing social networks’ strength that added social capital to the mix.

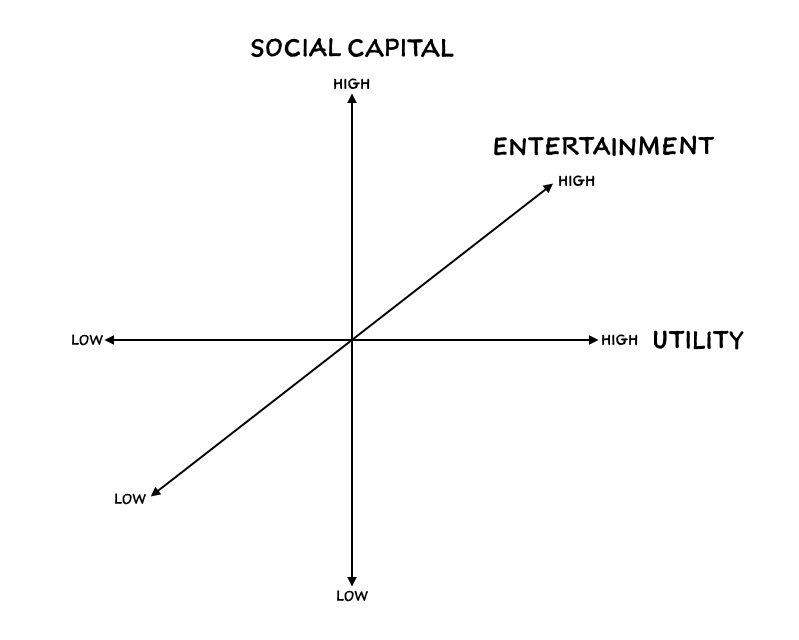

Wei evaluates social networks’ strength on three axes: Social Capital, Entertainment, and Utility. In the essay, he focused on Social Capital and Utility. Utility is relatively easy to understand. If you can find the answer to your question on Quora or easily reach an old high school friend whose number you lost on Facebook, those products are providing you utility. Social capital, on the other hand, is harder to define and relies on the creation of a “successful status game.” To help explain why some new social networks succeed and others fail, he used a metaphor: crypto. He said that new social networks are analogous to Initial Coin Offerings (ICOs) in four ways:

It’s a really good metaphor. Take Bitcoin and Twitter.

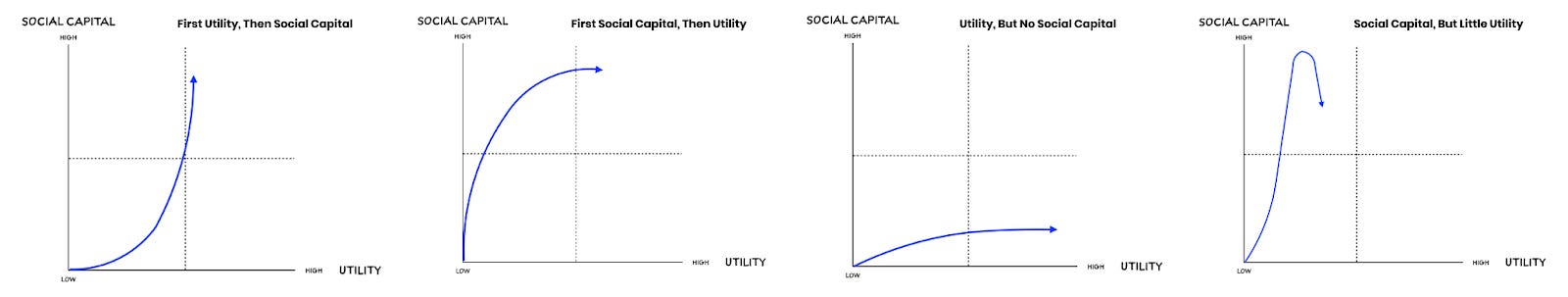

Neither Bitcoin nor Twitter existed fifteen years ago. Both are dominant forces today. They bootstrapped from nothing to something by rewarding early adopters, incentivizing them to do work for the network, and making it increasingly challenging to mine new tokens. All four points are important to understand, but the most useful is the idea of proof of work in status games. If everyone who signed up for Twitter got one million followers just for signing up, there wouldn’t be any social capital in having one million followers. The fact that high follower counts are scarce makes them valuable, and the proof of work requirement enables scarcity. Leaving Entertainment out of the equation, Wei talks about five arcs that social networks can follow, four of which are trade-offs between social capital and utility over time:

The fifth category, the “holy grail,” is Both Social Capital and Utility Simultaneously. To find an example, Wei goes to China’s WeChat, which combines a Facebook-like Moments feed (social capital) with a whole lot of utility, about which I wrote:

WeChat created a killer combo of social capital and utility from the get-go, which hasn’t really been replicated in the West. Even for social networks that get it right, though, Wei points out that there are two forms of asymptotes that limit growth or lead to downright collapse. Social Asymptote #1 is Proof of Work itself. Not everyone in the world can do what it takes to gain social capital on any given social network, which creates an upper limit. I’m fascinated by TikTok, but I’ve never made a TikTok, because I’m not a great dancer and I’m just not willing to put in the work to get good at whatever the TikTok algorithm requires. TikTok is still growing absurdly fast, but if even I, who loves social networks, won’t use it, there’s a ceiling somewhere. Social Asymptote #2 is Social Capital Inflation and Deflation. On the inflation side, when a social network gets too successful, and there are too many people using it, the company behind it inevitably needs to introduce an algorithmic feed to handle all of the noise. Wei argues that Facebook introducing an algorithmic feed was always likely because the only scarce resource in an abundant digital world is users’ attention, so it’s necessary to deliver the things they’re most likely to engage with. It makes sense, but it was a tough break for any of the companies that relied on Facebook for a connection with their audience. On the deflation side, social networks can get less cool as more people join. The canonical example here is what happened to Facebook when parents started joining: all the young people left for Instagram and Snapchat. Once the cool kids start leaving, the slightly less cool kids follow, then the next group, then the next, and since more of the less cool group (parents, in this case) keep joining, the cool proportion gets worse fast. “At that point,” Wei cautions, “that product or service better have moved as far out as possible on the utility axis or the velocity of churn can cause a nose bleed.” That’s the meat of the argument:

Wei spends the rest of the piece giving examples and adding richness to the thesiss. Again, you should read it, but for our purposes, there are few particularly valuable tidbits that I’ll highlight:

What if you could get the benefits of a social network in a more portable, decentralized package? It’s time to turn it over to NFTs. To learn what’s been happening with NFTs over the past couple of months, and how NFTs are a lot like a social network based on the framework in Status-as-a-Service… Not Boring JobsNot Boring Jobs is the best place to find your dream role at a fastest-growing, not boring startup. In a little over a week, 151 of you have applied for Not Boring Jobs! Today, I’m featuring three amazing jobs, with two non-technical options: Two quick programming notes:

Thanks to Dan and Puja for editing! Disclosure: I am an idiot and don’t own the NFTs discussed today, except one Axie. How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Thursday! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Compounding Crazy

Monday, August 2, 2021

Everything is moving so fast out there. What if it's just getting started?

Is That a Family Office in Your Pocket?

Thursday, July 29, 2021

Or are you just a happy Equi client?

Together, More Bull, More Bear, More Fun

Monday, July 26, 2021

Pinduoduo: A Chinese Characteristics x Not Boring Collab

Infinity Revenue, Infinity Possibilities

Monday, July 19, 2021

The Deceptively Cute Game Growing Faster Than Any Company in History

Introducing Not Boring Capital

Monday, July 12, 2021

Behind-the-Scenes of Raising a Fund to Invest in Companies with Stories to Tell

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month