Yandex: Google Through the Looking Glass

You're on the free list for The Diff. Subscribers-only issues you missed this week:

Coming next week, a look at a company that collects an 0.1% cut on the transactions it enables (which still adds up to almost a billion-dollar run-rate), supply chains, the fight to own logins and identity, and more. Subscribe now to get these posts and access the full back catalog. Yandex: Google Through the Looking GlassPlus! Shifting the Curve; Where Housing Demand Comes From; Throughput; Lobbying; Customer Service-as-a-Service

Welcome to the Friday edition of The Diff! This newsletter goes out to 24,225 subscribers, up 111 since last week. In this issue:

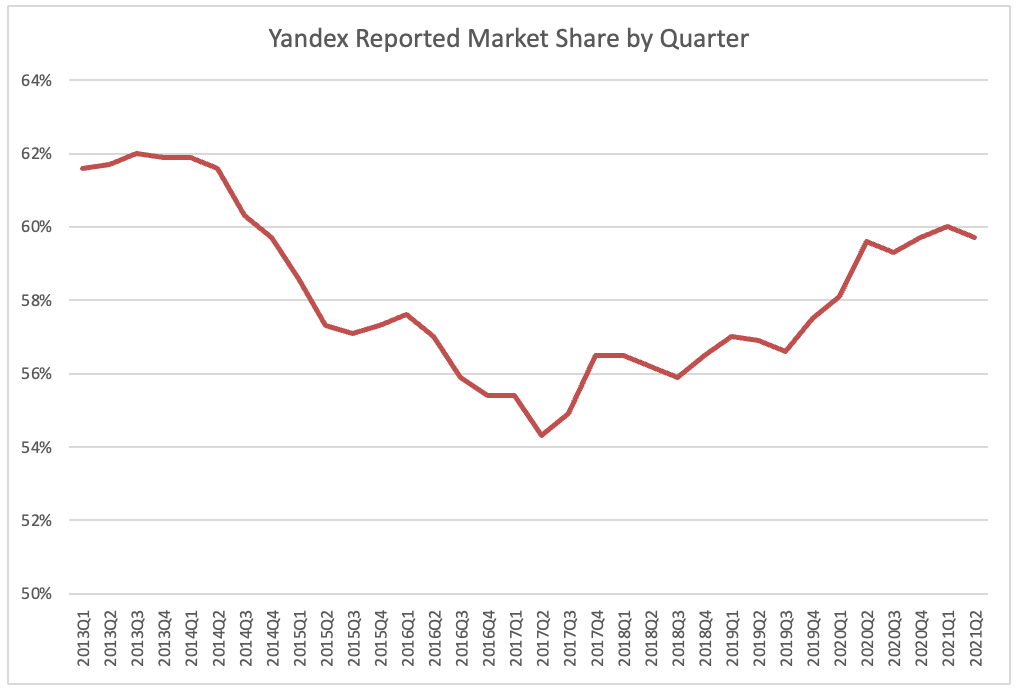

Yandex: Google Through the Looking GlassWhen I started following the search industry closely around a decade ago, you could neatly divide the world into two markets: there was search in China, where Google didn't have a shot, and there was search outside of China, where Google was either the dominant company by far or on the way there. (The simple stat for demonstrating that around 2010 was that the top three search engines in the UK were Google.com, Google.co.uk, and the Google-owned YouTube.) Since then, Seznam, the Czech search engine that once had #1 market share in that country, Yahoo! Japan switched to powering its results with Google, and Korea's Naver has held on to its share, although this seems to be declining. In Russia, Yandex went through a period of decline, but since reaching a low point in early 2017, the company has actually gained share, and now sits at around 60% market share in Russia.

Yandex is actually older than its other search engine competitors; the company dates back to a 1990 project to systematically catalog and search through Russian patent data.¹ This turned out to be a very good way to train linguistics software, since the USSR produced abundant patents—rather than license Western inventions, they reinvented them, so so the patents were actually a more thorough corpus of human knowledge than other countries' patents. But the fall of the USSR forced the company to pivot, several times. The USSR and its collapse gave Yandex another advantage: the Soviet higher education system skewed towards engineering over other disciplines, and Russia still produces more engineering graduates than the US as of a few years ago. Yandex's product pivoted a few times, and moved onto a few platforms, but since the company's engineers were obsessive about code quality, they were able to move it from Windows to FreeBSD, and then to Sun, with a few days of effort each time. This seems like a minor detail from a company's early life, but is quite important: technical debt is one of the problems that, even if it doesn't kill a company, eventually slows its pace to a crawl since every incremental feature adds more bugs and dependencies, to the point that all the company's engineering resources are spent keeping systems going. (For more on this general problem, from the organizational side, see here ($).) What Yandex eventually moved into is quite close to Google's earlier model: they had a good system for understanding natural language, and for finding documents that matched the intent of a search query rather than the exact wording. So they decided to get into search—but they chose enterprise search, selling companies software that they could use to either search their internal files or offer search as a feature on their website. The actual Yandex site, a general-purpose Russian-language search engine, was thrown up as a sort of demo to impress customers rather than as a full-featured product itself, and it took a while for the company to realize that this was what its model ought to be. This kind of pivot has happened before; Pixar kept making better and better demos to sell its hardware to movie companies until it became clear that the best client for Pixar's hardware was Pixar itself. Search was not an obviously good business when this was happening, in the late 90s. When online ads were mostly sold by the pageview, the only thing worse for business than a search engine was a good search engine that would promptly redirect people to another site, which would then capture all of those lucrative pageviews. And even the ads business was questionable. When Yandex launched, Russia had a GDP per capita of $4,700 in current dollars, which was declining fast. And it wasn't a great country for e-commerce, with low payments penetration, and lots of corruption. It's also eleven time zones wide, which makes it hard to offer cheap or timely delivery to the entire country as opposed to a few big cities. But search turns out to be one of the best businesses of all time, for several reasons that are worth understanding when evaluating the Google/Yandex struggle:

Each of these features produces nonlinear returns to the winner, and they mostly compound together. The most-used search engine has better results, gets more users, earns more from each user, and can thus afford to spend more to acquire users—all while growing its addressable market on both the searcher side and destination side. Being a #3 or #10 search engine is a tough business, but being #1 is phenomenal, since revenue naturally approaches an asymptote defined by the unit profit of every economic act that can somehow be expressed in a search query. This still requires effort; search data does not magically transform into better results, and it takes ongoing engineer-hours to keep things improving. But a search engine with dominant market share really is a wonderful money-printing machine, the likes of which has never been seen before. This makes search engines a great platform for building other kinds of businesses. Google has launched enough different efforts with its search cash flows that the company eventually revamped itself as Alphabet, a holding company of which search was just one element. But many of these other products are either downstream from search (YouTube, as mentioned above, is also one of the world's most popular search engines, and is a good source for results within Google) or upstream of it (Fiber makes sense for Google because Google gets a return both from selling Internet access and from additional Internet use—and it induces other ISPs to provide faster, cheaper access, too; Google Fiber is basically a conspiracy to turn $1 of Google capex into $5 of Charter/AT&T/Comcast capex, all of which serves Google's strategic imperatives). Yandex, too, has diversified: they have a marketplace, subscription media, cloud computing, food delivery, a voice assistant, self-driving cars, last-mile delivery, and a ride-sharing service that's about a third the size of Uber (but profitable). In fact, it was a joint venture with Uber, although Yandex recently bought out most of Uber's stake and took an option on the rest. It's a tech chaebol, with a presence in almost every sector that converts bits into money. One exception to this is money itself: Yandex and Russian megabank Sberbank had a long-running joint venture which they unwound last year ($, FT), with Yandex keeping a marketplace business and Sberbank retaining a payments platform. And this points to another element of the Yandex model: part of the reason it can be so unconstrained is that it's a national champion, with freedom to act derived in part from how useful it is to the state. Sberbank, too, has close ties to the government, and in this case won out. It's not completely clear why Yandex's market share started to tick up a few years ago, but it can't have hurt that Google closed down a Russian engineering office in response to stricter Russian Internet rules in 2014 and has since faced indignities like a police raid on their Moscow office a few days ago. (This seems to be a part of the playbook in some places; Yandex's Ukraine office got raided by police, too.) Yandex has made some of its state commitments explicit: in 2019 the company approved a "public interest foundation" with the power to veto large external shareholdings or sales of Yandex assets, as well as the right to nominate two members of Yandex's board of directors. It also has the right to declare a "Special Situation" when it deems national security at risk, giving it the power to replace Yandex's CEO without a shareholder vote. The foundation's head helped run Putin's last presidential campaign. So Yandex turns out to be an interesting illustration of tech nationalism. Search engines are important, especially in a country whose political system depends on shaping the flow of discourse and the availability of information. Yandex is a valuable company, but it's also a valuable strategic asset, so it's a great business in which shareholders will always be the junior partners. A Word From Our SponsorsWe build the planet’s most effective, proven, and scalable carbon capture systems: forests. Terraformation’s mission is to restore the planet’s lost forests, restabilize our climate, and change the future. Our specialty is doing it rapidly, and with systems that will last until our grandkids grow old—with native plants, solar-powered, modular seed banks and desalination systems, and the tech to keep the trees happy and healthy. Think of us as Silicon Valley hypergrowth meets sustainable forestry heroes. This week we launched a crowdfunding campaign on Republic. Want to invest in the future? ElsewhereShifting the CurveIn June, I wrote about how countries are starting to care about environmental issues earlier in their development, instead of the usual pattern where high growth leads to high pollution until a country passes middle-income status. One good piece of evidence for this is that Africa's largest bank will no longer fund coal power plants, and will stop funding coal mining in five years. When capital is global, companies have to weight issues based on the wealth of the people who are about them, not just based on what locals are worried about. This has a near-term impact on economic growth, but over the long term it probably means more funding, albeit at a lower return, which can be a net gain. There's a lot of uncertainty there, and development economists who talked about premature deindustrialization in the past may look at premature decarbonization as a driver of global inequality in the future. (This doesn't mean the consequences won't be worth it, just that there will be consequences; the implicit bargain between the slowly-decarbonizing developed countries and the rest of the world is that when other countries reduce their fossil fuel use, they'll get some kind of investment to compensate. If that doesn't happen, they'll go back to coal.) Where Housing Demand Comes FromWhile it's fun to explain recent housing price increases by looking purely at near-term factors like GDP growth, the great Covid migration, and low interest rates, it's worth noting that some of today's price increases were baked in a few decades ago. The population of 30- to 39-year-olds is rising, and that drives demand for housing of all kinds. ThroughputThere are many causes for the current supply chain problems, but one of them is that US ports have limited capacity; as of earlier this week there were 55 ships waiting to access the ports of LA and Long Beach, with an eight-day wait, partly because total volume at the port is up 80% Y/Y for the first half of this year. One rumored solution is 24/7 operations. At one level, it's impressive that warehouses and shelves are still stocked given the vast increase in consumption relative to 2019, and especially relative to expectations in early 2020. But at another level, it's an opportunity to look at some of the legacy limitations of the US supply chain, and at how relaxing them might lead to a system that's flexible enough to handle wide swings in demand. LobbyingThe World Bank is discontinuing its ease-of-doing-business report after an investigation showed that the report's outcomes were being gamed to improve China's rankings ($, WSJ). There is something very meta about this, since manipulating a major international organization into publishing altered numbers does indeed show a commitment to doing as much business as possible. In one sense, the report is covering one kind of ease of doing business—explicit rules and minimal red tape—while underrating a model where there's lots of red tape, some of the rules are unwritten, but as a consequence working with the right people means getting things approved faster than they would be in a more formal and legible system. It also illustrates a broad problem: the demand for quantitative rankings of qualitative factors far exceeds the supply of rigorous ways to rank those qualitative factors, so ultimately every ranking is going to be based in part on how well it lines up with preexisting assumptions. A perfect ranking isn't possible, and the plausible alternative is one that's determined by noisy biases rather than a desire to make one particular country come out ahead. Customer Service-as-a-ServiceAmazon is splitting its customer service offering from its general fulfillment service, letting merchants use Amazon's customer service even if they do their own warehousing and shipping. Amazon's model focuses relentlessly on figuring out exactly what can be unbundled, and then slicing every subset of their offerings as finely as possible so they can satisfy every incremental bit of demand. The immediate effect of this is to drive a bit more revenue, and to have a more measurable system—the more of Amazon that can be evaluated through its own P&L statement, the easier it is for them to allocate capital. But this process is also one of the drivers of the e-commerce rollup business: it makes working with Amazon increasingly complicated, which creates a niche for companies that specialize in figuring out which Amazon services are worth buying, and when. (Disclosure: I am long Amazon.) 1 "Yandex" is partly a pun, since "Я" is pronounced "Ya" and means "I" in Russian. It's also an abbreviation for "Yet Another Indexer," and it's unclear if this influenced Yahoo's later claim to be "Yet Another Hierarchical Officious Oracle" a few years later. You’re on the free list for The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, September 11, 2021

China, Chips, ByteDance Philosophy, Hacks, Payments

Modern Financial History Begins in 1998

Friday, September 10, 2021

Plus! Two Turnarounds; Smart Glasses; Credit cards, Spending and Splurging; The Cyclical CEO Condition; Permanent Pricing

Longreads + Open Thread

Saturday, September 4, 2021

Construction, EDM, Talent, Aerospace, Applied Divinity Studies, Black Wednesday

Globalized Talent and the Brand Grab

Friday, September 3, 2021

Plus! Developing Vietnam; Liquidity, Discount Rates, and Theft; Shortages; Pigs and OPEC; Statistical Privacy

Longreads + Open Thread

Saturday, August 28, 2021

Games, MBO, Espionage, Manchukuo, France, Fracking, Banks

You Might Also Like

Are these the two best trading hours?

Saturday, January 11, 2025

Brand New Genesis Algo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌭 America gets the works

Friday, January 10, 2025

The US added a lot more jobs, TSMC posted strong results, and plumbing the depths | Finimize Hi Reader, here's what you need to know for January 11th in 2:57 minutes. The US economy ended the year

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏