Margins - Memestocks and Reddit redesigns

Ranjan here. This post will be a bit of a love letter to Reddit as well as a theory on how a 2017 funding round and key hire laid the seeds for the memestock craziness of 2021. Reddit is probably the social platform that has brought me the most uncomplicated joy over the past decade (Note 1). I gauge the quality of a movie or TV show if the first thing I do after watching it is spend hours dissecting it on Reddit. I get a bit emotional thinking about how important r/predaddit was in keeping me confident and sane up until the birth of my first kid. I still type "x item reddit" into Google to research any new products. I once gave a wedding speech where it was all wedding advice gleaned from Reddit (fun fact: it was my pizza arbitrage friend!). I started spending time on the platform in 2011, and couldn't get over just how much insight there was to be found, and my defunct startup, Informerly, was originally launched under the MBA-tastic tagline "Reddit meets Bloomberg". The first idea my cofounder and I tried was building a social news community focused for professionals. It felt like there was a massive gap between the depth of conversation taking place on Reddit and how fragmented discussions were across the professional information tools I had experienced on a trading floor and while at the Financial Times. We pivoted fairly quickly to a personalized newsfeed product versus social news, but finally in 2021, Reddit for the enterprise has turned out to be....Reddit. I should be ecstatic. Hedge funds are monitoring Reddit conversations. Every esteemed financial publication has had endless headlines about merry bands of Redditors. I have even been on CNBC talking about Reddit memes. This was kind of the dream!! But there's one thing about Reddit’s ascendance I want to highlight, and it goes back to the very unique funding structure through which the platform has been allowed to develop. Media Shangri-LaA lot of Margins readers might be somewhat familiar with the Reddit founding legend. The startup was part of the first YC batch, pretty quickly was sold to Advance Publications (the parent company of Condé Nast) for $10 million. As a full disclaimer, what comes next is pure media gossip: Apparently, the purchase was a strong reaction by senior execs at Advance Publications who were worried about "not getting the internet" so they jumped on Reddit. Once it made its way into the corporate behemoth, no one really knew what to do with it, but they didn't want to mess with it and hurt their potential internet cred, especially as the print media business was beginning its decline (again…pure, unadulterated media biz dev gossip, if anyone has more insight please reply!) For years, Reddit lived this kind of utopian commercial-pressure-free existence. The post-ranking and voting mechanisms that generated amazing discussions never really evolved from the early days, but they didn’t really need to. It worked. The site grew to hundreds of millions of monthly pageviews, with barely any advertising revenue goals or a concerted push for engagement or growth. It didn’t work as a business but as a digital gathering place (Note 2). My favorite thing was there wasn't even a proper mobile app (remember Alien Blue?) even as Facebook and others loudly went mobile-first. It was only in October 2014 that the utopia ended. Reddit became a standalone commercial entity, raising a $50 million round. This isn’t really relevant, but I just had to share this part of the announcement:

The next few years weren't the smoothest, with multiple CEO resignations and no shortage of controversy. The interface and app didn't change that much, but there was a slight push on the advertising side. In 2014, the site only made $8mm in ad revenue (and their commercial ‘team’ worked out of the same WeWork as yours truly!), and they grew to about $20 million in ad revenue in 2016 - remember that was when there was endless speculation about could "Reddit become a real business". It was in 2017 that things really started picking up on. Reddit raised a $200 million round (including money from very professional money like Coatue) at a $1.8 billion valuation. Armed with institutional money and credibility, Reddit started making serious moves. It started with a major redesign:

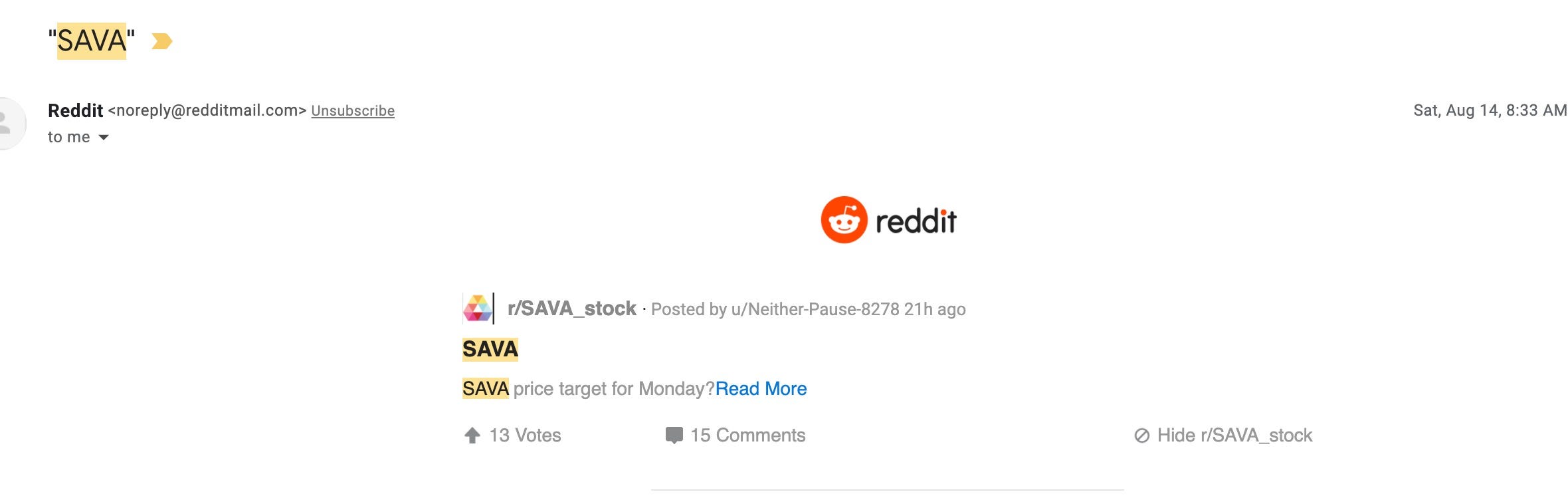

For anyone who has used Reddit, its simplicity was always a key UX selling point. That was the first sign that it might start to look a bit different. Growth LegendsFor me, the biggest sign that this was turning into a growth machine was the April 2018 hiring of Jen Wong, the former Chief Operating Officer at Time Inc. (who guided them to a very successful exit to Meredith). I knew a bunch of people at Time who worked in her organization and the consensus was she was a Chamathian-level growth legend. She had cut her teeth at Huffington Post and then PopSugar and knew how to rapidly scale digital media properties. At Time Inc she rapidly jumped up moved up to Chief Operating Officer as they leveraged every ounce of a century of brand credibility to surpass traffic and revenue goals. (My favorite was in 2016 when they launched Extra Crispy, a breakfast-focused editorial vertical. Fond memories of 2016 digital media). At the time of her hiring, Reddit had around 330 million MAUs. She boldly told the WSJ that they would grow to one billion monthly users. I still remember reading that line because it was clear that the entire strategic vision had shifted to hypergrowth...which is...fine. Of course, I wondered if the Reddit I had come to love would get morphed into some Facebook-like, quick-hit passive feed, but I accepted its utopian Advance Publication days were never a sustainable business. EngagementAfter years of static product development, Reddit's web and mobile presence started rapidly evolving. I remember receiving the first email Daily Digest a couple of years ago. Right now I'm scrolling through my app feed and I'm seeing a Top Broadcast live video thing, about 50% of the posts have some kind of imagery or video, I see a few "Popular on Reddit right now" suggested posts that are all videos. There are plenty of promoted posts (mostly video, some imagery)..again...which here are a number of "similar to" suggested Subreddits (because I follow r/Patriots, maybe I'll like r/buccaneers, I follow the r/BATProject so maybe I’d like Binance). There are "Because you visited this community before" suggestions (r/ouraring - does anyone have thoughts on this product?). At some point, I had to turn off my iOS notifications because everything was "you might like this post or community". That suggested content is annoying but logical. Any content feed that’s looking to hit a billion users will probably be video-heavy and need to keep surfacing more communities and content. I’ve definitely been getting Reddit links shared from a lot more normie friends who had never mentioned the platform before. SAVAAgain...this is all....fine. Reddit is reportedly raising up to $700 million, is valued around $10 billion, and is supposedly looking to IPO around $15 billion. And of course, as we all know, Reddit has now achieved a cultural resonance thanks to r/wallstreetbets I never could've dreamed of when I was awkwardly pitching a startup that would "bring Reddit to the professional world" 🤮. But on this last part, for a long time, I never connected Reddit's engagement-driven transformation and the explosion of memestocks. I had always been impressed by how insightful a lot of the r/WallStreetBets analysis was. For the early part of the memestock craze, I just assumed it had rightfully spilled over into the mainstream. But in mid-August, a friend was going on about Cassava Sciences ($SAVA). It had nearly doubled from a recent low (from around 65 to 130) and he was saying it would revolutionize medicine or something. I had heard of the stock in passing but never paid too much attention. I briefly ended up in r/SAVA, and a few days later, this was my Reddit daily digest email. It became a regularly suggested subreddit and followed me around my Reddit app and emails like a pair of shoes you clicked on once in the digital ad world. Reddit was insisting that I pay attention to $SAVA. At some point, I ended up on this post questioning if SAVA is a fraud and read about the CEO's Elon Muskian compensation scheme that ties cash payouts to sustained valuations:

This really went from a casual search to Reddit insisting repeatedly that I pay attention to SAVA and me feeling that I was now 'doing the research' and uncovering some grand conspiracy. It was such a clear reminder of how quickly this kind of stock-market analytical radicalization can take place. I went from trying to ignore a stock to a single search convincing me I had uncovered some deep state-esque management conspiracy. Topical RadicalizationIt's hard to say whether this form of topical radicalization is intrinsically bad. I bought a sous-vide a few years ago, and can genuinely say that r/sousvide has sous-vide radicalized me. I think about sous-vide a lot. I challenge my levels of sous-vide'ing with new types of food (I just did octopus the other day). I critique the steak-searing abilities of others. And I love it! I'm genuinely convinced sous-vide innovation is a revolution in home cooking. This is Reddit perfection. The other day a friend (again, the Pizza Arbitrage restaurant owner friend!) told me that making mozzarella could be a fun activity to do with my kids and I read through some r/cheesemaking threads. Just like SAVA, cheesemaking posts instantly started making their way into my Reddit feeds. I still haven't joined r/cheesemaking or made cheese, almost out of algorithmic defiance. But cheesemaking is still on my mind because Reddit has deemed it a topic that could get me more engaged with the platform...and it's probably right! MemestocksWhen the history of the memestock craze is written, there are a lot of known factors (or at least, they’re clear to me). ZIRP. Robinhood and the gamification of trading. Stimulus checks and people sitting at home. But especially, in light of this week’s amazing Wall Street Journal series the Facebook Files (which I’d recommend everyone read every single piece and we’ll certainly cover it soon), unanticipated consequences of engagement-driven algorithms are top of mind. When Reddit raised a ton of money and hired a media growth legend, I’m sure sending AMC to the moon was never on anyone’s mind. But as we slowly try to make sense of what’s happened in the financial markets over the past year, it’s worth remembering how a redirection in a business model and UX tweaks can create massive outsized behavioral changes that make the world a lot weirder and harder to understand. Also - while we happily keep Margins free to excuse our unpredictable delivery schedule, if you feel so inclined: I’ll be taking part in the Making Strides against Breast Cancer walk in Central Park in October for the American Cancer Society. Would love it if anyone could make a donation! Note 1: One thing I purposefully left out of this entire post is the ‘bad side’ of Reddit. There are endless issues that arose over the years (TheDonald, The Fappening, and the list goes on). I concede those issues are a good reminder that engagement-driven algorithms aren’t the only issue we collectively need to get our heads around (plenty of them existed long before the big changes at Reddit). This would probably require an entirely different post, but whenever people try to say “people are bad” or “Fox News is also bad! It’s not just Facebook” my answer usually is...yes. Note 1: While writing this post and thinking about pre-2014 Reddit, it really did make me wonder whether some kind of taxpayer-funded social network with no aggressive commercial goals could create that digital town square that actually could be a reasonable town square. Note 3: If the question of old-school Reddit credibility ever comes up, I will readily bow down to my co-host Can. He worked at Digg when it was dominating the world of social news (and whose demise opened the door for Reddit’s success). If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Advertising Stagflation

Sunday, August 1, 2021

Its the 1970s for digital marketers

Ape Armies and Investor Relations

Saturday, June 5, 2021

A boomer no-pants Zoom and 💎🙌

Grift is Good

Monday, May 17, 2021

Greed is so 1980s

Cathie Wood and Content Strategy

Wednesday, March 24, 2021

Downloadable spreadsheets and media hacking

Bitcoin and Buying Things

Sunday, February 28, 2021

Here's to the risk managers, not the risk takers.

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The