Not Boring by Packy McCormick - Absolute Unit

Welcome to the 545 newly Not Boring people who have joined us since Monday! Join 77,171 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts Today’s Not Boring, the whole thing, is brought to you by… Unit Unit is a banking-as-a-service platform that lets tech companies embed financial features into their products. Developers can sign up for Unit’s Sandbox to start building banking into your product in days, not months. In the background, the Unit team keeps making the product better; in just the past two days, they shipped white-labeled UI and an integration with Plaid Exchange. (If that’s your kind of shipping cadence, check out their jobs here). If you’re a tech company with a loyal audience that wants to make your customers’ lives more convenient and create new revenue streams, you should sign up for Unit today. Hi friends, Happy Thursday! After a few weeks’ hiatus, we are back with another Sponsored Deep Dive x Investment Memo. As a reminder (or an introduction for the Not Boring Newbies) I’ve always said that I only write Sponsored Deep Dives about companies I’d want to invest in — the whole point is to expose you to some of the most exciting and innovative startups out there before anyone else does — and now that Not Boring Capital exists, I put my money where my mouth is whenever possible. You can read about how I select Sponsored Deep Dive subjects here, and increasingly, I plan to write them about portfolio cos. You might be able to sense a theme in these deep dives. Software has eaten the world; now, it’s finance’s turn. We’re programming money into everything. One of the manifestations of that is web3 -- crypto makes everything ownable. Another that I’ve been fascinated by is fintech, and particularly fintech infrastructure. Better infrastructure is redefining who can offer and access financial products and shifting the balance of power in favor of companies with audiences. Let’s get to it. Absolute UnitLast year, I was discussing a consumer fintech company with Byrne Hobart, the author of The Diff, who’s way smarter than I am on fintech (and all subjects tbh). He made an observation that’s obvious in hindsight, but that was particularly succinctly-put and has stuck with me since:

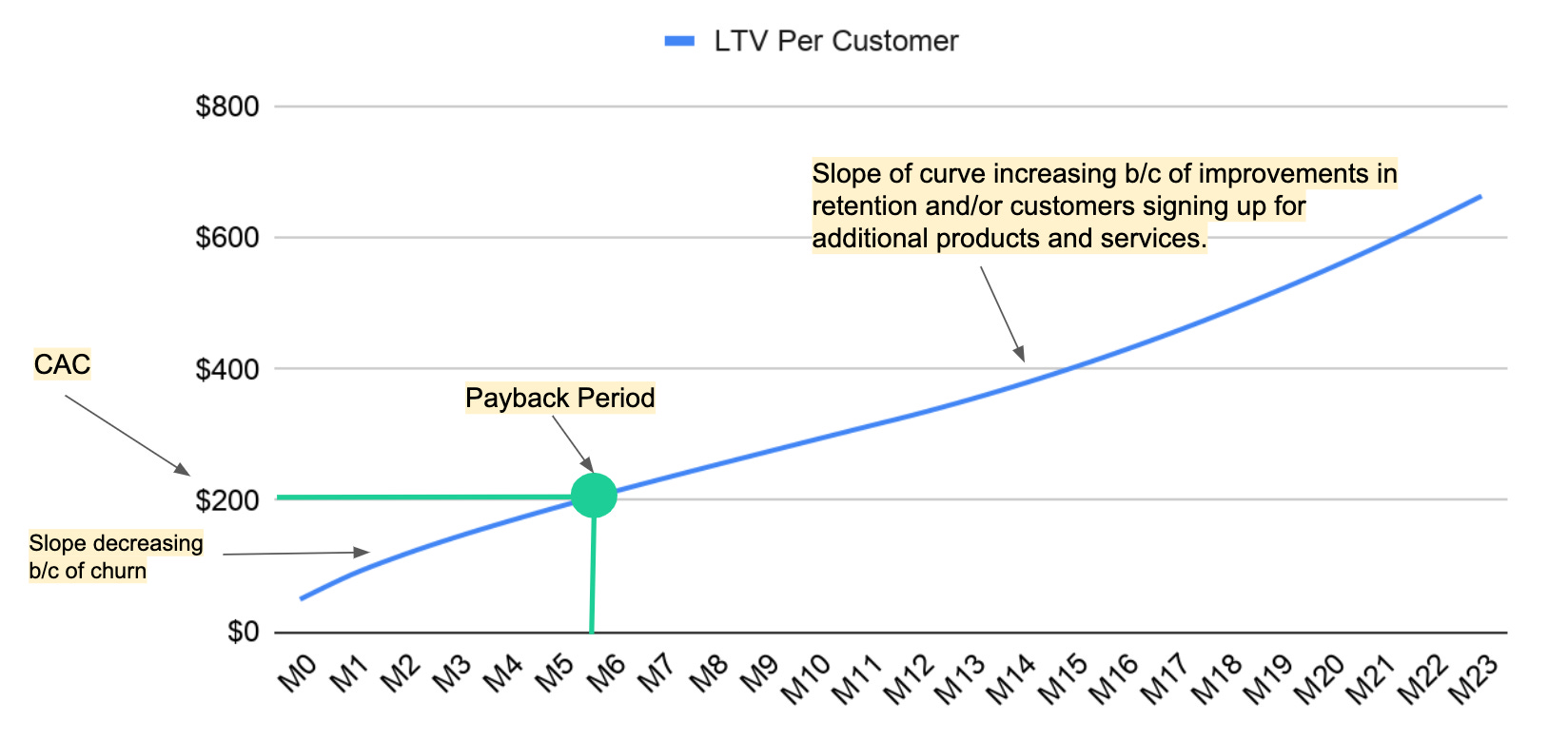

We were talking about a wealth management product, but the argument applies to fintech companies more generally. Here’s what he meant. Businesses spend a certain amount of money to acquire each customer -- the Customer Acquisition Cost, or CAC -- and they hope to make many multiples of that money back over the time that the customer continues to use their product -- the Lifetime Value, or LTV. The lower the CAC and the higher the LTV, the better. Put starkly, spending $1 to acquire a customer who pays you $100 over time is better than spending $100 to acquire a customer who pays you $1 over time. (This post by Ro CEO Zach Reitano and CFO Aron Susman, DTC Metrics Explained, goes in depth if you’re interested in learning more.)

Byrne’s point was that when everyone is going after the same customer via the same channels with similar products, the company that can convince itself that it can make more money per customer will pay more to acquire those customers. The most optimistic company gets the most customers, even if the optimism was misplaced. If they’re too optimistic, they lose money. The more accurate companies lose customers. Everyone loses. In the beginning of a new industry, when there’s less infrastructure and less competition, the battleground is product: can you actually build the thing you say you’re building? Over time, as a space matures and the building blocks become standardized, the battleground moves to audience. When anyone can sell some version of the same thing, acquiring customers becomes the hardest part. That’s why Google and Facebook make so much money. As more competitors vie for the same customers, CAC goes up, and companies need to either accept a lower CAC/LTV ratio, or increase LTV by increasing prices, cross-selling more products, or improving retention. This is true across industries, and it’s particularly true in consumer fintech. There are only so many financial products that most people buy -- bank accounts, debit cards, credit cards, loans, investing, transfers, wires, and a few other things here and there -- and the market is enormous. That means lots of companies offering similarish products and either competing for the same customers directly or going after ever-more-targeted niches. Starting from scratch today, it’s nearly impossible to profitably build a neobank. There are too many competitors converging on the same product suite targeting the same customers. The CACs are too damn high. But what if you could go where the customers already are? That’s the bull case for Unit, a banking-as-a-service (BaaS) platform that lets tech companies embed financial features into their products. It improves the CAC/LTV ratio from both sides of the equation:

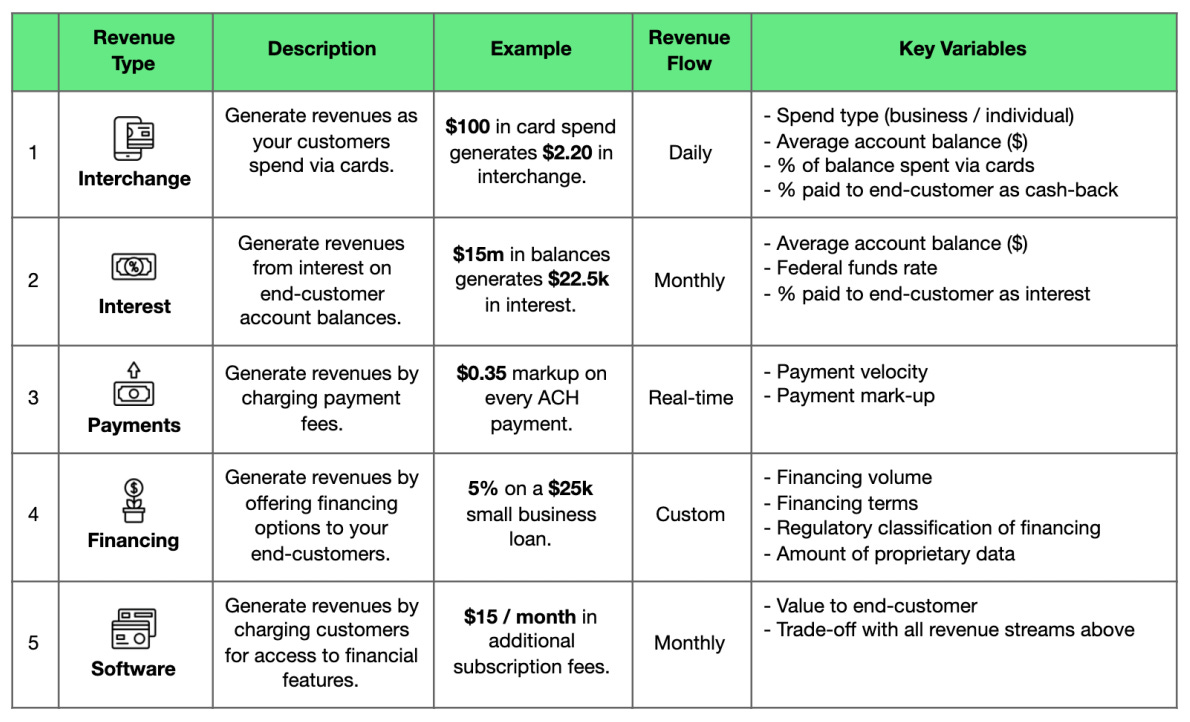

Unit flips fintech economics on its head by teaming up with the companies that have already won the trust of their customers. No additional CAC, more LTV. In some cases, Unit can even reduce its clients’ CACs, like it did for Wethos:   That’s how you build profitable financial products. Unit offers a single platform of APIs, Dashboards, SDKs, white-labeled UIs, plus third-party integrations with best-in-class financial products, built on top of partner banks. It abstracts away all of the complexity; the client just deals with Unit, a one-stop shop for tech, compliance, and security. By making it easy for a wider range of companies to offer financial products to their customers, Unit doesn’t really steal share; it expands the pie. Customers win. Tech companies win. Unit Wins. Even Unit’s partner banks win. Google, Facebook, and big banks lose. That’s resonating with customers and investors. In June, Unit announced a $51 million Series B, led by Accel. I’m pumped that Not Boring Capital got a chance to participate in the round. Unit is spreading like wildfire. Since I last spoke to Itai one week ago, Unit has grown its client roster by 17%. Today, I’ll explain why I’m so excited about Unit by covering:

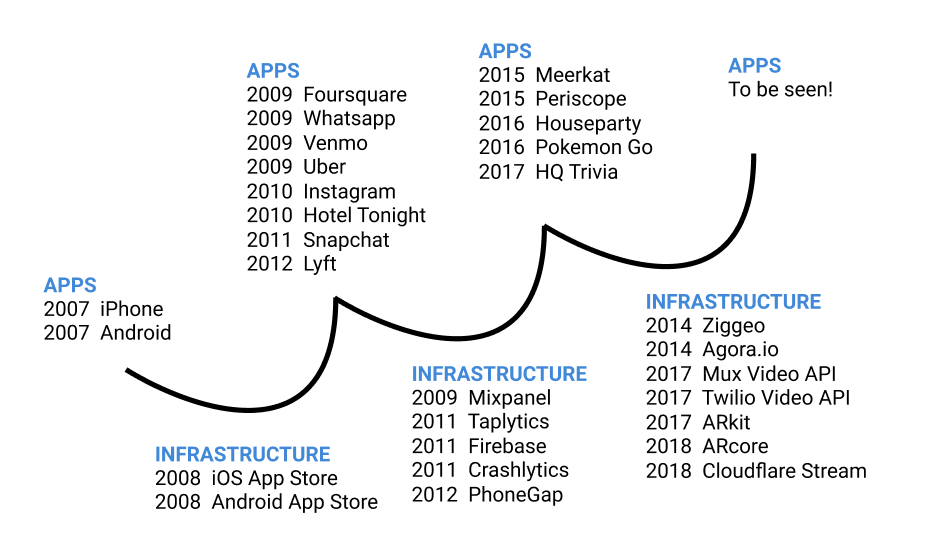

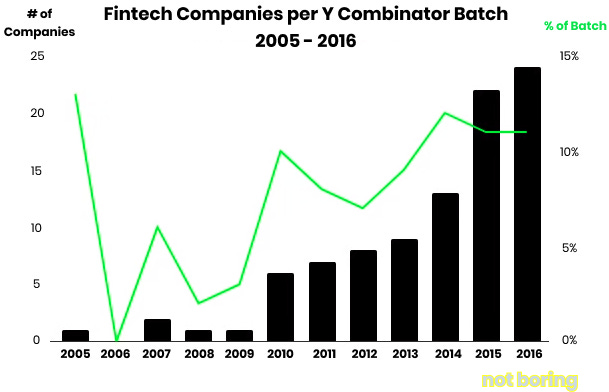

To understand Unit’s opportunity today, we need to look back at fintech’s recent history. The Fintech Apps-Infrastructure CycleLast week, in The Interface Phase, we talked about the apps-infrastructure cycle, a framework proposed by USV’s Dani Grant and Nick Grossman to explain how apps necessitate new infrastructure, and infrastructure enables new apps. Fintech has been in its own apps-insfrastructure cycle since the Global Financial Crisis (GFC). Fintech wasn’t really a thing before the GFC. There were companies that made it easier to do financial things online, like PayPal, but the industry didn’t really exist. Listen to any podcast with a fintech investor and they’re bound to say something like, “Look, I was just interested in how technology could [payments, lending, wealth management]. When I started, ‘fintech’ wasn’t a category like it is today.” Banks were dominant; tech companies were just hanging around the edges. The 2008 Financial Crisis created a chink in the banks’ armor, and entrepreneurs took advantage by building a wave of end-user-facing financial apps -- neobanks, trading apps, roboadvisors, lending platforms, and the like. While it’s not a perfect proxy, the number of fintech companies in each Y Combinator batch rose dramatically from one in 2005 to 24 in 2016. Spot the leap: coming out of the GFC, fintech companies spiked from one in 2008 and 2009 to six in 2010, and never looked back.

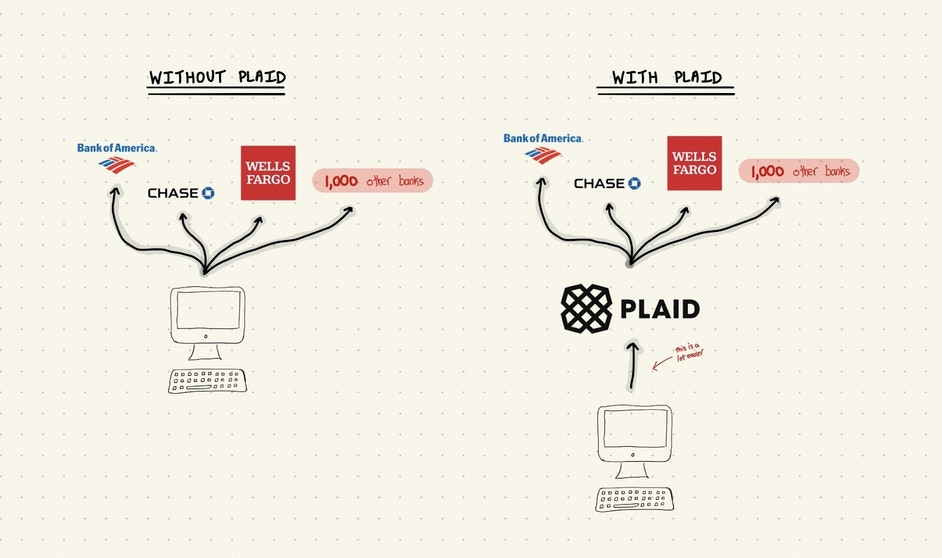

Some huge apps were built during this era, which Unit co-founder Itai Damti calls Fintech 1.0: Robinhood, Venmo, SoFi, and Chime are four representative winners. Early Fintech 1.0 apps had to do a ton of hard work themselves to get their businesses off the ground -- compliance, underwriting, clearing, connecting to banks, moving money, and much, much more. A new group of entrepreneurs saw the number of new apps, noticed that all of the Fintech 1.0 companies were doing the same hard things over and over, and set out to build infrastructure. Plaid, launched in 2013, is an API-first company that lets developers connect their apps to peoples’ bank accounts. It sounds simple, but before Plaid, integrating with banks and then maintaining those integrations was a massive pain and resource drain. Plaid started out working with existing players who felt the pain -- Venmo represented 40% of Plaid’s revenue in the early days -- but Plaid’s existence also expanded the market. By taking on the responsibility of one of the biggest headaches, Plaid made it easier for new entrepreneurs to build fintech products. Plaid was the beginning of fintech’s first infrastructure phase, and today, there’s a whole host of infrastructure players that form what Alloy’s Charley Ma (also an investor in Unit) captured in “the 2020 fintech stack”:  To learn more about Unit, the competitive Banking-as-a-Service space, Good Strategy, Bad Strategy, and the opportunity for Unit and embedded finance… How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading, and see you on Thursday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Crypto Bezos

Monday, September 20, 2021

What Would Bezos Build If He Were Starting Out Today?

The Interface Phase

Monday, September 13, 2021

First we shape our interfaces; thereafter, they shape us.

Nifty Corporates

Monday, August 30, 2021

VISA, Budweiser, Marvel, and the Positive Sum Corporate NFT Awakening

Solana Summer

Monday, August 23, 2021

The $21B Blockchain and the Arrow of Time

Story Time

Monday, August 16, 2021

The Progressive Decentralization of Narrative

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month