Go-to-market strategy: what startup founders can learn from the NFT craze

It's been another wild week for non-fungible tokens (NFTs) and the crypto market:

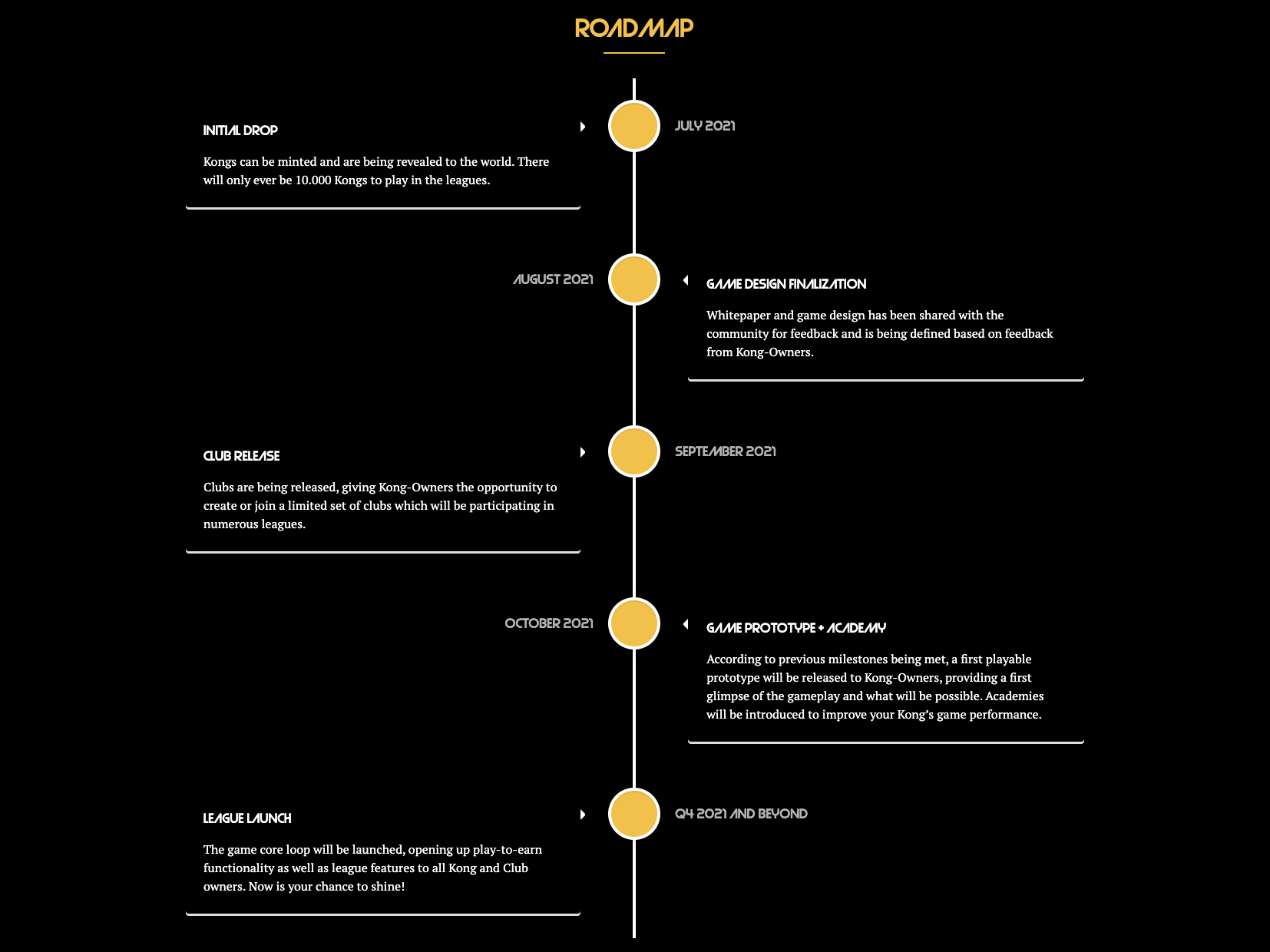

To some, the NFT craze is just another bubble “some kids trading jpegs.” Others believe it’s the early transition to the next stage of the web evolution (web3) that will disrupt the way content creators distribute and monetize their content. While that’s an interesting debate, it's not what I will discuss in this post. Instead, I've spent some time trying to understand the tactics NFT projects use to gain traction. Like early-stage startups, they also have limited resources with core teams ranging from 1 to 5 people. What surprised me is that most projects use a similar approach in their marketing, and I think there's a lot to learn from it. Could their go-to-market strategy become a new playbook for more traditional startups? Let’s dive in! Roadmaps: the new pitch decksMost NFT projects raise money directly from users through the minting process, the act of publishing artwork on the blockchain, and issuing a token to guarantee its authenticity. To motivate people to mint their artworks, NFT projects often publish a roadmap (or whitepaper) to describe future product developments. Many projects promise the moon to get people to invest, but most of them can't deliver. On the other hand, successful projects tend to present more realistic goals. So what can traditional startups learn from this? Product roadmaps are often just one of several slides that startups use to pitch their ideas to potential investors. But making these roadmaps available to the public can help startups to:

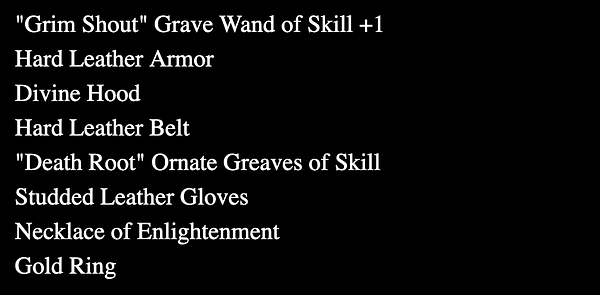

More and more companies are now “building in public.” Here are some examples of public roadmaps for inspiration: Github, Front, or Buffer. While those are great, I suggest going further and include an illustrated version directly on your homepage. Community-led growthIn my opinion, the most impressive thing about NFTs is their communities. This tweet below summarizes well the growth loop behind every successful NFT project. NFT projects are able to bootstrap early demand without spending any money on marketing because owners are directly incentivized to spread the word to others. The more they talk about their NFTs, the more likely their value will increase. Limited supply → increasing demand → prices go up In short, community-led growth is about turning your followers into leaders. The Loot project is probably one of the best examples of a community-led initiative.   Because the public could interpret it in any way they wanted, many people found a home for it. After a month, it has been converted into hundreds of projects, from games to songs. For those looking to buy, the cheapest one on sale as of this writing goes for $18,639! Yes, for a jpeg with random words on a black background :) For traditional startups, community-led growth is the new grail (read buzzword): But while the concept of community is simple.

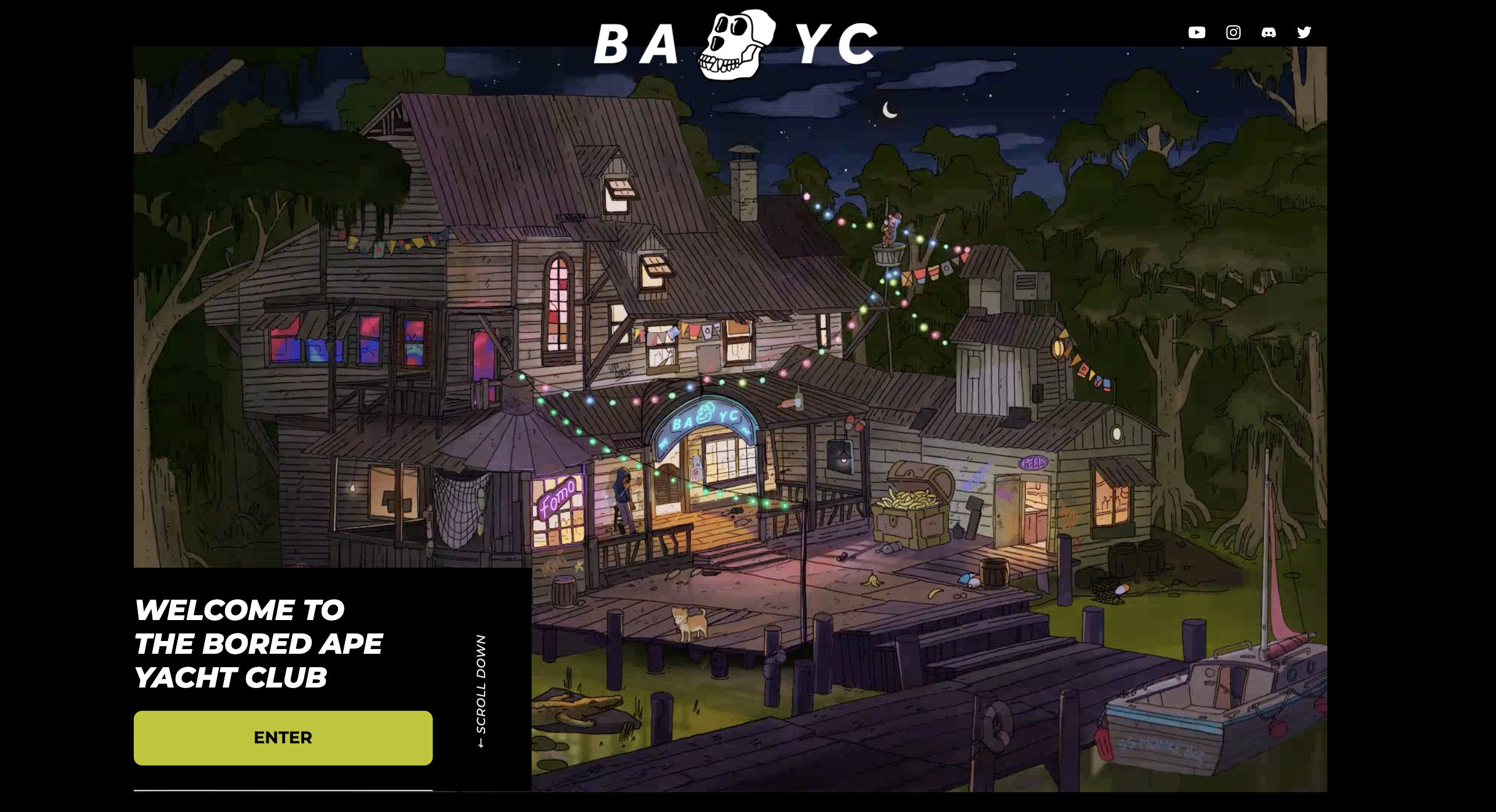

Very few startups manage to align incentives/interests, and even fewer dare to let their community self-organize. One of the few successes that come to mind is Notion:   Brand universeToday, there are 20,378,228 NFTs on sale on OpenSea (the leading secondary market for NFTs) for 216K active users. For new projects, it’s stand out or die trying. A great example of a project that stood out is BAYC (Bored Ape Yacht Club). In an interview for the New Yorker, the BAYC creators describe how they thought about differentiation early on:

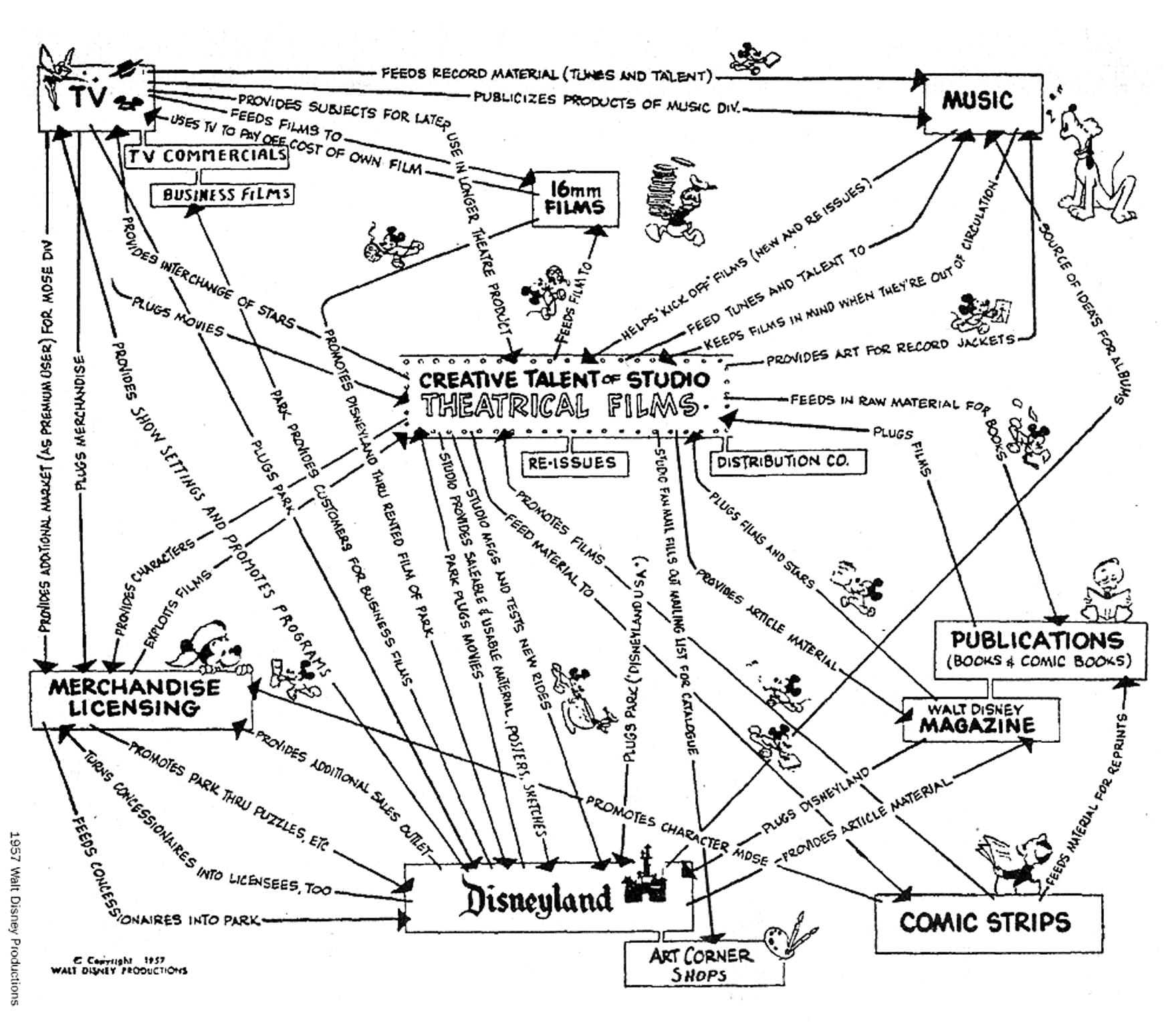

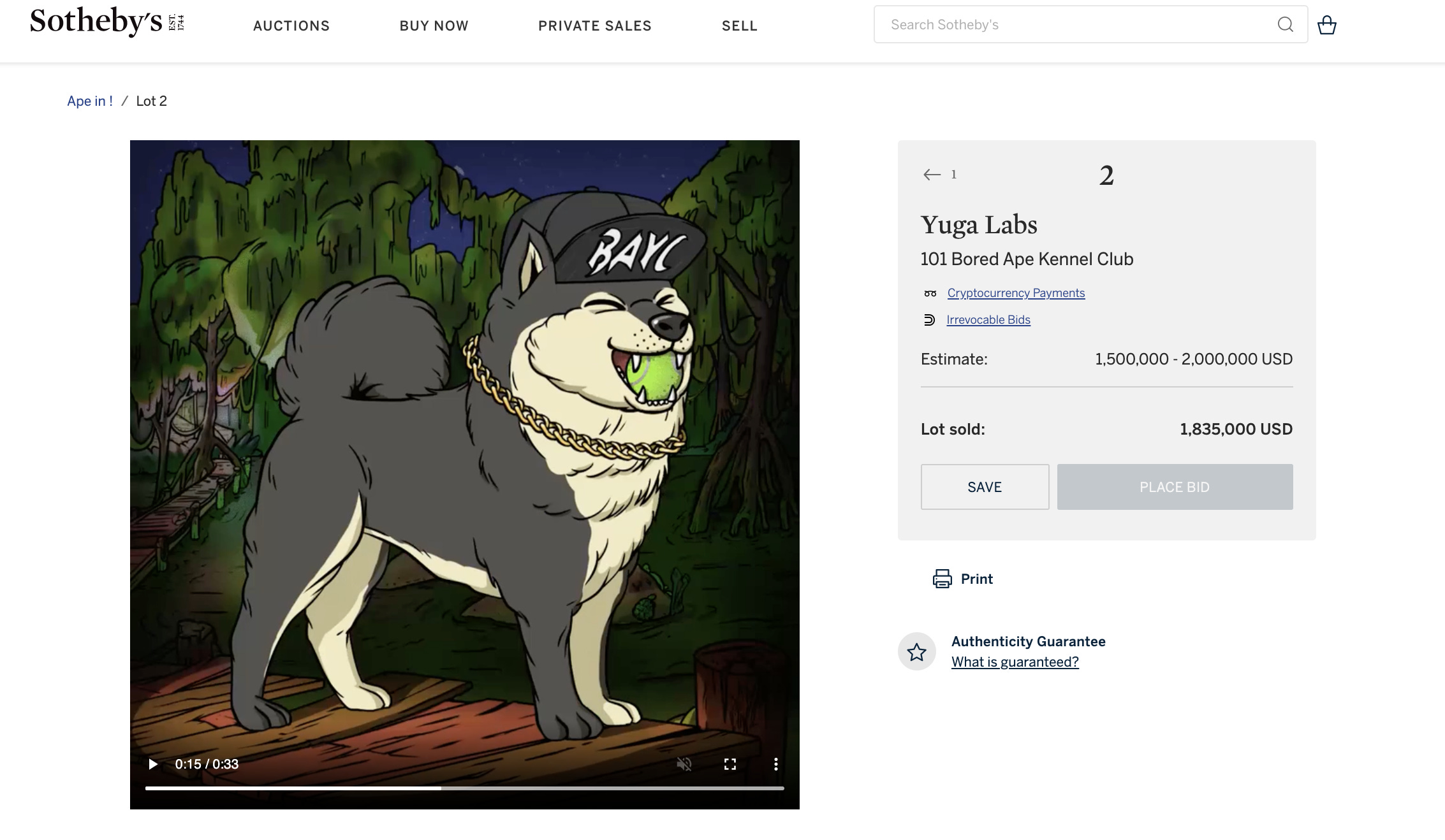

To stand out, the BAYC creators borrowed from the Disney recipe and created a rich and culturally relevant universe around their avatars. While I wouldn’t advise a startup to spend $40K upfront on branding, it can’t be an afterthought. In a crowded global marketplace, positioning matters more than ever. So what would this map look like for your startup? And what’s your brand IP? Early adopter rewardsA common practice in crypto and NFT is airdrops. In simple terms, it’s like gifting. The main difference with most gifts is that their value can increase significantly over time. For example, the creators of BAYC gifted early members a dog NFT (Bored Ape Kennel Club). This “cute gift” turned out to be quite lucrative. A bundle of 101 Bored Ape Kennel Club NFTs recently sold for $1.8 million! Gifting is also a common practice among traditional startups, but these gifts have generally low perceived (and depreciating) value like branded swag and stickers. If you want to rally early users, don't give them an item that will quickly lose its value. A few ideas:

Loyalty incentives #hodlRetention is the single most important thing for growth. Yet, most startups create more incentives for new users (discount and trial offer…) than for existing ones. To solve this issue, NBA Top Shot came up with an innovative solution:

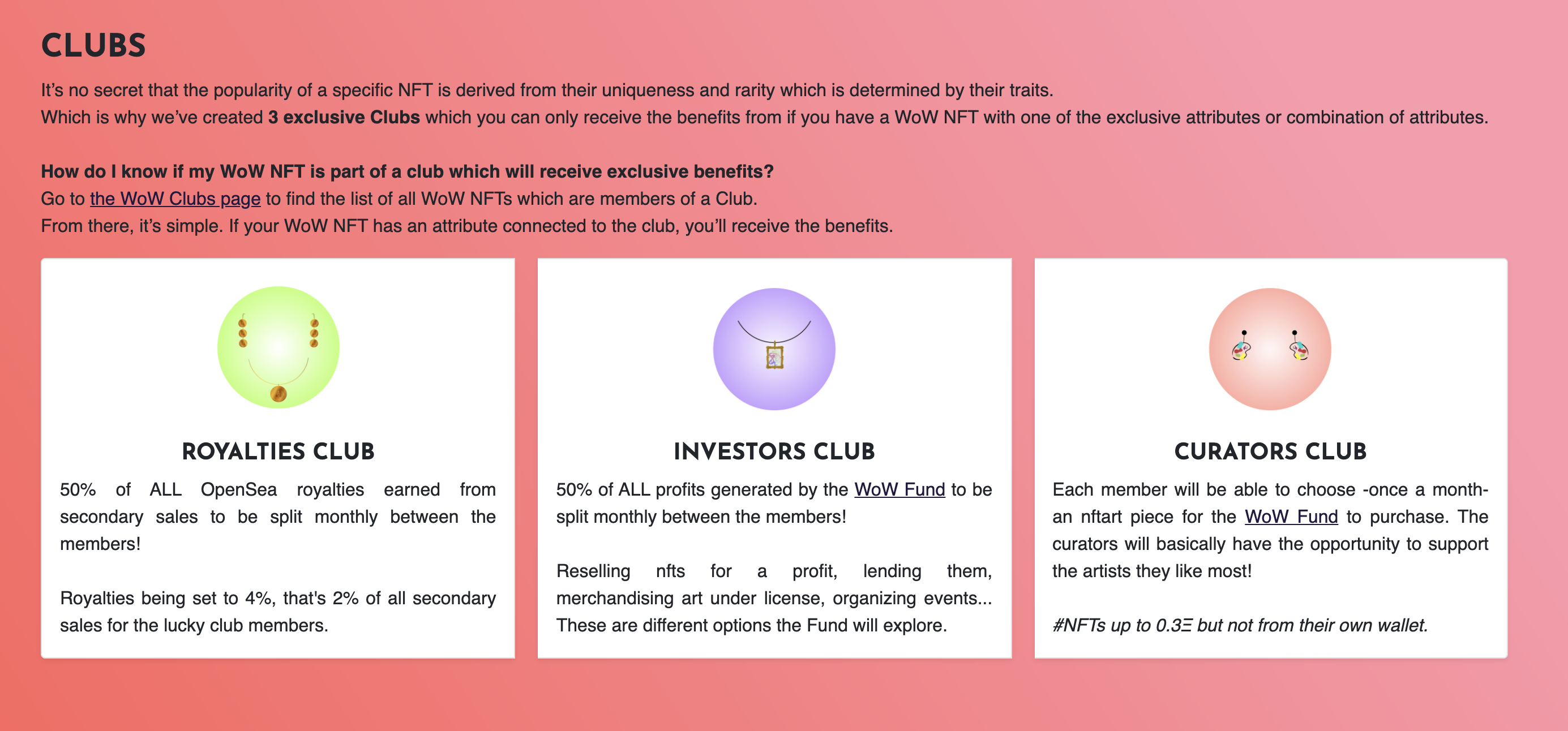

Access to new products isn’t only on a first-come, first-served basis but also weighted based on the customers’ previous platform usage. Other projects like World of Women incentivize simultaneously new and existing users with benefits attached to specific NFTs: some providing royalties on future transactions and others giving exclusive access to new collections. Loyalty programs are nothing new but “stay to earn” dynamics are. The closest thing I can think about coming from a traditional startup is when Airbnb set aside 7% of their IPO shares to hosts. As customer acquisition costs keep climbing, more startups will explore creative ways like this to reward their most valuable customers. Customer obsessionThis CNBC interview from 1999 shows that Jeff Bezos wasn’t trying to build just another Internet startup but leverage what the Internet had to offer to provide a better customer experience.

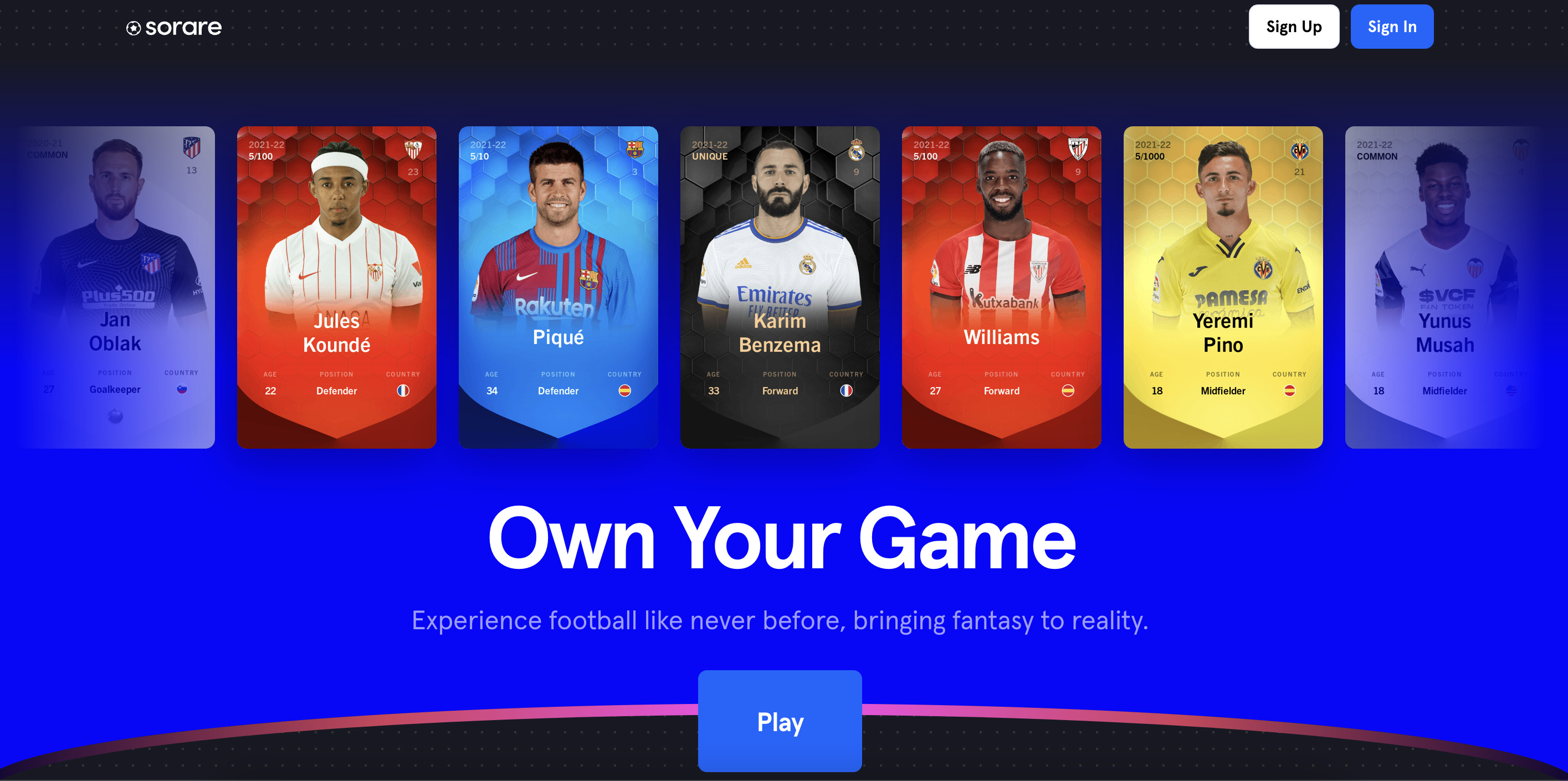

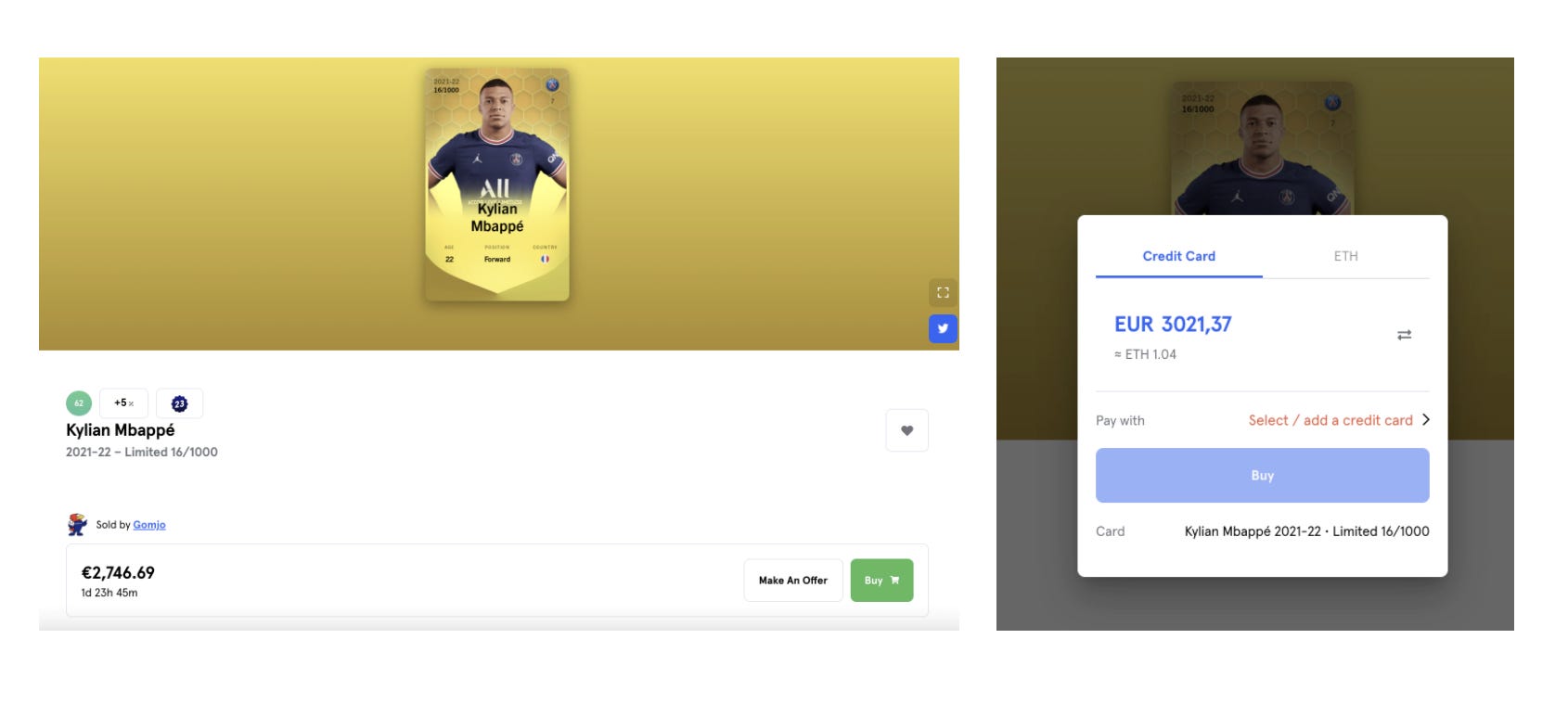

Like Amazon did with the Internet, the most successful NFT projects do not focus on technology in a vacuum but on their customers’ needs. For example, Sorare never mentions NFTs on their homepage and allows users to checkout with more traditional payment methods than cryptocurrencies. They built a customer experience that removes frictions and jargon focusing on what users are already familiar with. A common mistake for startups is to brag about the technology powering their products, whether it’s machine learning, blockchain, or others. But it’s often at the expense of the customer experience. So keep it simple! TakeawaysStudying how the most successful NFT projects go to market and gain traction shown me that there was nothing magical or groundbreaking about their marketing. They leverage tactics that have been around for a long time and that can apply to more traditional startups too. Here are five key takeaways:

If you’re in the process of going to market, I hope that this post was valuable. If you have any questions or need help with anything, feel free to reach out 👋 Until next time, PS: A good NFT-related meme for the road

If you liked this post from Erwan Derlyn, why not share it? |

Older messages

Joining as the first marketer

Tuesday, August 17, 2021

Illustration by Gustav Bodin A friend of mine recently landed a job at a startup as the first marketer and reached out for advice. I often get this question, so I'm turning my answer into a public

Data strategy for early-stage startups

Thursday, July 1, 2021

with Jacob Gustafsson (former Analytics Lead at Zettle by PayPal)

Kickstarting customer acquisition is hard! Here's a simple framework to help you get started

Tuesday, May 25, 2021

It's never been easier to start a company. During the last 20 years, the time and cost of starting a business decreased substantially worldwide. But it's a double-edged sword: more competition,

Where to find your first growth marketer?

Tuesday, February 9, 2021

Beyond your own network and without contracting a talent acquisition agency

Class2020.se

Wednesday, June 17, 2020

A supportive community for new graduates

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved