DeFi Rate - This Week in DeFi - November 5

This Week in DeFi - November 5This week, Aave governance approves V3, ENS to launch a DAO and airdrop, Avalanche announces $220m dev fund, and Stellar gets a native AMM

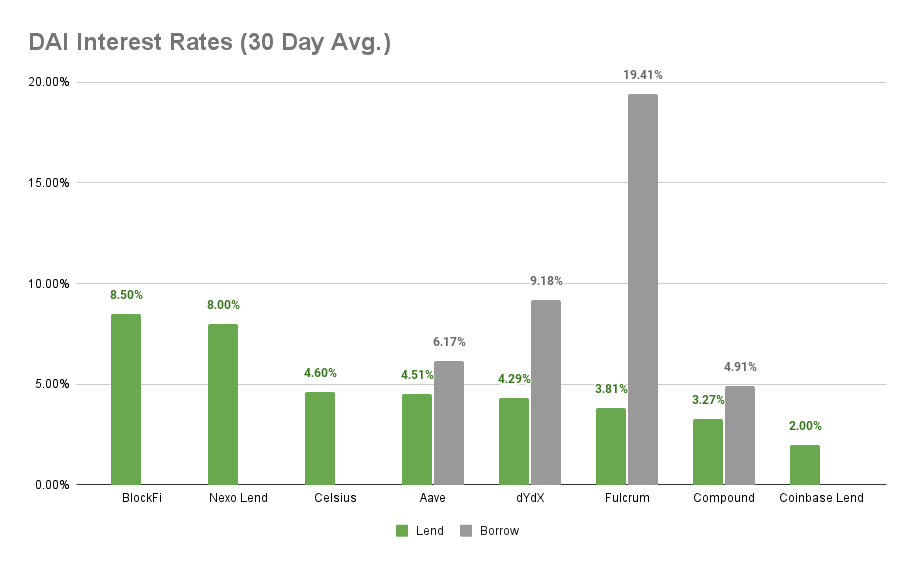

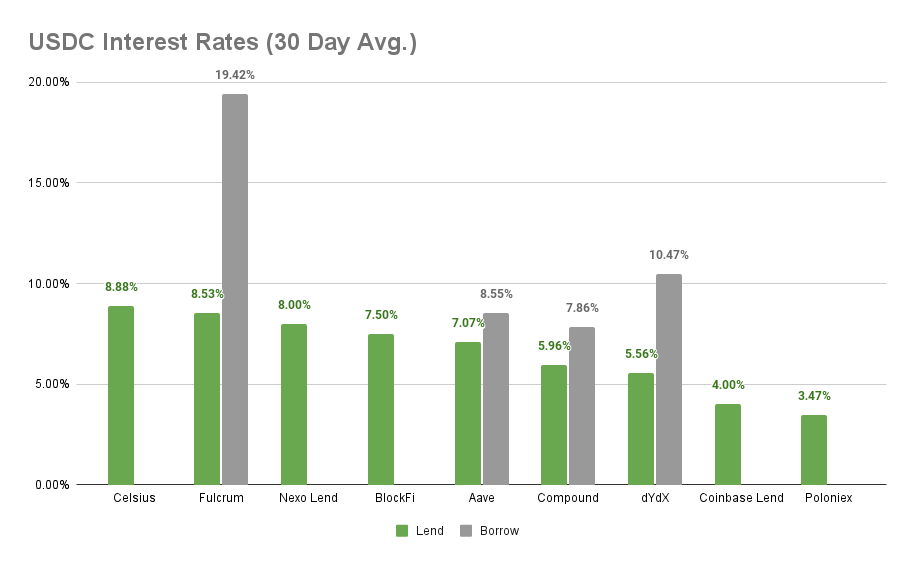

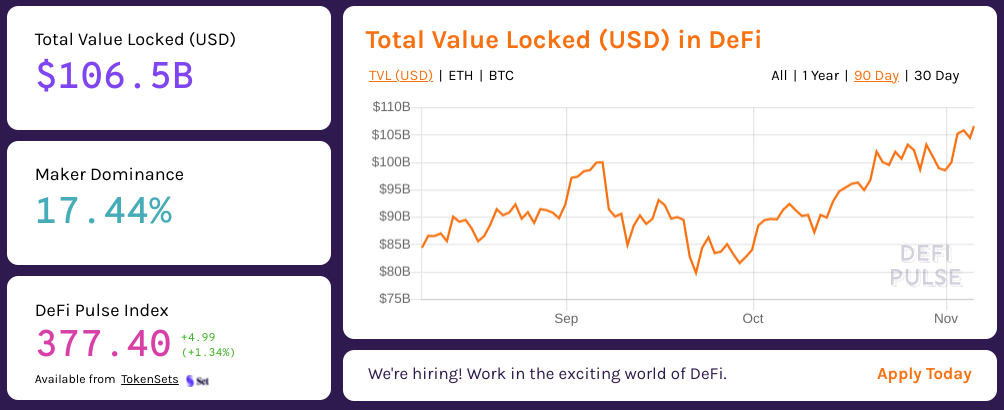

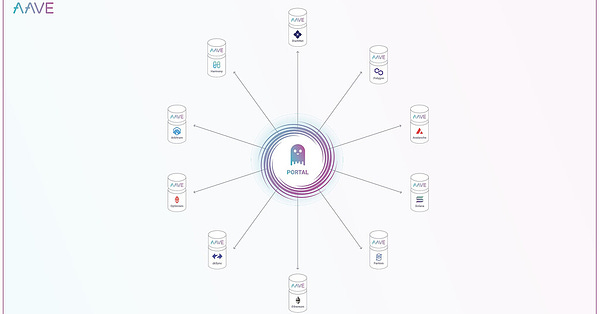

To the DeFi community, This week, the Aave community voted to approve a proposal for Aave V3, introducing the next evolution of the DeFi borrowing and lending protocol with a host of new features including adjustable borrowing limits for improved risk management and portal bridges between Aave instances on different protocols for cross-chain liquidity.   ENS, the Ethereum Domain Service, announced plans to transition to a DAO for managing aspects of the operation that are not already self-running, including management of the treasury and pricing for .ETH names. In addition, 25% of the ENS token supply will be airdropped to .ETH name holders and other contributors, including hundreds of Discord participants. Claiming begins November 8.   The Avalanche Foundation announced Blizzard, a $220 million developer fund intended to accelerate growth and innovation throughout the Avalanche ecosystem. In particular, funds will be directed towards enhancing DeFi, enterprise applications, and NFT and cultural applications, and will be distributed via equity investments and token purchases, in addition to technology, business development, and ecosystem integration support.   And Stellar, focused on fast, inexpensive blockchain-based payments, introduced automated market maker (AMM) capabilities at the protocol level, allowing greater access for Stellar users and providing improved liquidity and reduced slippage through an aggregated source for token swaps. The Stellar AMM will also make it easier for developers to access deep liquidity for decentralized exchange, making it easier to build on Stellar and focus on UI and UX considerations.  Another big week for Layer 1 competition for DeFi developers and users, as protocol upgrades and funding initiatives continue to roll out to try to attract attention in an increasingly crowded industry. Decentralized governance also continues to rapidly prove its viability as protocol upgrades like Aave V3 garner support from the community and offer upgraded functionality for all users. It may seem trivial, and the scale is still relatively small on a world stage, but it’s hard to overstate just how much of a change decentralized governance and DAOs could bring to the world in a very short time frame. Governance, for good reason, tends to evolve slowly, and has seen limited change in the second half of the 20th century and into the 21st. And while the underlying framework of democratic voting and open debate are some of the hallmarks of DAO governance, the capability to have these discussions, track consensus, and implement transparent changes - in real-time or asynchronously - could have massive implications for how the rest of society functions, well beyond DeFi and blockchains. Imagine a world where public records for a town or city don’t live in byzantine file systems, where boring tasks like naming conventions and version control are out in the open for public input instead of in the hands of a back-office developer, or where budgetary approvals come not from a handful of appointed officials, but from a transparent process where discussion is open to the whole affected community. We have a long way to go for infrastructure and UX to be ready for these types of applications. But it’s worth remembering just about everything available in DeFi today was simply a dream not even three years ago - this new technology stack unlocks a pace of innovation and implementation never before possible in human history. People are hungry for greater control and transparency in all aspects of their lives - and we’ve already got it in the oven. Think big! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8% APY Cheapest Loans: Compound at 4.91% APY, Aave at 6.17% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.88% APY, Nexo Lend at 8.00% APY Cheapest Loans: Compound at 7.86% APY, Aave at 8.55% APY Top StoriesNerveNetwork is partnering with TRONNsure Network Gradual Launch on Polygon: Capital Mining LaunchOlympus Pro — Introducing Fantom Cohort 1 Launch PartnersIntroducing Ribbon TreasuryStat BoxTotal Value Locked: $106.5B (up 0.44% since last week) DeFi Market Cap: $163.33B (up 5.25%) DEX Weekly Volume: $23.44B (up 0.47%) Total DeFi Users: 3,813,100 (up 2.92%) Bonus Reads[Samuel Haig – The Defiant] – DeFi Founders Debate Whether to Resist or Embrace Regulation [DEFIYIELD.App] – Ultimate Yield Farming Guide For Avalanche Network [Fabian Klauder – DeFi Times] – How to Navigate the Cosmos Network [Stefan Stankovic – Crypto Briefing] – Inside the War Room: How Indexed Finance Traced Its $16M Hacker [Anthony Sassano – The Daily Gwei] – Civilizational Infrastructure - The Daily Gwei #371 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - October 29

Friday, October 29, 2021

This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

This Week in DeFi - October 22

Friday, October 22, 2021

This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

This Week in DeFi - October 15

Friday, October 15, 2021

This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

This Week in DeFi - October 1

Sunday, October 10, 2021

This week, Fireblocks wants in on Aave Arc, Polygon users overtake Ethereum, R3 is building for DeFi, and SocGen bank wants DAI for bonds

This Week in DeFi - October 8

Sunday, October 10, 2021

This week Fei launches V2, DominantFi comes to Polygon, Visor Finance colab with Perp Protocol, and Stripes gets $8.5m for interest rate swaps

You Might Also Like

WuBlockchain Weekly: U.S. Government Authorized to Sell $6.5 Billion Worth of Bitcoin, Pro-Crypto Pierre Poilievre…

Friday, January 10, 2025

The US government has received approval to liquidate 69000 Bitcoins (valued at $6.5 billion) seized from the “Silk Road” darknet market, a government official confirmed to DB News on Thursday. ͏ ͏ ͏ ͏

US Government can now sell $6.5 billion Silk Road Bitcoin before Trump enters office

Thursday, January 9, 2025

Federal court ruling accelerates sale of Silk Road Bitcoin as market watches closely. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: TGEs Look To Heat Up Crypto In 2025

Thursday, January 9, 2025

Monday Jan 6, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR TGEs To Heat Up Crypto In 2025 Solana Remains Skeptical About AI Agents BTC Looks To Regain Momentum, DOGE & SUI Surge UK

Mining News in December: Ethiopia's Rise, Huaqiang North Mining Machine Prices Rise, Oilfield Giant Invests in Bit…

Thursday, January 9, 2025

Title sponsored by Bitdeer, a NASDAQ-listed mining company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Let's Make Money from Farming

Thursday, January 9, 2025

CRYPTODAY 140 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ripple CEO Brad Garlinghouse hails Donald Trump meeting as US crypto engagement grows

Wednesday, January 8, 2025

Trump's pro-crypto stance sees Ripple and other crypto leaders engaging in transformative talks at Mar-a-Lago. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏

What opportunities are there in combining DePin with AI? What difficulties are there?

Wednesday, January 8, 2025

This podcast episode features a discussion between Wu Blockchain founder Colin Wu and EO Hao, CEO and founder of Future Money Group. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin sell-side liquidity hits lowest level since 2018 fueling BTC rally

Tuesday, January 7, 2025

Whales quietly accumulate as sell-side liquidity hits five-year low, driving new BTC highs. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏