DeFi Rate - This Week in DeFi - November 12

This Week in DeFi - November 12This week, Raydium and Serum announce LP rewards, Wormhole support for Polygon, Polkadot's Acala raises $400m, and Maple permissioned DeFi

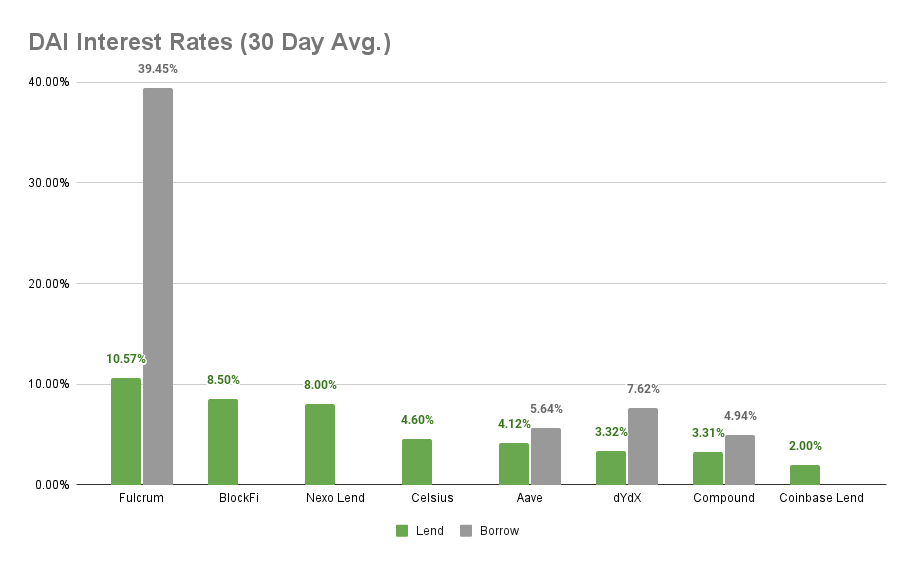

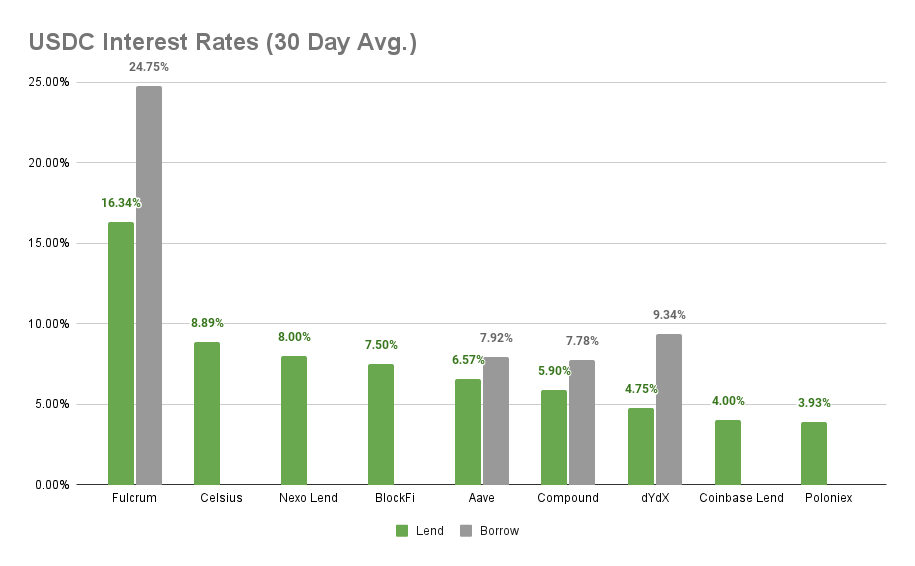

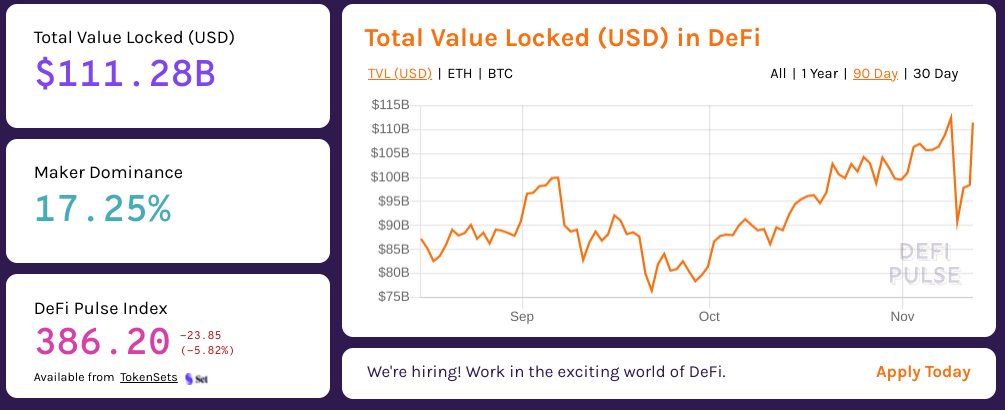

To the DeFi community, This week, Solana-based DEX Raydium announced a partnership with liquidity aggregator Serum to kickstart cross chain transactions with liquidity mining rewards. ERC20 tokens for popular protocols including dYdX, Uniswap, And Axie Infinity will get new incentivized trading pools over the coming weeks, with assets bridged using Wormhole.   Wrapped token cross-chain bridging solution Wormhole announced support for Polygon this week, the first L2 solution to be added to the wormhole network that currently connects Ethereum, BSC, Terra and Solana. With more than $5 billion currently on the Polygon chain, the move could unlock significant additional cross chain liquidity for popular protocols and tokens.   Acala, a Polkadot-based DeFi hub for decentralized exchange, DOT liquidity staking, and sporting its own decentralized stablecoin, raised more than $400 million in DOT tokens in the first parachain auction for the Polkadot ecosystem. More than 50,000 investors participated in the ‘crowdloan’, which will need to be paid back over time by the Acala protocol.  And Maple Finance launched a permissioned DeFi pool with an eye towards giving financial institutions the regulatory certainty they need to start using smart-contract based protocols in their business. The Pool will only accept interactions from verified KYC entities and will aim to collect $20 million in liquidity in the first month after launch.  CoinDesk @CoinDesk Uncollateralized lending is taking a step forward with a permissioned @maplefinance pool between @BlockTower and @GenesisTrading. @Blockanalia reports https://t.co/OBvFNvO5aCAs the number of blockchains seeing significant traction in DeFi, NFTs, and other use cases continues to multiply, it can be harder than ever to know where to allocate capital for the best returns. Ethereum finds itself in an awkward position as a victim of its own success, now almost entirely reliant on L2 solutions to onboard users into the Ethereum ecosystem, just as L1 alternatives like Solana, Avalanche, and several others are hitting inflection points in UI, UX, and liquidity. L1 Ethereum will likely remain on the sidelines until protocol upgrades can bring greater transaction throughput, but the remainder of the crypto market is highly fractured, limiting both composability and localized liquidity. The good news is a multitude of cross-chain bridges and swap protocols have emerged to begin meeting the demand for portable value across the overall crypto ecosystem. The proliferation of these bridges raises a classic dilemma for the crypto investor - over time, are returns greater at the protocol layer, or the application layer? Much of the excitement of 2020’s DeFi summer revolved around the then-novel notion that protocols like Yearn or Aave, operating across multiple chains, would deliver better returns than betting on the growth of any one smart-contract platform like Ethereum or Solana. The jury is still out on this question, but for application-layer fans, cross chain bridges represent the newest opportunity to get in on the ground floor. So much of application-layer investments turn on the particular tokenomics of a given project, so a shotgun strategy might yield less than optimal returns; always do your research. But for projects with the right market fit and well designed distribution strategies, life changing money could be on the table once again. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Fulcrum at 10.57% APY, BlockFi at 8.50% APY Cheapest Loans: Compound at 4.94% APY, Aave at 5.67% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Fulcrum at 16.34% APY, Celsius at 8.88% APY Cheapest Loans: Compound at 7.78% APY, Aave at 7.92% APY Top StoriesNansen Brings Market Intelligence Support to Solana’s Growing EcosystemBrave partners with Solana to integrate into the browserHarmony announces strategic partnership with PowerPool to bring diversified smart indices to ONE ecosystemAdd Liquidity on KyberDMM Pools with a Single Token DepositStat BoxTotal Value Locked: $111.28B (up 4.49% since last week) DeFi Market Cap: $168.14B (up 2.94%) DEX Weekly Volume: $26.07B (up 11.22%) Total DeFi Users: 3,888,300 (up 1.97%) Bonus Reads[Lukas Schor – The Defiant] – How DAOs are Challenging VCs in the Race to Fund Web3 Projects [Owen Fernau – The Defiant] – ConsenSys Founder Joe Lubin Teases MetaMask Token $MASK [Trent Van Epps – Bankless] – Ethereum Roadmap Update | End of 2021 [Stefan Stankovic – Crypto Briefing] – What Are Polkadot’s Parachain Auctions? [Anthony Sassano – The Daily Gwei] – Global Settlement Infrastructure - The Daily Gwei #376 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - November 5

Friday, November 5, 2021

This week, Aave governance approves V3, ENS to launch a DAO and airdrop, Avalanche announces $220m dev fund, and Stellar gets a native AMM

This Week in DeFi - October 29

Friday, October 29, 2021

This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

This Week in DeFi - October 22

Friday, October 22, 2021

This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

This Week in DeFi - October 15

Friday, October 15, 2021

This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

This Week in DeFi - October 1

Sunday, October 10, 2021

This week, Fireblocks wants in on Aave Arc, Polygon users overtake Ethereum, R3 is building for DeFi, and SocGen bank wants DAI for bonds

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏