DeFi Rate - This Week in DeFi - November 19

This Week in DeFi - November 19This week, Paraswap airdrops PSP tokens, Injective starts $120m in LP rewards, Pendle LP rewards on Avalanche, and $1.5m for synths on Solana

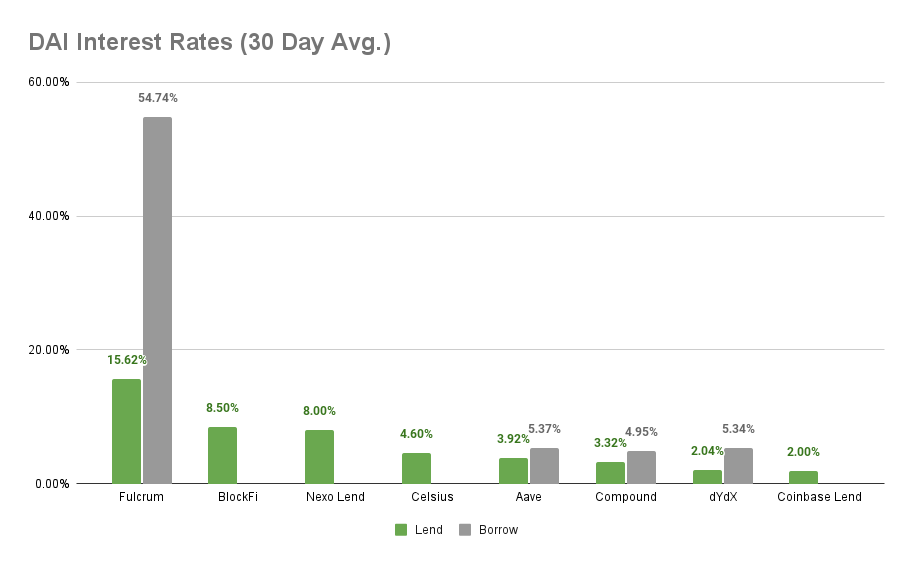

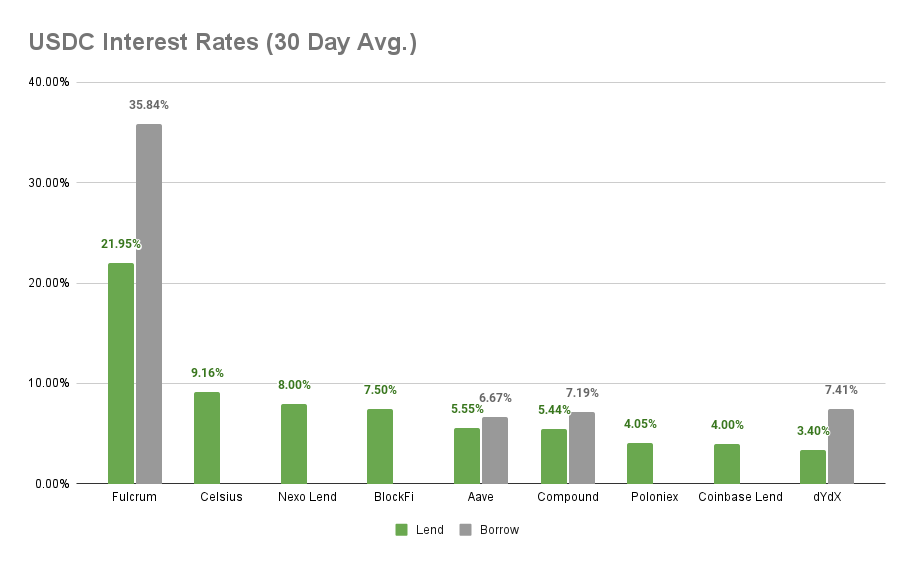

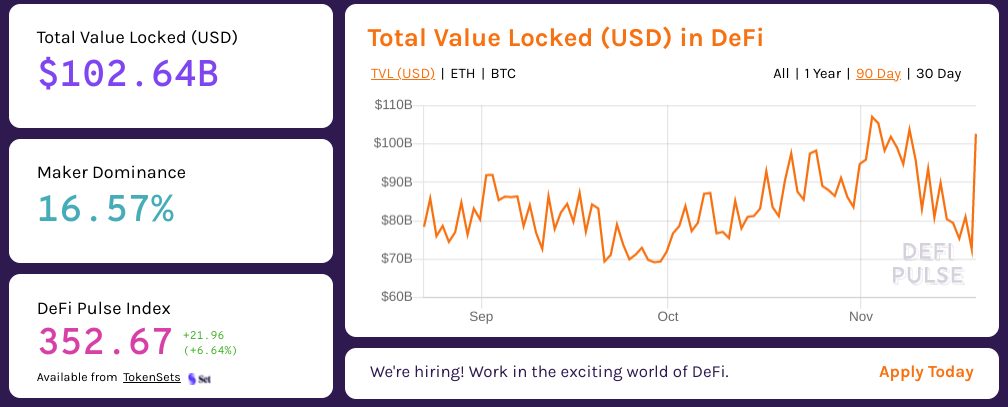

To the DeFi community, This week, Paraswap distributed PSP tokens to approximately 20,000 active users of the protocol, a small fraction of total users defined based on a fairly strict criteria of consistent recent use of the protocol and exclusion of ‘gaming’ wallets and address clusters.  Injective launched Astro, a liquidity mining program that will distribute 10 million INJ tokens currently worth $120 million to market makers and traders on the platform. Rewards will be distributed over five years, with more than 162,000 INJ available in the first month.   Pendle Finance, allowing users to lock tokens with future yield potential to receive those rewards immediately, launched on Avalanche, with LP tokens from Trader Joe and BENQI eligible for staking. Deposits of these trading pairs will also be eligible for PENDLE rewards of 125% of the base rewards for pools during launch week. And Polysynth raised $1.5 million for synthetic assets on Solana, aiming to make available more than 100,000 synth assets following mainnet launch. The funds will go towards building a development team and completing smart contract security audits, as well as development of a Virtual Market Maker (VMM) that Polysynth claims will eliminate the need for bootstrapped liquidity from LPs and risks like impermanent loss.  Airdrops have come a long way since emerging around the ICO era, where crypto startups would simply airdrop hundreds or thousands (sometimes millions or more!) of their protocol token to every address on the Ethereum blockchain in the hopes that such generosity would foster interest and investment in their project. As with most ICOs, these early airdrops were poorly designed, rarely had the intended effect, and for the most part ended up as worthless dust in wallets of the day. Not everyone is thrilled with the Paraswap airdrop, many having their own particular argument about how they should be entitled to a greater share of tokens, or any tokens at all. But a close reading of the structure and reasoning behind the tightly controlled PSP distribution reveals a thoughtful effort to only distribute tokens not to users that happened to try the protocol early, or that had made one or two large trades, but that had consistently and meaningfully used the liquidity aggregation service and were likely to continue to do so. Remember, airdrops are not a reward for showing up early or throwing around lots of value - they’re a distribution channel for the keys to the castle, and ideally a reflection on the type of community distributing protocols want to foster long term. Uniswap and ENS are examples of other approaches to performing airdrops, but Paraswap has set a new bar for thoughtful investigation and ultimate distribution to those accounts most likely to strengthen the protocol long-term. One last reminder; if you genuinely believe in a protocol, and aren’t just looking for the next free bag of tokens to dump, there’s nearly always ample opportunity to grab PSP or other protocol tokens at a discounted valuation on the secondary market. Don’t expect to get rich on airdrops, but instead work to identify quality projects and consider the economics of distribution from the founders perspective, and you shall be richly rewarded. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Fulcrum at 15.62% APY, BlockFi at 8.50% APY Cheapest Loans: Compound at 4.95% APY, Aave at 5.37% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Fulcrum at 21.95% APY, Celsius at 9.16% APY Cheapest Loans: Compound at 7.19% APY, Aave at 6.67% APY Top StoriespSTAKE Raises $10M to Bootstrap Liquid Staking ProtocolDeFi Land is Launching on AcceleRaytorPortal partners with Polygon to advance DeFi on BitcoinHarvest Becomes the Main Integrator of Idle Finance B2B ProgramStat BoxTotal Value Locked: $102.64B (down -7.76% since last week) DeFi Market Cap: $152.5B (down -9.30%) DEX Weekly Volume: $25.96B (down -0.42%) Total DeFi Users: 3,979,800 (up 2.35%) Bonus Reads[Samantha – Bankless] – DAOs: Changing the course of human life [Samuel Haig – The Defiant] – ConstitutionDAO Members Decry High Gas Fees After Narrowly Losing Auction [Jack Melnick – The Tie] – Unipilot and Popsicle.Finance: $6bn+ TAM for Liquidity Optimization [ycctrader – The Defiant] – Ape Diaries: Gasless Yield Farming on Aurora, NEAR’s EVM-Compatible Blockchain [Anthony Sassano – The Daily Gwei] – Strong Hands - The Daily Gwei #379 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - November 12

Friday, November 12, 2021

This week, Raydium and Serum announce LP rewards, Wormhole support for Polygon, Polkadot's Acala raises $400m, and Maple permissioned DeFi

This Week in DeFi - November 5

Friday, November 5, 2021

This week, Aave governance approves V3, ENS to launch a DAO and airdrop, Avalanche announces $220m dev fund, and Stellar gets a native AMM

This Week in DeFi - October 29

Friday, October 29, 2021

This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

This Week in DeFi - October 22

Friday, October 22, 2021

This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

This Week in DeFi - October 15

Friday, October 15, 2021

This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏