The Daily StockTips Newsletter 12.29.2021

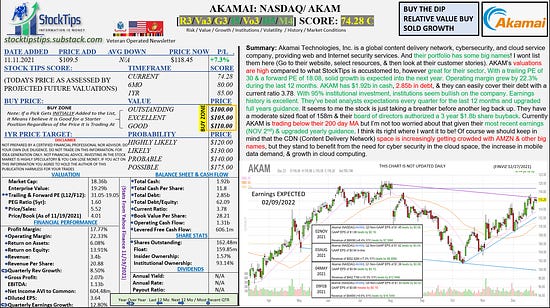

The Daily StockTips Newsletter 12.29.2021I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional Ownership (I), Volatility (Vo), Earnings History (H), & Market Conditions (M). I then score them, set price targets, & provide a quick thesis about the company. I do not throw stocks up until I thoroughly research them. The way I figure it, I ought not be drawing attention to stocks I'm not confident enough to buy myself. The Stock Tip Report is NOT investment advice, it is strictly to assist you in your own idea generation, & you should always do your own DD. Please read the "Important Disclaimer" at the Bottom of this Page.IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.TODAYS OVERVIEW: 1x New Stock Added to the Buy List. 10 Stocks near/at/above the Buy Zone (Waiting to Swing). 9 Stocks (Profiting) Above the Buy Zone. 40 Stocks on the Price Based Assessment Watchlist. 12 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer). 2 Stocks on the Highly Speculative Highly Volatile List (Read the Warning/Disclaimer). WE’RE ON YOUTUBE NOW! See HERE & HERE All profit & loss removed from the list will forever be posted below. Please note that the numbers only reflect the difference between the INITIAL buy price & the sell price without credence to the effects averaging down, which I often do. Gains can therefore look much less than what was actually achieved by 1-10%.Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus) Commentary: Does anyone truly care about COVID anymore? I think at this time no matter how governments tell folks to mask up, vaccinate, or implement restrictions, COVID is going to spread all the same & there is truly nothing that can be done about it short of herd immunity (Disclaimer: I am fully vaccinated). Israel is eyeballing a 4th dose of vaccine, Omicron had already spread worldwide before the CDC even knew it existed, & despite rising infections there is very little political or financial will power to begin shutting down full economies having spent more in two years than all of World War II (Adjusted for inflation). Indeed even President Biden, though it was likely a “political” mistake, said that there is “no federal solution” to combatting COVID. So why am I telling you this? So when the next COVID variant comes around, we will likely want to buy the dip, just as we did with Omicron the last time. And boy is it ever paying off now! Now we have 13 stocks in the green (9 Deep Green) and 6 Stocks in the red (3 deep red). Some good value in that red too! In all the StockTips portfolio has profited through a new covid variant, crappy Black Friday / Cyber Monday retail numbers, record inflation, Fed Chair scares, government shutdown threats, supply chain bottlenecks, increasing energy costs, & regulatory uncertainty amid calls to tax unrealized capital gains. I am exceptionally proud of how my picks have preformed over the lst two months. And of course, we not only made it through all that hell, but next earnings season is coming up quick which should generate some excitement. Its all because we bought reliably profitable sector/industry relative value on a pullback of little to no consequence, with a decent amount of institutional investment, primed for growth under favorable economic conditions. This limited our downside allowing us to weather storms without reducing exposure & profit potential, while maximizing possible upside as well! For those of you who held tight, you ought to congratulate yourselves. Nevertheless we shouldn’t get ahead of ourselves & keep an ever watchful eye for surprises. There is no need to take on an increased level of risk nor deviate from the original strategy by chasing FOMO. There is still plenty of FUD out there that can ruin our party. Don’t forget that! Another variant could hit, China or Russia could be up to their old tricks, the Chinese real-estate sector could collapse further, Inflation could spike higher, bond yields could spike higher, the Fed could push up their timeline, & the list goes on. Indeed there isn’t much on the economic calendar or some seriously major earnings news expected this week so we will enjoy the calm while it lasts. HIGHLIGHTED COMPANY OF THE DAY: AKAMAI AKAM Selling Today! I like this company but its slow moving & I needed to clear up some space. Anyway AKAM is up 7.3% in the same period SPY was up 2.3%. I’m happy outperforming the S&P by 5%. There are many plays below in the paid section well above 7.3% but I assess more upside which is why they’re staying. Significant News Heading into 12.29.2021:

Insider Buying Activity from the Last Trading Day: NOT Awards, NOT Compensation, but BUYING! (Usually Reported After Market Hours) PAID CONTENT BELOW:

Remember: I Search for Historically/Reliably Profitable Companies, Trading at a Sector/Industry Relative Value, on a Pullback of Little to No Negative Consequence, Favored by Institutions, & Under Favorable Assessed Future Economic Conditions. The reason the below section is paid content is these gems are really tough to find & take quite a bit of research to justify addition to the list! I’m a very picky fella & I don’t like to lose! . ... Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 12.28.2021

Tuesday, December 28, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The Daily StockTips Newsletter 12.27.2021

Monday, December 27, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

A Christmas Message for StockTips Subscribers

Saturday, December 25, 2021

An Inspiring Christmas Message From the Editor of StockTips

The Daily StockTips Newsletter 12.23.2021

Thursday, December 23, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The Daily StockTips Newsletter 12.22.2021

Wednesday, December 22, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏