Margins - Margins takes on Web3

Hi! Can here. Long time, no see! I started a company. It’s called Felt and it is about maps. And yes, we are hiring! Scroll to the end to learn more. For a long time, I resisted opining on crypto, even though I had a lot of early exposure to it. My roommate circa 2011~2012 was really into Bitcoin. He was so convinced that it was the next big that he set up ASICs, devices that were designed specifically to mine Bitcoin, in some San Jose schools’ storage cabinets thanks to a network of ethically flexible janitors. The whole thing felt off. On one side was an admittedly enterprising guy who used to make six figured from his side jobs and on the other was a public school system (I think?) getting fleeced and a bunch of people with a lot to lose risking their jobs at a chance to make a quick buck, having bought into this whiz kid’s story. But I think it worked? Maybe I was wrong. And you know, maybe I’m just bitter that I never get in on this action! But I’m pretty sure that’s not the whole reason. “It’s Just Math” they said

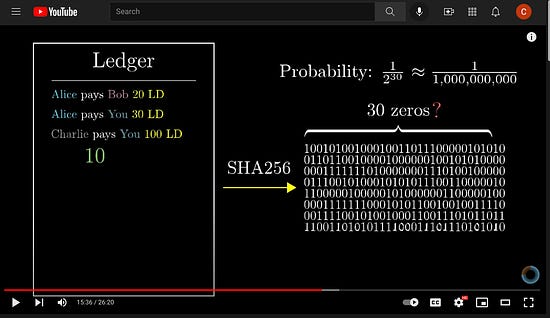

My curiosity started out pretty normal. Bitcoin I grokked pretty easily, and the math, so to say, checked out. I knew about practical cryptography and things like Merkle trees both from school and work. However, as the crypto conversation turned from running a wildly-expensive yet cleverly-designed distributed ledger to building a world computer that does everything On The Chain, something went off the rails. There were genuine moments where I felt like I was in the middle of an elaborate performance act, or that I was the only not in on the joke. Everyone talked about things being decentralized, except everyone interacted with the “chain” more or less using the same couple services. The storage and processing capabilities seemed to be laughably impractical, even accounting for the possibility that it could eventually get faster. And most importantly, the user experience as doing even the simplest thing as fun as getting a root canal. Even though the money and content kept flowing, but nothing really came out on the other end. I shook my head, and largely moved on.

Years later as crypto became even more more stream, I started following it clost again. I even tried to invest a bit of my own money in the doomed-to-fail ConstitutionDAO since I couldn’t resist (being) a good troll. But the fees alone surpassed my trolling budget so I succumbed to bad jokes on Twitter. Luckily for everyone, Ken Griffin turned out to be a bigger (and richer) troll than I could ever imagine being and just bought the damn thing outright. But, for the longest time, I’ve tampered my own skepticism of the crypto industry with a heavy dose of skepticism of my own understanding. While I considered myself technical enough to start a tech company, I thought maybe some of this stuff went over my head. I should have trusted myself more. A Wild Post AppearsI’ve been meaning to write this post for a while. I even started a draft but just couldn’t finish it. Again, I was able to wrap my head around easily on the even the gnarliest of the “crypto” part of the cryptocurrencies (surprise: there’s not much!), but I still thought something, ANYTHING, must have been evading me. And admittedly having somewhat of an internet following, I also didn’t want to put a target on my back. Besides, betting against billions of dollars seemed like a bad idea in itself. People who are raising billions in dollars to invest solely in crypto apps must have seen something I haven’t seen, I thought. I’ve been wrong before, and this must have been one of those times. I closed my draft tab, and went back to reading about the Theranos lawsuit instead. And then, yesterday, much to my co-author Ranjan’s chagrin, who’s been begging me to finish this piece, Moxie Marlinspike, the founder of Signal and the architect of the end-to-end technology used in WhatsApp, finally came up with the post I wish I could have written. Finally, I felt a tiny bit vindicated. The entire post is chock full of information and insights a lesser writer (ehem!) would have taken paragraphs to deliver. He approaches the entire field with the fresh-faced optimism of a kid who just got his first set of Legos but at same time is extremely thorough and systematic. He doesn’t just stop at building but instead follows the trail of evidence to see where things really lead. The Inner Workings of CryptoIn short, Moxie’s overarching diagnosis is that the technological fundamentals of cryptocurrencies are at very much at odds with the applications people are trying to build on them. And since the skew between the reality (the constraints embedded in the technology choices) and the hype (Web3 applications such as NFTs and DeFi apps) is so large that people were forced to bridge that gap with giant hacks, all of which are decidedly centralizing in nature. At their best, these hacks are what they are: onerous workarounds that are aesthetically unpleasant and operationally cumbersome, and maybe marginally wasteful. For example, since you can’t really store any meaningful amount of data on the blockchain, most NFTs are actually nothing but pointers, such as URLs to data stored on servers that a potentially untrustworthy third-party controls*. This is objectively bad design:

Overzealous adoption of a hot trending technology is nothing in new tech, if not a rite of passage for any young engineer. But the thirst by which people seemed to have built applications to ride the hype wave have blinded people to the extremely obvious shortcomings of the infrastructure.

And it goes on and on. If you you want to take anything from my piece, it should be that you should read Moxie’s piece instead. Notably, Vitalik Buterin, the creator of Ethereum blockchain penned an equally calm response on a Reddit thread. He more or less acknowledges all of the criticism and argues that the “missing-middle” that bridges the gap between the current limitations of the technology and the apps is coming soon. While Vitalik is also a gifted writer, I’ve personally found his post much heavier on the jargon and somewhat dismissive of the larger points of Moxie’s post.    Are we the baddies?As much as I dislike (read: resent) the primary political ideology that animates, and increasingly is funded by, the crypto space a little part of me rooted for them. Despite my misgivings on the tech, I did wonder what things could look like if we funded the internet with something other than chumboxes and various other adtech scum. And as someone who competes for talent against world’s largest firms who enjoy monopoly margins and can practically hire people for hundreds of thousands of dollars to sit around all day (🔥🔥🔥), the idea of taking away even a part of their power had both an emotional and strategic appeal. For a long time, I thought that the large sums venture money going into various crypto companies were barely veiled (or or not) Ponzi schemes. However, I’ve since changed my mind. It’s still in the eye of the beholder if many of the “Layer 2” style crypto companies that build their own “chains” are speculative vehicles where the goal is not to build a product, but instead to sell it to the next person for higher. It’s Time to InvestYet, I am now convinced that most of the money going into Web3 is going for the “right” reasons: people are in it to make huge sums of money by not just speculating, but actually investing. Here’s Moxie again:

Once you see what is going on for real in the crypto space, you realize it’s not that the extremely normal Twitter user and part-time venture capitalist Chris Dixon was being delirious in his seminal “Why Web3 Matters” thread. It was that he was being extremely evasive (or maybe ignorant) about why firms like his are now so interested in this space. These firms that have brought you Web 2.0** style centralization with all its benefits and downsides, are now looking for their next big hit. And while Big Tech has already grown to a democracy-defying size while making all their early investors richer beyond dreams, crypto promises a whole lot more; an ability to own and fully control entire economies. Who could (or should, as an investor) miss out on investing in new monopolies that are vertically integrated across the entire economies? It’s probably not lost on people who have been investing in Coinbase that if you could own the on-ramp into the crypto ecosystem for the masses, that you can exploit all the advantages of being a, or even the, bottleneck as well as benefit from economies of scale over time. Of course while Coinbase can charge exorbitant transaction fees today on the retail side, they must know that music will stop with competitors coming in. It’s an existential necessity for them to expand into other parts of the crypto industry. They already announced its own NFT marketplace, and have a MetaMask competitor in the works as well. On the flip side, OpenSea and their investors must understand a marketplace like their own is the textbook example of a winner-takes-all phenomenon and benefits greatly from network effects. It would in fact be very much in OpenSea’s interest to rip out the crypto parts of their business, both technically and strategically, both so that they can run their business more efficiently and actually make it harder for people to their works out of OpenSea. And how long do you think it’ll be before they go after some of Coinbase’s business? For many companies in this space, such centralization efforts will seem benevolent as the crypto pie is still growing. But keep your eyes fixated on the future, not the past. They must all be seeing more competition in their future than their past. When that happens, expect even more centralization than there is today. When that happens, the crypto-folk might be left wondering why they let those who built today’s internet with all its problems, own the next one as well. Final thoughtsClose friends know that I’ve long admired the positivity of the crypto field, with all their “gm”s and WAGMIs. I also enjoy the tinkerer’s mindset of the whole scene, with their relentlessness. The mere aesthetic of the scene that feels like a breath of fresh air compared to the mind-numbingly boring, tame af VR crap from Zuck & Co. There’s also something nice about the center of a new technology not being the Bay Area, let alone the United States for once. I’m, however, still unsold on the promises, and am skeptical of the motivations of most people. I believe the “hitman for hire” problem people bring up with crypto is relatively straightforward to fix, but the mere human capital, both in terms of talent and conversation, that goes into the field annoys me personally. I also don’t know how to square the environmental impact with what little we have achieved with it so far, especially if you discount the self-trading. I also worry the ironically opaque nature of the technology coupled with the lax regulatory approach will make the current speculative profits by the lucky insiders will make it an attractive choice for those who have been left behind by the more traditional markets. I was wrong about my roommate and his grift before. Let’s hope I am wrong this time around too. FeltMy new company is called Felt, and we want to be the best place on the internet to make maps. After raising a seed round, my co-founder Sam, who previously founded Remix, and I spent the last year building the kindest and most talented I’ve ever worked with. Our goal is to make Felt the best place to be if you are passionate about maps on the web. We are actively hiring for many roles, and especially looking for talented folks to join our front-end team to build something quite magical. Check out our blog about how we think about technology, about prototyping and maps on the web. We are good people, I promise. *: There are some even further workarounds to this workaround. The primary approach is using IPFS, which is reasonably decentralized. It’s worth noting that IPFS doesn’t use a blockchain, but is based on a content-addressable system similar to BitTorrent. Between 2012-2015, I worked at a company that was building something very similar. And yes, the organization behind IPFS did create a cryptocurrency called Filecoin to incentivize IPFS adoption. The success of Filecoin remains dubious and like many other coins, its price is generally correlated to BTC. **: I am not sure how we ended up re-defining Web 2.0 to mean “Facebook and Google style centralization” versus what it was initially supposed to be: an API based internet where you could freely exchange data between services programmatically. This retconning grates on me, but that’s an entire different rant. If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Peloton, Valuations, and Innovation

Thursday, December 16, 2021

Stock prices and strategies

The Teenager Economy

Saturday, October 16, 2021

"I hate you! You don't understand me!"

Memestocks and Reddit redesigns

Monday, September 20, 2021

"You may be interested in...."

Advertising Stagflation

Sunday, August 1, 2021

Its the 1970s for digital marketers

Ape Armies and Investor Relations

Saturday, June 5, 2021

A boomer no-pants Zoom and 💎🙌

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The