Margins - The Teenager Economy

Ranjan here. We've kept Margins free, both to spread our ideas as wide as possible and so we don't feel overly stressed about writing regularly. However, if you've ever enjoyed our writing, I'd love if you could donate to a fundraiser I'm working on with the American Cancer Society for Breast Cancer Awareness Month. Okay, on to the post: I bought my first pair of Allbirds in Feb 2020. There are certain things I’ll forever associate with providing me much-needed comfort during the early part of the pandemic. My Allbirds are one of them. I love those shoes. Allbirds recently filed to go public and we’ve now seen its financials. The overall economics are not horrible, but they're not great. The one thing that’s clear is they are unprofitable and have never been profitable. That was weird to find out, because their CEO talked about how they were profitable (from 2018):

This Forbes piece did a great job covering this phenomenon of the overly "enthusiastic entrepreneurs" that claimed profitability for years until their verified numbers became public:

The piece cites how the CEOs of Warby Parker, Peloton, and plenty of other companies would all casually drop “we’re profitable!” into interviews. They weren't alone:

Saying you're profitable when you're not feels dishonest. But if you were a buzzy, private company over the past decade, you had every incentive to stretch the truth. Your investors were likely fine with it because it would garner additional interest. An individual journalist would never shelve a trendy story over an inability to verify that detail. And as Warby Parker has shown the public markets will not only forgive you, they'll reward you with a valuation worthy of a pure software company After the fact, you can always say “non-GAAP!” and “adjusted!” and no one could ever really question you. That's how Peloton justified it:

It's that perfect goalpost-shifting stretch of the truth. As a private company, the only parents in the room were your investors and your board. Maybe constrained access to capital or aggressive journalism might have also acted as parental forces that would provide guidance and discipline, but those limitations haven’t been there either. TETHERI'd imagine most Margins' readers have been exposed to the Tether story. I'll try to avoid too much explanation, but basically Tether is a stablecoin that underlies a lot of Bitcoin (and other crypto) trading. A stablecoin is supposed to enable seamless crypto transactions by replacing fiat US dollars, and to do this properly, it should have $1 of real USD backing every $1 of Tether they issue. Tether does not. The story has been dripping out for a few years now but Bloomberg just put out a canonical piece on the mystery of where is the money backing Tether. More than anything, the sheer size of the operation jumped out at me:

and

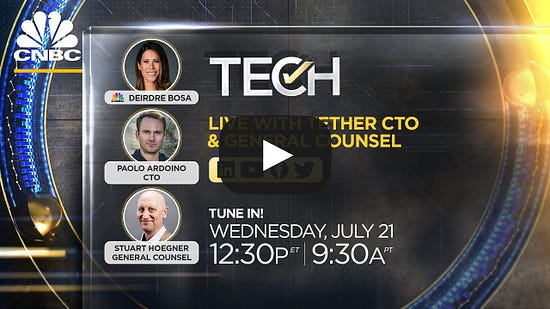

The story only gets wilder and involves one of the stars from The Mighty Ducks and the guy who co-created the cartoon Inspector Gadget (really!). But the thing that Tether-is-a-fraud-red-pilled me a few months ago was this Deirdre Bosa interview with the Tether GC and CTO:  It's just...so...weird. You have, technically, one of the largest financial institutions in the world, and the General Counsel has a big printed receipt thing (that is I guess a reference to the Bitcoin Genesis Block), the CTO's internet connection drops, and overall, they're unable to answer the most basic of questions. This hits harder for me having worked at a giant bank for years and seeing how disciplined and careful everyone is about everything. And…that’s really not saying much given the behavior of banks in the 2000s. But...why not keep doing this? The NY Attorney General had opened a probe but let them settle. Tether's circulation keeps growing, and while they're certainly in the purview of Gary Gensler, there has been zero oversight. Seriously, read the entire Bloomberg piece. It's an amazing narrative, but also a powerful reminder of how the combination of endless risk appetite coupled with a complete lack of oversight means major influential companies can act like moody, rebellious teenagers. PARENTINGHaving 4 and a 2-year-old makes you think a lot about limits and rules. It's amazing to see just how effective these little humans, whose brains are still forming, are at calling upon some weird quirk of evolution that instructs them to push boundaries just a little bit further every day. Setting rules and disciplining your kids isn't exactly fun. It often feels thankless and it’s stressful, but it just needs to be done. When I was reading about private company profitability proclamations and Tether absurdity, the consistent theme seemed to be a lack of parents in the room. Once upon a time, a board member or an investor might have been the one to caution a founder about exaggerated claims. The public markets might have scolded them for their dishonesty. As Matt Stoller might say in his BIG newsletter, the government has forgotten how to govern. All the institutions and economics that once would’ve forced a company to behave a bit more maturely have been missing. These companies are certainly not toddlers. In any other era, given their age and revenue levels, they would've been well into their lives as grown-up public companies with audited financials. They're fairly mature and they're certainly smart. But for so long, no one has imposed any discipline or heavy-handed guidance and we directly see the resultant bad behaviors. We're dealing with teenagers. The DTC companies mentioned above are certainly not too bad. No one reprimanded them for those little lies and they got away with it. Tether...man...that company feels like the parents left the teenager at home alone for a month and gave them a key to the wine cellar and a credit card with no spending limit (is that part ZIRP?) It's not just private companies. As regulators are years behind in trying to figure out what to do with longtime public companies like Facebook, the company's entire PR strategy has become that rare combination of petulance and arrogance unique to a teenager. It’s that “I just read the Fountainhead” and know better than you attitude that I personally know so well - I was a high school policy debater!!! The more I think about all this wackiness and assholery across the economy, it becomes clearer that there have simply been no parents around. The institutions or financial constraints that are supposed to teach a well-formed, but still developing mind, the difference between right and wrong haven’t been around. The entire economy feels like it’s acting like a teenager. Every CEO tweet, every odd price action, Adam Aron not wearing pants, just all of it. The more I remember my own mindset during those awkward, formative years, the more everything starts to make sense. Note 1: There’s one mystery about Allbirds that really fascinates me. For years, they have referred to TIME magazine saying they are the “World’s Most Comfortable Shoe”. It’s in their S1 six times. It’s their Google Title Tag. They say it nonstop. After skimming through their filing, I went back and found the original article. The weirdest thing is, the headline clearly says what Allbirds keeps citing….but the article never even comes close to saying this. I re-read it five times thinking “maybe it’s kind of in there somewhere” but nope, the author never even alludes to thinking this. Maybe he does, but he didn’t write it. The only mention of ‘comfortable’ is: Allbirds, a new San Francisco-based startup aimed at designing environmentally friendly and comfortable footwear, launched Mar. 1. Knowing very well that at a company like TIME the author likely isn’t writing the headline, and they might even A/B test different headlines, who wrote this headline?? Was the headline writer just a personal fan of Allbirds? Are they now a well-compensated marketer at the shoe company? Was it one of maybe ten different combinations that performed the best? I’m so intrigued… (the original article author did have a hilarious response to a tweet of mine on this):  Note 2: To my Mom and Dad, if you’re reading this, thank you for putting up with me during those teenage years, because….yikes. If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Memestocks and Reddit redesigns

Monday, September 20, 2021

"You may be interested in...."

Advertising Stagflation

Sunday, August 1, 2021

Its the 1970s for digital marketers

Ape Armies and Investor Relations

Saturday, June 5, 2021

A boomer no-pants Zoom and 💎🙌

Grift is Good

Monday, May 17, 2021

Greed is so 1980s

Cathie Wood and Content Strategy

Wednesday, March 24, 2021

Downloadable spreadsheets and media hacking

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The