Not Boring by Packy McCormick - The Oscar Puzzle

Welcome to the 1,162 newly Not Boring people who have joined us since last Monday! Join 98,942 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) Hi friends 👋, Happy Thursday! Today is a first for Not Boring: a Sponsored Deep Dive on a public company, Oscar Health. I’ve only done Sponsored Deep Dives on private companies (and one blockchain), not for any reason other than the fact that startups have been the only ones to reach out. As a reminder, you can read how I choose what companies to write Sponsored Deep Dives on here. Oscar fits the three things I look for in a Sponsored Deep Dive company:

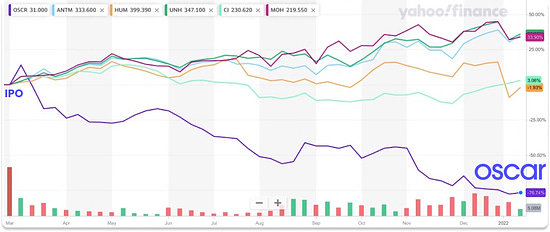

Beyond those three things, Oscar is a special one. It’s the only health insurance provider I’ve actually chosen for myself (way back in 2013), one of NYC’s most successful startups of the past decade, and my favorite kind of company: one whose complexity means that the market has a hard time understanding it. That complexity comes from the fact that Oscar is trying to be two things at once: an insurance company and a tech platform. It’s a big bet -- those are two very different businesses -- but if it pays off, they have the chance to make the healthcare experience meaningfully better. Plus, while it’s no longer private, it’s still very much an underdog in an industry full of giant incumbents, just like a startup. Despite its success, people still assume the giants will hold their positions for decades. Maybe that’s true in insurance in a way that it hasn’t been for any other industry, but that’s not the bet I’d make. Let me put the disclaimer/disclosure right up front: Disclaimer/Disclosure: THIS IS NOT INVESTMENT ADVICE! It never is, but that’s particularly true in an industry like insurance in which I’ve spent much less time. This is for educational and entertainment purposes only. Do your own diligence. I decided not to buy any OSCR since I knew I was writing this piece, although I may buy some after sending. This will likely be my stance on public company deep dives going forward. Thrive Capital, a large shareholder in Oscar, is an LP in Not Boring Capital. And let’s get to it. The Oscar PuzzleIn late 2013, when I left the cushy confines of Bank of America Merrill Lynch and its gold-plated corporate insurance plan to head to a small Canadian startup that hadn’t even established a US entity, I was given a budget and told to go find my own health insurance. Oddly, I knew exactly what health insurance I wanted to get: Oscar. I’d seen the ads on the subways: “Hi, we’re Oscar, a new kind of health insurance company.” I loved the clean look. They used *tech*. I was now in “tech.” They were from New York. I lived in New York. It was a no-brainer. And when that clean welcome box showed up -- a welcome box! from an insurance company! -- I knew I’d made the right choice. (I checked with the company, and I was Member #5,540. At Oscar’s current 594,000 members, that means I was in the first 1% of people ever to sign up.) Little friendly touches like that box were all part of Oscar’s original vision of building a health insurance company that could help its members navigate the healthcare system like a doctor in the family would. Since I signed up, Oscar has grown membership over 100x. It’s on a multi-billion dollar revenue run rate. It launched a tech platform, +Oscar, and partnered with leading health systems like Cleveland Clinic. It went public… and its stock is getting crushed. Oscar IPO’d on March 3rd at $39 per share and started trading at $36 per share, good for a market cap just north of $7 billion. Since then, it’s down nearly 77%, its market cap hovering around $1.5 billion. It’s underperforming both the major indices… …and the traditional health insurance companies, like UnitedHealth, Cigna, Anthem, and even Humana, whose stock has struggled more than its peers as of late. On the surface, the mystery is solved simply: Oscar isn’t profitable yet. Say what you want about the traditional US health insurance industry (OK, fine, twist my arm: it’s confusing, inefficient, expensive, antiquated, and about 20 years behind on UX), but those companies print money. In Q3 2021, UnitedHealth, the most profitable, made $4.1 billion on $72.3 billion in revenue. Oscar, on the other hand, loses money on every patient on average. In health insurance terms, its combined ratio is greater than 100%. In Q3 2021, Oscar put up an adjusted EBITDA loss of $189 million on $673 million in revenue. Oscar’s stock had started to recover into Q3 earnings, but fell when the company reported that its medical loss ratio (MLR) – the percentage of premium it pays out for care – shot up from 82.4% in Q2 to 99.7% in Q3 thanks to an unfavorable risk adjustment data validation (essentially an insurance payment audit and true-up, read more here if you really want) and, of course, COVID. Oscar’s membership grew 41% YoY, from 420k to 594k, and revenue grew 63%, but the simple bear case would be that, amending the old joke for health insurance, you can’t lose money on every managed life and make it up in volume. But still, Oscar is trading below 1x its current revenue run rate, growing very fast, and signing up big partners to its software platform, +Oscar. It feels like an overreaction. Besides, Oscar wasn’t designed to be profitable yet. In fact, it’s doing two unprofitable things at the same time: building an insurance company and a tech platform from scratch. Both require real scale to become profitable, and Oscar’s bet is that by combining both, they’ll be able to achieve more scale, deliver better care, and generate better margins over the long-term than either side could alone. That’s why Oscar is making three decades-long, interconnected bets: Bet #1: Technology can meaningfully improve member engagement, which leads to a better insurance business. Oscar believes that by building a better experience, it can increase member engagement, by increasing member engagement, it can better guide its members’ care, and that by guiding its members care, it can create better long-term health outcomes at a lower cost. The pithy way to explain this piece of the strategy is that an ounce of prevention is better than a pound of cure. Bet #2: A better, tech-powered insurance business will help Oscar sell its technology to hospital systems who want to take risk, improving margins and increasing revenue without increasing Oscar’s risk. In 2018, Oscar launched what would become +Oscar, its tech platform that lets health systems and other insurers tap into all of the tech that Oscar has built over the past decade. To understand this piece of the strategy, think Amazon and AWS. Oscar has spent a decade building and battle-testing its own proprietary tech, and now it’s selling that tech to others who need it and earning software margins in the process. Plus, those customers give Oscar scale. Bet #3: Turning its tech into a platform for third-parties will build scale into both the insurance and tech businesses, which will help improve care and lower costs. Combining Oscar’s insurance business with its +Oscar partners’ – like the Cleveland Clinic and Montefiore – will give Oscar the scale it needs to build a huge, profitable insurance business. Scale is useful in two ways here:

The best way to think about this piece of the business is like Shopify: arming the rebels (in this case, health systems and care providers) in order to compete with the giant incumbent health insurers. Taken together, it’s a long-term series of bets which is, understandably, confusing to investors in the short-term. As The Abstract Investor summarized, the challenge, and opportunity, is that:

That theory checks out, particularly when you look at how Oscar has performed compared to other public health insurtech companies: Bright Health Group and Clover. Oscar has traded in-line with those companies despite the fact that the businesses are very different. If you need scale and tech to disrupt health insurance, neither Bright nor Clover has both. Bright is essentially a rollup and partnerships play with little meaningful tech; Clover is a tech player in the Medicare Advantage space with only a quarter of the “lives under management” that Oscar has, and no platform play like +Oscar to achieve scale. Oscar is the only player in the space that has a shot at achieving scale through technology. The fact that these three very different companies are trading in line, and falling while the incumbents’ stock prices rise, is weird. It means the market is saying that, unlike practically every other industry in the world, health insurance will be impervious to disruption from technology-first companies. That seems off. I think the Oscar baby is being thrown out with the insurtech bath water. So today, we’re going to dive in and try to piece together the murky puzzle. I’m not a healthcare analyst, and I don’t even try to play one on the internet, but I do love a good puzzle. We’ll cover:

To understand the bets that Oscar’s making, we need to understand how health insurance businesses work and where they’re broken. I promise I’ll make it as not boring as possible. How Health Insurance WorksAlmost every industry is easier to understand than it appears at first glance. It’s just about understanding the vocabulary, how businesses make money, and what levers they have to pull. Health insurance, while there’s a ton of complexity in the details, is not hard to understand at a high level. To understand how US health insurance works at the highest level (conveniently, that’s also the only level at which I understand it), let’s look at three things:

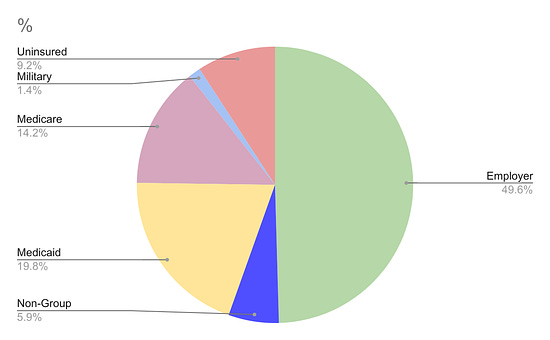

The Size and Composition of the Market Healthcare in the US is an unimaginably large market. Americans spend $4 trillion on healthcare per year -- 18% of GDP -- and 75% of that passes through insurance companies. Half of Americans have group, or employer-sponsored, health insurance, 35% have government insurance (Medicaid, Medicare, or Military), 9% are uninsured, and 5.9% have non-group plans. This last group, the individual market, is where Oscar started.

The employer market is the monster here. It’s probably what you’re familiar with. Insurance companies sell plans to your company, and you get to choose from among their plans. In this system, your insurance is tied to your job, and people bounce from insurer to insurer as they move jobs. That means that no one insurer is incentivized to optimize for long-term health, so they optimize for the short-term, which often drives up long-term costs. To learn more about the health insurance industry, Oscar’s backstory, its tech-enabled insurance business, its insurance-enabled tech business, and how the puzzle fits together… Thanks to Dan for editing, and to Josh, Mario, Jackie, and JoAnna for working with me! How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Not Boring Capital: 2 Fund, 2 Boring

Monday, January 10, 2022

Not Boring Capital's $30M Fund II and the Value of Weird Investments

The Laboratory for Complex Problems

Monday, January 3, 2022

web3 as a simulation

The Best is Still Yet to Come

Monday, December 13, 2021

The Last Not Boring of 2021

Replit: Remix the Internet

Thursday, December 9, 2021

Replit Raises $80M Series B to Bring the Next Billion Software Creators Online

The Pareto Funtier

Monday, December 6, 2021

More fun making money, and more money having fun

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month