Surf Report - Surf Report: Jo-Jo the idiot circus boy

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

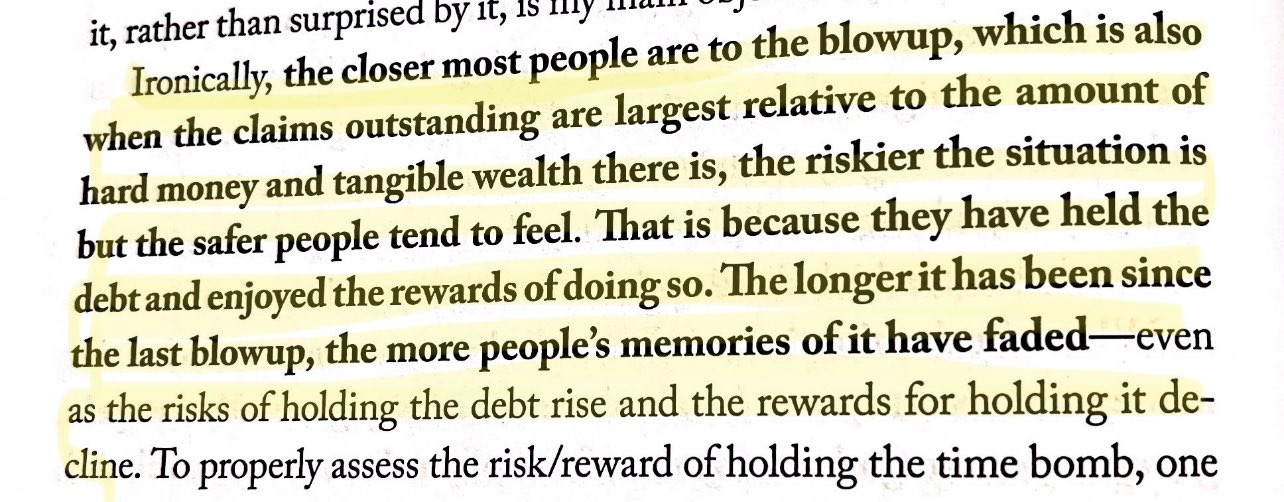

Hi everyone—I’m so glad to have you here. What a week. There’s an excerpt from Ray Dalio’s latest book, Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail, that highlights the danger of forgetting:

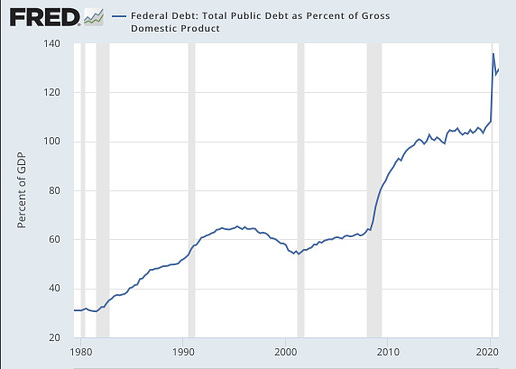

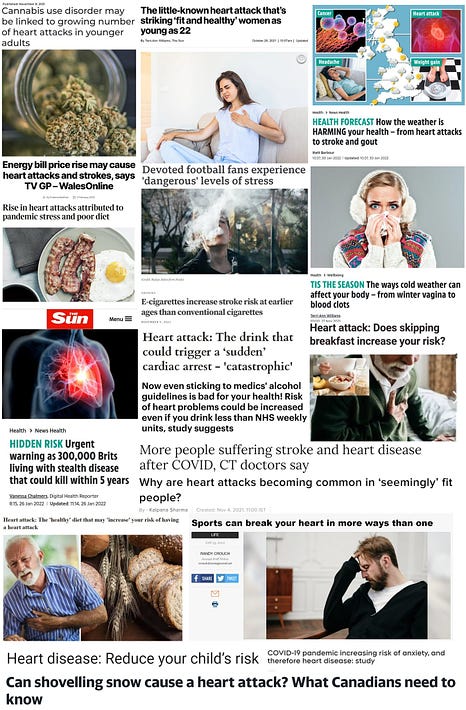

Ray Dalio is a billionaire investor and hedge fund manager who spent his career focusing on debt (i.e. bond) markets, and was very influential in developing a successful strategy built around debt cycles, both long-term and short-term. (I’ve shilled it several times on here, but his 30-minute video overview, “How The Economic Machine Works,” is a phenomenal must-watch and re-watch for any student of markets). His understanding of debt, bubbles, risk, and hedging strategies are of particular importance right now given our current predicament. That is, a national debt that has reached $30 trillion. (Here’s my thread for wrapping your head around this ridiculous number)  Dalio is not perfect. He famously called Bitcoin a bubble waiting to pop and disappear back in 2017, but he recently changed his tune, stating he has made investments in Bitcoin as a regular percentage of his own personal assets. (He also makes a point to overlook human rights violations in the name of a good investment) None of us are perfect, and we all make mistakes, but I consider what Dalio has to say because of his ability to update his views and revise his thinking when information changes or he achieves a new insight. This ability to change one’s mind about opinions formerly held is the mark of a very good decision-maker. You know who I don’t listen to? Wall Street analysts. Not a single Wall Street analyst out of 78 expected a jobs number anywhere close to what we got this week. The actual print was double the highest forecast. As an aside, you may be wondering: where are all these newly employed people? My guess was on Wall Street as analysts but the real answer was funnier: the government of course. It takes lots of overhead to create this big a mess. ADP reported that private-sector employment (that is, non-government) actually decreased by -301,000 from December to January, on a seasonally adjusted basis. The world has become so untethered from reality and so far up its own scapegoat-finding hindquarters that I’m sad to report we now live in a world where TV doctors are claiming price hikes cause heart attacks. 😐 It seems in the last year everything (well, almost everything) has been blamed as the potential cause of an increase in heart attacks across the population, from daylight savings time to stressful sportsball games to [checks notes] the weather, but now we can add “price hikes” to the list. I don’t know what is causing lots of heart attacks in all sorts of people all of a sudden (I don’t study cardiovascular problems, I study monetary problems) and it appears legacy news outlets don’t know either, but that’s not stopping them from telling us anyway. When people are desperate to place the blame somewhere there is no shortage of places to go, but by grabbing all of them, like a child’s grabby hand inside a bucket of Halloween candy, it creates a backdrop of confusion and mistrust. This, then, creates a whole new set of problems for which new things to blame are needed. I call this the flywheel of responsibility avoidance. It’s like a wind turbine only instead of wind it’s petty misdirection. We heard a multitude of excuses these past two years about why inflation would not be, could not be, has not been, and actually well sort of is a problem, but at no point was monetary debasement and the literal inflation of the money supply pointed to as the actual cause. No, THAT certainly isn’t it. Definitely not. Look, the Federal Reserve and the U.S. Treasury are trying to bring this disastrous train safely into the station but they have derailed. They are stuck. And to be fair, I think they know it and they’re reaching into their Halloween candy bucket with their tiny hands and offering to us whatever sugar-coated lie they happen to pull out. My metaphor is mixed but I like it and I’m sure you get my point.

The political and monetary establishment is desperate for an excuse to not raise rates. They’re still saying they’re gonna do "six or seven" rate hikes this year. They have to say that. My guess is we’ll see two or 3—maybe—but they’ll be tiny and only so that they can walk them back at a future date as a way of doing something. And back and forth we go, for as long as traders don’t notice how bad the situation really is. If you’ve never seen the classic Chris Farley and David Spade comedy Tommy Boy then bear with me, but the monetary system at the moment is being run like Jo-Jo the idiot circus boy with a pretty new pet: interest rate manipulation. They think they can just keep dialing up the interest rates or dialing down interest rates as they see fit from their perch atop the kingdom with their elite vantage point. They love their pet. They bring it everywhere. Dialing up. Dialing down. Suggesting dialing moves they might make. Walking back those dialing move comments. Sometimes things get a little out of hand, inflation starts to get “overheated.” But it’s just transitory. Okay, maybe not. The dial gets temperamental sometimes and doesn’t work as expected! But then the day comes when their beloved interest rate tools and stimulus-prodding money printer gets pushed so hard—used so much, for everything, all the time, in a persistent way despite red alarms on all sides that… the whole thing collapses. That’s when they destroy their pretty little pet. They blow it. The main reason they’re in this situation is because they’ve spent the past decade and a half not realizing that their tools are less of a dial and more of a switch. Intervention in markets and manipulation of rates and printing of money are not things you can provide fine-grained control over but are effectively a single shock to a system whose effects propagate over time and create a series of knock-on effects that make control completely impossible. Flip the switch, then fasten your seatbelt. The train has left the station. So what’s an investor to do? Hedge against the irresponsibility and debasement efforts of central bankers with a non-zero allocation to the one digital asset that Fidelity, one of the largest asset managers in the world, just explicitly endorsed:

It’s rare to see a single answer to a simple question in a world full of excuses and responsibility avoidance, but maybe it comes as no surprise that Fidelity’s advice is to incorporate something into your portfolio that is not controlled by Jo-Jo, and that marches to the beat of its own block. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Fact from fiction

Sunday, January 30, 2022

Listen now (10 min) | Issue 61: 01.30.2022

Surf Report: Do you see what happens?

Sunday, January 23, 2022

Listen now | Issue 60: 01.23.22

Surf Report: The part & the whole

Sunday, January 16, 2022

Listen now (12 min) | Issue 59: 01.16.2022

Surf Report: Healthy and painful truth

Sunday, January 9, 2022

Listen now | Issue 58: 01.09.2022

Surf Report: Lessons of history

Sunday, January 2, 2022

Listen now (10 min) | Issue 57: 01.02.22

You Might Also Like

$120k/Year with a small audience?

Wednesday, March 5, 2025

If you're wondering how to build a thriving business while staying authentic and leveraging the power of SEO and YouTube... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Founder Weekly - Issue 675

Wednesday, March 5, 2025

March 05, 2025 | Read Online Founder Weekly (Issue 675 March 5 2025) Welcome to issue 675 of Founder Weekly. Let's get straight to the links this week. Mr. Wonderful Lost Out on $400 Million… Will

How advertisers unlock measurable outcomes for performance-based campaigns

Wednesday, March 5, 2025

Scaling performance advertising beyond search and social

Your Practical Path to Marketing Automation

Wednesday, March 5, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo We're halfway through the week, Reader, how's your marketing strategy

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🕵️♂️ The “Write to Your Former Self” Growth Hack

Wednesday, March 5, 2025

PLUS A referral growth loop that fuels itself and a funnel that actually converts.

Communities Are The Rage

Wednesday, March 5, 2025

With centralized social media showing many of us how NOT to build community, people and brands are turning to community platforms to build out their own slice of the Web. Marketing Junto | News &

Musk takes an L

Wednesday, March 5, 2025

Judge shut down his legal move... but the fight's not over yet!

Primer: From Software to Schools

Wednesday, March 5, 2025

Watch now (47 mins) | To fix the school system, build schools ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private funds pick their shots

Wednesday, March 5, 2025

PitchBook buys portfolio monitoring startup; AI's effects on emerging tech; humanoid robotics startup could hit $40B valuation Read online | Don't want to receive these emails? Manage your