Surf Report: The Sus Special™ - On trust, risk, & vulnerability

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. I think often of past times in history and of my favorite writers who were there to articulate what so many were experiencing but lacked the wordsmithery to express. Dr. Hunter S. Thompson is a beacon for me in this realm of the great men & women of letters, and lines from a famous passage in his classic work of Gonzo journalism, Fear & Loathing in Las Vegas: A Savage Journey to the Heart of the American Dream, drifted into my head as I was poring over the morass of media coverage these past few days:

I make a particular point to keep these newsletters as apolitical as possible to the extent that such a thing is even possible, and the way I do that is by focusing on the money—the economics—of a situation in light of past events and future possibilities. The particular party, administrators, or officials in power at a given time, though they may be the proximate causes of certain events, are less important to reaching truthful insights about implications, consequences, and recourse for individuals. Things have happened—now what? Right now things are looking super sus across the board and around the world, regardless of the country you’re in or the team you root for in the voting booth, and the common denominator is money. Specifically, your money. Let’s start with Canada, a country near and dear to my heart as a lover of kind people, ice hockey, poutine, and the French language: Parliament has asked every single financial systems provider—banks, credit card companies, investment firms, securities exchanges, crowdfunding platforms, software providers, insurance companies— to freeze the accounts of anyone directly or "indirectly" (?) found financially supporting the current protests in the nation’s capital city. Then what happened? Banks across the country experienced simultaneous “outages” to such a sudden and extreme degree that pundits were openly speculating on the possibility of bank runs as an explanation. (I should note that bank runs aren’t technically possible in a fiat monetary system where currency is printed in large quantities by banks at will, but only on a hard money standard where the threat of convertibility always looms over bankers’ heads and keeps their fractionalized lending and rehypothecation behaviors in check and safely within the realm of reasonableness)  What has essentially happened is widescale civil search & seizure of private property without due process or civil penalties has been deemed allowed if the government suspects you're breaking the law. They did this by invoking temporary “emergency” powers, but have already made those temporary powers permanent. Check it out. It’s an unusual move to say the least for a constitutional democracy—freezing people’s savings on the suspicion that they are indirectly supporting something, rather than having to charge them with a crime first, but then again maybe it’s the sort of thing that happens all the time but under much less spotlight and mostly in countries not discussed on the evening news. This focus on citizens’ bank accounts and money has led traditional financial analysts to start asking a very practical question: is Canada still investable? This is a question I’m interested in, because it’s the kind of question that captures so much of a complex situation into a practical decision that has to be made instead of nebulous feelings to be felt. Whether you support or denounce the financial recourse taken by the Canadian administration, you still have a choice to make about where your money goes and who you trust to hold it. Would you want to send capital to a country who freezes bank accounts without due process? For some people the answer may be ‘yes’ under the assumption that they are themselves lawful citizens, but what happens when you have to answer this question while they are in the midst of changing the laws themselves?

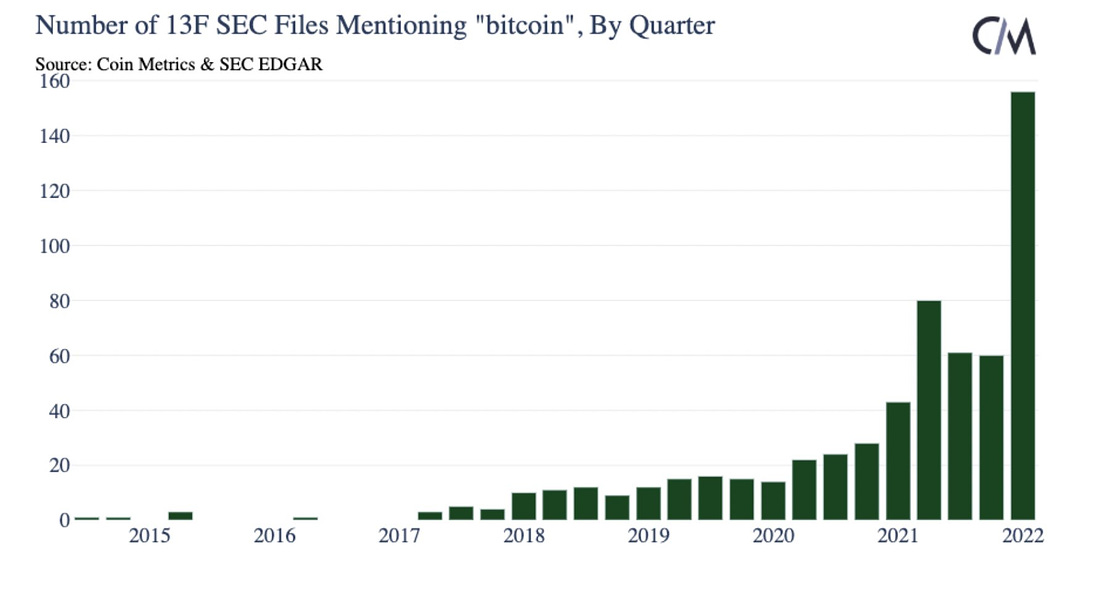

I suspect the silence from Western leaders on this weaponization of the banking industry is a tacit signal that they want to leave open for themselves the option to take similar measures in the future, so expect to hear more about U.S. capital controls and “emergency” financial surveillance measures in the coming decade. Maybe not due to protests and road blockages, but oh I don’t know crypto-fueled cyberattacks or somesuch.   Like I said. Sus. This whole topic is very important with long term consequences and has nothing to do with truckers or vaccine mandates. Capital and talent flow to where they're treated best, and history tells us that things tend to go off the rails when leaders see themselves as rulers instead of service providers. When "emergency" powers are used to skirt the law and ignore due process, shift your attention to what this precedent will permit in the future and how many of your law-abiding actions today might be subject to reclassification at a later date. What happens when the person you don’t like is in charge and now has access to these powers? What type of person do powers like these attract in the first place? Even the Financial Action Task Force (FATF) recognizes the counter-terrorism clause in its own AML/KYC rules has the potential to be exploited by power hungry politicians for political gain in a way that abuses human rights. And just this week in Myanmar, two college students were sentenced to seven years in prison for violating an “anti-terrorism law” after their donations to refugees were divulged to the military junta. It’s at the point you’re probably expecting me to explain how bitcoin fixes this. But bitcoin absolutely does not fix this if you have trusted a bank or exchange to custody your bitcoin and hold it for you in lieu of keeping it on your own wallet with a private key that you hold. Not your keys, not your coins. No keys, no cheese. Same goes for dollars, gold, yen, or rupees. Even the CEO of cryptocurrency exchange Kraken, in a rare demonstration of honesty and sincerity taking precedence over corporate profit-seeking, urged concerned customers not to keep funds with any centralized/regulated custodian. If you've trusted a bank with holding it, whatever it is, then it will always vulnerable to suspension, confiscation, or freezing. You’re always one “emergency” away from a new set of rules to submit to. Complying just lets those in charge know they can push harder. (This was something I picked up from reading the Pulitzer-Prize winning book The Power Broker: Robert Moses and the Fall of New York. I highly recommend studying the power-hungry as a way to avoid falling prey to their playbook of tricks. “Power needs tools and circumstance, and neither need be earned.”) These events have woken up not a few people to the idea that bitcoin isn’t simply a speculative tech asset to be traded up and down for dollar gains, but has practical functionality and usefulness during trying times (as in: “trying” to take your money.) People are also starting to question the actual riskiness and volatility of bitcoin that has been so loudly fear-mongered by legacy media outlets over the years when those high-quality stocks you were encouraged to buy instead suddenly plummet 45%, wiping out over $500 billion in market cap. Those are the “less risky” alternatives? Things started looking even more sus after the Federal Reserve finally banned its employees from trading stocks and bonds but after Fed Chair Jerome Powell was caught profiting from the inflationary conditions he created by trading during a restricted blackout period and directing Wall Street bailouts. To wit: Fed officials sold all of their stocks here to avoid any “conflict of interest.” 🧐 This global trend of dismissing the trivial, fringe, and unconcerning right before declaring them Big Important Emergencies That Demand Wartime Measures sure does seem to be catching on.  Jon Stewart even caught up with Federal Reserve President (Kansas City), Thomas Hoenig, to make sure he’s not misunderstanding the absolute madness of central banking right now, only to watch the man explain why fiat is a fraud based on confidence & mass delusion 😅:   It’s fitting and in part no coincidence that bitcoin—a censorship resistant, seizure resistant, decentralized, sound money alternative—had one hell of a week too, but I mean that in a good way:

So where does this leave us? Well, I think one takeaway from the current fiscal and policy climate is that money is the first thing governments try to grab when they are not happy with the behavior of the people they are meant to represent. Financial instruments—cash, bonds, securities, commodities—in themselves are politically neutral tools for coordinating trade, exchange, production, and specialization in a society, but finance can be weaponized just like energy. The goodness or badness of a monetary system lies largely in the hands of whoever is allowed to wield it. Force and coercion are evidence of desperation, and money is the de facto means of exerting force insidiously in a way that allows certain rights to implicitly, rather than explicitly, restricted. “There are no other constitutional rights in substance without freedom to transact.” The way forward for investors is to simply be aware of these large power structures, learn the game, and react accordingly. Decentralization is one powerful principle you can anchor your decisions to and a core ethos of bitcoin, but it also sits adjacent to the tried-and-true portfolio investment advice around diversification—to avoid single points of failure, prepare for the expected, hedge against possibilities, and gain exposure to future events whose probability is determined by using the actions, behaviors, and policies of the past as a guide. The past week definitely revealed some dark corners but the future looks bright. I mean that as an optimist but also as a noticer of things, which are related. It has been said that optimists tend to notice opportunities that pessimists miss. I see more people than ever who are learning, asking questions, and catching on. Getting sharper. Every action has consequences and resilience is bred from adversity. It’s only by being tested that your abilities improve and your vigilance sharpens. And to improve—to get smarter, wiser, more aware, more ready—is about the best news there is in a world trying its best to keep you in the dark.

Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Brrrassic Park

Sunday, February 13, 2022

Listen now (11 min) | Issue 63: 02.13.2022

Surf Report: Jo-Jo the idiot circus boy

Sunday, February 6, 2022

Listen now | Issue 62: 02.06.2022

Surf Report: Fact from fiction

Sunday, January 30, 2022

Listen now (10 min) | Issue 61: 01.30.2022

Surf Report: Do you see what happens?

Sunday, January 23, 2022

Listen now | Issue 60: 01.23.22

Surf Report: The part & the whole

Sunday, January 16, 2022

Listen now (12 min) | Issue 59: 01.16.2022

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏