Wrangling Venture Entropy with Standard Metrics

Wrangling Venture Entropy with Standard MetricsQuaestor Rebrands to Standard Metrics and Raises a $23.7M Series AWelcome to the 1,033 newly Not Boring people who have joined us since last Monday! Join 105,562 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts Hi friends 👋, Happy Thursday! One of the most frequent topics in Not Boring is the extraordinary growth of venture capital. More dollars invested, more funds, smaller funds, bigger funds, decentralized funds, global funds. The space fascinates me endlessly. All of that growth in every direction means that the venture landscape has gotten a lot more complex. There’s an opportunity for new companies to help make sense of it all. That’s where Standard Metrics comes in. Today’s post is a Sponsored Deep Dive on a company that I invested in through Not Boring Capital. As always, I only write Sponsored Deep Dives on companies I would invest in, and in most cases, I actually have. You can read my thought process on deep dives here. I’ll always disclose my conflicts. No conflict, no interest. Let’s get to it. Wrangling Venture Entropy with Standard Metrics(You can click this 👆 to go read the full thing online) Every few years, there’s a new *thing* that’s going to change the face of venture capital investing as we know it. AngelList, ICOs, crossover funds, solo capitalists, crowdfunding, CartaX, Capital-as-a-Service. Most of them boil down to a few questions; how can we:

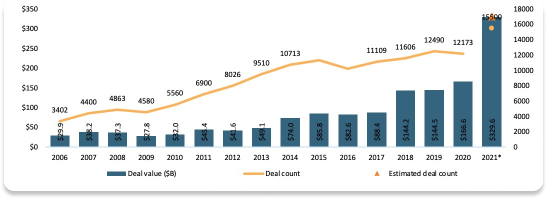

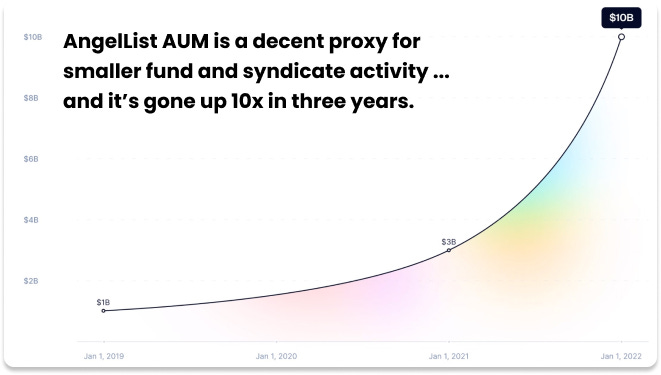

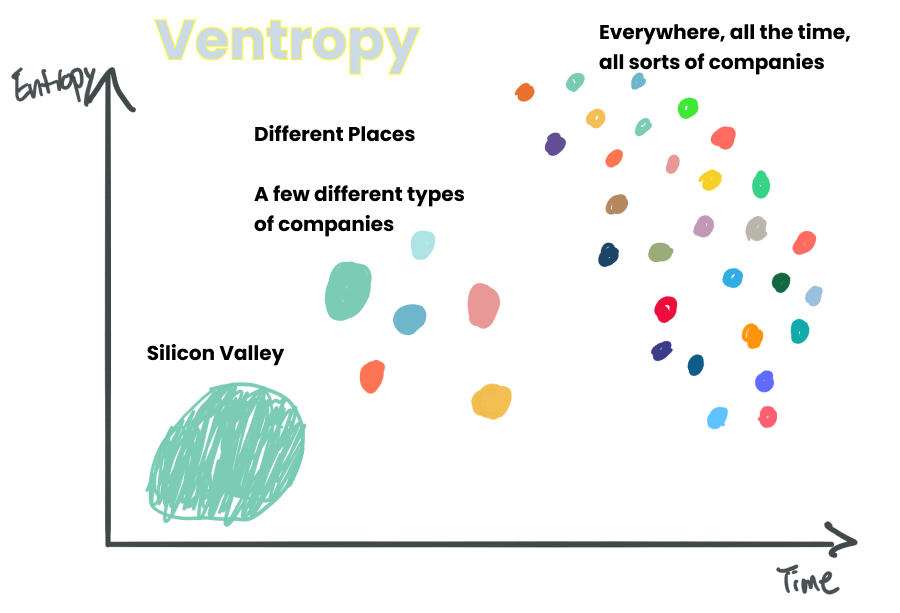

Which all boil down to one question, really: how can we get the private markets to behave more like the public markets? In terms of size and activity, the private markets, and venture capital in particular, have been growing at a torrid pace. In 2021, venture capitalists invested $329.6 billion into startups across 15,500 deals… in the US alone. Those numbers are so large as to be practically meaningless, so a visual comparison to previous years might be helpful. The $329.6 billion invested in 2021 was just a hair short of doubling the all-time record… set in 2020. The two most active years before that were 2019 and 2018. There hasn’t not been a new record set since 2016. While the market has tightened a little in the growth stage, following public markets and the specter of rising interest rates, the pace in the market as a whole doesn’t seem to be slowing down. Big funds are raising bigger funds and there are more small funds, solo capitalists, and syndicate leads investing more money than ever. As one proxy for the latter, AngelList, which hosts smaller, newer funds like Not Boring Capital, now supports over $10 billion in assets, 10x higher than it supported in 2019. Venture capital has come a long way since there were a handful of firms on Sand Hill Road investing into a handful of companies each year. Now, venture firms are everywhere and come in so many flavors Baskin-Robbins would blush. And each venture firm backs somewhere between a dozen and a couple hundred startups, from all around the world, in all stages of maturity and industries and levels of operational sophistication and, and, and. You get the point. The startup ecosystem has jumped from a lower state of entropy to a higher one. There’s no going back. Since the start of COVID, with more money flooding the market and more deals happening more quickly over Zoom, the venture market has jumped to a higher state of complexity. Very valuable companies like AngelList, DocuSign, and Carta (recently valued at $7.4 billion) help to wrangle some of that entropy with software. But there’s still a big infrastructural puzzle piece missing. The private markets need standard metrics. So, the private markets need Standard Metrics. Standard Metrics’ goal is to build a data and relationship graph for the private capital markets. That’s a deceptively tricky goal to achieve. Others have tried and failed to build a “Bloomberg for the Private Markets,” one resource to provide the same level of information and transparency to the private markets that public market investors have access to. But Standard Metrics is starting with a more bite-sized ambition: get VCs to use its product to track the handful of metrics that matter most for their portfolio companies, like Cash in Bank, Revenue, Monthly Burn, and Gross Margin. Win the VCs, the logic goes, and you can win their portfolio companies and their LPs, all of whom come with their own set of VC relationships, each of which come with fresh portfolio companies and LPs. When the spark catches, it can spread like wildfire. VC to Portfolio Company. Portfolio Company to VC. VC to LP. LP to many VCs. Many VCs to Many LPs and Portfolio Companies. Slowly at first, and then suddenly, you become the standard. To help set the standard, today, Standard Metrics is announcing a rebrand from Quaestor to Standard Metrics and a fresh $23.7 million Series A led by 8VC, which incubated the company in 2020, with participation from Spark Capital, Slack Fund, Fin VC, Alpha Edison, Kindergarten Ventures, First Trust Capital Partners, January Capital, and Not Boring Capital, among other funds. Individual investors include a16z’s Sriram Krishnan, Bain Capital Ventures’ Merritt Hummer, Quiet Capital’s Morgan Livermore, Meritech’s Craig Sherman, and Redpoint’s Medha Agarwal. (Actually, it was $3.7 million in notes and a $20 million Series A. Precision around metrics is important!) When you build for VCs, your customers can also become your investors, and your investors can become your customers. That’s true here. The hard part is: to set the standard for an industry, you need to win over most of the industry participants. Standard Metrics will need to displace incumbents and stand out among newer companies that look like competition on the surface. Getting that right requires the right timing, the right team, and the right strategic bets. So today, we’ll cover:

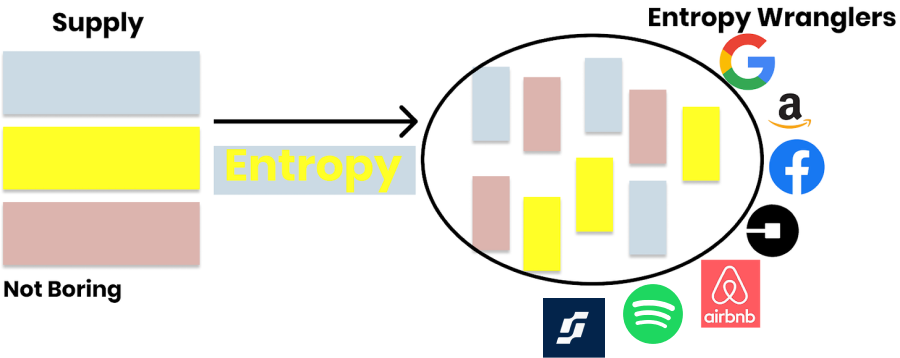

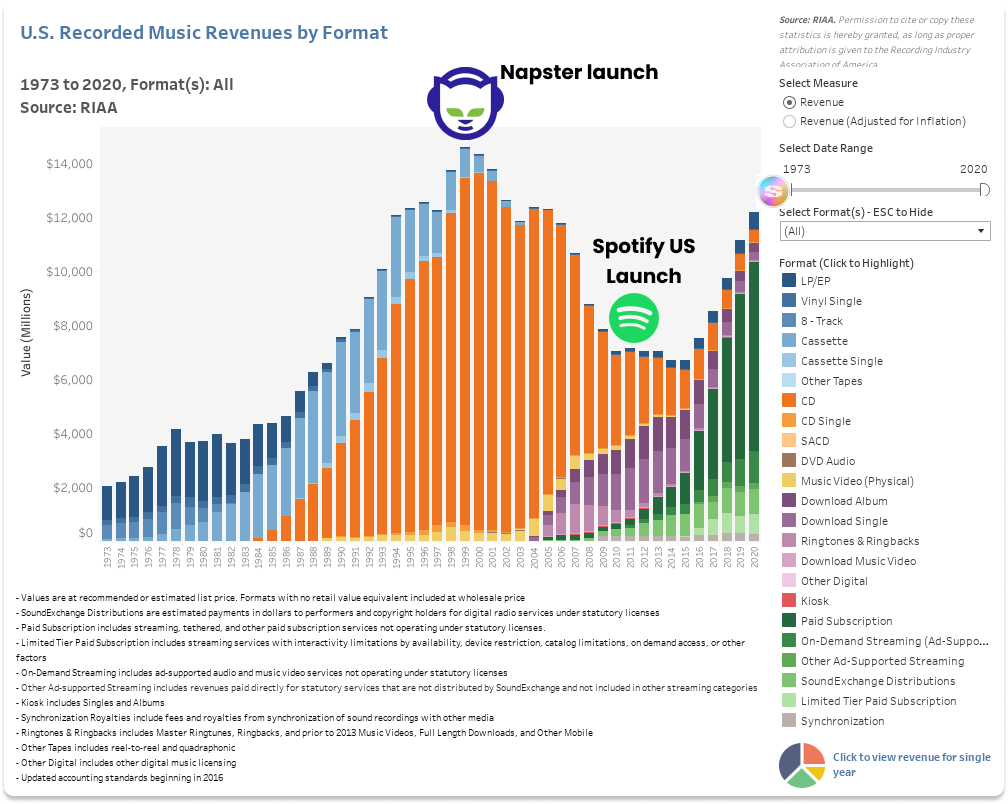

The timing couldn’t be better. Venture is in need of an Entropy Wrangler. Entropy WranglingIn July 2020, the same month that Quaestor announced itself to the world, I wrote one of my thinkpieciest thinkpieces: Entropy Theory. Look, I was new to writing newsletters and Ben Thompson was a big inspiration and I wanted to name my own theory, too. It was a little presumptuous. But I actually think the idea holds up. The main point of the essay was to add direction to the Jim Barksdale quote: “There are only two ways I know of to make money: bundling and unbundling.” That always felt Sisyphean to me. “We’re not just bundling and unbundling,” I wrote, “but unleashing energy, organizing it, and then unleashing new energy on the next thing.” An industry is in status quo. Some force or forces come along and shake things up, unleashing new energy and creating constructive chaos. Some company comes along and creates order from the chaos, at a higher, more advanced state. I called that company an Entropy Wrangler. The Entropy Wranglers capture a lot of value, and they themselves create a platform for more entropy, and then new players come along and wrangle that entropy. Think about the music industry. Napster and other file sharing services wrought chaos on the market; Spotify worked with all of the parties involved to bring order to the chaos. Today, it’s worth $29 billion. Spotify made it easier for more people to publish music — higher entropy — but it’s hard for most of them to make a living. That creates an opening for a new Wrangler, maybe a Music NFT platform like sound.xyz. z It doesn’t have to be that dramatic. An Entropy Wrangler doesn’t have to save an industry from decline. Google, for example, took advantage of the good chaos created by the internet’s rapid growth by building a tool that made sense of it all. It set the standard, and leagues of SEO specialists fight to follow it. In the process, it indexed itself to the growth of the internet. That’s been kind to Google shareholders. That’s the kind of Entropy Wrangler Standard Metrics is building, bringing order to the chaos and opportunity brought on by the growth of venture and web3 investing over the past couple of years. In the process, it hopes to become an indexed bet on the growth of private market investing. The Quaestor QuestSo the timing is perfect. How about the team? They’re intimately familiar with the problem. Before there was Standard Metrics, there was Quaestor. And before Quaestor, there were spreadsheets. Lots and lots of spreadsheets. Very often, venture capitalists fund people who are trying to solve a pain point in their personal or professional lives. Occasionally, VCs spin up their own companies – called incubation – by identifying a hole in the market with no solution and bringing in someone to lead a company to fill it. It’s very rare to find stories about the overlap in that Venn Diagram: VCs incubating companies to solve their own pain points. That’s how Standard Metrics began its life as Quaestor, inside the walls of 8VC. The venture capital firm’s partners realized that the companies in their portfolio, some of the most technically sophisticated in the world including Anduril, Asana, The Boring Company, Cityblock, Flexport, Oculus, Palantir, and Wish, were still updating them via spreadsheets (at best) and PDFs (yuck), and that there might be an opportunity to fix that with software. According to the company’s announcement post in July 2020, “Quaestor was born from a simple question: why is it so difficult for startups and investors to collaborate around financial data and business metrics?” I’ve had this experience first-hand from both sides of the table, and it’s a surprisingly real problem for something seemingly so simple. At Breather, we tried a bunch of things to keep our board members up to date on metrics, from the standard monthly investor update and quarterly board deck – which I’m sure some junior person on their team had to put into a spreadsheet – to operating models to an investor dashboard in Looker. Inevitably, that Looker got bloated with different requests for specific data points or some investor’s favorite metric based on their experience with another quasi-analogous company. It was also as certain as death and taxes that an investor would see a number, take it out of context, and blow up its importance, wasting hours of the exec team and data team’s time. As an investor – albeit a non-lead one usually without data rights – I’m at the mercy of whatever founders decide to put in that month or quarter’s update. Key metrics change often, companies report things differently, and all of that information is squirreled away somewhere in my inbox until I take the time to manually move it from email to Airtable. It makes staying on top of portfolio companies’ performance a bigger challenge than it needs to be. On the individual level, it’s a pain. At the system level, it’s a huge drain of time and resources:

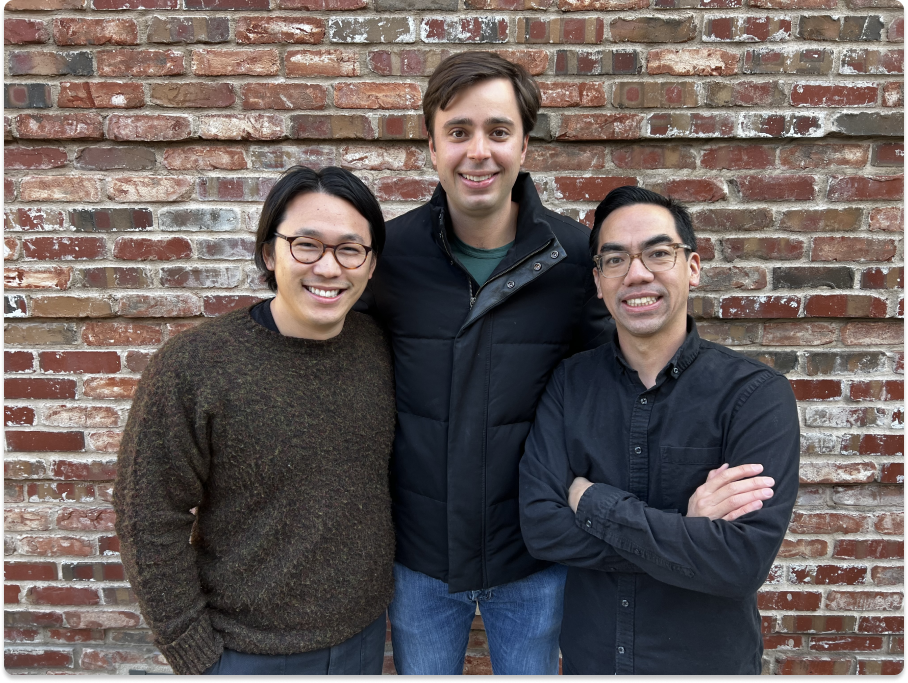

If the solutions to some of the biggest challenges facing humanity lie in the technological innovation of talented entrepreneurs, then wasting their time going back and forth on metrics should be a crime. Conversely, tools that save entrepreneurs time and let them focus on the things they’re uniquely good at should generate a ton of leverage. So the team at 8VC, including partners Joe Lonsdale and Alex Moore, put together a co-founding team to go build it, with a mix of operator and investor DNA:

The trio, which had a mix of operator and investor DNA with a sprinkle of experience building best-in-class tools for the space, spun out of 8VC in March 2020 as Quaestor, named after the treasurers of Ancient Rome. (They’re not the only ones who liked the name for a money-related business – I uncovered Quaestor.com’s first inhabitant from the Internet Archive’s Wayback Machine.) In July 2020, Questor announced a $5.8 million seed round from 8VC, Spark, Abstract Ventures, Riot Ventures, Fathom Ventures, and GFC. In the TechCrunch piece announcing the raise, Melas-Kyriazi explained the types of questions Quaestor would help answer:

As TechCrunch highlighted, Quaestor was opinionated from the beginning, with two goals:

Why guide customers to use the financial metrics? As Melas-Kryiazi explained at the time, “Most entrepreneurs come from a product background or engineering or sales and they might not necessarily have worked in finance before.” A set of … standard metrics … would make it easy for entrepreneurs to understand which metrics matter. That’s a good, simple answer for the press, but there’s more there than that. The decision to pick standard metrics from the start is one of two subtle strategic decisions the company made that will ultimately determine whether it’s successful in building the data and relationship graph for the private markets:

There are strong companies in the market including incumbents like IHS Markit, and new entrants – Cabal and Visible.vc – that look like direct competitors on the surface. But Standard Metrics is betting that those two strategic choices will differentiate it and help win the market. Standardizing MetricsWith this Series A announcement, Quaestor is officially changing its name to Standard Metrics. Aside from being much easier to spell, John told me that the new name better reflects the company’s mission: “In this next growth phase, we are building true standards for how critical information is shared in the private markets for the first time using software.” Building a standard set of metrics was Standard Metrics’ first strategic choice. Picking a certain set of metrics that every investor starts with, instead of letting investors or companies choose their own starting set, is a strategic decision, not in the vague sense, but in the sense that it comes with trade-offs that the team believes are worth it. Every company using Standard Metrics starts with these eight metrics:

Investors can and do choose to add other metrics to request from their companies – they may be vertical-specific metrics, metrics the investor has found to be particularly predictive, or even things like ESG metrics that matter to the investor – but it all starts with those eight. I asked John why they chose those eight when each vertical has its own metrics, and he explained:

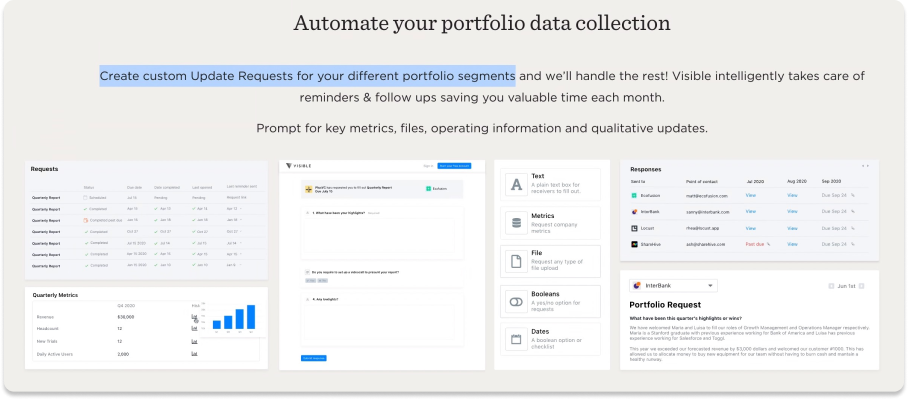

The approach is subtly different than Visible.vc’s. While both companies let investors customize metrics, Standard Metrics always includes the same eight metrics, whereas Visible.vc lets investors start from scratch for each segment or even portfolio company. On the surface, Visible.vc’s approach might appear to make more sense. Of course customers should get to choose for themselves, and of course different types of companies should have different sets of metrics. And if you’re building a purely SaaS product, it probably is. But Standard Metrics has a bigger vision: it’s trying to build a data and relationship graph on top of which it and others can build a series of apps. Today, the data that investors get from companies is all over the place, negotiated on a case-by-case basis, and practically impossible to compare consistently. So to start, Standard Metrics needs to wrangle that entropy and build a standardized set of metrics. In other words, just as equity is the atomic unit on top of which Carta built a series of products, operational metrics are the atomic unit on top of which Standard Metrics will build a series of products. Standard Metrics wants to build the core system of record for operational metrics, the main source of truth investors rely on to run their businesses and make decisions. “Standards allow everyone to move faster,” John explained, “and we think there are enormous advantages to standardization of data through software. For example:

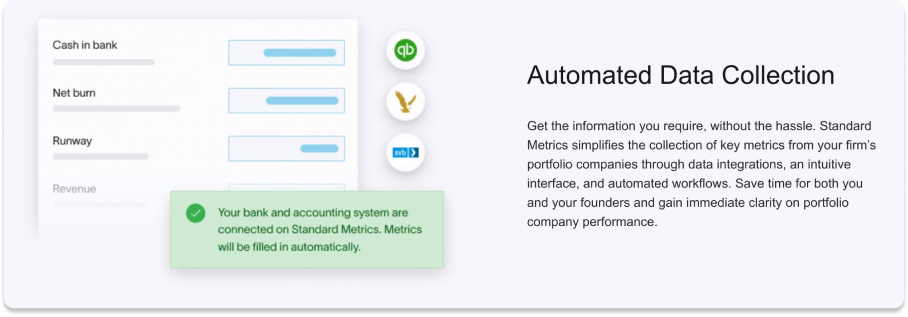

But picking metrics is one thing, collecting them is another. Standard Metrics offers integrations with banks and accounting software to make collecting the metrics seamless. That’s useful, and it’s an improvement over incumbents like IHS Markit, but for modern software, integrations are table stakes. There are startup-focused accounting tools that do the same. The question is: how do you actually get enough companies to give you that data that you become the standard? That brings us to Standard Metrics’ second strategic choice. To learn why VCs make a good target customer and what happens when the private markets have Standard Metrics…Thanks to Dan for editing the piece, and to John and the Standard Metrics team for working with me to tell their story. Thanks for reading and see you on Monday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Web of Relations

Monday, February 14, 2022

Carlo Rovelli, Quantum Theory, and the Nature of Reality

Snappr: Building API-First, Last

Thursday, February 10, 2022

From Self-Service Photography Marketplace to Visual Content Workflow Software

Ownership and the American Dream

Monday, February 7, 2022

Getting America its Swagger Back

Braintrust: Fighting Capitalism with Capitalism

Monday, January 31, 2022

Or, how web3 businesses can use tokenomics to create and capture long-term value

The 100,000 Foot View

Monday, January 24, 2022

Or, how not to become a fortune cookie

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month