Braintrust: Fighting Capitalism with Capitalism

Braintrust: Fighting Capitalism with CapitalismOr, how web3 businesses can use tokenomics to create and capture long-term valueWelcome to the 2,262 newly Not Boring people who have joined us since last Monday! Join 103,299 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts Hi friends 👋, Happy Monday! I was planning to write this Sponsored Deep Dive on Braintrust and send it last Thursday like I normally do for Sponsored Deep Dives, but as I got deeper into the piece, I realized that Braintrust is a perfect case study on how a web3 protocol can compete with, and potentially beat, web2.0 incumbents. It’s playing out now, in real-time, and is one of those approachable “real use cases” that supporters and skeptics alike long for. So this is a Sponsored Deep Dive on a company that I invested in via Not Boring Capital last year. You can read my Sponsored Deep Dive selection and thought process here, but on a Monday, not a Thursday. I’ve only written one other SDD on a Monday – Solana Summer – and like that piece, I’m only doing it because this is a piece that I would have written on a Monday, and I’m writing it just like I would write a Monday piece. I’m not selling anything – there’s no tracking link anywhere – and I’m not telling you to invest. It’s just that, in Braintrust, I found the perfect vehicle for so many of the arguments I’ve been trying to put into words. Disclaimer: Brainstrust has a publicly traded token – BTRST – so let me yell this as loudly as I can: THIS IS NOT INVESTMENT ADVICE. I mean this. BTRST is worth multiples of what it was when I invested last year. The whole crypto market has been volatile, and BTRST has been more volatile. Not Boring Capital owns BTRST tokens, but I have no idea what the price will do in the next day, week, month, year, or decade. The team has said publicly many times that they don’t care what the token price is. Always DYOR. Let’s get to it. Braintrust: Fighting Capitalism with CapitalismIn the very first post I wrote about web3 last January, The Value Chain of the Open Metaverse, I wrote:

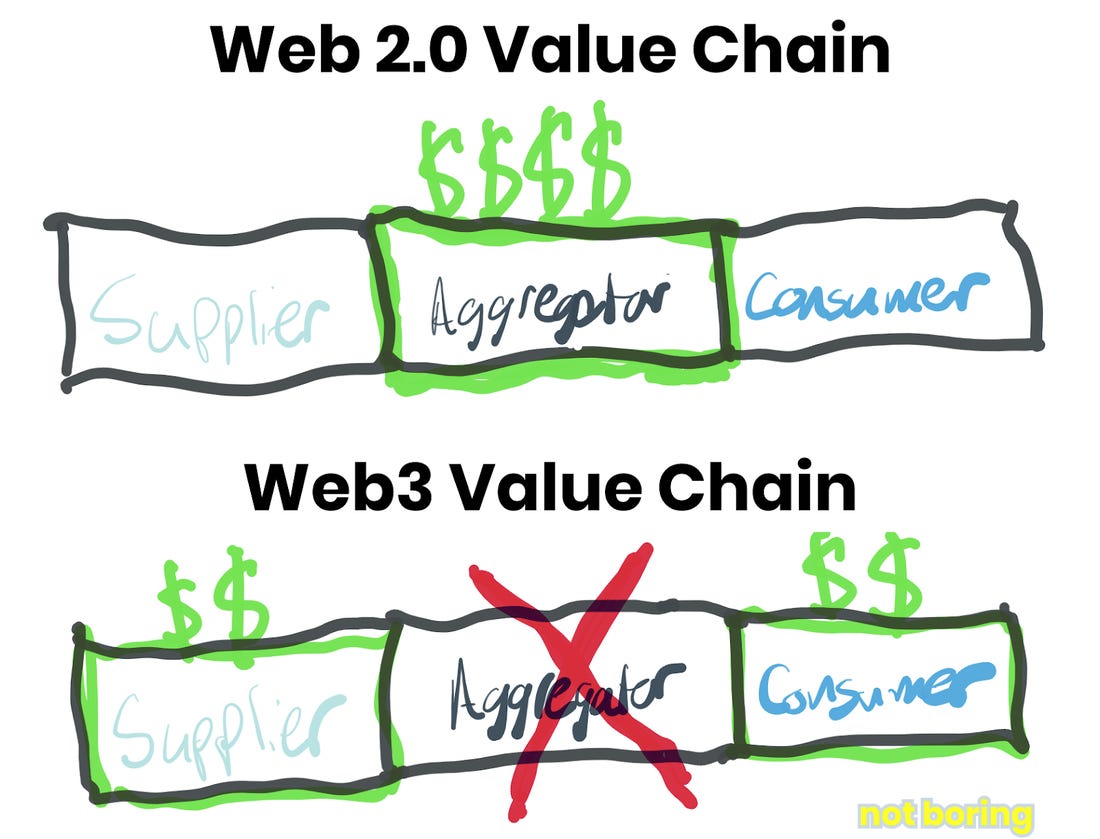

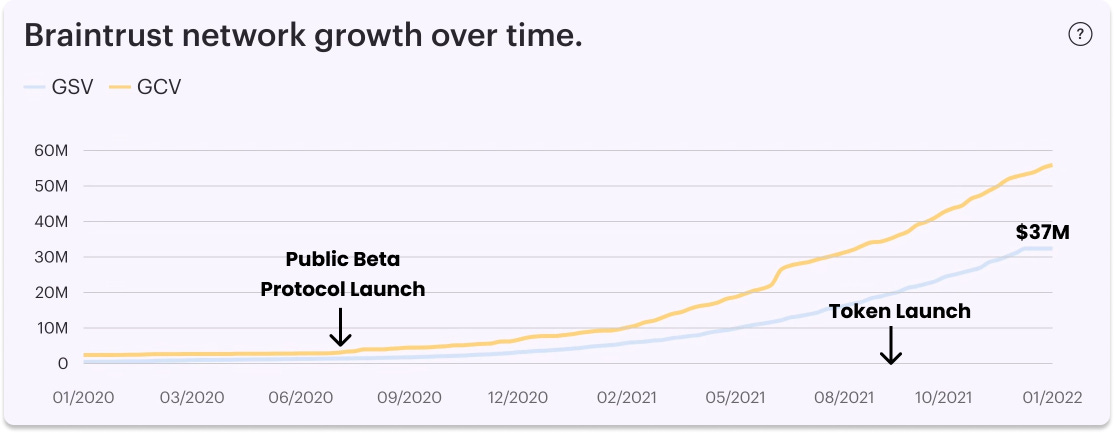

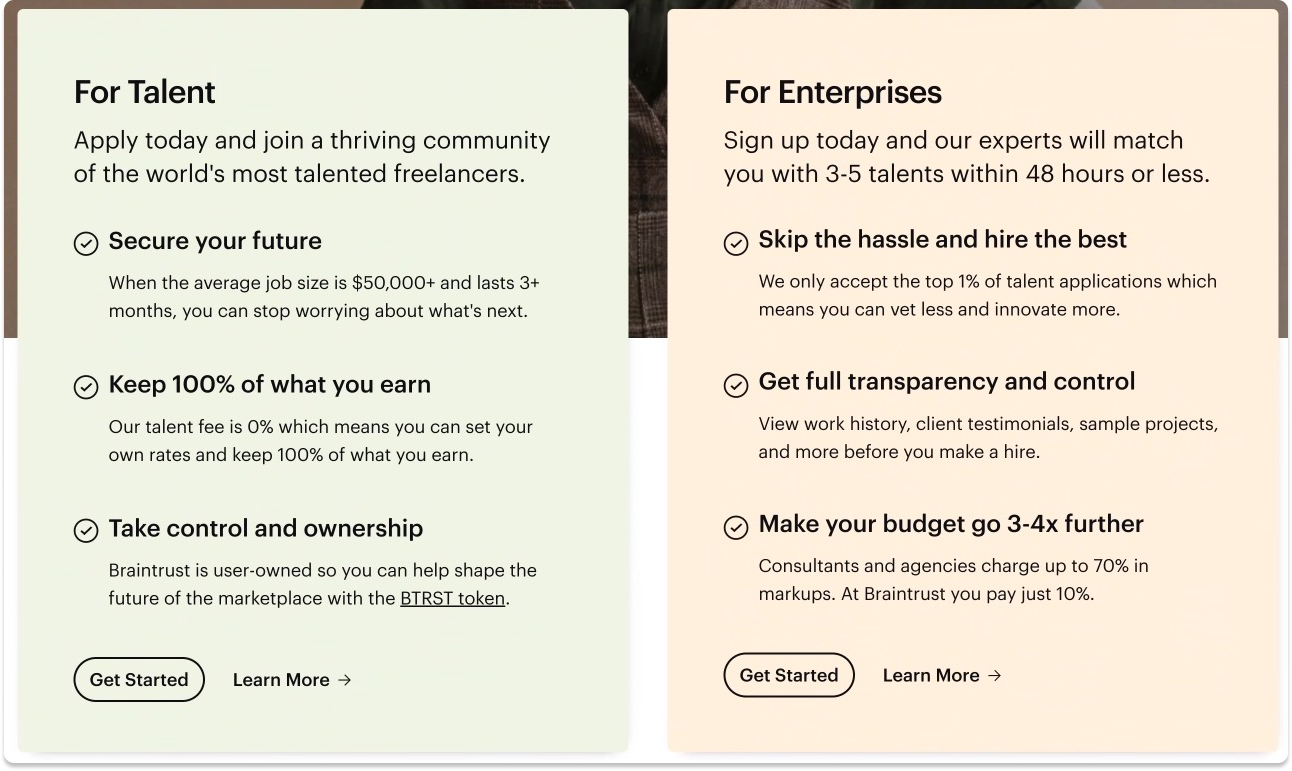

I wrote that piece as someone who had previously been curiously skeptical about web3. The first thing that clicked for me was the understanding that as people spent more and more time online, in ~*the metaverse*~, we would want to buy, own, and sell our own digital things without needing to rely on, and more importantly pay an extractive take rate to, someone sitting in the middle. I made this beautiful graphic to help visualize what that looks like: As you know, my brain can get out there, and an imagined future in which we rely more heavily on digital assets and would like to own and transact with those assets wherever we go in digital space was enough for me to buy in to the web3 vision. But I also understand that many people want to see “real use cases” before getting too excited. “Just show me one thing that a normal person would use in their everyday life,” these people reasonably demand, “that is better than the existing alternative because of the use of web3 tools.” Allow me to introduce Braintrust. Braintrust is a user-owned talent network that is growing fast and reaching real scale just eighteen months after launching the public beta of the protocol last June. $37 million in Gross Service Value (GSV) – what Clients pay Talent – has flowed through the network, with nearly twice that contracted for the coming months. This isn’t theoretical or conceptual. It’s happening now, matching real people with real jobs at top companies. You can watch the growth daily on its public dashboard. That dashboard also shows that 2,373 total jobs have been completed at an average project size of $72,474 and duration of 228 days. Braintrust’s market cap is $315 million, its fully diluted market cap is $896 million, and in December, it announced a fresh $100 million token sale to Coatue, Tiger, and existing investors to fund grants to grow the ecosystem. This is web3 in the real-world. Braintrust is not a radically new product or business model. It doesn’t require you to believe that digital objects have value or promise multi-thousand percent yields. Braintrust just connects companies looking to hire flexible technical talent with that talent, and charges a fee for doing so. Simple. It looks like a normal talent marketplace on the surface. This is its homepage: It doesn’t slap you in the face with web3. You need to scroll to the fifth section to find the first glimpse: “Take ownership: Braintrust is controlled by you, the Talent, through the BTRST token.” The value proposition to the two sides of the marketplace – Talent and Enterprises – mentions the token as just one of six reasons to use Braintrust. Braintrust is a clear distillation of an incredibly important point: good tokenomics can enhance a strong value proposition, but can’t replace a strong value proposition. Side Note: we’re going to talk about tokenomics a bunch, so let’s define the term. I like to think about it as designing economies by setting rules for how tokens are distributed, what participants can do with them, and how value accrues to them. Tokenomics are one reason tokens have advantages over equities: they can be programmed to do more. OK, back to it. But even without mentioning a token, the reasons that both sides of the market start using Braintrust are clear:

The fact that they can also earn tokens in order to have a vote on the future direction of the network is icing on top, but important icing. When you trust a platform with your livelihood, you want to make sure it can’t break that trust. Instead of being the network’s raison d’etre, web3 is a toolkit that Braintrust uses to do the long-term strategically rational things that all marketplaces should do but that many can’t because of alignment and time horizon misalignment, like keeping take rates minimally extractive. To be clear, using web3 tools doesn’t mean that Braintrust is perfect. Tokens aren’t magic beans. This Redditor provides a good first-hand account as a freelancer with both pros and cons. Community governance can be messy and imperfect. Tokens invite people to game or scam the system. I’m sure there will be many unhappy Clients and Talent over the years. Braintrust isn’t a foregone conclusions, but a series of bets:

It’s early, but the bets seem to be paying off. Since founding Braintrust in 2018, co-founders Adam Jackson and Gabriel Luna-Ostaseski, along with the core teams and community, have built Braintrust into one of the most pragmatic and fastest-growing web3 businesses on the planet. But there’s a long way to go to achieve the vision and pull all talent network business onto its protocol. Braintrust has done $37 million in volume all-time. Upwork, a Web2 talent network, did $904 million in its last quarter alone, Fiverr did ~$260 million. Deloitte did $50.2 billion in revenue in 2021. In all, companies spend trillions of dollars on talent every year. In that context, Braintrust’s volume to date should look like a blip in a year or a decade. And now that Braintrust has gone full DAO, it’s up to the community to pull it off. Ultimately, Braintrust is a familiar business model in one of the oldest businesses in the world – hiring – with a few modern enhancements. Its success will be measured by how it competes against public incumbents over time. The question for Braintrust is: can a user-owned network both create and capture more value than its investor-owned counterparts? If by the end of this piece, you can understand how the answer might be yes, then you understand web3. Braintrust is the gateway drug. So today, we’re going to go deep on how it all works:

But first, I want to turn it over to Adam to set the stage. The Braintrust ManifestoIn October, Braintrust co-founder and CEO Adam Jackson joined my friends Ben and David on the Acquired LP Show. At one point Ben asked him how his “incendiary” comments about Web2 marketplaces jibed with his history as a three-time Web2 marketplace entrepreneur. Adam’s answer is a modern Greed is Good speech. I’ll title it Fighting Capitalism with Capitalism. It’s a long block. Read it.

If web3 had to elect a President to appeal to the widest swatch of the population, Adam might be the guy. His is a pragmatic, no bullshit approach. That speech sets the terms for the rest of the piece and makes it clear what he’s going for.

The rest of this piece is about figuring out whether web3 makes those two seemingly contradictory ideas – extracting less and capturing more value – possible. (Hint: I think it can.) That requires understanding how marketplaces have typically worked. Web2 Marketplaces and the Take Rate TemptationFirst things first: I think Web2 marketplaces are great. I ordered dinner on DoorDash last night. I took an Uber home the night before that. I’m staying in an Airbnb later this week. Marketplaces are some of the biggest and most impressive businesses built in the past two decades. Even after recent selloffs, they’re worth hundreds of billions of combined dollars, all value created in the past decade or so (except eBay, which I think came out of Bell Labs in the1950s): These marketplaces not only organized existing markets and stole share from incumbents; they grew the markets in which they operate through their existence. The vacation rental market is bigger because Airbnb exists. Ridesharing is bigger because Uber exists. Done right, marketplaces attract and match new supply and new demand while removing friction and lowering costs. Great stuff. Love Web2 marketplaces. But there are also challenges with the model, or opportunities for improvement: Like the fact that marketplaces need to pay a lot to acquire both supply and demand, often over and over. See: the bloody Uber v Lyft battle. Or that so many successful marketplace businesses end up becoming advertising businesses – great for the business, annoying for the customer. See: all of the national fast food chain advertisements at the top of your DoorDash screen. Or that at some point, in order to increase supply, they drop the quality bar and people figure out how to game the system and it gets really hard to figure out what’s good and what’s not. See: Amazon third-party sellers. Or that successful marketplaces often increase take rates in order to increase profits once they believe participants are sufficiently locked in that they won’t leave. See: practically every marketplace in the history of marketplaces. To learn more about why web2 marketplaces switch from attract to extract and why they often do it too early, how Braintrust works and why it can keep take rates lower, longer, how value accrues to the token, and the answer to the question — how can a user-owned network both create and capture more value….Thanks to Dan for editing, and for Adam and the Braintrust community for working with me! Thanks for reading and see you on Monday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

The 100,000 Foot View

Monday, January 24, 2022

Or, how not to become a fortune cookie

The Web3 Debate

Tuesday, January 18, 2022

Rebutting Prof G's Web3 Rebuttal

The Oscar Puzzle

Thursday, January 13, 2022

Or, how to disrupt a regulated industry full of scaled incumbents over decades

Not Boring Capital: 2 Fund, 2 Boring

Monday, January 10, 2022

Not Boring Capital's $30M Fund II and the Value of Weird Investments

The Laboratory for Complex Problems

Monday, January 3, 2022

web3 as a simulation

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month