Coin Metrics' State of the Network: Issue 144

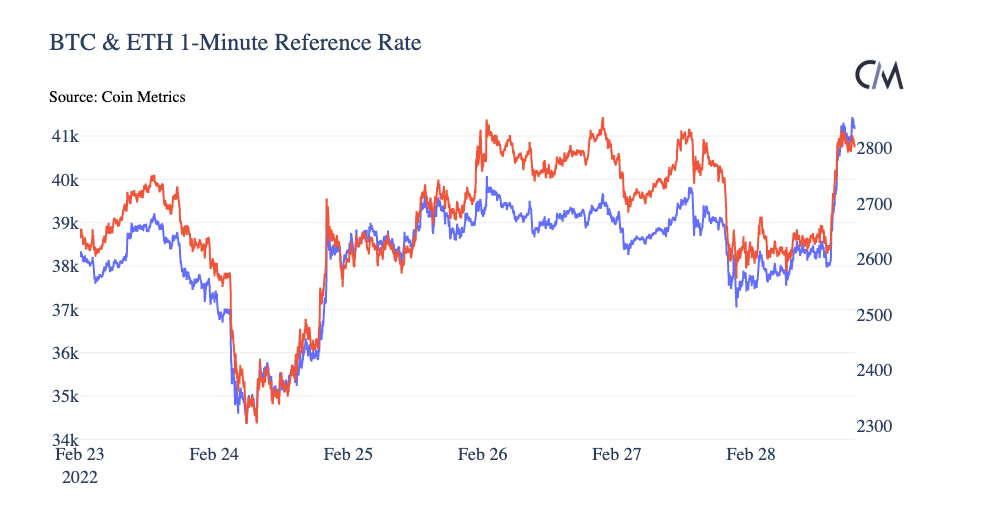

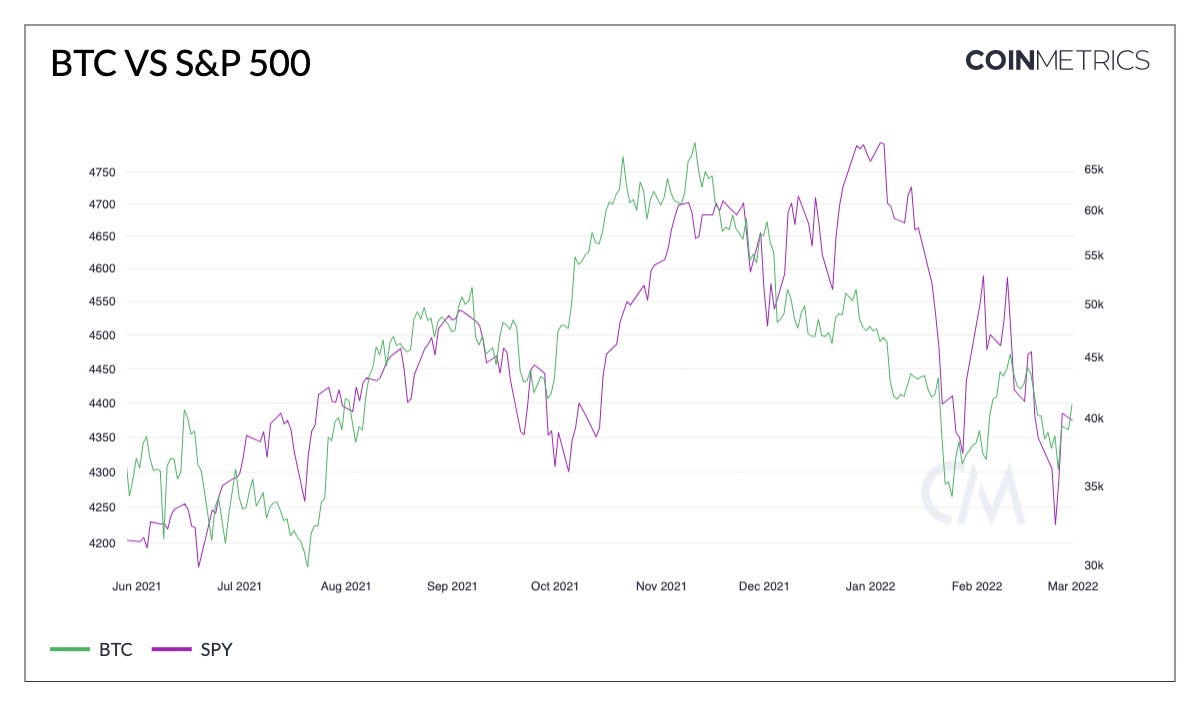

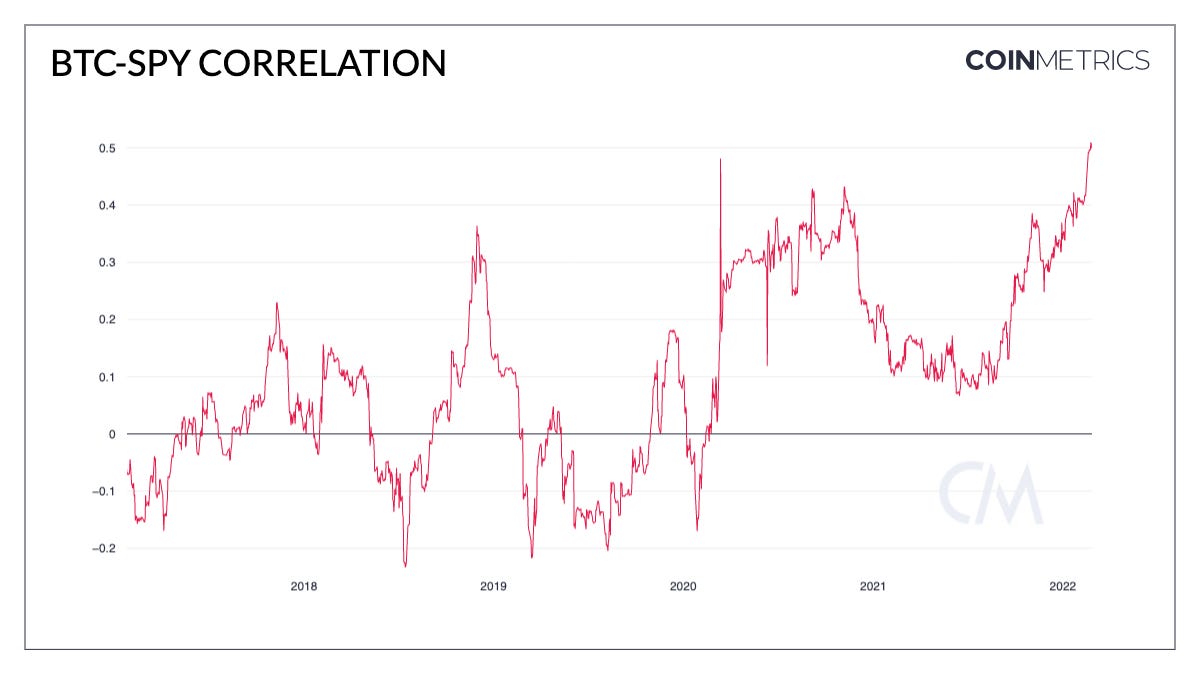

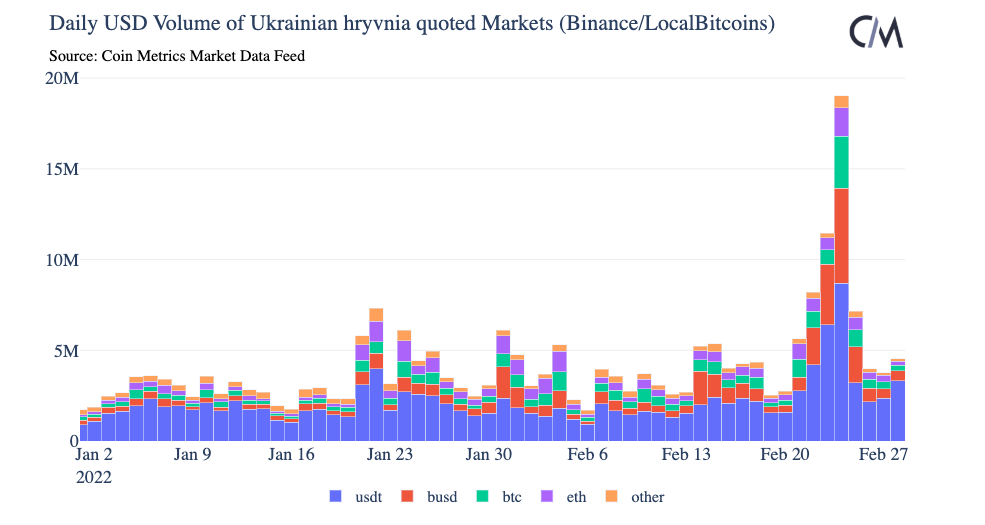

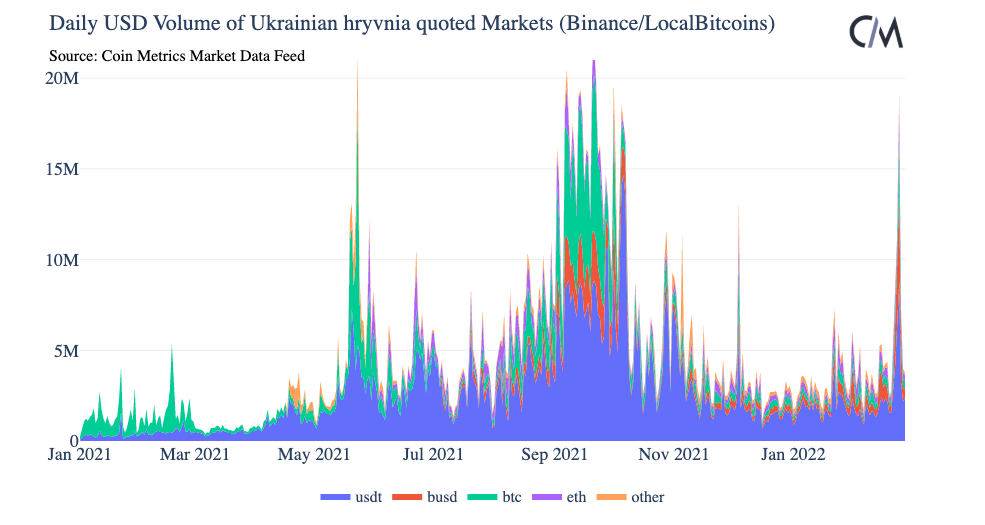

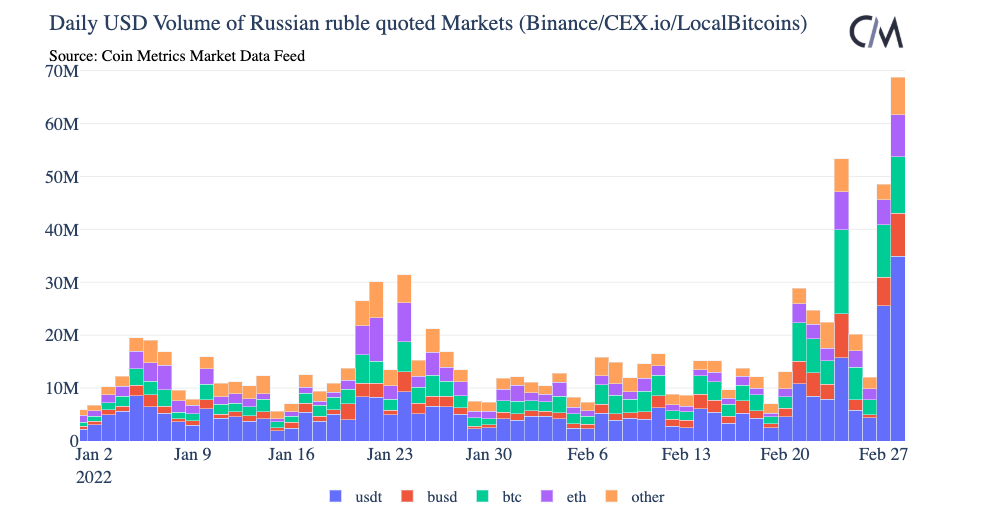

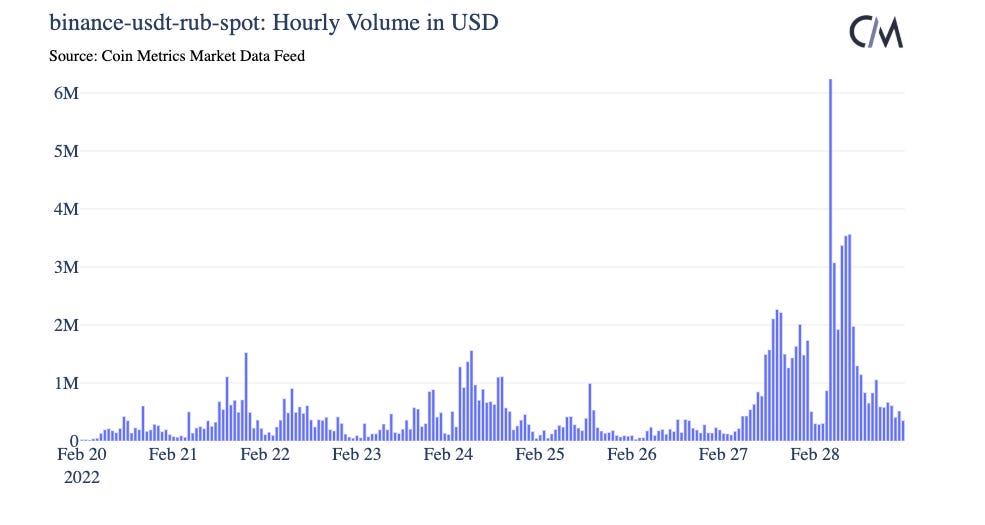

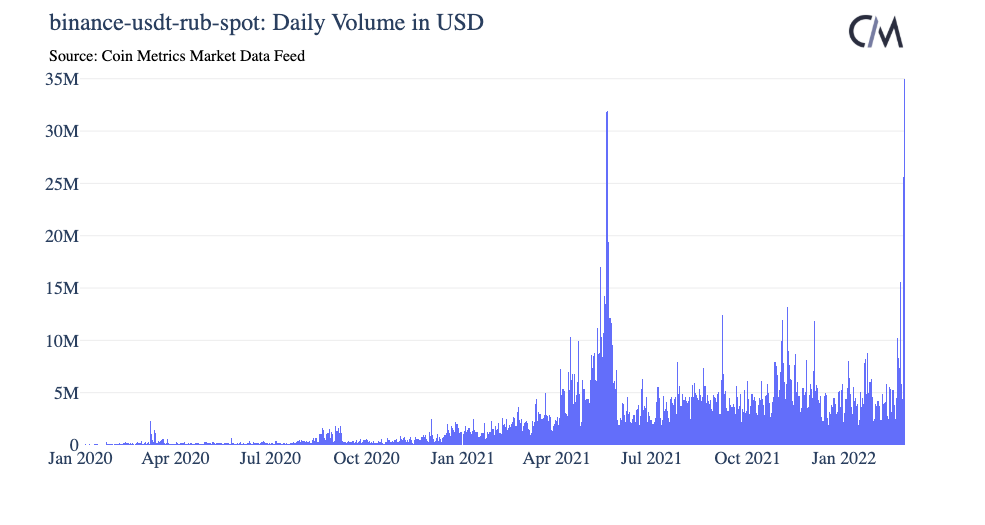

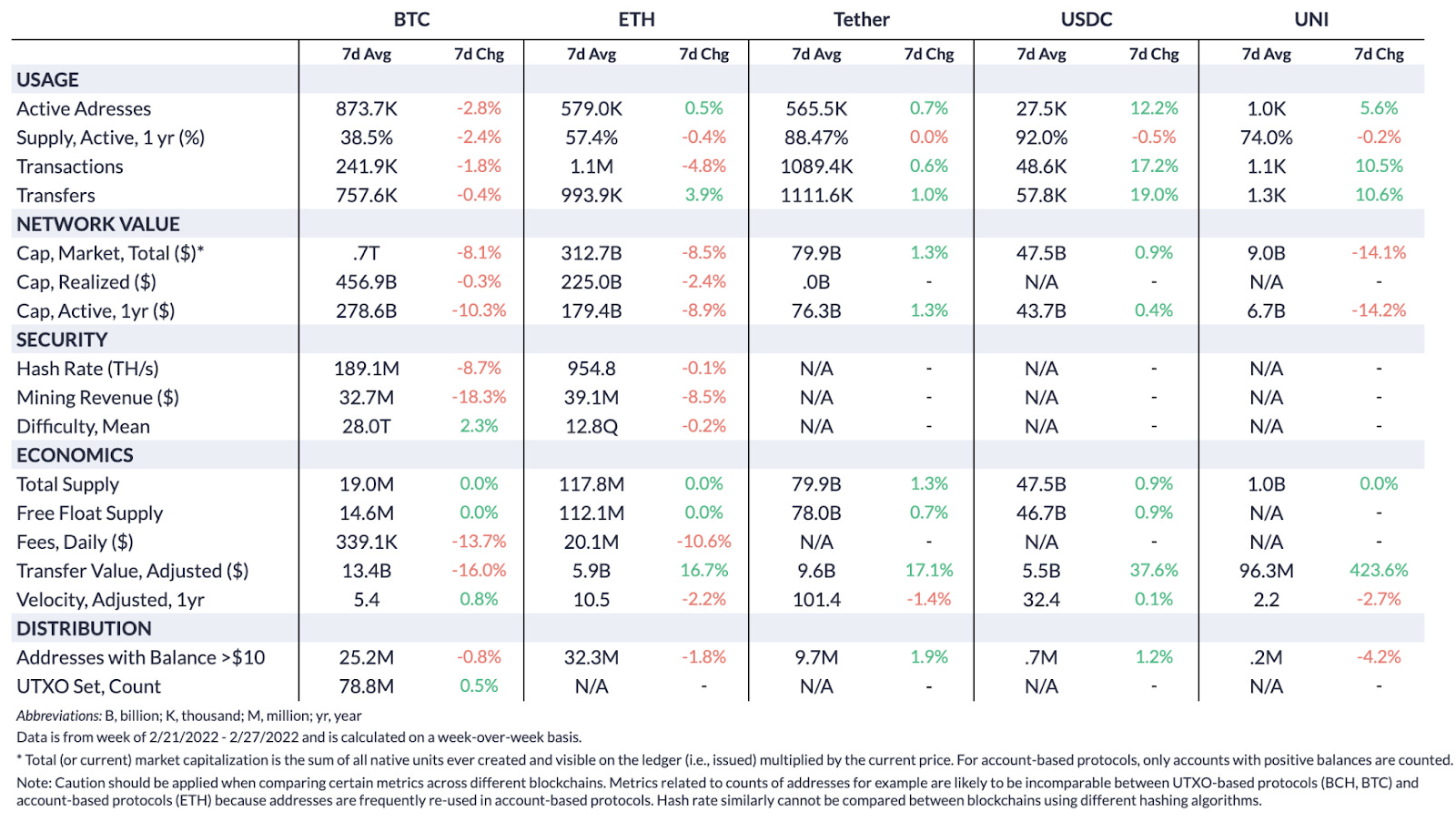

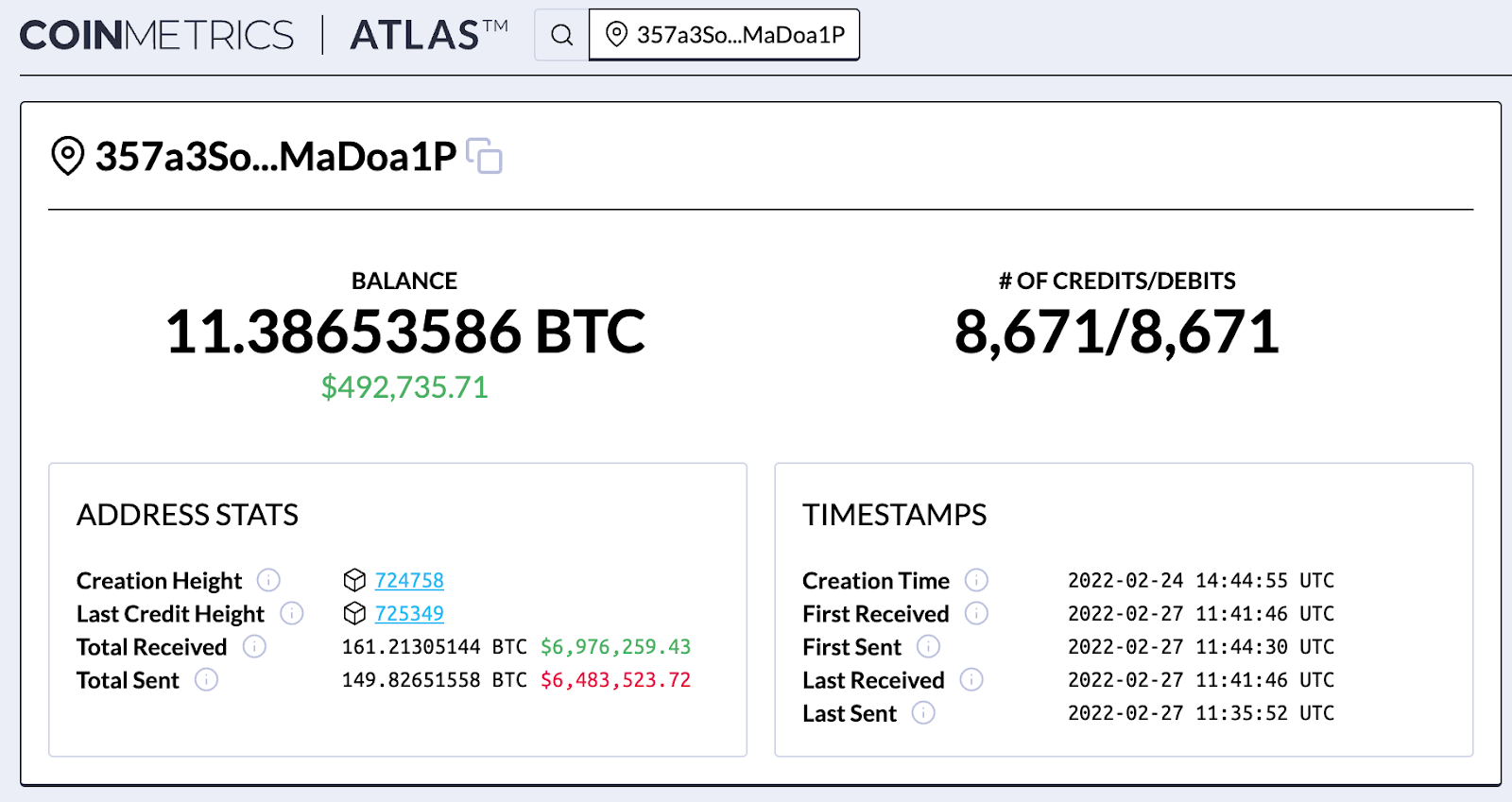

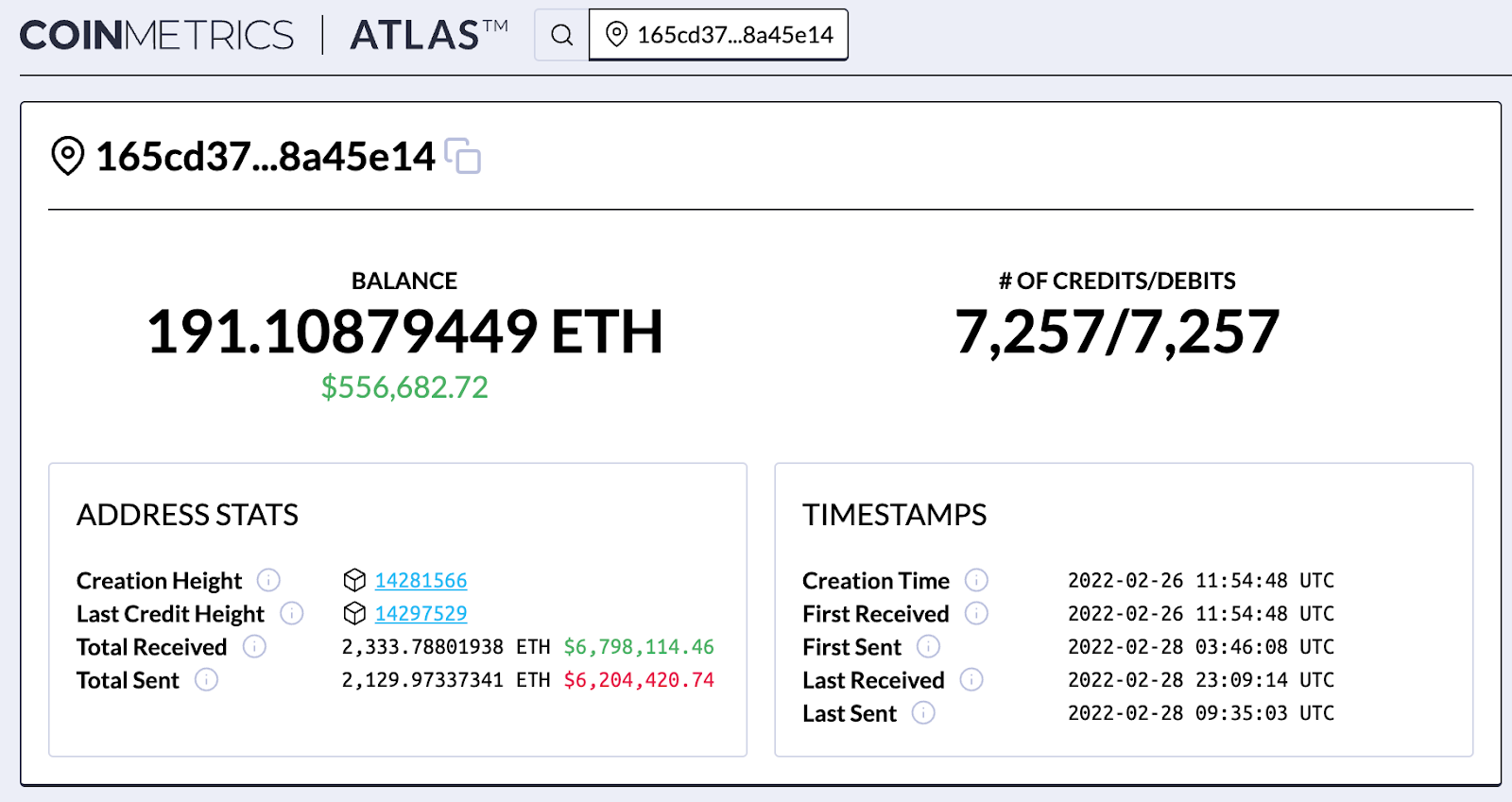

Get the best data-driven crypto insights and analysis every week: Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here. Crypto for UkraineBy Nate Maddrey and Kyle Waters Following Russia’s invasion of Ukraine last week the crypto community has banded together to help support Ukraine and its citizens, raising over $15M of donations.  The civilians affected remain the main concern. But bitcoin (BTC) and other cryptoassets have also come into the spotlight as many Ukrainian and Russian citizens have lost access to their traditional banking systems. BTC initially crashed following the first news of Russia’s invasion around 03:00 UTC on February 24th, dropping from $37K to as low as $34.35K. But less than 24 hours later BTC regained its previous price and began to move up to its highest level in weeks. Most other cryptoassets also followed a similar pattern - ETH initially crashed on the news of the invasion, but finished the day in the green. Source: Coin Metrics Reference Rates Equities and other asset classes also initially crashed then rebounded on the 24th, with growth stocks like Apple (AAPL) and Tesla (TSLA) holding up relatively well. Overall, the S&P 500 (SPY) moved relatively similar to BTC over the last week. But yesterday (Monday, February 28th) BTC began to separate, raising about 10% on the day while the S&P 500 dipped. Source: Coin Metrics Formula Builder Things are changing rapidly, and crypto’s reaction over the last week is undoubtedly complex and multifaceted. A shift in macroeconomic expectations probably played a partial role - crypto has been predominantly driven by macroeconomic factors since the beginning of the pandemic in March 2020. The correlation between BTC and the S&P 500 (SPY) has risen to its highest level ever over the last week (there are many different ways to calculate correlation - the below chart shows Spearman 90 day rolling correlation). This suggests that BTC and equities are still being partially driven by the same underlying factors. Both markets crashed to start the year as rampant inflation led to an expectation of a series of rate hikes in 2022. But some investors now appear to think upcoming rate hikes may be less severe. Source: Coin Metrics Correlation Charts In addition to macroeconomic conditions, the narrative around BTC and other cryptoassets is also changing. With many Ukrainian and Russian citizens unable to rely on their traditional banks amidst outages and incoming sanctions, more and more people are starting to realize the importance of having censorship resistant assets that can be transferred globally without having to depend on traditional financial rails. With the Ukrainian Central Bank limiting electronic cash transfers, many Ukrainians have turned to crypto. BTC and other cryptoassets are much easier to transport than physical assets like gold and can be self-custodied without the need of any bank or third-party, both of which become exceedingly important when you may need to relocate at any given time. Trading volume of crypto markets quoted in Ukraine’s local currency, the Ukrainian hryvnia, has spiked over the last week. Source: Coin Metrics Market Data Feed The below chart shows hryvnia quoted markets on Binance and LocalBitcoins for BTC, Ether (ETH), and stablecoins like Tether (USDT) and Binance USD (BUSD) since the start of 2021. Since the start of the invasion, hryvnia volume for these markets has risen to some of its highest levels ever. Trading volume on Kuna, a popular exchange in Ukraine, has also reportedly spiked. Source: Coin Metrics Market Data Feed Similarly, Binance, CEX.io, and LocalBitcoins markets quoted in Russian rubles have seen increased volume since the 24th. Source: Coin Metrics Market Data Feed As the U.S. and other countries have begun to target Russia’s central bank with sanctions, the foreign exchange rate of the ruble (RUB) has plummeted, leaving many Russian citizens desperate to convert their money into BTC and USD. Source: Coin Metrics Reference Rates The demand for stablecoins on Binance, which is reportedly the most popular exchange in Russia, has also increased since the start of the war. Trading volume of Binance’s USDT-RUB market has spiked over the last week, with the largest increase coming over the last two days as ruble price rapidly declined. Source: Coin Metrics Market Data Feed USDT-RUB volume was $35M yesterday on Binance, a one-day record high for that market. Source: Coin Metrics Market Data Feed Crypto has already proven to be a highly effective way to raise donations that can be transferred to anywhere around the world. And as an asset that can be self-custodied, easily transported, and used without the need for a third-party or bank, crypto will undoubtedly continue to play an increasingly important role in a quickly changing world. To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Active Bitcoin and Ethereum addresses remained at roughly the same level week-over-week. Stablecoins volume picked up on-chain, with USDT and USDC transfer value increasing ~17% and ~38%, respectively. Stablecoin activity has picked up amid market uncertainty as demand for relative safety and stability increases. Network HighlightsWith its global reach and near instant settlement, crypto has been a powerful tool to quickly rally resources for social and humanitarian relief for Ukraine and its citizens. In the wake of last week’s events, the Ukrainian government announced it would accept cryptocurrency donations, posting Bitcoin and Ethereum wallet addresses. The amount of funds sent to these addresses can easily be tracked on-chain. So far, in only 3 days since the address was created, about 161 total BTC has been sent to the Ukrainian-controlled Bitcoin address, worth nearly $7M. On Ethereum, about 2.3K ETH has been sent, worth an additional $6.8M. In addition to ETH, donors have also sent USD stablecoins including $1.5M worth of USDT and $137K of USDC. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 143

Wednesday, February 23, 2022

Wednesday, February 23th, 2022

Coin Metrics' State of the Network: Issue 142

Tuesday, February 15, 2022

Tuesday, February 15th, 2022

Coin Metrics' State of the Network: Issue 141

Tuesday, February 8, 2022

Tuesday, February 8th, 2022

Coin Metrics' State of the Network: Issue 140

Tuesday, February 1, 2022

Tuesday, February 1st, 2022

Coin Metrics' State of the Network: Issue 139

Tuesday, January 25, 2022

Tuesday, January 25th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏