Not Boring by Packy McCormick - Flow: The Normie Blockchain

Flow: The Normie BlockchainZigging When Others Zag and Progressively Decentralizing to Win the FutureWelcome to the 841 newly Not Boring people who have joined us since last Monday! Join 106,711 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) Not Boring Talent CollectiveI’m launching a Not Boring Talent Collective with Pallet. There’s no smarter, more curious group than Not Boring readers, and there’s nothing that every company I talk to needs more than smart, curious people. Collective members get exclusive job opportunities at companies in the Not Boring portfolio and broader Not Boring network. If you want to transition — sayyyy from web2 to web3, or just to something new: Hi friends 👋, Happy Monday! One of my favorite kinds of essays to write are the ones where there’s an obvious consensus opinion … that turns out to be completely wrong. I think that’s what we have today. Many people in crypto dismiss Flow, the blockchain originally developed by Dapper Labs, as too centralized or corporate. While it started that way, what’s happened since and beneath the surface is much more complex and fascinating. They’re building a maximally decentralized platform to support a billion users building complex worlds on-chain, even if it means making some hard trade-offs upfront. This is a Sponsored Deep Dive on Flow. As with Solana and Braintrust, I figured that the interest in Flow is broad enough that it deserved to be a Monday piece. While the piece is sponsored, these are all my real and genuine views – there’s no perfect blockchain; it’s all about making the right trade-offs to serve the target audience and use cases. The future is multi-chain. Plus, if I weren’t genuinely fascinated, there’s no way that I could have written 14,000+ words – they would have paid me for less than half that many! You can read about how I choose and write Sponsored Deep Dives here. Disclaimer: As always, this is not investment advice. I own a small amount of FLOW. As always, I only write sponsored deep dives on companies or assets I would invest in personally – but this piece is for entertainment and educational purposes only. If you saw my portfolio over the past couple of months, you would know that you’d have to be a fool to buy something just because I wrote about it. Plus plus, I’m clearly conflicted. As always, if you’re going to invest, do your own research. Let’s get to it. Flow: The Progressively Decentralizing Normie Blockchain(Click here ☝️ to jump directly to the online post) TL;DR This is the longest Not Boring essay in history, so let’s start with a quick summary:

Physical Properties with Digital SuperpowersCrypto can give digital assets physical properties with digital superpowers.

I’ve explained crypto as a way of getting back to our roots, but on a global scale, in recent essays. In The DAO of DAOs, for example, I wrote, “I think that stakeholder ownership is the natural state of things, and that we just haven’t had the technology or models to coordinate such widely distributed governance and ownership before.” I was proud of myself for coming up with the comparison. Turns out, I was years behind Roham Gharegozlou. In December 2018, the Dapper Labs CEO gave a TED Talk titled Life is Non-Fungible: The Evolution of Ownership, Assets, and Us:  In it, he walked through the history of ownership, collectibles, and money to highlight NFTs’ place in the grand arc of human history. He even used Legos to describe composability long before that became the default analogy. Concluding the talk, he said:

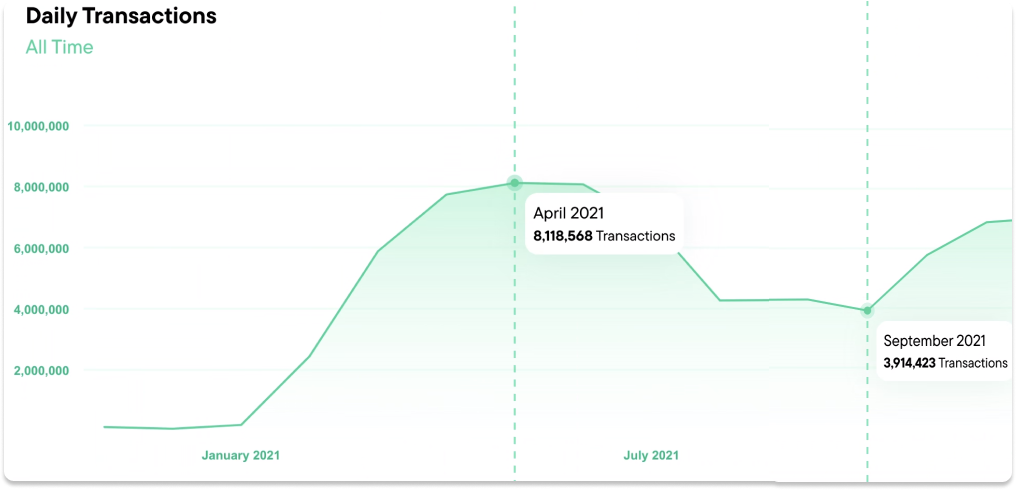

It was prescient. Roham gave the speech two full years before 99.99% of us had ever heard the term “NFT.” Since then many others have used the concepts Roham laid out in it to explain this wild new world approachably. Today, the company Roham co-founded, Dapper Labs, and the blockchain it created, Flow, wants to give entire digital worlds physical properties with digital superpowers. Flow describes itself as the “blockchain for open worlds.” It has at its disposal the lego blocks of crypto, DeFi, NFTs, and DAOs. Roham and the Flow team understand that open worlds, like the physical one, thrive with more participants from all walks of life, skill sets, and ability levels. Their job is to make it as easy as possible for anyone with an idea to build it and remix it with others’. They know that what makes physical cities and spaces vibrant aren’t the spaces themselves, but the people in them. Nerds built the internet, but normies brought it to life by filling common spaces like AIM chat rooms, Facebook, and Twitter. Both are needed for a thriving digital ecosystem. But as Roham pointed out in the talk, the barriers to adoption for normies are high. Speed, scalability, user experience, and cost will have to improve dramatically until normies start participating in their daily life. The stakes are high, too. We spend more and more time in digital worlds, playing the Great Online Game, in 2D worlds like Twitter to fully immersive video games. We both use and shape our digital worlds. The question is whether we’ll get the same property and voting rights in our digital worlds that we do in our physical ones. If we get it right, we’ll get the benefits of physical properties with digital superpowers. That’s what Roham and the team set out to do with Flow. It’s a blockchain built for open worlds, but really, it’s a blockchain built to onboard hundreds of millions or billions of mainstream consumers. Normies. As it stands, though, Flow is a dark horse in the crypto community. After a scorching Spring of 2021, Flow usage dipped. Transactions peaked at 8.1 million in April 2021. They fell by more than half to 3.9 million by September. Flow hasn’t generated a ton of buzz on Crypto Twitter in the intervening five months. When I asked this holy war-inducing question the other day in order to fish out thoughts on Flow without tipping my hand that I was writing about it…  … and not a single person mentioned Flow. My sense is that CT isn’t currently taking Flow seriously as a standalone blockchain because peoples’ first interaction with Flow felt too centralized. The battle has moved on to L1 chains like Solana, Avalanche, Near, Polkadot, and Celo, L2 sidechains like Polygon and Fantom, and zero-knowledge leaders like Starkware and zkSync. While those other chains already allow permissionless deployment – anyone can write a smart contract and deploy it to mainnet without asking anyone – Flow doesn’t yet (although it expects to by summer). It doesn’t feel as web3. But it would be a huge mistake to dismiss Roham and the team. They’ve arguably done as much as anyone aside from Satoshi Nakamoto and maybe Vitalik Buterin to bring people into web3, normies and degens alike. Because when you ask people how they first got into crypto, a huge slice of the population gives one of two answers:

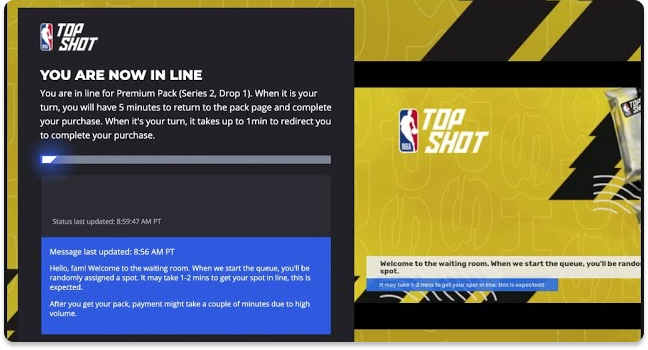

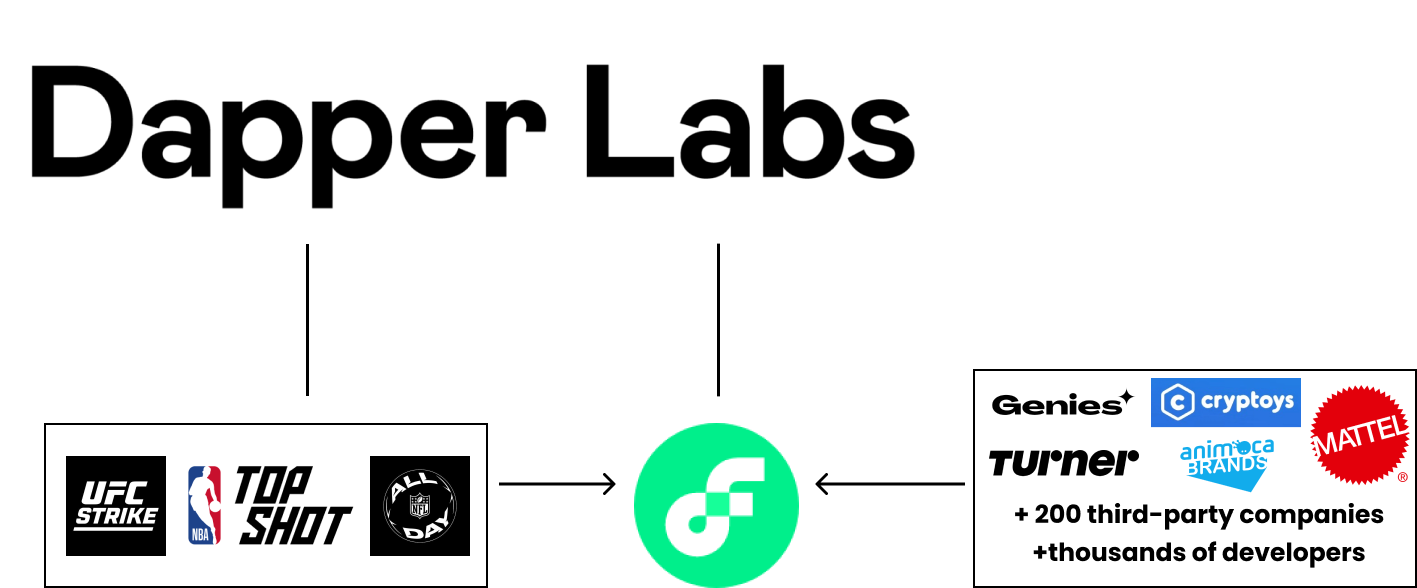

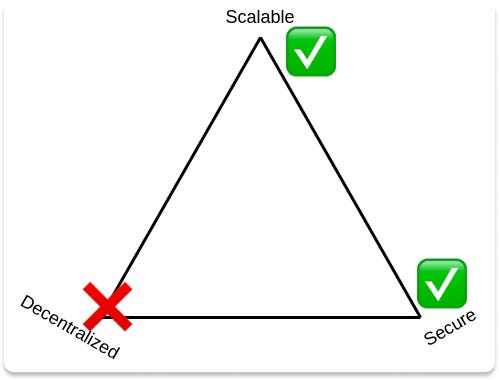

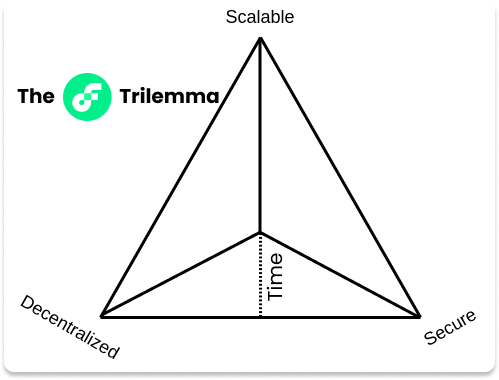

Some of the most degenerate pseudonymous people I know in the space started their respective journeys down the rabbit hole by either purchasing jpegs (well, technically, SVG files) that looked like this: Or by queuing up here… … entering their credit card info, and stacking NBA highlights in a custodial wallet. CryptoKitties and NBA Top Shot were my entrée into web3, too. In the first piece I ever wrote about the space, The Value Chain of the Open Metaverse, I wrote about CryptoKitties and Top Shot. NFTs were the first web3 use case that really clicked for me beyond token speculation. They were my a-ha moment. As more of our lives became digital, I realized, of course we’d want a way to own our digital things. Ownership of unique digital assets was made possible by the ERC-721 token standard. Tokens like ETH and BTC are fungible: every ETH is worth as much as every other, and people don’t care which ones they own. On Ethereum, fungible tokens work off of the same standard: ERC-20. For something like CryptoKitties, though, each of which is unique, ERC-20 didn’t work. So the team behind CryptoKitties, Axiom Zen, created a new standard, ERC-721. If ERC-20 tokens represent digital money, ERC-721 tokens represent digital things. Turns out, there’s a big market for digital things. The wild part is: CryptoKitties, ERC-721, and NBA Top Shot were all created by the same people, Roham and his team. The team that today runs Dapper Labs, led by co-founders Roham (CEO), Dieter “Dete” Shirley (CTO), and Mikhael “Mik” Naayem (CBO), started working together at Vancouver-based startup studio Axiom Zen, where they created CryptoKitties on top of Ethereum. While there, Dete co-authored the ERC-721 Standard and introduced the term “NFT.” When Ethereum couldn’t handle the volume that CrypoKitties drove, they decided to spin up a new company, Dapper Labs, create their own blockchain, Flow, and build NBA Top Shot as its first app to show off its potential. For the avoidance of confusion, since we’ll be talking about both a lot, Dapper Labs is the parent company of both Top Shot and of the Flow blockchain, but Flow is a distinct entity from Dapper. The relationship between Dapper and Flow is somewhat like the Ethereum Foundation and Ethereum or Solana Labs and Solana, except that Dapper Labs is a for-profit entity that also builds applications on top of Flow, like NBA Top Shot, NFL All Day, and UFC Strike. As we’ll discuss throughout the piece, Flow is becoming increasingly independent and distinct from Dapper over time. With CryptoKitties and Top Shot, Dapper built an incredible top of funnel machine for the entire space. But it’s also been an incredibly leaky one. In early 2021, when Top Shot took off, it gave over a million people their first web3 experience. When they wanted to do the next thing… there wasn’t much else to do. The Flow blockchain was mainly Top Shot. Third-party developers couldn’t build on top of it without approval from the Dapper team; Flow didn’t yet allow the permissionless deployment that lets wild things emerge randomly in other ecosystems. Users either went back to web2 or continued their web3 exploration in more developed ecosystems like Ethereum and then Solana. Would-be web3 entrepreneurs and developers largely did the same. For the more hardcore among them, Flow, which allowed users to purchase with credit cards and lacked off-ramps to non-custodial wallets in the early days, seemed too centralized to build on. That’s the bear case, and it’s the commonly accepted case. 🥱 But the bull case for Flow is that it’s playing a different, longer game. In Own the Internet, my bull case for Ethereum last summer, I wrote that I was bearish on chains attempting to compete directly with Ethereum. I like L1s that differentiate and try to win for certain use cases. The two chains I highlighted in that piece: Flow and Solana. Solana, which I wrote about in August, was built to win high-frequency DeFi use cases, and it’s in the lead there. Flow’s wants to win by getting as many regular consumers, or “normies,” onboarded as possible. That means starting with the strategy most people associate with Flow: working with global brands those consumers love like the NBA, NFL, UFC, La Liga, and Dr. Seuss. Beyond IP holders, Flow seems to be tapping into huge pools of consumers via the tech giants; Google is an investor and a leak last month showed Instagram is working on integrating Flow NFTs. There are also the beginnings of a very interesting developer ecosystem on Flow, with unicorns like PlayCo and Animoca building games on Flow alongside emerging success stories like Genies and Cryptoys. Flow is targeting both today’s normies and the next generation of users and builders so web3-native they won’t even call it web3. One of Flow’s biggest hidden advantages is that it’s trying to onboard (and retain) all of the youngest users via Genies, Cyptoys, Brud, and a more seamless experience. Those young users will become creators and builders and whales. Building for them means Flow can play the long game. That time horizon is the part that people not intimately familiar with Flow miss. I missed it too. When I started talking to the Flow team about potentially writing the piece, my assumption was that the Flow team had decided to approach the The Scalability Trilemma – blockchains can only have two of three of Security, Decentralization, and Scalability – by completely sacrificing Decentralization in exchange for Scalability and Security. Now I actually think they’re trying to solve the Trilemma without sacrificing any of the three by adding a fourth dimension: Time. For Flow, the team re-thought how to build a blockchain that can handle complex dapps serving billions of users from scratch. They realized that it might be possible to solve the Trilemma by adding a bunch of complexity upfront, reducing decentralization in the short-term, and building a product and ecosystem that achieves all three over time. In other words, it’s impossible to solve the Trilemma with simple solutions from day one, but it’s possible to do it if you relax the time constraint and “decentralize” progressively. So what does that complexity look like? Under the hood, Flow’s architects reimagined everything:

Flow has decentralized in a slow, progressive fashion. They aren’t in a rush. They’re building for the next billion users, the mainstream users. Building for the mainstream means making different trade-offs in the short-term in pursuit of the long-term vision, and it means making Flow the most welcoming place for the next generation of builders to build rich, composable experiences. That takes time. Taking time is a risky play, and one that’s in no way guaranteed to pay off in such a fast-moving environment, but if it works, it has the chance to make Flow the first blockchain with real, “oh shit everyone is using this,” network effects. It’s hard to bet against the Flow team. They’ve been through the Hype Cycle a couple times now, and they just keep building and attracting millions of users. At this point, four years into Dapper Labs and less than 18 months into Flow’s public life, we might not even need to wait that long to see liftoff. Flow is finding its rhythm. For example, remember that transaction cool down we talked about a few paragraphs ago? Flow’s already bounced back. It’s picking up steam. There were 3x more Flow transactions last month than there were in September, in the midst of an NFT bear market. Overall, Flow has handled more NFT transactions than any other chain by far. But its ambition is to be more than an NFT chain. It’s building the “blockchain for open worlds.” Layne Lafrance, Flow co-founder and Product Lead, explained that “Flow is designed to be performant when people come together, build together, build on top of things. Complex communities need to be able to evolve.” To that end, in October, Dapper acquired Brud, the team behind virtual celebrity Lil Miquela helmed by Trevor McFedries, who also founded popular DAO Friends with Benefits (FWB). Trevor will be running Dapper’s push into DAOs on Flow, dubbed Dapper Collectives, starting with Brud DAO. I asked Trevor when we’ll see Brud DAO, and his answer encapsulates the way that Dapper builds: “We’re doing it as soon as possible, but the motto here is the anti-Facebook: Move Slow and Get it Right.” “We could be wrong,” Roham admitted, “But if we’re right, this is the way to build new mainstream consumer products.” There’s no guarantee they get it right. Looking at Flow’s market cap compared to other L1s, the money suggests that people think it’s unlikely. But the Flow team has been patiently snapping LEGO blocks together in pursuit of a big, long-term vision, and they know better than anyone how to bring consumers into web3. It’s worth understanding what they’re up to:

There’s a lot to cover, so before we dive in, I want to set the stage and define the stakes. To learn about Flow’s differentiated strategy and architecture, untold behind-the-scenes stories, the power of young users, and much more…Thanks to Dan for editing, and to Roham, Mik, Dete, Layne, Trevor, Chris, Will, Emilio, Brett, and Akash for your input! Thanks for reading, and see you on Thursday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Ukraine

Monday, February 28, 2022

Resources, Links, and a Little Optimism

Wrangling Venture Entropy with Standard Metrics

Thursday, February 24, 2022

Quaestor Rebrands to Standard Metrics and Raises a $23.7M Series A

Web of Relations

Monday, February 14, 2022

Carlo Rovelli, Quantum Theory, and the Nature of Reality

Snappr: Building API-First, Last

Thursday, February 10, 2022

From Self-Service Photography Marketplace to Visual Content Workflow Software

Ownership and the American Dream

Monday, February 7, 2022

Getting America its Swagger Back

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month