Coin Metrics' State of the Network: Issue 145

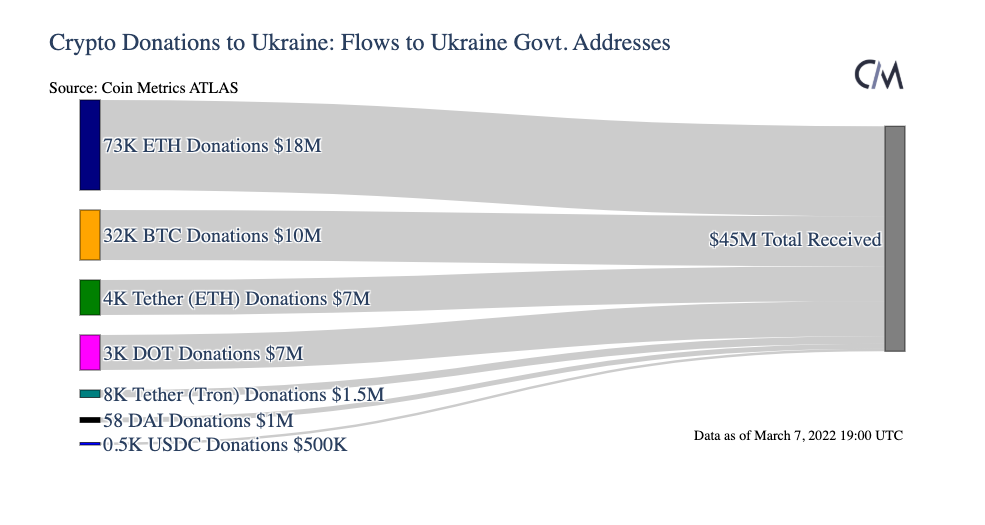

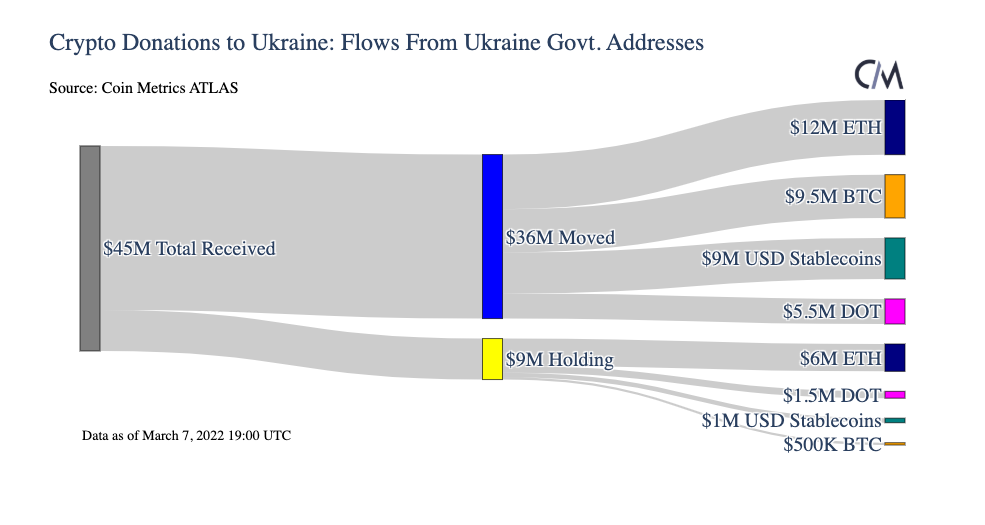

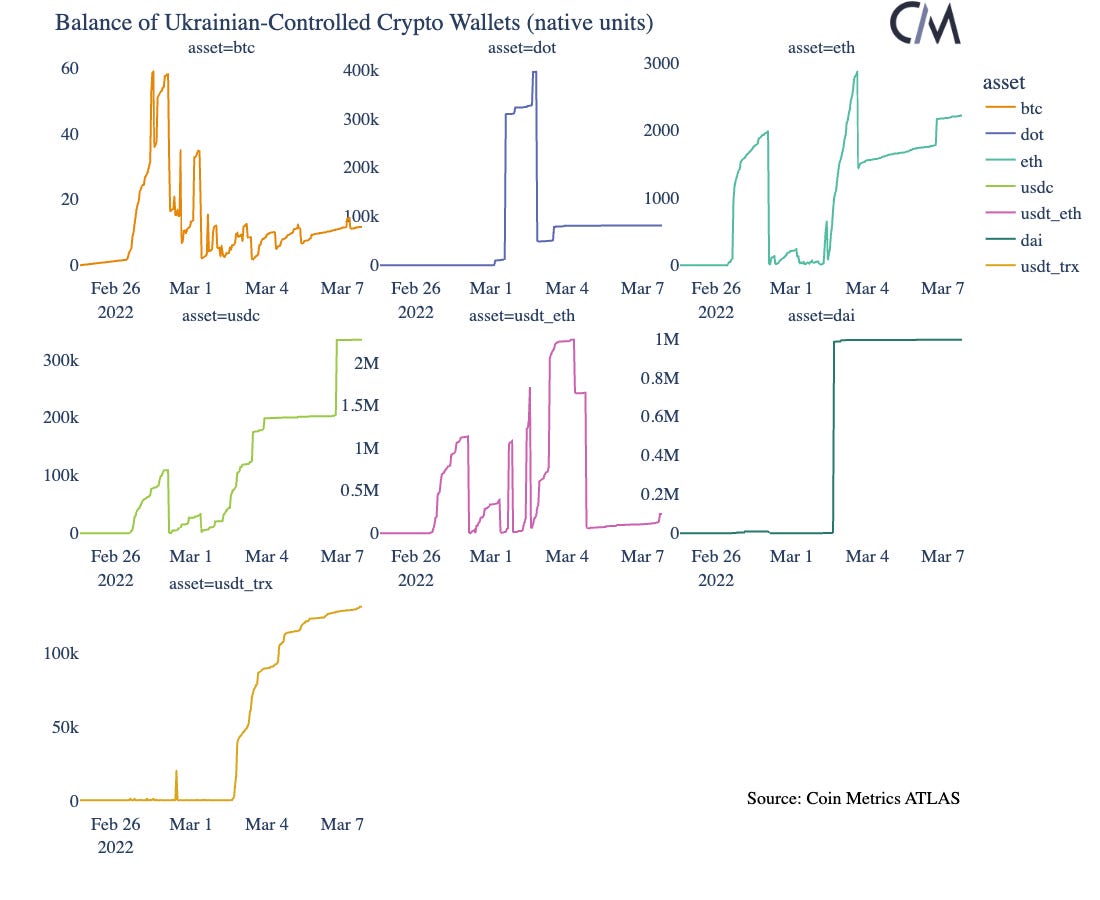

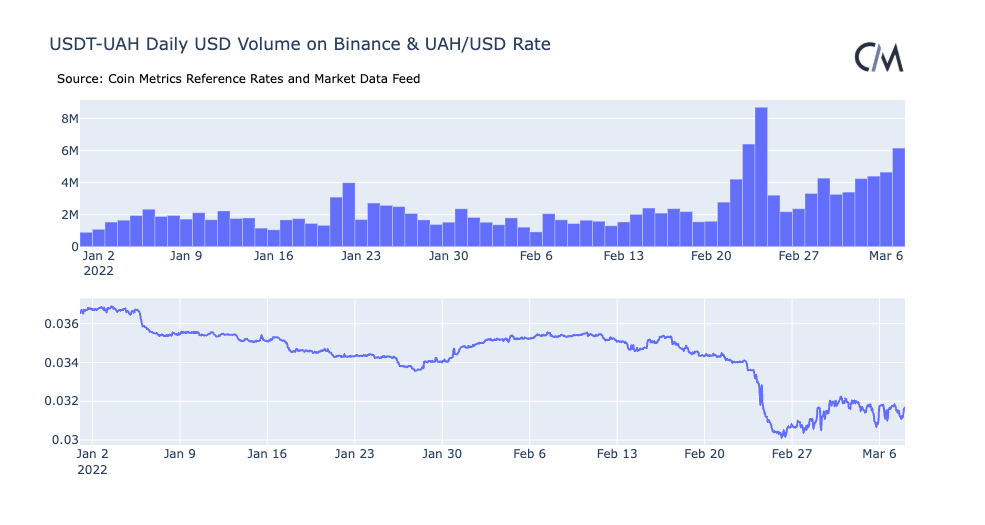

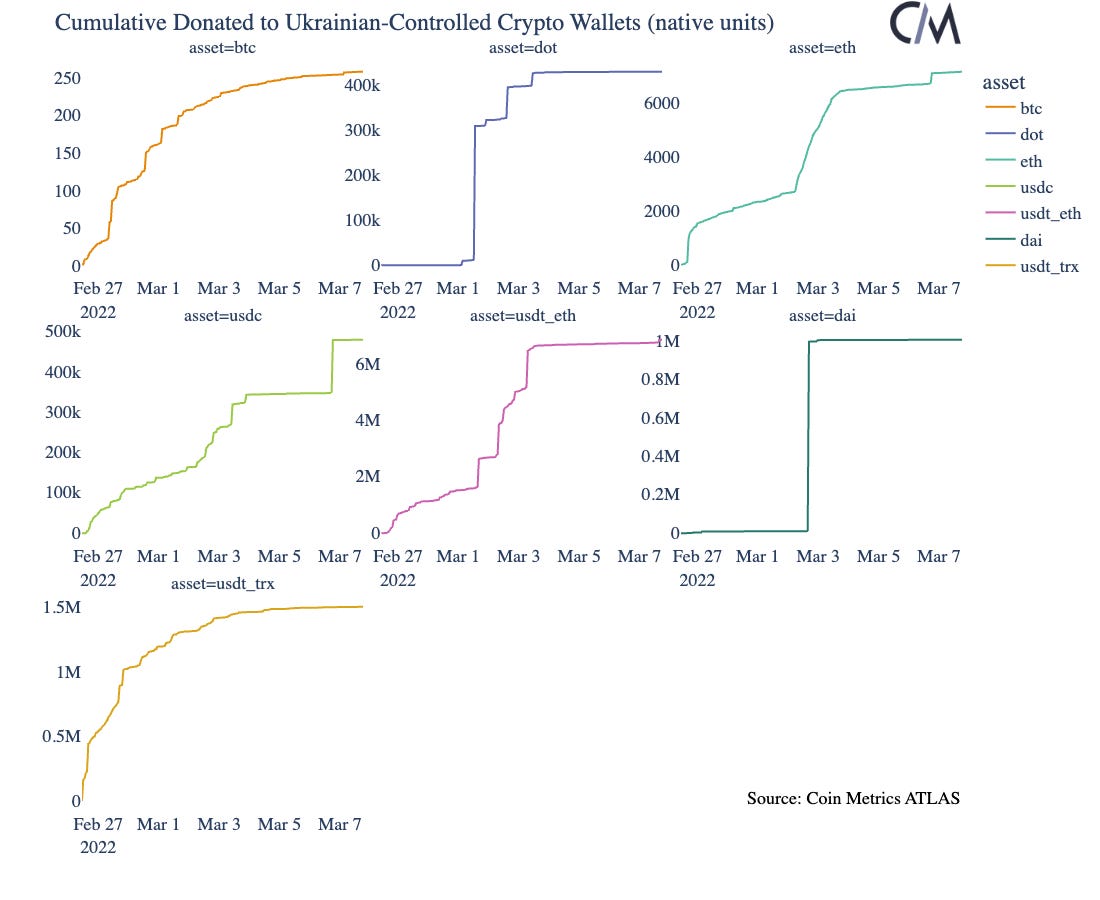

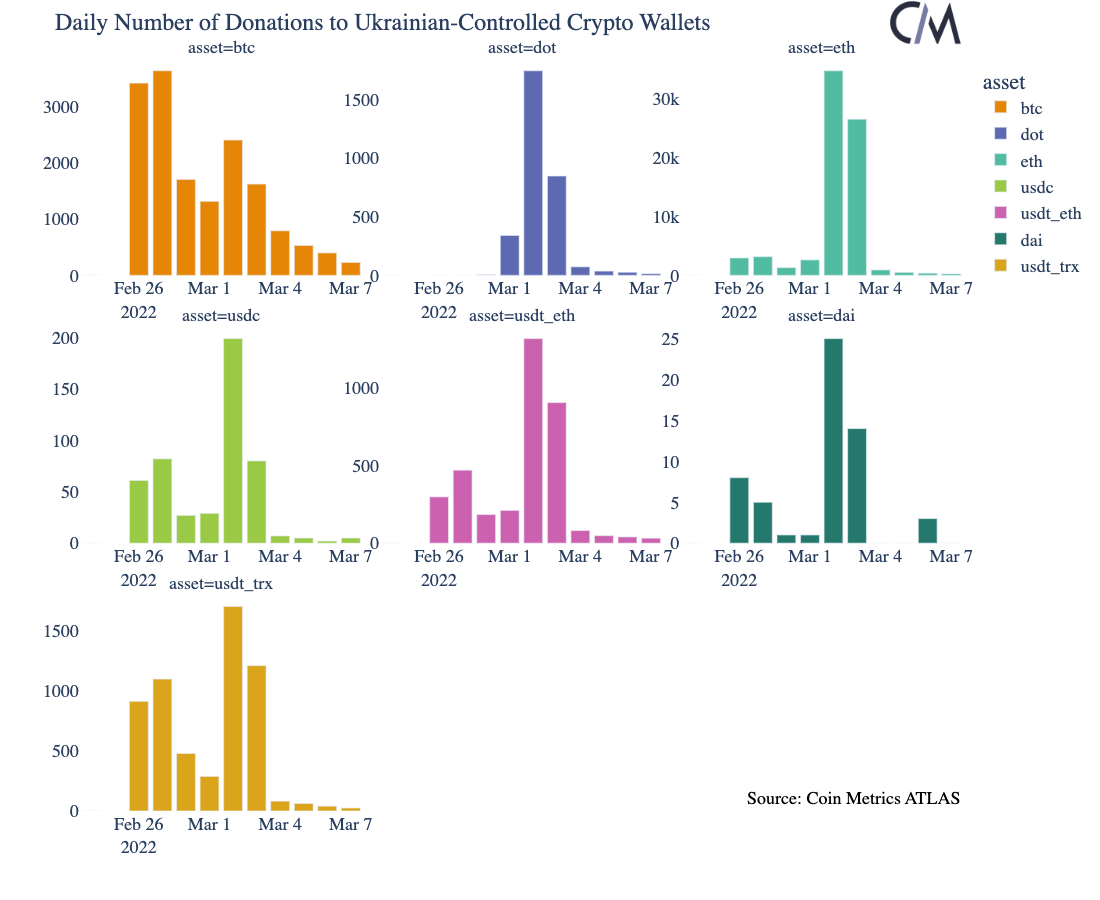

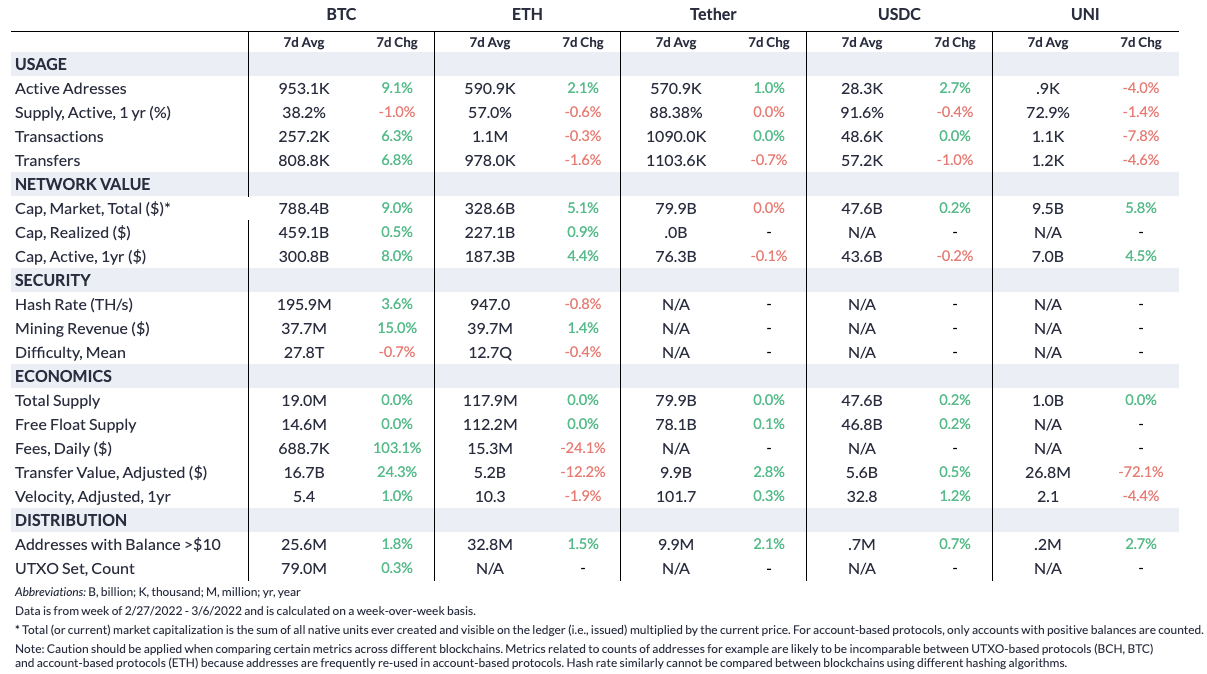

Get the best data-driven crypto insights and analysis every week: Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here. Ukraine Receives over $45M in Crypto DonationsBy Kyle Waters and Nate Maddrey Amid the tragedy of war in Ukraine, the crypto ecosystem has served as a critical lifeline for Ukraine and its citizens. In just under two weeks, donors have sent over $45M in crypto assets to Ukrainian-government controlled wallets for relief and supplies. The significance of open financial networks powered by public blockchains like Bitcoin and Ethereum has arguably never been more acute. Globally accessible 24/7/365, crypto is proving to be an important tool for activism and mobilization of resources. The transparency of public blockchains also allows blockchain data observers like Coin Metrics to verify and analyze the flow of funds to the Ukrainian-government addresses. As of Monday, March 7th 19:00 UTC, $18M of ether (ETH), $10M bitcoin (BTC), $7M of Polkadot (DOT), and $10M of USD stablecoins composed of Tether, USDC, and DAI had been received by Ukraine. The flow chart below shows the breakdown of total funds sent to Ukraine’s public BTC address Many different types of crypto assets and networks have been used to help fund Ukraine’s defense efforts and humanitarian relief. Last year, Ukraine was ranked one of the top countries adopting crypto on a per capita basis. Ukraine’s crypto fluency and broad knowledge of various blockchains and native currencies has likely contributed to the success and speed of the fundraising. Most contributions have been sent using the largest crypto assets BTC and ETH. But other crypto assets and dollar-backed stablecoins have been used. Even blue-chip NFTs have been sent including 1 of the 10K CryptoPunks, worth ~$150K. But the most liquid crypto assets have so far been the focus, as they are more likely to be accepted as a means of payment or readily exchanged for fiat currencies. Data from Coin Metrics’ ATLAS blockchain explorer shows that the Ukrainian government has moved most of the donated funds out of its wallets, with only ~$9M held in the balance of the wallets as of the time of the analysis. The analysis above shows the breakdown of funds that have moved from the Ukrainian wallets versus the amount that is still being held. Most of the funds are being sent to the Ukrainian exchange, Kuna, that helped set up the addresses. Note this does not necessarily mean the assets have been sold yet and might be held on the exchange still. However, the government has confirmed that it has spent at least $15M of the received funds and has found some suppliers that are willing to accept crypto as payment for items such as food packages, night-vision devices, bandages, and bulletproof vests. Looking at the addresses’ balances over time, the most liquid assets are being tapped the fastest. BTC and the US dollar stablecoin Tether (on Ethereum) are being spent the quickest (though big portions of the ETH and DOT have also moved). This is likely due to these crypto assets’ good liquidity profiles, or ease of trading and converting to fiat currencies. Demand for Tether in Ukraine has especially appeared strong recently. As Ukraine’s local currency, the hryvnia, has fallen versus the US dollar, demand for US dollar backed assets like Tether has increased with daily volume rising in the USDT-UAH market on Binance. Sources: Coin Metrics Reference Rates and Market Data Feed The Ukrainian government has expressed a goal of doubling the total amount of crypto raised to $100M in the coming days. Looking at the cumulative data, there is still a steady stream of donations coming in, albeit at a slightly slower pace. However, there have been some big jumps with large donors making considerable contributions over the last week. For example, Polkadot founder Gavin Wood donated $5M worth of DOT on March 1st. The number of ETH donations accelerated on March 2nd with the announcement of a potential token airdrop but have slowed since the plans were reconsidered for an NFT project instead. Despite the spikes in the data, the average contribution size has been relatively low. The average BTC donation sent has been 0.016 BTC (~$650) while the average donation of ETH has been 0.01 ETH (~$250). The large number of donations and modest average donation size suggests that the funds are coming from smaller contributors in addition to large crypto holders or so-called “whales.” Crypto-financial rails together with an active crypto populace have undoubtedly helped facilitate a fast and successful Ukrainian fundraising and aid campaign. The example of Ukraine’s crypto campaign is further evidence that as crypto adoption grows, so will its role in society as a medium of coordination and value transfer around meaningful causes. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Activity on Bitcoin picked up last week with active addresses rising over 9% week-over-week. Bitcoin fees, which have been particularly low over the past few months, increased slightly. The average fee of $4.31 on Bitcoin last Wednesday, March 2nd was the highest single day average since last December. However, this is still far below levels from spring 2021. Meanwhile the Ethereum fee market showed signs of cooling last week. The average fee on Ethereum on Saturday (March 5th) was $9.29 – under $10 in a single day for the first time since last August. Network Highlights  Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is’ and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 144

Tuesday, March 1, 2022

Tuesday, March 1st, 2022

Coin Metrics' State of the Network: Issue 143

Wednesday, February 23, 2022

Wednesday, February 23th, 2022

Coin Metrics' State of the Network: Issue 142

Tuesday, February 15, 2022

Tuesday, February 15th, 2022

Coin Metrics' State of the Network: Issue 141

Tuesday, February 8, 2022

Tuesday, February 8th, 2022

Coin Metrics' State of the Network: Issue 140

Tuesday, February 1, 2022

Tuesday, February 1st, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏