The Signal - Could India get caught in sanctions?

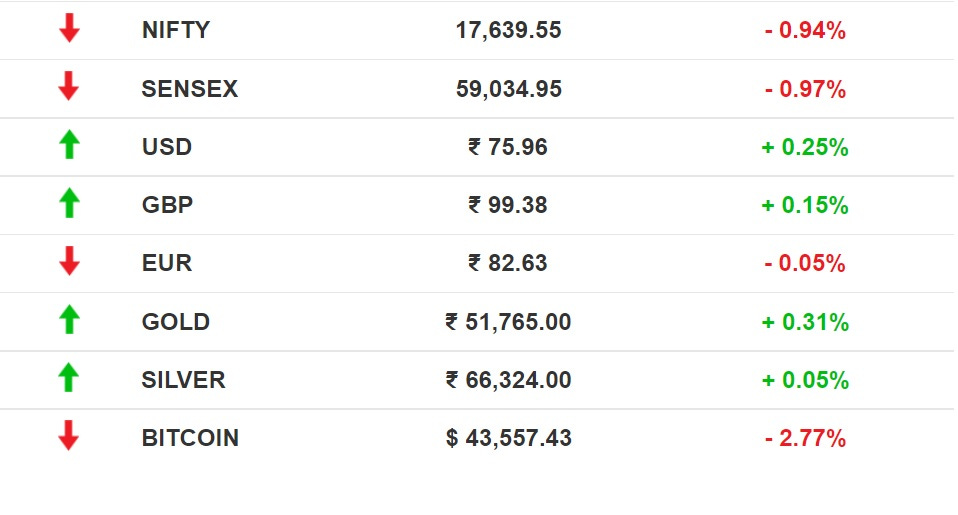

Could India get caught in sanctions?Also in today’s edition: MNC banks warn of holiday risk; Maruti runs low on market share; Unacademy fires 1,000; Copyright claims come for popstarsGM! See what we did there? That’s the new cool way of saying good morning in the crypto world. Apparently, it’s not just a fad but also a reaffirmation of your commitment to the blockchain ‘movement’. It’s the revolution. It’s a therapist. Folks would kill for GM. Well, you get the drift, don’t you? Ed Sheeran was recently involved in a legal battle over his song Shape Of You. There's a reason why there's a surge in plagiarism lawsuits in the music industry. In other news, supply chain disruptions are causing problems for India's auto industry. Maruti Suzuki has recorded a steep drop in market share. Tune in to The Signal Daily for more! The Market Signal*Stocks: Indian equities continued to follow global cues and trended lower ahead of the Reserve Bank of India's decision on interest rates today. Although a hike is not expected, investors will look out for a change in language. The central bank has committed to maintain an easy monetary policy to support the economy but is under pressure from rising prices. To add to it, the US Fed has indicated a further 50 basis point rate hike. Coffee Day Enterprises shares slumped by 9% after it defaulted on a ₹470 crore loan. Zee Entertainment shares slipped 3% after Invesco said it would sell its 7.8% stake in the company. MARKETSMourning Holiday Put Market At RiskLata Mangeshkar’s death on February 6, 2022, shocked the country. But investors in Indian stock markets were in for another shock the next day, a Monday, which was declared a general holiday to mourn the deceased singer. Except, it was not a trading holiday. What happened? While banks and forex markets were shut, the stock market was open which meant settlements had to be done. Brokers had to run from pillar to post to secure funds. Many mutual fund schemes could not arrange funds and numerous trades by foreign investors were not confirmed. What now? Six multinational banks—JP Morgan, Deutsche Bank, Citi, BNP Paribas, Standard Chartered and HSBC—have now written to NSE Clearing Ltd, the National Stock Exchange’s trade settler, to avoid such shocks in the future. They want stock markets to remain shut if banks do not function. AUTOMaruti’s Market Share SkidsMaruti Suzuki sold the least number of cars in FY22, causing its market share to slump to 43%. The last time it dipped that low was in FY14. Tata Motors drifted in, occupying a 12.1% market share. Roadblocks: Maruti braved the demonetisation phase but its dream run was halted. Blame it on tough competition and global supply chain issues that have not spared even luxury cars such as the Ford Mustang and the Chevy Camaro. Hike: Maruti Suzuki will hike prices of all its cars, its fourth in the past one year. Hero MotoCorp, Honda, and Toyota have raised prices too. There was a 3% decline in new vehicle registrations with the RTO in March 2022. RUSSIA-UKRAINE WARThus Far And No More, US Warns IndiaAfter several weeks of intense behind-the-scenes cajoling to get India to turn against Russia, the US has donned its whupping gear. Finger wagging: President Joe Biden’s economic advisor Brian Deese stated that the US is “disappointed” and warned India it would suffer long-term consequences if it got any closer to Russia. Biden dropped the first hint when he said India was the only country in the Quad that was “somewhat shaky”. Next, US deputy NSA Daleep Singh talked tough when he visited Delhi. Calling Russia China’s “junior partner”, Singh wondered if New Delhi expected Moscow to jump to its rescue the next time Chinese soldiers barged in through the border. Defence secretary Lloyd Austin told American lawmakers that India should scale down its weapons purchases from Russia. Austin said it was “not in their [India’s] best interest to continue to invest in Russian equipment”. At the UN, Russia was ousted from the General Assembly even as India abstained.

STARTUPSCanary In The Mine?In what could be the first sign of a startup funding winter, Unacademy is handing out pink slips to a 1,000 staff. Some of those laid off worked at Prepladder, a company that it acquired in 2020 in a burst of pandemic-fuelled expansion. Those fired include 300 educators as well as those in sales and other functions. Tough times: The firing speaks to the emerging environment for startups that rely heavily on burning cash to acquire business. Unacademy, which was valued at $3.4 billion when it raised $440 million from Temasek in August 2021, is said to be spending $15 million per month. Raising money is becoming tougher as big investors themselves are shaken and the cost of capital is rising. Unless, you choose your deals wisely, like rival UpGrad did. MUSICPopstars Face The MusicThe verdict is out: Ed Sheeran’s Shape Of You, the most streamed song in Spotify history isn’t copied. The art of lifting songs isn't new, and Sheeran's case won’t be the last. Dua Lipa is facing not one, but two cases of copyright infringement for Levitating. #nowlifting: It got easier to fall into a musical mess after artists Robin Thicke and Pharrel Williams coughed up a fine for copying “the feel” of Marvin Gaye’s song Got to Give It Up. It’s probably why Taylor Swift paid a percentage of writers’ credit to Right Said Fred for Look What You Made Me Do. The last word: At a time when there’s an extensive volume of music available across streaming platforms, how does one finger it down to serendipity or plagiarism? It doesn’t help that algorithms across Spotify and YouTube favour songs with a similar “DNA” for recommended playlists, putting pressure on artists to follow the beaten path. After all, isn’t everything a copy of a copy of a copy? FYIFunding rounds: Shopping rewards startup Fetch Rewards has raised $240 million, taking its valuation to $2.5 billion. Rigi, a social platform startup, is in talks to raise $10 million from investors, including Sequoia and Accel. Doubling valuation: Flipkart now plans to raise $60 billion-$70 billion from its IPO scheduled for 2023. This is nearly double the current valuation of the company. Bought a pie: Billionaire investor Warren Buffet’s Berkshire Hathaway has quietly built up an 11% stake in computer maker HP. Super app is here: Tata Neu has finally gone live for users across India. The super app offers a bouquet of services like groceries, payments, electronics, flight bookings, food delivery and more. POTUS warns Amazon! Joe Biden told the company about resisting unionising: “Amazon, here we come. Watch. Watch.” The SEC is, meanwhile, probing the retailer on how it uses third-party-seller data. Rouble returns: After being pummelled post-sanctions, the Russian rouble has recovered its value of pre-war levels. Checkpoint: Pakistan Supreme Court restores Parliament. Imran Khan will face no-trust vote on Saturday. FWIWBizarre-job alert: There's a job opening at the world's most remote post office in Antarctica. The JD involves counting penguins, maintaining historic artefacts and running a gift shop. Based on the "tiny" Goudier Island, off the Antarctic Peninsula, the site will be up and running for the first time since the pandemic. Message to future: Ireland's census form has included a time capsule. Of sorts. Locals are encouraged to leave a message to future generations to give them a glimpse into their ancestors’ lives. The messages will stay under wraps for 100 years. So far, people have created a comic, a music score, and an illustration of the Chris Rock slap at the Oscars. Off-grid: Hong Kong is “effectively off the map” as a global aviation hub, as the city continues to impose onerous restrictions, including a ban on inbound flights and quarantining passengers. It’s hardly a consolation that the isolation period is reduced to one week. Hong Kong is following one of the world’s strictest inbound travel curbs after a Covid-19 outbreak. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Paytm boss makes a vow

Friday, April 8, 2022

Also in today's edition: It's Musk vs SEC; Short video players load up on cash; WarnerMedia loses head; Akasa squeezes rival even before take off

Could India get caught in sanctions?

Friday, April 8, 2022

Also in today's edition: MNC banks warn of holiday risk; Maruti runs low on market share; Unacademy fires 1000; Copyright claims come for popstars

Paytm boss makes a vow

Thursday, April 7, 2022

Also in today's edition: It's Musk vs SEC; Short video players load up on cash; WarnerMedia loses head; Akasa squeezes rival even before take off

Musk boards Twitter

Wednesday, April 6, 2022

Also in today's edition: No one percenters in crypto; Inflation bites RBI; Disney+ Hotstar plugs into Chinese AI; No woke chatter at Amazon

Singapore co gets proxy sanctioned

Tuesday, April 5, 2022

Also in today's edition: Banking behemoth in the making; MPL to enter Web3? There's a startup M&A boom; All eyes on Tether

You Might Also Like

🎟️The Quest is calling you

Tuesday, November 26, 2024

And why the HubSpot Blog ages in reverse ... View in browser hey-Jul-17-2024-03-58-50-7396-PM Don't write off a scavenger hunt as mere kids' play. A well-designed hunt can move attendees closer

New Pricing & Black Friday Deal

Tuesday, November 26, 2024

Some updates to my lead program for design agencies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)

Rox

Tuesday, November 26, 2024

How to Manufacture Path Dependence in Applied AI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are You Doing Cross Promotions Wrong?

Tuesday, November 26, 2024

Want Growth? Stop Sleeping on Cross Promos 🔑

This new ad format can boost sales by 15%

Tuesday, November 26, 2024

It's Thanksgiving Week, and online shopping activity will peak in a few days. You may be noticing more shoppable ads this year–interactive ads that allow customers to buy directly from the ad

Why Is Bitcoin's Price Dropping Right Now?

Tuesday, November 26, 2024

Listen now (3 mins) | Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏