Surf Report - Surf Report: Priority ingestments

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

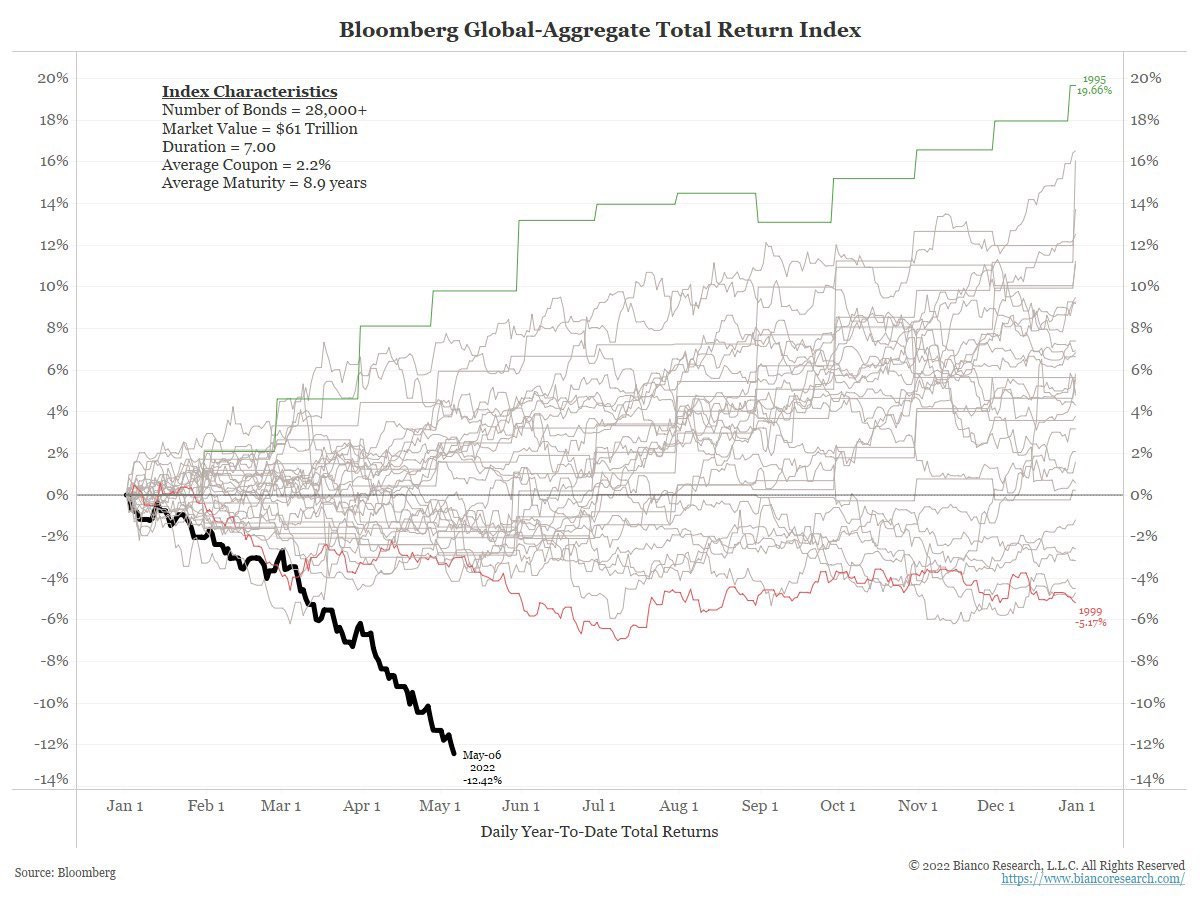

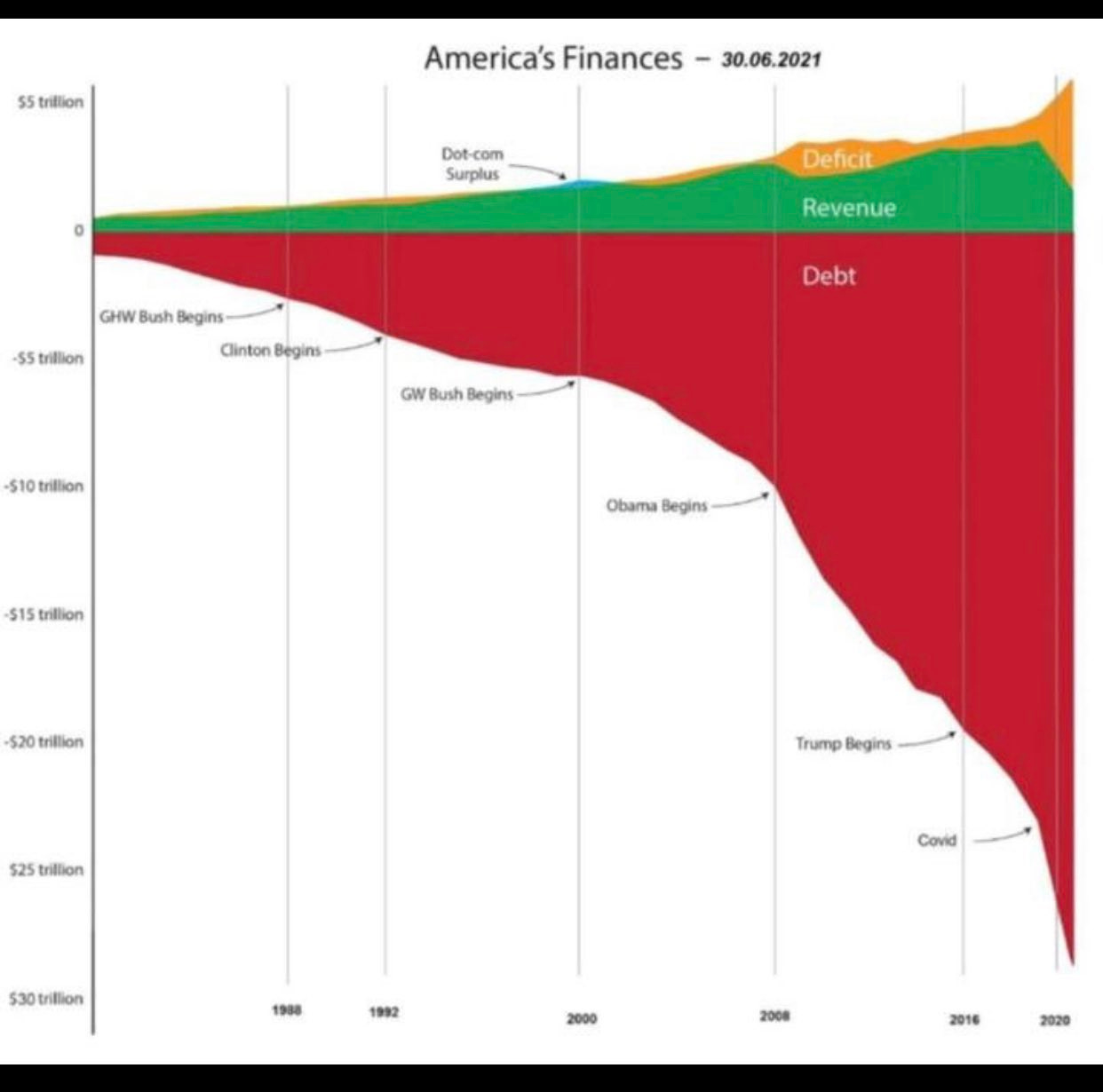

Hi everyone—I’m so glad to have you here. What a week. The difference between food and nutrition largely comes down to the difference between quantity and quality. Having vs. being. Consuming a sufficient amount of calories of food is a simple matter of near-term life and death, but it’s the appropriate choosing of the types of food eaten over time that will influence the long-term duration and nature of the life. Having enough is vital. Being well is, unfortunately, entirely optional. As it happens the world is currently on the verge of an actual food crisis, the result of a deeply unhealthy financial diet maintained over the course of decades. The literal and the figurative are officially swirling together in a sour vortex of distended price signals and cancerous asset growths. Arteries are strained, blockages abound, drugs are being pumped into the system to mask the pain… the cumulative iatrogenic effect has left the world confused about whether the disease or the treatment is causing more harm at this point. (It might sound like I’m exaggerating the severity here, but Brazil's Agriculture Minister literally said on Wednesday that the world is set to face a food crisis.) How bad is it? Well, first of all U.S. planting progress is extremely behind schedule compared to last year: for example, only 14% of corn crops have been planted as of last weekend compared to 42% a year prior, and the condition of wheat crops is currently the worst for any date since 1996. We also have a major fertilizer shortage. Much like feeding a body, the effects of these shortages in both quality and quantity will be felt later and are not immediately apparent. And because you are what you eat and also what what you eat eats, the effects propagate up the food and agriculture chain in a ripple effect that I worry people are still underestimating. Add to this the fact that the string of fires and explosions in food processing plants continues to accelerate, all scuttled out of major news coverage for some reason and no prominent investigative journalist curious enough to look into it. Not sure what to say about this, just wanted you to be aware that it is happening and will almost certainly provide the justification needed for more government intervention and control in order to Help The Situation™️. But biological food is just one part of the global societal organism. Our mechanical sources of energy are also on life support. The US east coast is currently running out of fuel, with inventories of diesel dropping to the lowest absolute level in at least 32 years and NY & L.A. diesel prices hitting new records. This particular hydrocarbon is of obvious importance to trucking & global shipping, whose role in the supply chain is to transport the food and make it accessible, but diesel is also used for making solar and wind power infrastructure. (And don’t look to Main Street as a marker of economic health either: 34% of retailers couldn’t make rent in April.) All of this has finally made its way to the central nervous system of our global financial system: the bond market. Vanguard's Total Bond ETF has fallen all the way back to its 2007 inception price, which needless to say is a strange thing for the supposedly “safe” and “predictable” fixed income instrument to do, wouldn’t you say? 🧐 People want out of debt markets, even longtime fans. The biggest Treasury buyers outside the U.S.—Japanese institutional managers—are quietly selling billions (I’m not sure how quiet it is if it’s a Bloomberg headline…), and part of the reason has to do with the balance sheet being jacked up. U.S. trade balance has gone vertical in the wrong direction, with the deficit surging to a record high of $109.8 billion in March, topping $100 billion for the first time in history. This is what happens when a country doesn’t produce anything except money out of thin air and needs to import everything material from overseas. “We’re good for it! We’re the US! Just put it on our tab!” It appears banks and governments around the world are finally looking at the tab. Don’t expect to hear any of this from the talking heads inside your television set though. No, to hear our own government tell the story: things are going great, and we’re on the mend thanks to the [checks notes] “American Rescue Plan.” Jobs are up, they say. You should be thanking us! We’re rescuing you!! STOP SQUIRMING!!! This is a classic case of gaslighting. You are not crazy, but they are trying to make you think you’re crazy by insisting that what you experience going on is not, in fact, what’s going on. Don’t forget, it’s an election year. The mendacity will only get worse.  Secretary Janet Yellen @SecYellen April’s jobs report is a strong sign for our recovery — the economy created 428k jobs & the unemployment rate is near a 50 year low. Our labor market is recovering far quicker than past recoveries, in large part thanks to actions by @POTUS & passage of the American Rescue Plan.The government and its cadre of 3-letter agencies are also trying to normalize buying 'value brands' to cope with the rising cost of living. Also, don’t buy houses, live in pods instead. Don’t eat meat, eat cheap processed substances that have great profit margi—er, will save the planet! Are these new lab substances good for you? Wrong question! It’s all you can afford now. ✨ And this past week, in the very non-transitory inflationary year of two thousand twenty-two, what did the central banking cartel do to finally Help™️ the situation? They raised interest rates 0.5% and announced plans to sell off $95B in Treasury bills and mortgage bonds every month, trying to further tighten into an already rapidly tightening economy. They are quite literally, and apparently, trying to make things worse at this point. The time to do these things was 2 years ago before they printed money and stuffed it into people’s pockets to create artificial demand for which there was no supply to meet it. At least then there was a chance of tightening to work. Now, there is zero chance. But they can delay the inevitable for a long time, so don’t mistake this as a reason to panic. It’s a reason to be pissed off, sure, but do not underestimate their ability to hide negative consequences and obfuscate culpability. If there’s one thing they are skilled at, it’s that. Fed Chair Jerome Powell—the guy who rejected inflation warnings a year ago and said he saw only mild inflation ahead and actually committed to increasing inflation back in 2020—was renominated and is still in charge of the central banking cartel. And never forget that he was caught illegally trading stocks during the restricted FOMC blackout period, and lied about muni bond conflicts. Most people don’t know or care about any of this. And that’s part of the problem. Let’s not lose perspective here, all this financial mumbo jumbo is unnecessarily complicated and admittedly given far too much credit as it is. They’re trying to make it look like they’re doing something. The facts that matter are:

In health terms, this crisis has led to something akin to chronic fatigue. Regular folks just can’t catch a break or keep up with the compounding reduction of their purchasing power. None of the stock indices are returning more than the increase in the money supply, though a little bitcoin added to your portfolio goes a long way. It’s no coincidence that bitcoin’s rise from ~$3000 in March 2020 to its current range between $30,000-$69,000 occurred amidst this economic backdrop. It’s an asset that’s only been gaining more mainstream acceptance and adoption, not just as a savings instrument but also as medium of exchange: $13.1 trillion was paid in Bitcoin last year, which is 20% more than the value of payments settled by Visa, the world's biggest private payments processing network. To even the initially skeptical, bitcoin has proven itself to behave more like a vitamin rather than rat poison. A nutrient-rich supplement. But, as with actual diet & nutrition: to each their own. One of the main problems with centrally planned regulation and blanket policy enforcement is that they leave no room for the particulars and unique needs of individuals. Penicillin can save your life or kill you depending on who you are and how your body reacts to it. A central planner sees no such distinction. The idea of individuals making their own choices on their own without a central planner to guide them makes no sense to an entity that see and thinks only in aggregates, averages, and models. From the vantage point of an academic cloister where truth exist in spreadsheet form only, you are nothing more than a rounding error. Right now the global financial markets are deeply unhealthy, but that doesn’t mean there aren’t opportunities for individuals acting within those markets to flourish at a local level. Though the emergent effect right now appears to be an economic heart attack, each of us specifically has an opportunity to prepare and navigate accordingly. However, what works for you will almost certainly not be what you’re being told to do by those who don’t share your resulting fate. What you put into your body and your portfolio make all the difference. No one will care about your health & wellness more than you, and this is especially true with your financial wellness. So eat, drink… but be wary. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Cultural Rot

Sunday, May 1, 2022

Listen now | Issue 74: 05.01.2022

Surf Report: Fury road

Sunday, April 24, 2022

Listen now | Issue 73: 04.24.2022

Surf Report: Dogs and tails

Sunday, April 17, 2022

Listen now (12 min) | Issue 72: 04.17.2022

Surf Report: Wakey wakey

Sunday, April 10, 2022

Listen now | Issue 71: 04.10.2022

Surf Report: You don't own me

Sunday, April 3, 2022

Listen now | Issue 70: 04.03.2022

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏