The Daily StockTips Newsletter 05.24.2022

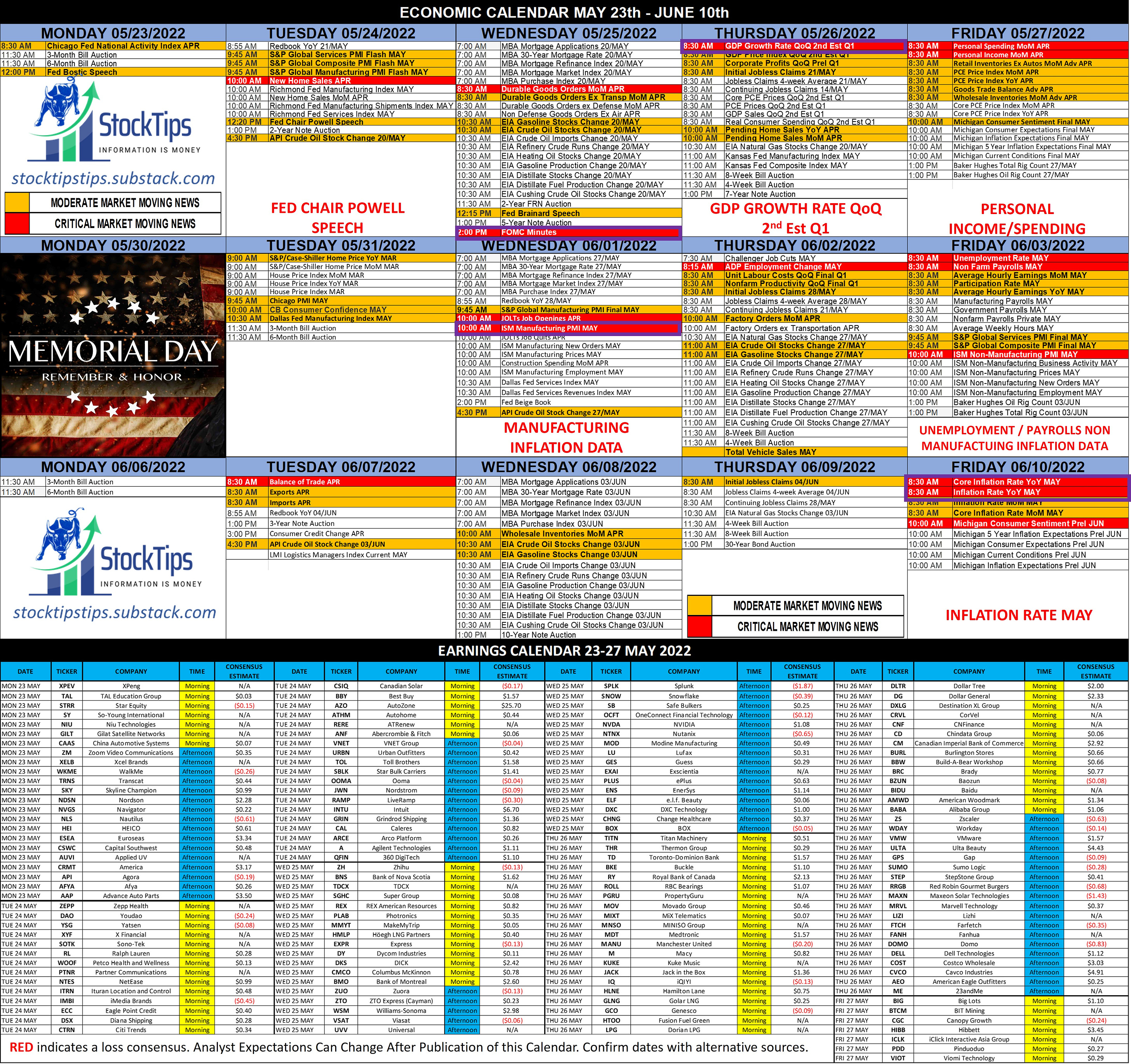

The Daily StockTips Newsletter 05.24.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. TODAY’S MORNING EARNINGS: ZEPP DAO YSG XYF SOTK RL WOOF PTNR NTES ITRN IMBI FRO ESLT ECC DSX CTRN CSIQ BBY AZO ATHM RERE ANF TODAY’S AFTERNOON EARNINGS: VNET URBN TOL SBLK OOMA JWN RAMP INTU GRIN CAL ARCE A QFIN IT’S A BATTLE OUT THERE: Shorts are looking for catalysts to take the market lower & longs are looking for catalysts to squeeze the shorts out & take the market higher. On the whole, the market is bearish. Yesterday pumped on Biden’s comments on possible reduction of China tariffs, just like the catalysts of Target & Walmart’s earnings were all the shorts needed to take the market lower. Now with uncertainty in the air & a plethora of market moving news on the economic calendar, we are once again facing red futures. Yesterdays pump was largely on tariff reduction speculation that has not been realized … which makes it a pump of no consequence. Seems this morning we’re going to pay for it as poor SNAP earnings provide the downside catalyst prior to housing data & a speech from Jerome Powell. FOMC minutes are due out tomorrow followed by the revised Q1 GDP read on Thursday, & personal income/spending on Friday. BIDEN TO DO AWAY WITH TRUMP/CHINA TARIFFS?: Yesterday President Biden claimed with regard to repealing China tariffs, "I am considering it. We did not impose any of those tariffs. They were imposed by the last administration and they're under consideration.” The question as to if Biden follows through will demonstrate whether Biden is an animal of ideology or practicality when it comes to this issue. Practically it makes sense to reduce or eliminate tariffs on China. It would certainly help ease inflation OVER TIME. Politically, it both makes him look weak on China & runs the risk of angering both unionized labor & farmers. Indeed if he repeals some tariff’s I am certain there will be some industries harmed which will provide plenty of red meat for his opposition to hit him over the head with … which is odd … because prior to President Trump, the Republican Party was the party of free trade. Political & economic considerations aside, Biden’s statement yesterday was enough to gain us a market rally. However there are plenty of traps left in this week’s minefield as the economic calendar demonstrates. In short, yesterdays deep green day was a “pump of no true consequence.” What do I think he’s going to do with respect to China tariffs? Well seeing as he isn’t going to get anything but a negligible economic response between now & election day, he may implement some measures of no true substance to mitigate some criticism on the economic front. But the longer he waits to do so the less likely he is to do it prior to the midterm elections. It is obvious that his political staff & his economic advisors disagree on the way forward. Still, they will not want to reduce tariff’s without getting some like concessions from China. So it would surprise me if he did anything substantive on these tariffs prior to the midterms. So what do a reduction in China tariffs mean to you? A temporary short opportunity in Vietnamese related stocks & ETF’s & a temporary market rally like the one we saw yesterday. Great for day traders … but not much use for long term investors in the short run. UPCOMING MARKET MOVING ECONOMIC NEWS:

Significant News Heading into 05.24.2022:

PAID CONTENT IN THE PAYWALL BELOW: (BUY LIST WILL BE UPDATED SOON)

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.23.2022

Monday, May 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.20.2022

Friday, May 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.19.2022 (AMKR & SAFM REMOVED)

Thursday, May 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.18.2022

Wednesday, May 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.17.2022

Tuesday, May 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏