The Daily StockTips Newsletter 05.26.2022

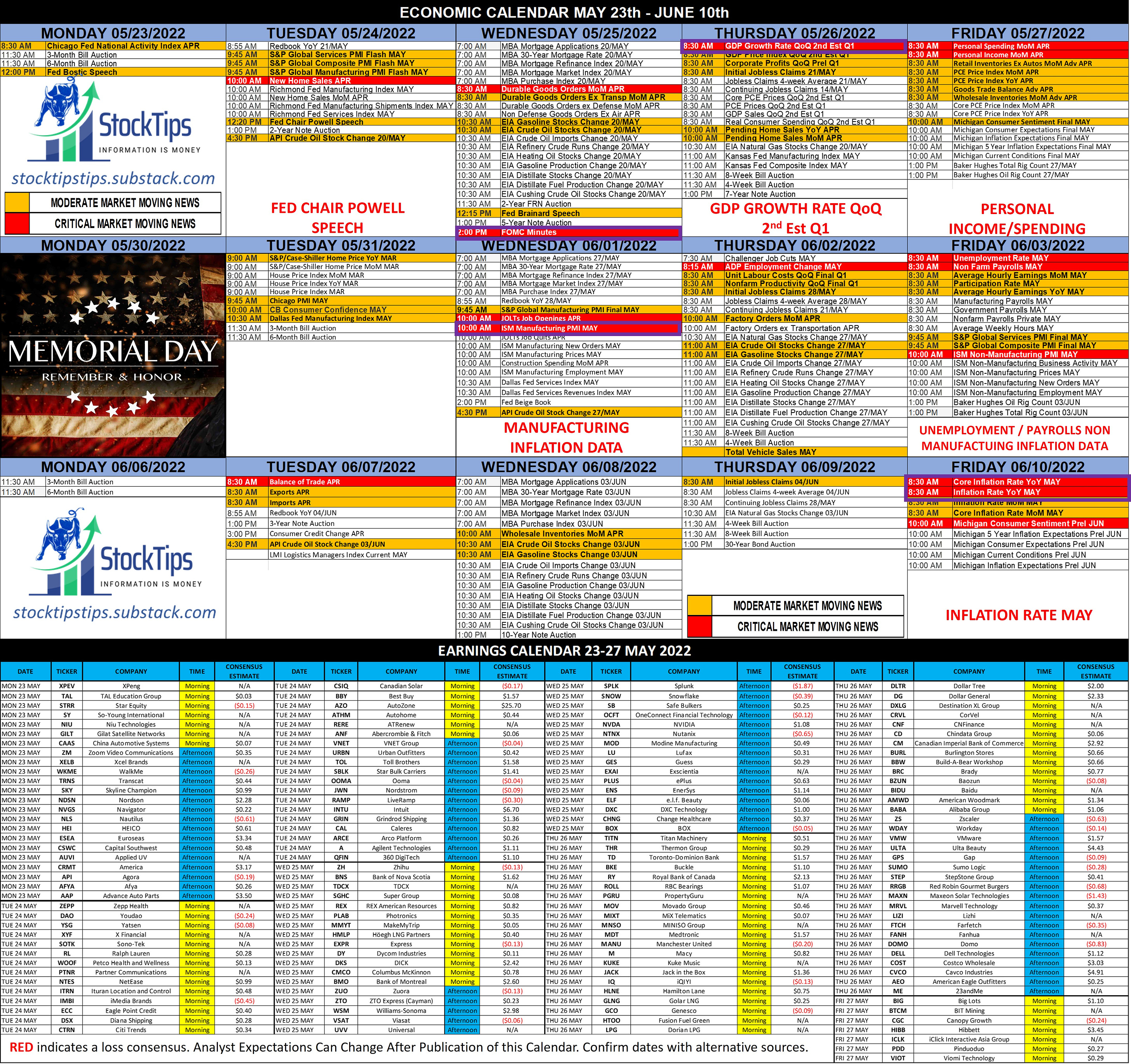

The Daily StockTips Newsletter 05.26.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. TODAY’S MORNING EARNINGS: LNVGY TITN THR TD BKE GASS SNT RY ROLL PGRU MOV MIXT MNSO MDT MANU M KUKE JACK IQ HLNE GLNG GCO HTOO EVGN LPG DLTR DG DXLG CRVL CNF CD CM BURL BBW BRC BZUN BIDU AMWD BABA TODAY’S AFTERNOON EARNINGS: ZS WDAY VMW ULTA GPS TARO SUMO STEP RRGB MAXN MRVL LIZI FTCH FANH DOMO DELL COST CVCO AEO ME YESTERDAYS DURABLE GOODS DATA: Analysts expected a 0.6% increase in month over month durable goods orders for April. Actual orders came in at 0.4%. Remember that durable goods are those goods, usually more expensive than disposable goods, that are expected to last longer than 3 years. Cars, furniture, & appliances, are all some examples, but as always the devil is in the details. For a more concise breakdown & understanding of yesterdays data SEE HERE. YESDTERDAYS FOMC MINUTES: The markets really liked this! It seems the Fed is likely (But be careful as things are fluid) to engage in another couple of 50bps rate hikes in June and July before a pause in September. I’m not certain this will help inflation at all over the long run, but it certainly seems as though the Fed is trying to play a balancing act between taming inflation & calming the equity markets. Right now, the equity markets seem to have undue influence over the Federal Reserve’s decision making, which isn’t exactly why the Fed exists. But the “dreaded” 0.75bps hike? Off the table if the FOMC Minutes are any indicator. Of course the Fed also want’s to slow economic activity down, but not to the point where the housing market suffers a significant reduction in home buying activity … which is kind of unavoidable. Remember that the Fed begins offloading the balance sheet on June 1st, meaning they will be reversing quantitative easing & sucking money out of the economy. TODAY’S ECONOMIC CATALYSTS: Today at 0830ET we will received the revised Q1 GDP Growth Rate (Second Estimate). Analyst expect a -1.3% QoQ GDP contraction. The GDP Price Index, which measures changes in the prices of goods and services produced, is expected to come in at +8%. This is likely to dominate economic headlines today. If the numbers are more favorable than expectations, it kind of sets us up for poor numbers in Q2. If less than relatively favorable, the markets will likely decline. With the reduction in home sales, inflation, & slashed tax returns due to folks getting their child tax credit front loaded last year, I’m not too excited about the eventual Q2 release. Other spoilers today could be the pending home sales (-2% MoM expected 1000 ET), & initial jobless claims for 21 May (215k expected at 0830 ET) BUY LIST UPDATE: I’m under a lot of pressure to find plays for you folks (both long & short) to add to the BUY LIST. However the market is too low to short & too bearish to buy. Valuations, given my economic outlook, are garbage in my opinion. Stocks could certainly go lower … indeed they SHOULD go lower. The earnings I’ve been tracking this season are nothing more than underwhelming. In the interim I’ve been posting the daily insider buys/sells above $50,000 in the paid section of the newsletter (under yesterdays earnings tracker), which can generally be used for a quick & easy profit depending on the market conditions & circumstances surrounding the buy/sell. You will note that insiders are selling much more than they’re buying. I’ve also posted the upcoming IPO Lockup & Quiet Period expirations in the paid section which are usually preceded by selling pressure. UPCOMING MARKET MOVING ECONOMIC NEWS:

Significant News Heading into 05.26.2022:

PAID CONTENT IN THE PAYWALL BELOW: (BUY LIST WILL BE UPDATED SOON)

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.25.2022

Wednesday, May 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.24.2022

Tuesday, May 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.23.2022

Monday, May 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.20.2022

Friday, May 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.19.2022 (AMKR & SAFM REMOVED)

Thursday, May 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏