The Daily StockTips Newsletter 05.27.2022

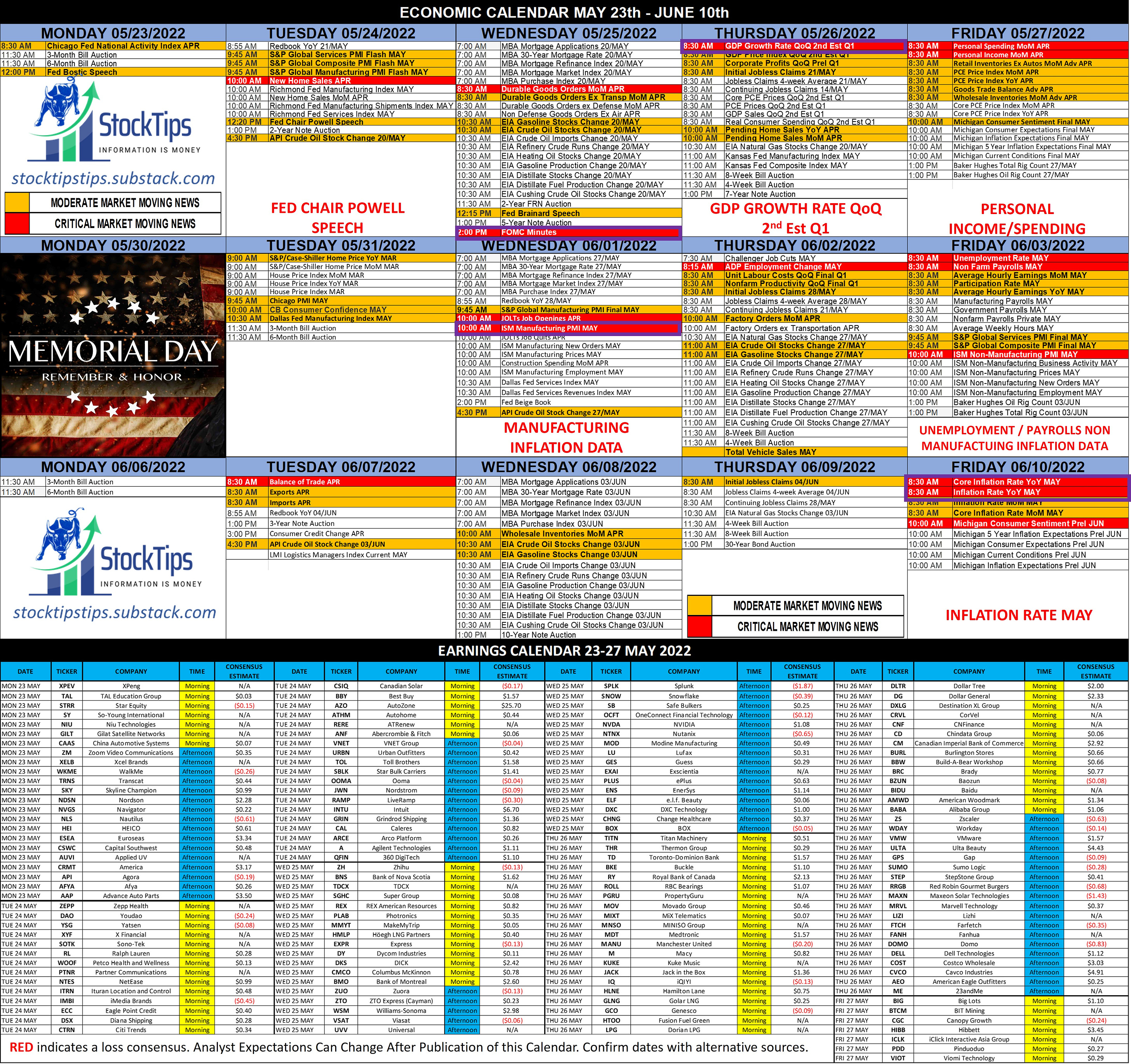

The Daily StockTips Newsletter 05.27.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. StockTips is NOW on Odyssey: I’ve been trying out a new Discord like chatroom called Odyssey. I’ve set up a channel HERE. I agreed with one of the developers that I would give it a try. Although I reeeaaaalllly hate Discord. Thus far I find Odyssey a far superior & more manageable platform. Nevertheless if you’re interested you may find StockTips here. I think it may only be for Apple devices thus far, but don’t quote me on that. I think its a great way to ask questions, chat, or contact me as you feel necessary. TODAY’S ECONOMIC CATALYSTS: Today the largest economic catalyst will be Aprils personal income & personal spending data MoM 0830 ET. Consensus personal income is expected to increase 0.5% … same as March. Consensus personal spending is expected to increase MoM by 0.7% … down from March’s 1.1%. I highly recommend you pay attention to todays (April) Wholesale Inventories & Personal Consumption Expenditures (PCE) Price Index (Both reported at 0830 ET). If inventories skyrocket it can mean firms are having trouble making sales, which means all those overpriced highly inflated goods they bought will need to be slashed in price to move product & remain competitive. This is great for lowering inflation, though not so good for company earnings. So keep an eye on it. Wholesale inventories are expected to come in at 2% higher MoM. The PCE index is the Federal Reserves FAVORITE INDICATOR OF INFLATION. The forecast comes in at 6.4% YoY & 0.3% QoQ. I don’t see any consensus analysts estimates. Consensus for Core PCE is 4.9% YoY & 0.3% MoM. All reported at 0830 ET. Retail inventories (excluding Auto’s) are forecasted to increase 1.5% MoM (No analyst consensus). Finally we have the always popular consumer sentiment for May 1000 ET. (59.1% Expected). SPECIAL MENTION: The May ISM Manufacturing PMI (an inflation indicator) will be released next Wednesday 1000ET. The month to month numbers imply an increase or decrease in production. Consensus comes in at 55.3 whereas April came in at 55.4. TODAY’S MORNING EARNINGS: VIOT PDD ICLK HIBB CGC BTCM BIG TODAY’S AFTERNOON EARNINGS: NTZ YESDTERDAYS ECONOMIC DATA:

BUY LIST UPDATE: I’m under a lot of pressure to find plays for you folks (both long & short) to add to the BUY LIST. However the market is too low to short & too bearish to buy. Valuations, given my economic outlook, are garbage in my opinion. Stocks could certainly go lower … indeed they SHOULD go lower. The earnings I’ve been tracking this season are nothing more than underwhelming. In the interim I’ve been posting the daily insider buys/sells above $25,000 in the paid section of the newsletter (under yesterdays earnings tracker), which can generally be used for a quick & easy profit depending on the market conditions & circumstances surrounding the buy/sell. You will note that insiders are selling much more than they’re buying. I’ve also posted the upcoming IPO Lockup & Quiet Period expirations in the paid section which are usually preceded by selling pressure. Significant News Heading into 05.26.2022:

PAID CONTENT IN THE PAYWALL BELOW: (BUY LIST WILL BE UPDATED SOON)

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.26.2022

Thursday, May 26, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.25.2022

Wednesday, May 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.24.2022

Tuesday, May 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.23.2022

Monday, May 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.20.2022

Friday, May 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏