The Daily StockTips Newsletter 06.17.2022

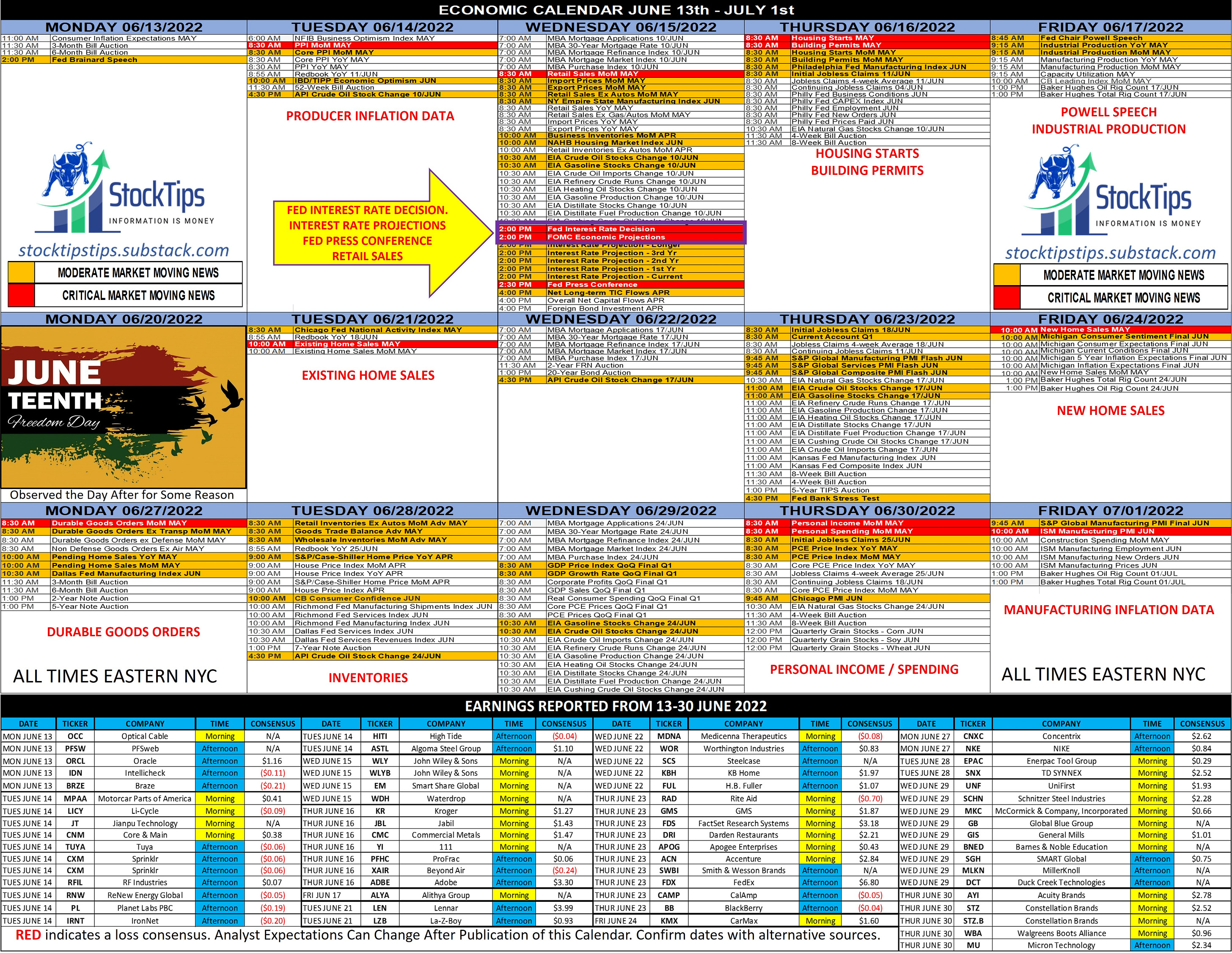

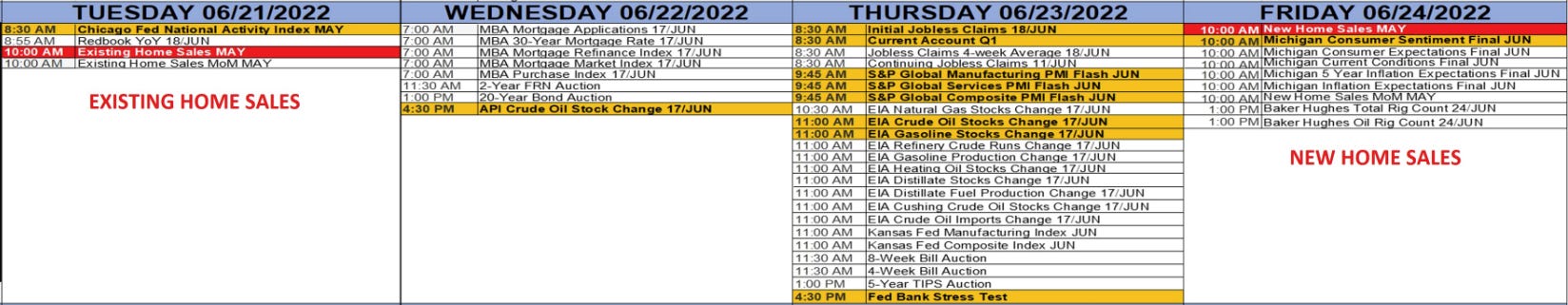

The Daily StockTips Newsletter 06.17.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. StockTips is NOW on Odyssey. It’s like discord but better in my opinion TODAY IS A QUADRUPLE WITCHING DAY!!: Don’t forget TODAY’s OBSERVATIONS: What a selloff huh? I certainly indicated yesterday there would be some rate hike remorse. The question is: Does the selling continue into Friday? I haven’t a clue. But valuations are nowhere near where I think they should be given current economic conditions, rate hikes, inflation, a declining housing market (yesterdays housing starts were atrocious) , decreasing margins, lower retail spending, increasing credit card debt, & increasing energy costs. Listen, I firmly believe the market is going lower. There are very few stocks I think we should go long on. In this market, you either go short or don’t invest at all. Even reliably profitable companies that are at bargain valuations are selling off. Don’t expect buy side rationality in this market. There may be some major short covering that sends the markets higher & longs who think the market is oversold given what they see in the lives of every day Americans (travelling / shopping / vacationing & such). However I continue to assess that current economic conditions will lead to much lower valuations as the year moves on. Be careful out there! POLITICAL RISK: There is a great amount of political risk in the markets as well. Let’s face it … no matter which political party you favor, it would be an understatement to say it isn’t looking good for Democrats. The amount of desperation amid the Democratic Party right now is real! It’s gotten so bad, President Biden is actually sending his Energy Secretary to meet with oil companies … & he himself may even meet with them virtually! This is a last dich effort, as he has offered to meet with everyone on producing more oil EXCEPT the oil companies. Now … I’m keeping an eye out for some major desperate unilateral initiatives in a frenzied attempt to switch the script prior to November elections. Student loan forgiveness is certainly on the table, but so too is invoking the Defense Production Act for everything from oil to baby formula (which he has already done for baby formula). The point I’m trying to make is that the Federal Government is certainly eyeballing mandating the economy from the top down, & the threat of government intervention is only going to get worse as the economy declines into recession. So this is yet another thought we ought to have when picking stocks. The economic outlook looks bleak … & there will be ample attempts in the future by both Democrats & Republicans to interfere with economic affairs as a result. NEXT WEEK: Next week is a 4 day week due to the Monday observance of Juneteenth. We will get more housing data … which is bound to disappoint. Indeed the analyst estimates are likely being revised as we speak ... so I wont go into those. Just remember that housing & the financing thereof is a major driver of the US economy! EARNINGS REPORTED ON 17 JUNE 2022: ALYA, JT. BUY LIST UPDATE: It’s always tough after a market dump to add either long or short plays. Be patient folks. All of the suggested short plays I posted earlier worked marvelously! But I’m hesitant to add more given the market lows. It seems to me that shorts are holding & when they cover the markets will rally. PAID CONTENT IN THE PAYWALL BELOW: 1 Stocks on the BUY LIST near/at/above the Buy Zone (Waiting to Swing) / 1 Options Strategy / A Detailed Breakdown of Yesterdays Earnings Beats & Misses / Most Recent Insider Buys/Sells / IPO Lockup & Quiet Period Expirations / 19 Stocks on the Price Based Assessment Watchlist / 3 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer) / 3 Stocks on the Highly Speculative Highly Volatile Small Cap List (Read the Warning/Disclaimer) / 5 Stocks on the short possibilities list. 👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 06.15.2022

Friday, June 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.16.2022

Friday, June 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.14.2022

Tuesday, June 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.13.2022

Monday, June 13, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.10.2022

Friday, June 10, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏