The Daily StockTips Newsletter 07.21.2022

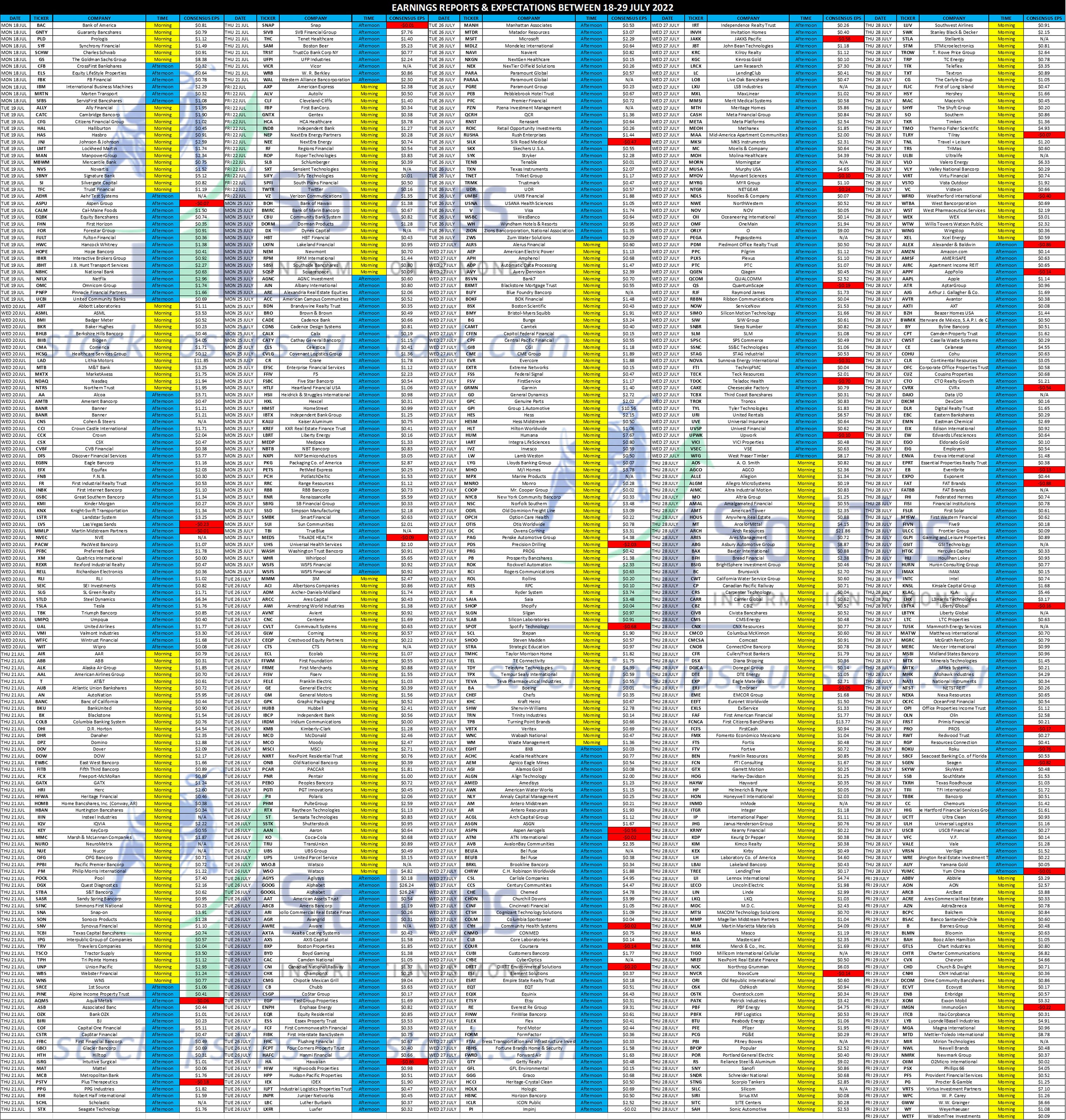

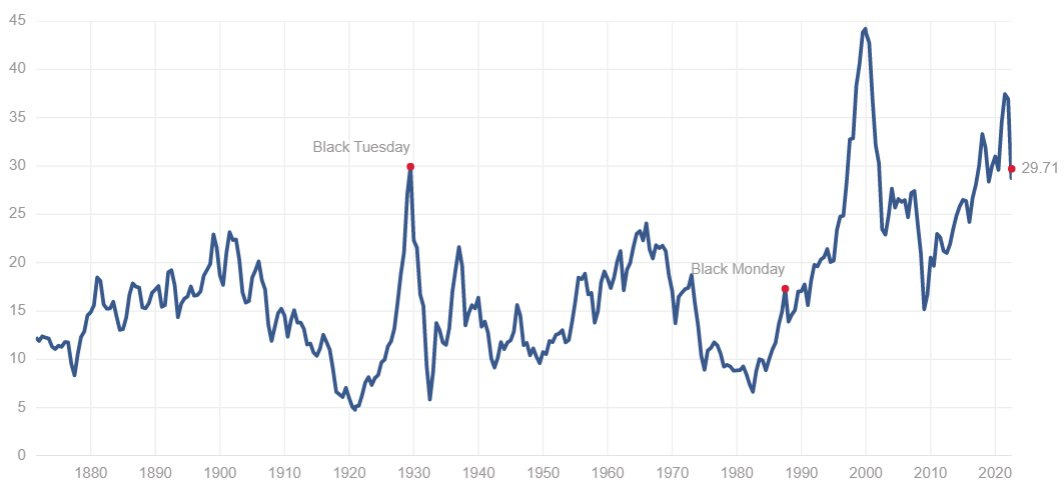

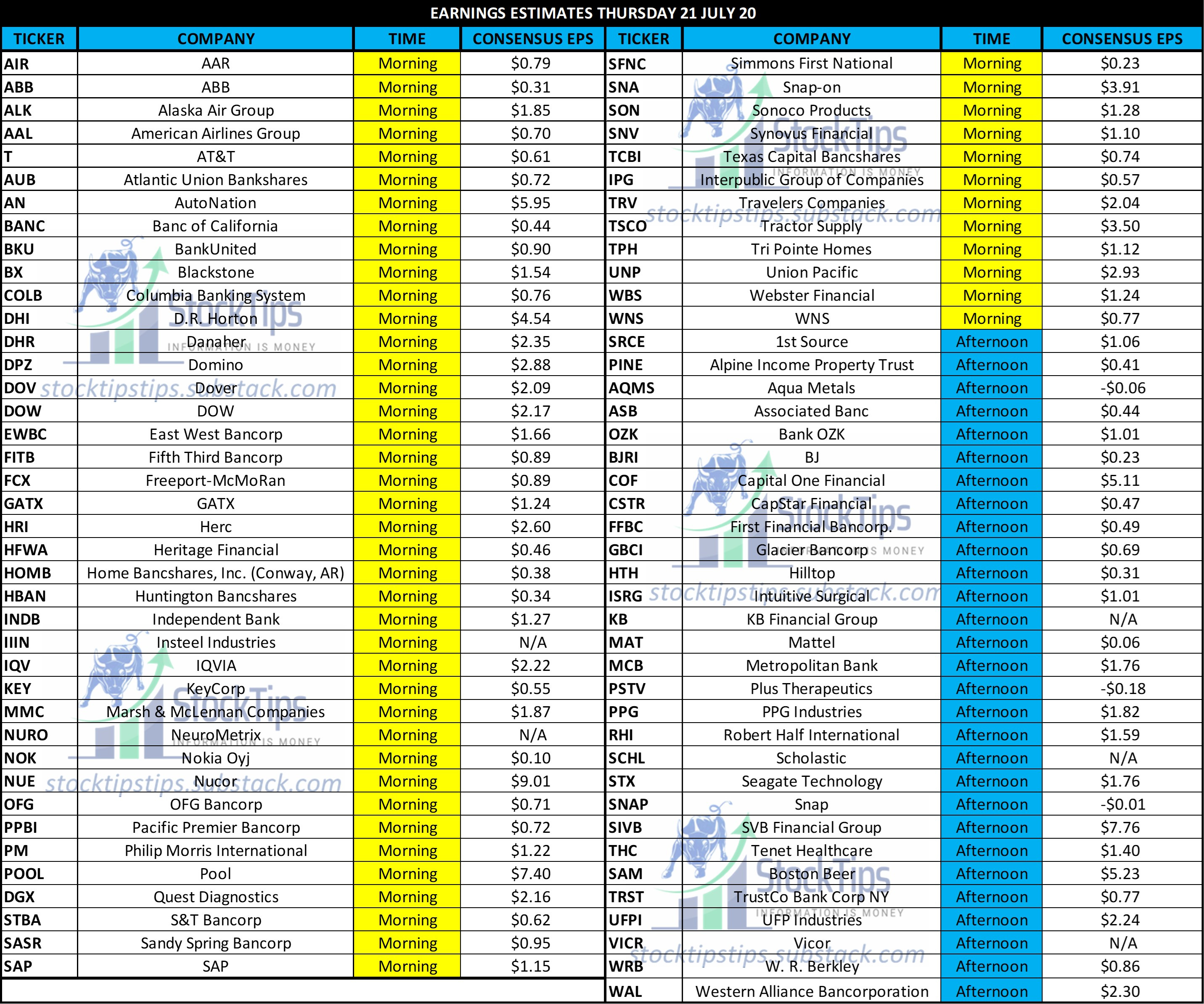

The Daily StockTips Newsletter 07.21.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. PAID SUBSCRIBERS: In the paid section we still have one short play (legging in slowly). I have also posted yesterdays insider trades & major earnings results. WHATS GOING ON?: Shorts have covered, the market is well aware that there wont be any surprises for a week or so, & Russia is opening up gas to Europe. Many earnings are beating analysts expectations, but expectations weren’t that high to begin with. It’s only a matter of time before the market figures this out. Yes, earnings are less lackluster than expected, but they’re still garbage. It’s important to remember that an “earnings beat” only means that a company is beating “analysts consensus.” Nevertheless I love it! What typically comes after such a scenario is the market rally’s & prices in earnings beats as if they’re something to gawk at. Then earnings hit, they may or may not beat expectations, & the stocks sell off. Retail then complains that “they beat, why isn’t the stock going up!!??” It’s because it got priced in early & another catalyst won’t be here until another quarter from now. I’ve seen this scenario time & time again. THE SHILLER PE RATIO: The Shiller PE Ratio is the average inflation-adjusted earnings from the previous 10 years. As you can see, the market is trading as if the street expects the post COVID boom to continue … trading 29.71 times historic inflation adjusted trailing earnings. For the last 100 years the avg & median Shiller P/E ratio has been around 15 or 16, spiking up significantly higher often before market crashes. The market briefly touched 15 in 2020, but took off again on stimulus spending & low interest rates. The all-time high in the Shiller P/E ratio was Dec 1999, when the figure reached 44.19 (Dot-com bubble). Currently she sits at an inflation adjusted 29.71 after coming off of the high 30’s earlier this year. The Shiller PE has been this high only two times in our history. Indeed I like the Shiller PE Ratio, because it takes inflation into account. And as companies register their earnings this season, you will especially want to consider how the profit margin measures up to inflation. Can a company with a 1%-9% YoY profit margin continue to operate under these highly inflated conditions & be considered profitable? Or are they just keeping up with inflation? Something to think about! Certainly the company is nominally growing at 1-9%. But can they hire, pay utilities, make repairs, replace goods/materials/inputs, grow, & compete with like companies in the future, when all of their profit is simply going to replace what they just sold? Perhaps the business will take on a loan to replace goods until better times… but at what interest rate? (Think about the Fed). Better yet, think of it this way; if your household budget is 9% more expensive than the year before but your pay is 4% higher than the year before, are you better off than the year prior? Are you going to spend or save more in terms of REAL spending power? And would you invest in the S&P when companies are trading 29x trailing earnings in a REAL inflation adjusted trailing PE? Still think this market rally is justified? Look at the margins in these earnings folks! ECONOMIC NEWS: Yesterday’s June Existing Home Sales came in at 5.12m. 5.38m was expected. Also lower than we were prior to the pandemic. That’s about all the major market moving news we have for the week. It is my firm belief that the market is rallying on the notion that there is no major surprise market moving economic data to be reported for some time. Even next weeks Fed rate hike & press conference isn’t likely to surprise. Earnings, from what I have seen thus far, are still lackluster. WORLD MARKETS:

RECOMMENDED:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 07.20.2022

Wednesday, July 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.19.2022

Tuesday, July 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.18.2022

Monday, July 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.15.2022

Friday, July 15, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.14.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏