DeFi Rate - This Week In DeFi – July 22

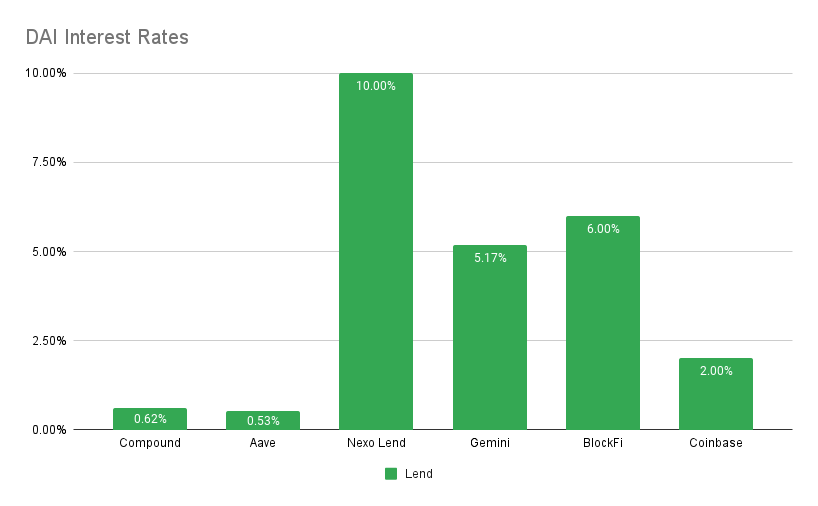

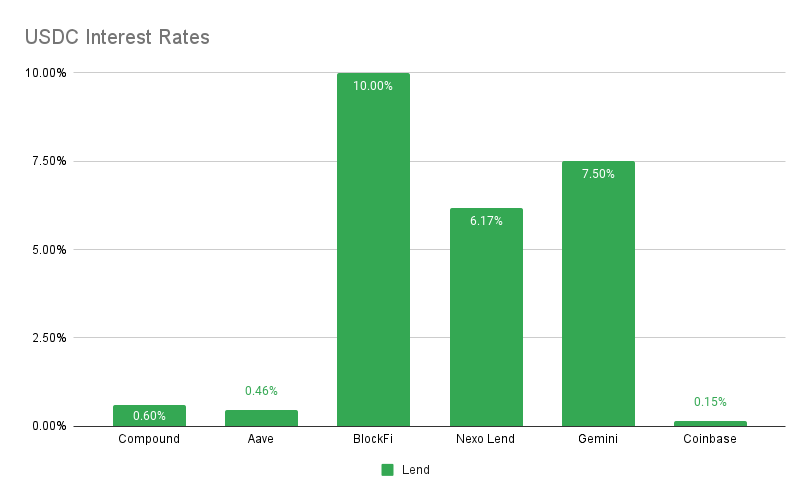

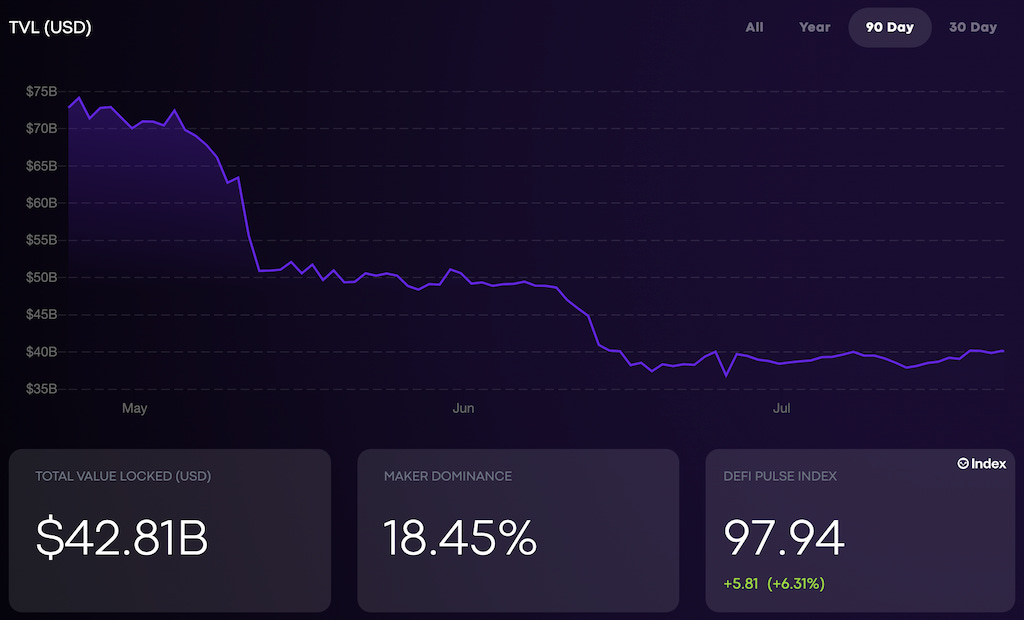

This Week In DeFi – July 22This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.To the DeFi community, This week, Curve Finance founder Michael Egorov has hinted that Curve may be the latest DeFi protocol to launch its own stablecoin. Egorov alluded to an over-collateralized model in a short quote from Redefine Tomorrow 2022, a DeFi and Web3 virtual summit organized by SCB 10X. This likely means a similar backing mechanism to MakerDAO’s Dai, which holds reserve crypto assets with a value that exceeds the number of outstanding Dai tokens. The move comes on the tails of Aave’s recent proposal to launch its own stablecoin, GHO.  區塊先生 ⚠️ (rock #58) @mrblocktw you know you know curve - stablecoin incoming 👀 $CRV 🚀 #stablecoinWAR https://t.co/sYg13WRLYzPolygon has announced zkEVM, a zero-knowledge rollup scaling solution planned for launch in 2023. The platform aims to cut Ethereum transaction costs by 90%, as well as triple the current transaction throughput. A testnet version of the platform is expected to launch sometime during this summer. Polygon Readies ZK Rollup Testnet, Eyes Mainnet Launch in 2023   It has been reported that Anthony Scaramucci's SkyBridge Capital will be launching a fund directed at web3 and crypto, set to be announced in September. The fund will focus on privately-held web3 companies and late-stage crypto firms. SkyBridge had previously filed with the SEC for a spot Bitcoin exchange-traded fund (ETF) in 2020, and has also invested in Bitcoin directly. Web3 and DeFi incubator Cumberland Lab has moved into the public sphere, following a quiet building period since March this year. The company is based in Singapore now has around 20 employees with five more on the way, identifying “crypto winter” as a favorable time to make business moves. Cumberland Lab was founded by partners of Cumberland DRW, the crypto trading giant. The crypto market may have found a local bottom, as the entire market including DeFi continues to rally after several months of downward action. Despite reports of decreasing venture capital in the space, web3-focused funds keep appearing left, right and center. This week especially has had some big-name additions, including SkyBridge, Christie’s and Cumberland. The Layer-2 scaling race also continues, as zero-knowledge rollups capture headlines this week. zkSync has promised a mainnet launch within 100 days, while Polygon followed up strongly with its own zkEVM testnet scheduled for this summer. As optimistic rollup platforms continue with their own token programs, it will prove interesting to see which projects garner the most adoption and usage. Another interesting space to watch is web3 social media, being dubbed “SocialFi”. As the technological restrictions of Layer-1 blockchains are eased, decentralized social media platforms are becoming more viable. Add to this the growing strain of censorship on existing social media, and we have a significant incentive to move things over to web3. Although highly experimental, innovation in the SocialFi niche is beginning to gain steam, with fascinating implications and opportunities – keep your eyes peeled! Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.00% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesUK Treasury unveils plan to regulate stablecoins in Financial Services and Markets billEU, US swap policy intel on European crypto regulation, stablecoinHouse lawmakers prep bipartisan stablecoin bill to unveil next weekJustice Department, SEC File Charges Against Alleged Coinbase Insider TradersStat BoxTotal Value Locked: $42.81B (up 6.6% since last week) DeFi Market Cap: $46.14B (up 13%) DEX Weekly Volume: $17B (up 70%) Bonus Reads[Sam Bourgi – Cointelegraph] – Crypto lender Vauld seeks protection against creditors: Report [Li Gong – The Defiant – Three Trends to Watch As the SocialFi Era Dawns [Chris Williams – Crypto Briefing] – Christie’s Doubles Down on Web3 With New Venture Arm [Osato Avan-Nomayo – The Block] – Ethereum scaling solution zkSync announces mainnet launch in 100 days If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – July 8

Friday, July 15, 2022

This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.

This Week In DeFi – July 8

Friday, July 8, 2022

This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.

This Week In DeFi – July 1

Friday, July 1, 2022

This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.

This Week In DeFi – June 24

Friday, June 24, 2022

This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.

This Week In DeFi – June 17

Friday, June 17, 2022

This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask