DeFi Rate - This Week In DeFi – July 29

This Week In DeFi – July 29This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.To the DeFi community, This week, another crypto venture firm swings big as Variant announces the launch of two new funds – powered by a total $450 million in capital. Variant raised $300 million for a so-called “opportunity” fund, along with a further $150 million for an early-stage startup fund. The funds will focus on projects that fall into or more of the following categories: DeFi, blockchain infrastructure, consumer applications in Web3 and experimentation with new forms of ownership.

NFT domain provider Unstoppable Domains has reached “unicorn status” after a $65 million Series A funding round, valuing the company at $1 billion. The round was led by Pantera Capital, with further contributions from a multitude of notable names including Polygon, CoinGecko, Spartan Group and more. Unstoppable Domains will use its fresh funding to reduce the friction of crypto payments between apps and to build a loyalty reward program.

Major staking protocol Lido DAO has rejected a proposed deal with Dragonfly Capital, which would have sold 10 million LDO tokens at $1.45 each. The proposal was turned down via LDO holder governance, with many arguing that the firm would be getting “free money” from the deal. They may have been right, with LDO surging all the way up to $2.42 at the time of writing – almost 67% above the proposed price.

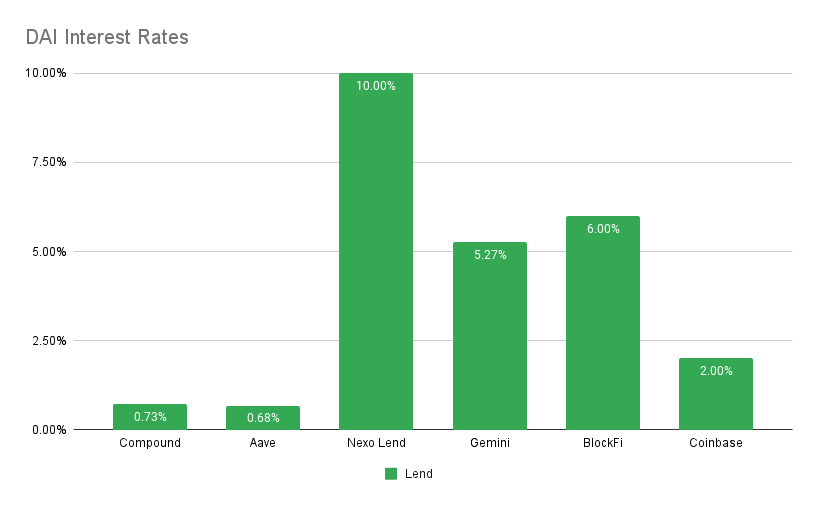

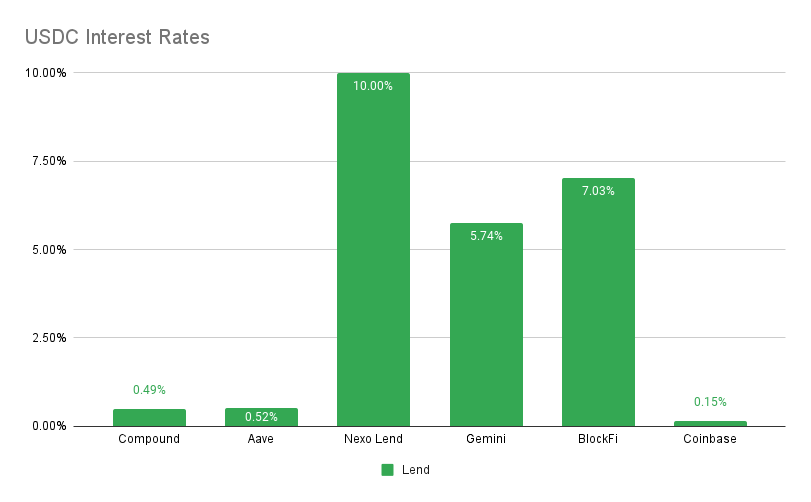

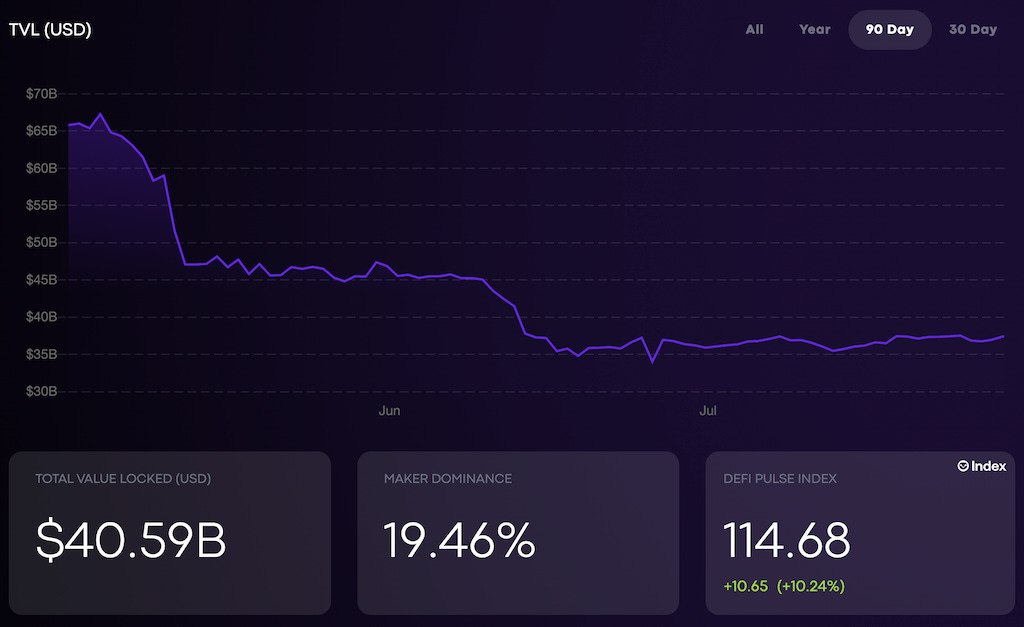

Competition amongst decentralized exchanges (DEXes) is heating up on Layer-2 Ethereum scaling platform Optimism, as Velodrome reaches more than $100 million in total value locked (TVL) this week. The figure puts Velodrome at the #2 spot for TVL on any DApp on Optimism, beating the more-established Uniswap.  The market has bounced back with force over the last week, despite the Federal Reserve hiking interest rates by another 0.75%. The total DeFi market cap – according to CoinGecko – has reclaimed the $50 billion level, while funding rounds continue to close successfully across the ecosystem for new projects. Most notably, Variant has raised almost half a billion dollars across two DeFi/Web3 focused funds – indicating there continues to be no shortage of interest in the sector among investors. Similarly, lending protocols have continued to acquire funding and adoption, even as CeFi lending giants such as Celsius go under. Coinbase and Kraken have backed CLST, a new institution-focused digital asset lending platform. Similar (but uncollateralized) platform Clearpool has expanded to Polygon, allowing institutions to access decentralized liquidity pools without collateral. Overall, it appears that institutional interest in DeFi and CeFi is refusing to die out – even after the recent bloodbath. Whether retail traders follow or not, may be another question. Will we immediately see a recovery boom, or is this crypto winter going to be longer than anticipated? Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.00% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.03% APY Top StoriesTether says that it holds no Chinese commercial paperFederal Reserve Hikes US Interest Rate by 0.75 Percentage PointU.S. Enters Recession Territory With Second-Quarter GDP Falling 0.9%Solana Opens First Physical Store in New York CityStat BoxTotal Value Locked: $40.59B (down 5.2% since last week) DeFi Market Cap: $50.06B (up 8.5%) DEX Weekly Volume: $14B (down 18%) Bonus Reads[Jamie Crawley – CoinDesk] – Coinbase, Kraken Back Crypto Lending Platform CLST in $5.3M Seed Round [Vishal Chawla – The Block] – Clearpool launches uncollateralized stablecoin lending on Polygon [Stefan Stankovic – Crypto Briefing] – After Losing $100M, Harmony Wants to Inflate Away Its Problems [Osato Avan-Nomayo – The Block] – Fantom community decides to use burn fee to fund ecosystem projects If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – July 22

Friday, July 22, 2022

This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.

This Week In DeFi – July 8

Friday, July 15, 2022

This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.

This Week In DeFi – July 8

Friday, July 8, 2022

This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.

This Week In DeFi – July 1

Friday, July 1, 2022

This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.

This Week In DeFi – June 24

Friday, June 24, 2022

This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask