DeFi Rate - This Week In DeFi – August 5

This Week In DeFi – August 5This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.To the DeFi community, This week, panic spread across the Solana network this week as almost 8,000 wallets were affected by an exploit, which saw both SOL and SPL tokens drained. It was eventually discovered that the exploit arose from an issue associated with mobile wallet, Slope – likely a “supply chain attack” on iOS wallets. Users have been recommended to create a new wallet and shift their assets, with a full post-mortem to be published soon.  Austin Federa | sms @Austin_Federa The last 24 hours saw developers, security firms, and individual contributors from across Solana, Ethereum, and cross-chain wallets come together to investigate what at first appeared to be a massive supply-chain hack, impacting Solana and Ethereum

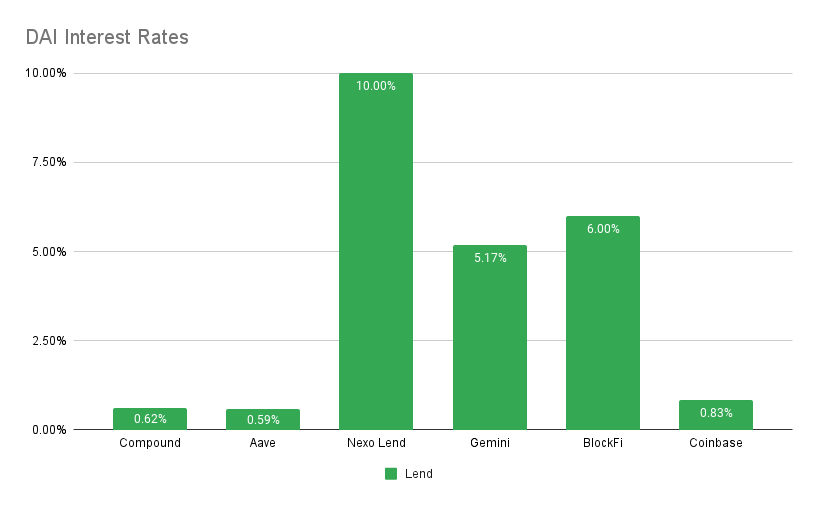

Cross-chain bridge Nomad suffered a $190 million hack – with more than 300 participating exploiters joining the “feeding frenzy”. A primary attacker took $95 million for themselves, while hundreds of additional addresses copied the attacker’s code to sweep the remaining vulnerable funds. The bug responsible for the attack came during a smart contract update, which was unaudited.  foobar @0xfoobar Nomad bridge getting actively hacked. WETH and WBTC being taken out in million-dollar increments. Withdraw all funds if you can, still $126m remaining in the contract that's likely at risk https://t.co/oDo7oT1glWAave governance has passed the proposal for its new yield-generating stablecoin, GHO. 99% of votes were in favor of launching the stablecoin, which will allow users to mint GHO tokens against supplied collateral assets. The GHO code will now be audited, while the community votes upon a starting interest rate for GHO and discount rate for AAVE stakers minting GHO.  Aave @AaveAave Voting is now open, ready set GHO https://t.co/HCbFLZ3O4G https://t.co/9HvdY3nFJhProof-of-Work (PoW) maximalists within the Ethereum ecosystem are gearing up to launch their own hard-forks of the network, as the formal transition (“The Merge”) to Proof-of-Stake nears. It has been reported that multiple PoW forks will emerge once The Merge is put into motion, with some worried about potential damage from such a split.  As “The Merge” continues to draw closer for the Ethereum network, proponents of the Proof-of-Work (PoW) chain are beginning to express their differences in ideology with the Proof-of-Stake Ethereum community. At least six PoW forks have reportedly been planned by groups within the ecosystem, however the amount of traction that any of these forks may obtain may not be highly significant. Why? Well, in contrast to the original Ethereum fork that resulted in Ethereum Classic and the Ethereum we know and use today, the current ecosystem hosts the marvel of several stablecoins and DeFi protocols. Following a chain split, the entire state of the blockchain will be copied – including all stablecoin balances and DeFi positions. Of course, these projects cannot honor redemptions and positions on both chains simultaneously – so they must choose their preferred singular chain to support. To a certain degree, it is these entities that have the final word on which chain is to be the primary one. Although arguments for a PoW network are strong, it appears that it may become very difficult for an Ethereum fork to thrive given today’s conditions. A fragmentation between multiple PoW forks will also weaken the likelihood of success of any individual one. How much of a market share can an Ethereum PoW fork really capture? How viable is it for an Ethereum project to tear away from the rest of the ecosystem, with which it currently coexists? Do all Ethereum-based projects have an incentive to stick together in their decisions? September will tell all. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.00% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesBlackRock to offer crypto access to institutional clients through Coinbase dealEurope dominates blockchain venture deals in Q2 as growth drops in Asia and the US$2B in crypto stolen from cross-chain bridges this year: ChainalysisSenators introduce bill establishing CFTC regime for crypto exchangesStat BoTotal Value Locked: $40.22B (down 0.9% since last week) DeFi Market Cap: $48.61B (down 2.9%) DEX Weekly Volume: $12B (down 14%) Bonus Reads[Ezra Reguerra – Cointelegraph] – Wirex partners with 1inch to enable wallet-based token swaps [Tom Matsuda and Adam Morgan McCarthy – The Block] – Arnault-backed VC firm Aglaé Ventures to launch €100 million web3 fund: sources [Mike Truppa – The Block] – Why popular blockchain bridge protocol Synapse is launching its own smart contract platform [Brian Quarmby – Cointelegraph] – Starbucks teases Web3 rewards program to attract new customers If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – July 29

Friday, July 29, 2022

This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.

This Week In DeFi – July 22

Friday, July 22, 2022

This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.

This Week In DeFi – July 8

Friday, July 15, 2022

This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.

This Week In DeFi – July 8

Friday, July 8, 2022

This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.

This Week In DeFi – July 1

Friday, July 1, 2022

This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask