DeFi Rate - This Week In DeFi – August 12

This Week In DeFi – August 12This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.This week, the US Treasury has sanctioned decentralized mixing service Tornado Cash. The move accompanies claims that North Korea’s Lazarus group laundered almost half a billion dollars’ worth of crypto using the protocol. Crypto infrastructure platforms Infura and Alchemy have also blocked users from accessing Tornado Cash, making it difficult for Metamask users to access the app’s default user interface. More recently, “decentralized” derivatives exchange dYdX has blocked addresses connected to Tornado Cash, calling into question the true degree of dYdX’s decentralization.

Ethereum’s potential Proof-of-Work fork chain has garnered enough attention to warrant a futures contract on derivatives-focused exchange, BitMEX. The exchange’s listing of ETHPOW futures for December 2022 will likely provide a good estimate of how much the possible fork’s tokens will be worth on the open market, should it attract enough attention. The Merge is just over a month away according to tentative dates set by the Ethereum Core development team, who project a September 15 launch for the network’s Paris upgrade.

Unsuspecting Curve Finance users lost over half a million in funds, following an exploit of the protocol’s official website. The project’s DNS records were compromised by hackers, who redirected traffic to a copycat website. The imitation site then tricked users into signing malicious transactions, resulting in their wallets being drained.

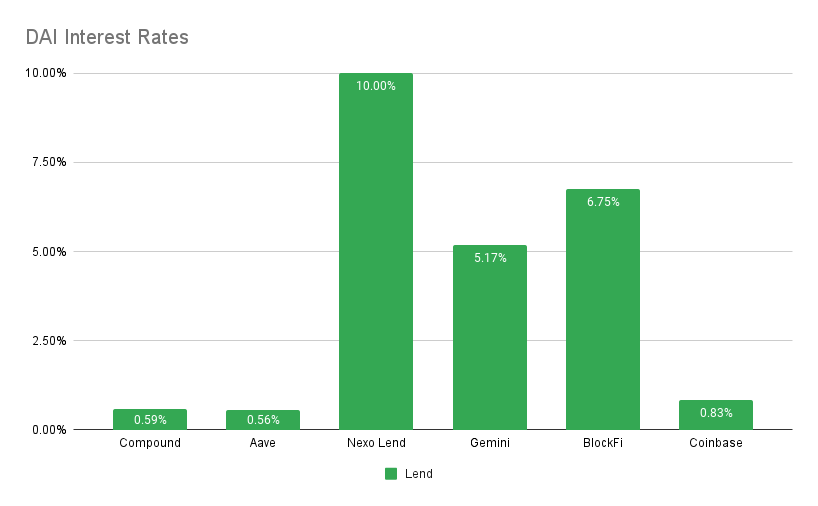

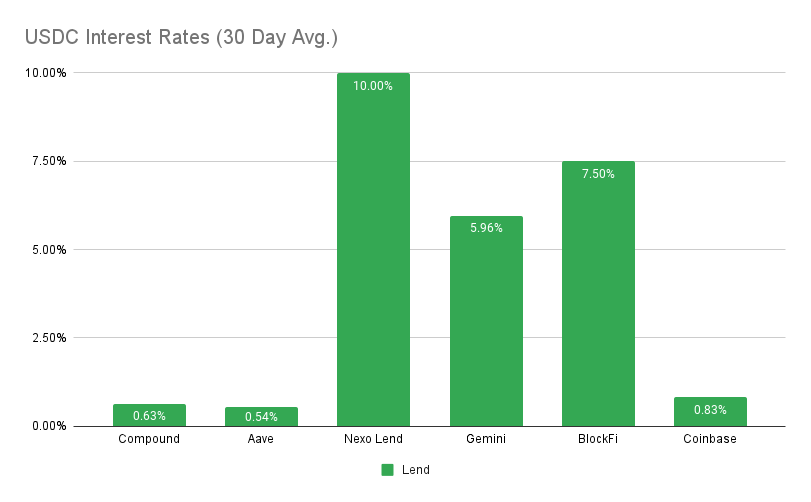

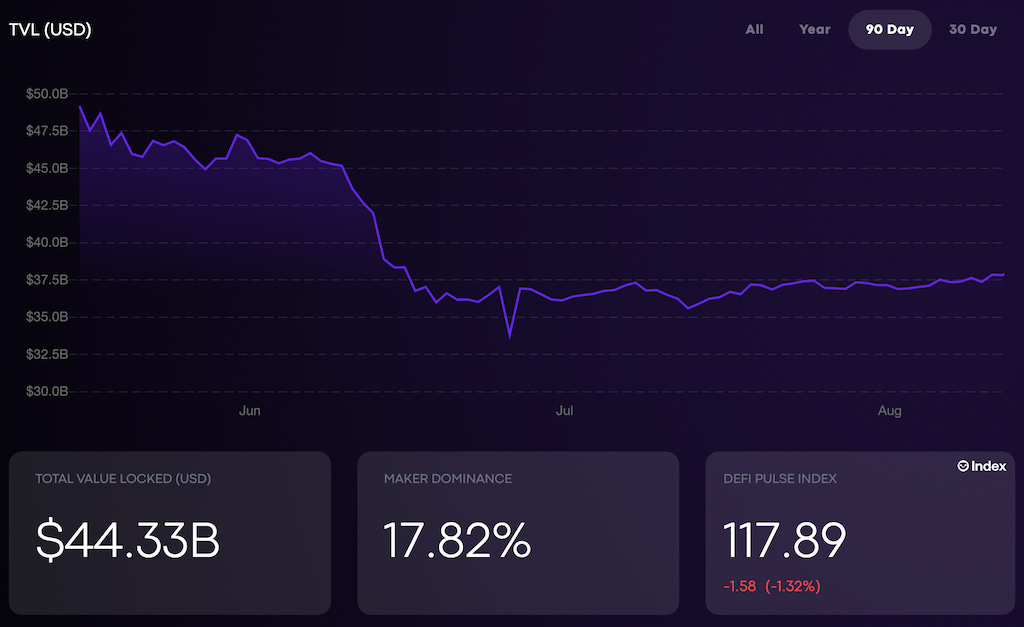

DeFi blockchain Injective has raised $40 million from Jump Crypto, BH Digital and others, as it seeks to improve the adoption and utility of its native INJ token. Injective also seeks to build liquidity for existing DApps on the chain, as well as support new ones being built. The chain is native to the Cosmos IBC network and already has backing from Pantera, Hashed and Mark Cuban.   Stablecoins continue to serve up drama in crypto land, this time surrounding USD Coin (USDC) issuer, Circle. The company has frozen user tokens associated with addresses on the US Treasury’s sanctions list – leaving users concerned about the vulnerability of their USDC tokens. The most crucial response has come from the MakerDAO community, due to the Dai stablecoin’s partial backing by USDC tokens. The MakerDAO community has gone as far as considering eliminating its USDC exposure completely, in a potential return to its roots as a completely decentralized stablecoin, free from centralized risk. The US Treasury’s move itself presents a much larger threat to the DeFi ecosystem, for the first time placing sanctions on a protocol rather than an individual or an entity. The precedent being set is a scary one, which could put any other protocol or platform at risk if it comes into contact with illicit funds. Given the permissionless nature of most of DeFi, this could involve almost any cog in ecosystem. As anonymous pranksters begin to send ETH from Tornado Cash into celebrity wallets to tarnish them, we have a real mess on our hands, from a compliance perspective. Do these sanctions even make any sense? How will we filter out true illegal actors from innocent bystanders? Regulation vs. crypto is getting tricky – and how it will turn out is anyone’s guess. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.75% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesEthereum’s Third and Final Testnet Merge Goes Live on GoerliBan Banks From Holding Crypto, UN Development Body SaysReddit's Community Points are migrating to Arbitrum NovaEthereum Layer 2s Could Take Revenue From the Blockchain as They Become More Competitive: CoinbaseStat BoxTotal Value Locked: $44.33B (up 10% since last week) DeFi Market Cap: $53.30B (up 9.7%) DEX Weekly Volume: $12B (no change) DAI Supply: 6.94B (down 0.57%) Bonus Reads[Savannah Fortis – Cointelegraph] – Chainlink ditches Ethereum PoW forks for PoS after The Merge [Jamie Crawley – CoinDesk] – Unstoppable Finance Raises $12.8M to Build DeFi Wallet [Frederick Munawa – CoinDesk] – Polkadot Now Has a Decentralized Version of 'Wrapped' Bitcoin [Osato Avan-Nomayo – The Block] – MakerDAO founder says it's 'almost inevitable' DAI will abandon USD peg If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – August 5

Friday, August 5, 2022

This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.

This Week In DeFi – July 29

Friday, July 29, 2022

This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.

This Week In DeFi – July 22

Friday, July 22, 2022

This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.

This Week In DeFi – July 8

Friday, July 15, 2022

This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.

This Week In DeFi – July 8

Friday, July 8, 2022

This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask