DeFi Rate - This Week In DeFi – August 19

This Week In DeFi – August 19This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.This week, web3 investment company CoinFund has announced a new $300 million fund with backing from institutional investors, family offices and crypto founders. Managing partner David Pakman says he has “never seen a bigger opportunity” in his 30-year tech career than crypto and web3. The fund, named “Ventures 1”, will continue to back CoinFund’s portfolio companies as they aim to raise Series A funding, while also seeking out new investments.

Stablecoin leader Tether has regained some traction following USDC’s token freezes amidst the Tornado Cash saga, as its market cap rose $2 billion since the controversy. Tether is also attempting to clear up its own image, recruiting BDO Italia to provide periodic attestations for its USDT reserves. The company has also stated it aims to obtain a “complete audit” in the future.   Tether @Tether_to Tether Announces Alignment With Top Five Accounting Firm And Confirms Attestations Will Now Be Completed By BDO Italia https://t.co/2vO7F2c3b2

Unstoppable Domains has launched a new app to enable users to manage their Web3 identity on-the-go. iOS users can now mint and manage decentralized domains on their mobile device, as well as build a profile card to share their digital identity. The app also supports WalletConnect for easy connections to 180+ DApps, as well as its own “Login with Unstoppable” service that controls the sharing of your data.

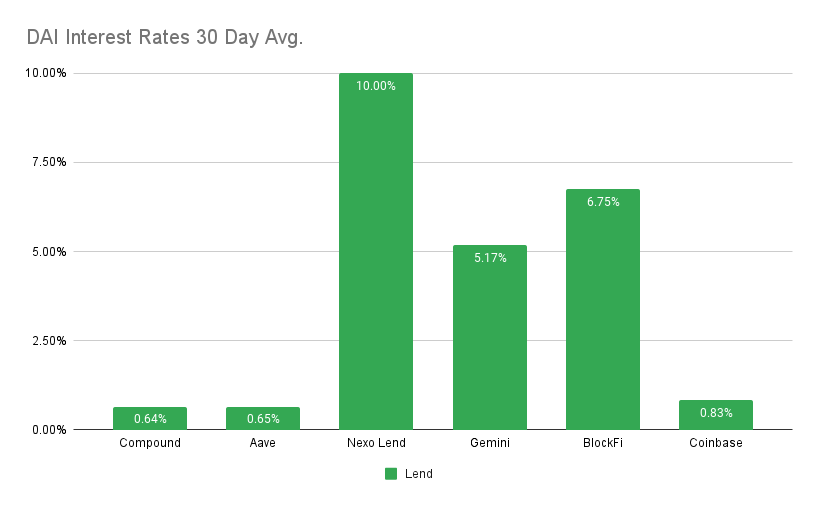

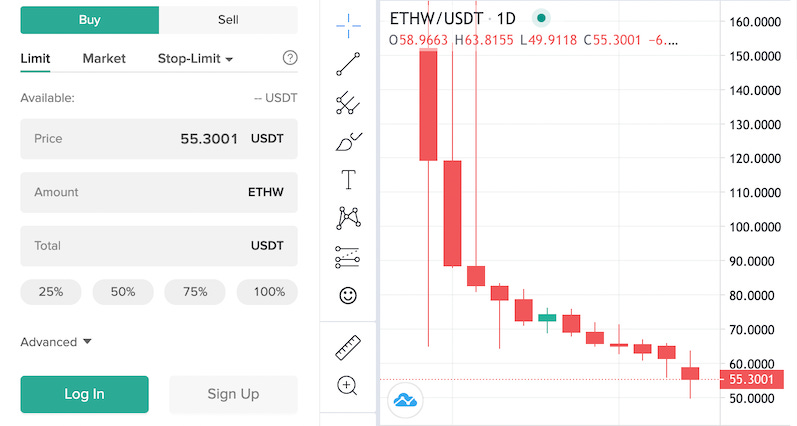

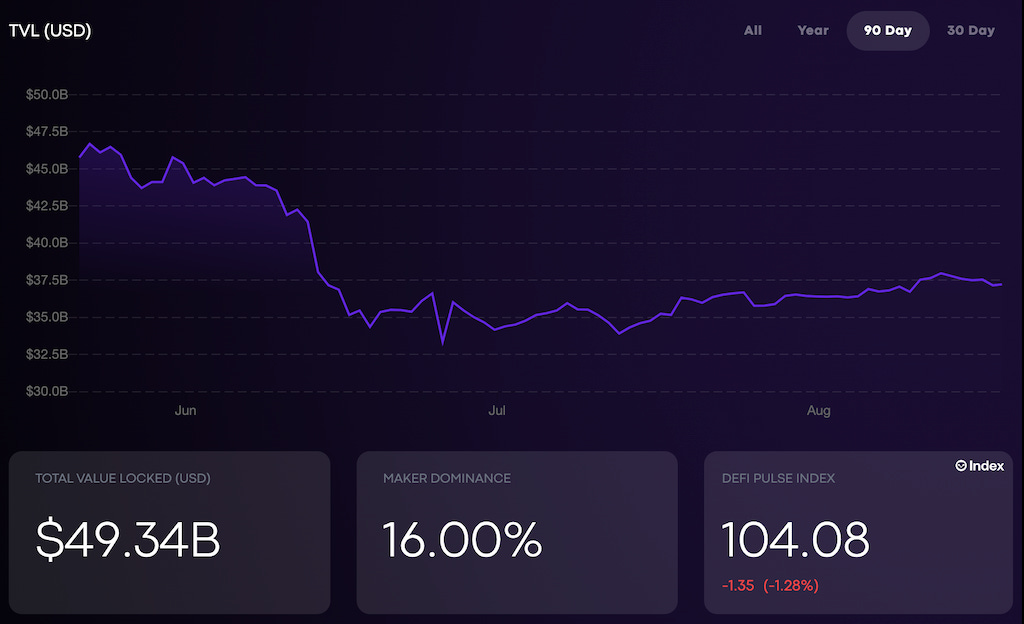

Dogecoin has rallied this week following the launch of Dogechain, a smart-contract compatible network based on Polygon Edge. The platform, powered by wrapped DOGE, is already home to multiple decentralized exchanges and dog-themed tokens. Many users have already bridged their tokens to the new chain, in hopes that they will receive an airdrop of Dogechain tokens. Ethereum’s potential proof-of-work fork appears to be losing hype, as price crashes on BitMEX futures and Poloniex. Token markets fro ETHPOW are now forecasting a price of around $50 – representing a relatively insignificant fraction of the current $1865 market price. Despite a very strong ideology behind retaining the proof-of-work algorithm, it looks like the market and ecosystem participants have made a very clear, unanimous choice to back the proof-of-stake upgrade. Meanwhile, the stablecoin market remains at war. Huobi’s HUSD has drifted significantly from its $1 peg, despite supposedly being fully-backed by reserves. Acala’s aUSD also had its own troubles, fighting off a smart-contract exploit to get back to its own peg. It seems almost no stablecoin is 100% safe right now – especially following USDC’s freezing of tokens last week. Tether has capitalized on the stablecoin ecosystem mess, making a push for greater transparency as competitors struggle. Monthly attestations from BDO may not be enough for Tether naysayers, however it will be one step in the right direction for the infamous company. Can they make good on renewed promises of an audit, though? It will be a pleasant surprise indeed, if so. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.75% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesFederal Reserve Releases New Guidelines for Crypto BankTornado Cash Sanctions Are Spiraling Into Compliance NightmaresCME Group to Offer Ethereum FuturesBuzz Over Potential Ethereum Hard Fork Token Fizzles as Price TanksStat BoxTotal Value Locked: $49.34B (up 11% since last week) DeFi Market Cap: $49.80B (down 6.6%) DEX Weekly Volume: $12B (no change) Bonus Reads[Osato Avan-Nomayo – The Block] – Aave says on-chain wallet address censorship would require DAO consensus [Sujith Somraaj – Decrypt] – Acala Stablecoin Edges Back to Dollar Peg After Burning 1.29B aUSD [Osato Avan-Nomayo – The Block] – HUSD stablecoin loses US dollar peg, drops to $0.90 as liquidity shrinks [Oliver Knight – CoinDesk] – Troubled crypto lender Hodlnaut files for creditor protection in Singapore If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – August 12

Friday, August 12, 2022

This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.

This Week In DeFi – August 5

Friday, August 5, 2022

This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.

This Week In DeFi – July 29

Friday, July 29, 2022

This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.

This Week In DeFi – July 22

Friday, July 22, 2022

This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.

This Week In DeFi – July 8

Friday, July 15, 2022

This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏