DeFi Rate - This Week In DeFi – August 26

This Week In DeFi – August 26This week, the Ethereum foundation confirms dates for the Merge, Coinbase announces liquid ETH staking, and Symbolic Capital raises $50M for "pioneering" Web3 apps.

This week, The Ethereum Foundation has officially confirmed dates for the long-awaited Merge. The process consists of two upgrades, the first of which (“Bellatrix”) is set to take place on Sept 6. The final and most important step of the Merge (“Paris”) will be executed at a specific terminal total difficulty – which is estimated to be hit between Sept 10 and Sept 20, depending on the hash rate leading up to that point. The Paris upgrade is expected to take a total of 13 minutes to be executed, assuming everything goes to plan.

Coinbase has unveiled its own liquid staking token for Ethereum, as it seeks to provide stakers with utility and transferability on their staked Ether on the new network. The exchange will issue ETH stakers with cbETH tokens, which can be redeemed at any time for the underlying ETH plus accrued interest. The token will be highly similar to stETH, the equivalent token issued by decentralized staking service, Lido.

Symbolic Capital has raised $50 million for a new Web3 venture capital fund, targeting "pioneering web3 applications". The company was launched in May of this year by Polygon founder Sandeep Nailwal and Cere Network founder Kenzi Wang. Nailwal says he is focused on founders from markets that are often passed over by traditional VC firms. Symbolic will utilize a special data platform to support its portfolio companies.

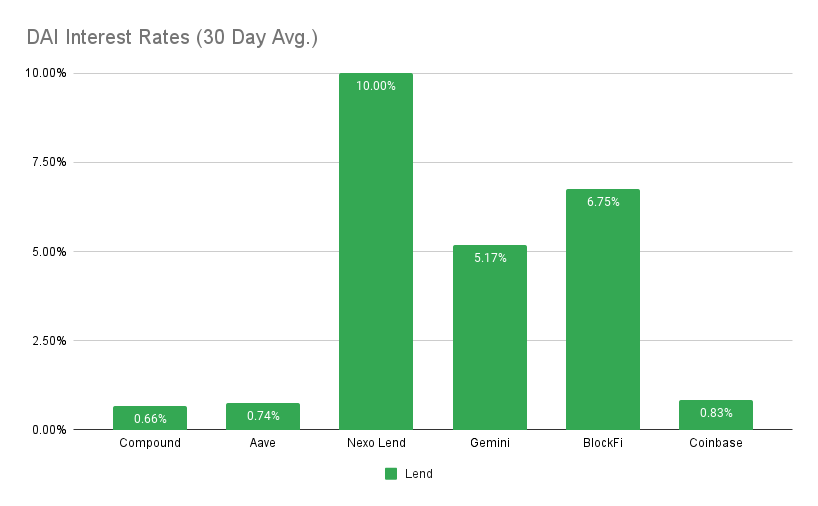

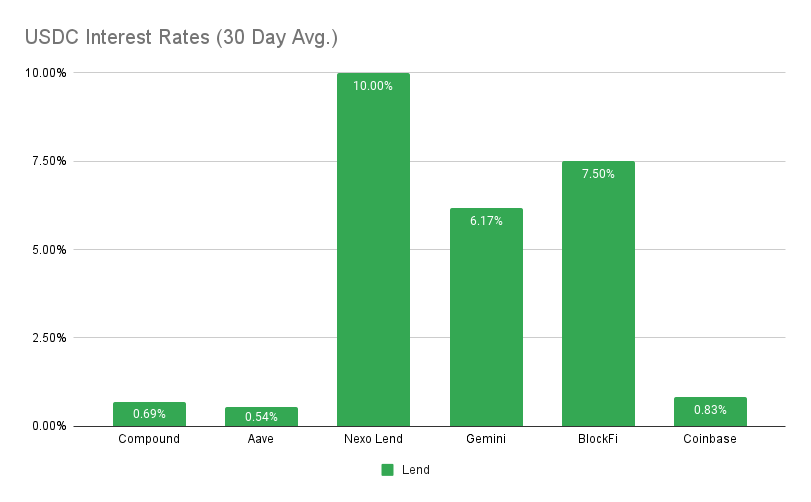

The community around stablecoin project Fei is upset over an exit proposal from the project’s team, which seeks to only partially repay hack victims – despite the protocol being believed to have sufficient funds to cover all of the losses. The shut-down comes as a result of “mounting technical, financial, and future regulatory risks.”   It’s finally happening! The merge is locked in for mid September and Ethereum is making its long-awaited transition to proof-of-stake. For the next few weeks, we can expect all eyes to be on Ethereum as people place their bets on a successful switch – while others place their bets on hiccups or shortcomings of the new network. One primary concern has arisen, following in the footsteps of the Tornado Cash saga. Will major stakers (such as exchange giants) begin to censor transactions in an effort to cover their own butts, while upholding the Ethereum network? We’ve already seen some censorship happening, as some builders and miners make moves to become “OFAC compliant” (OFAC being the Office of Foreign Assets Control). In short, these parties have been excluding transactions related to sanctioned or risky contracts and addresses, to mitigate their own risks. A slippery slope, the network (and others) could slowly descend into a centralized system, as major network participants choose their own safety over keeping the blockchain censorship-free – an understandable, yet undesired outcome. This has led to important discussions such as this one, which make a case for “slashing” censoring stakeholders – i.e. destroy or confiscate the stake of censoring stakers. More turbulence will undoubtedly come from proof-of-work (PoW) proponents and forks, with Binance becoming the latest exchange to announce support of PoW forks. Although still a small threat, these forks trading on major exchanges will almost definitely attract a large amount of trading volume and drama within smaller communities. Whether you’re in ETH or not, buckle up! The Merge is here, and there will be plenty of action coming along with it. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.75% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesBinance Confirms Support for Post-Merge Ethereum ForTether Won't Freeze Tornado Wallets Unless Directly OrderedMalaysian bank works on crypto-friendly ‘super app’ with Ant Group techBinance, FTX Among Crypto Players in Hunt to Buy Voyager Digital Assets as Coinbase Backs Out: SourcesStat BoxTotal Value Locked: $62.59B DeFi Market Cap: $46.55B (down 6.5%) DEX Weekly Volume: $14B (up 17%) Bonus Reads[Sam Kessler – CoinDesk] – The Graph Adds Gnosis Chain to Its Decentralized Blockchain Indexing Protocol [Brayden Lindrea – Cointelegraph] – It’s a go! Uniswap Foundation becomes reality after 86M votes in favor [Shaurya Malwa – CoinDesk] – Decentralized Exchange THORSwap to Support Cross-Chain Swaps for Over 4,300 Ethereum-Based Tokens [Hannah Miller – Bloomberg] – Sam Bankman-Fried’s FTX and Alameda Merge Their VC Operations If you liked this post from This Week in DeFi , why not share it?

|

Older messages

This Week In DeFi – August 19

Monday, August 22, 2022

This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.

This Week In DeFi – August 12

Friday, August 12, 2022

This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.

This Week In DeFi – August 5

Friday, August 5, 2022

This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.

This Week In DeFi – July 29

Friday, July 29, 2022

This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.

This Week In DeFi – July 22

Friday, July 22, 2022

This week, Curve hints at launching its own stablecoin, Polygon announces zkEVM rollups and SkyBridge may be launching a web3 fund.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏