DeFi Rate - This Week In DeFi – August 26

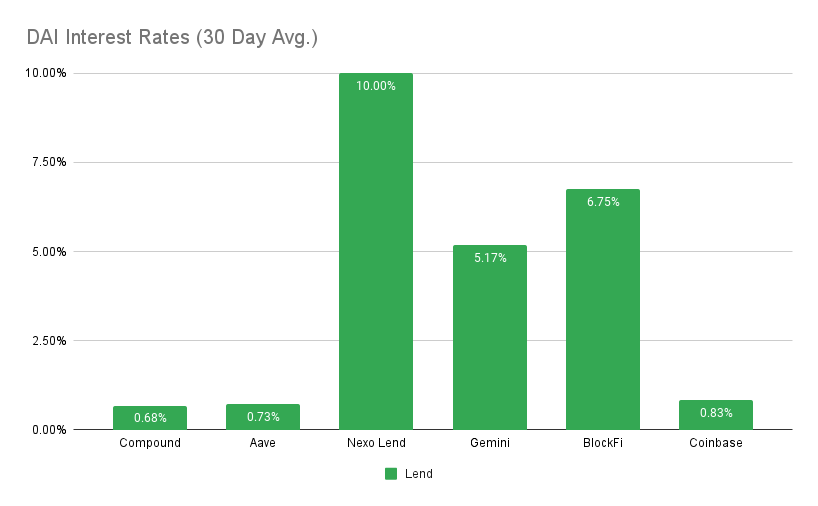

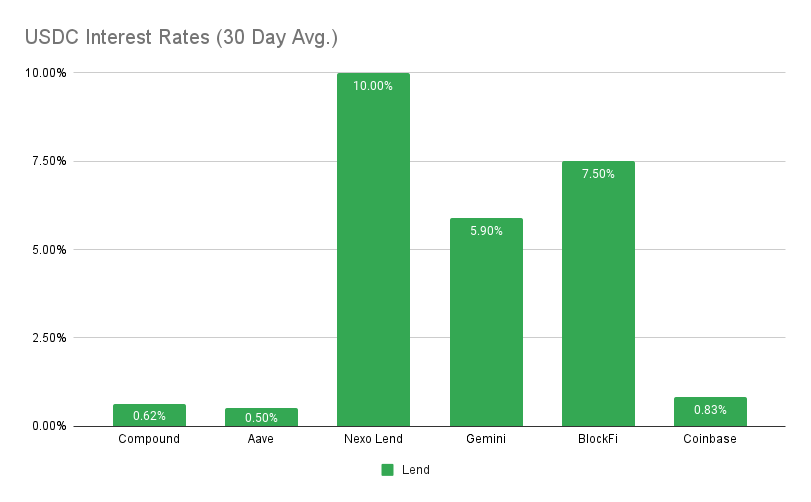

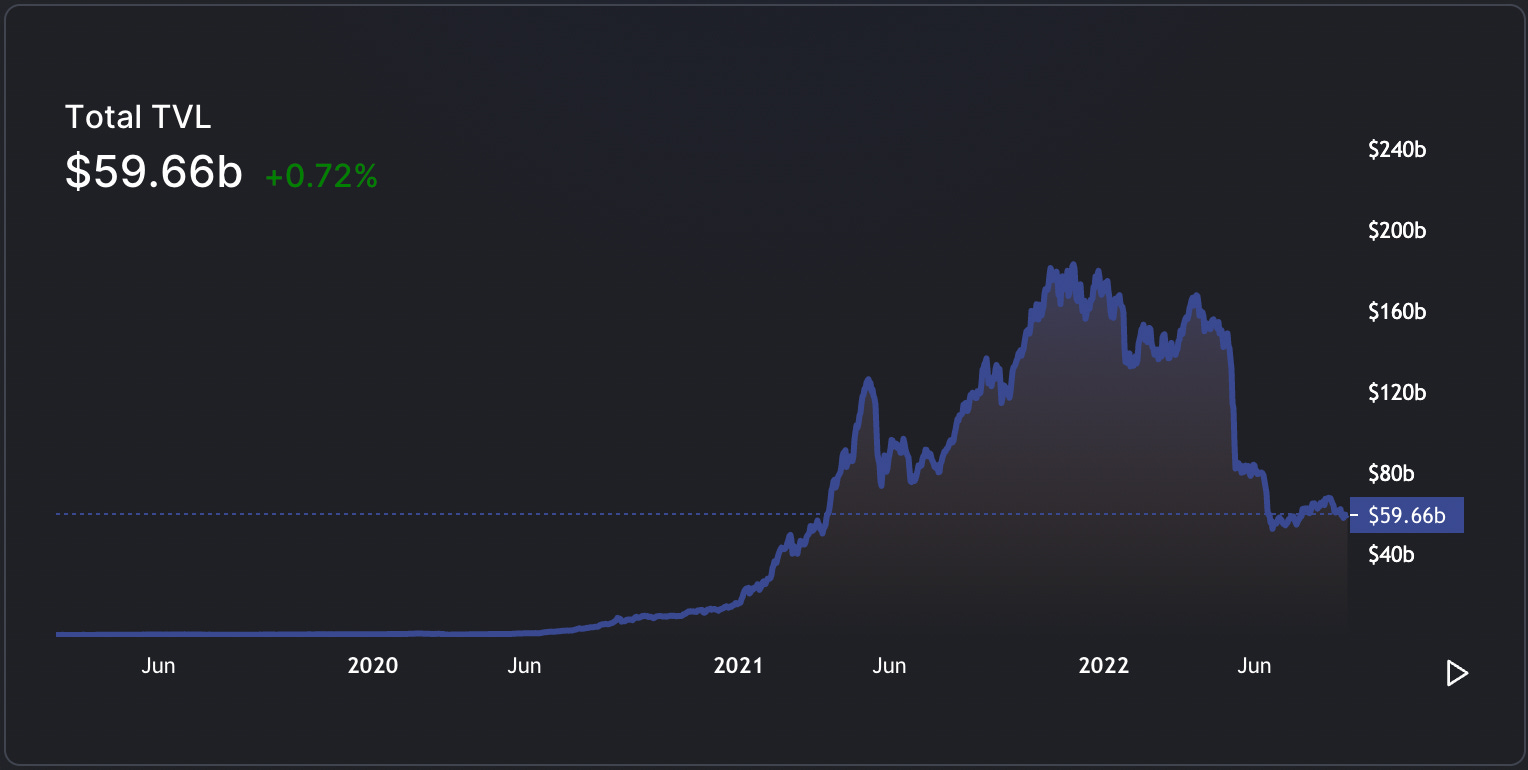

This Week In DeFi – August 26This week, 1inch airdrops $OP to wallet users on Optimism, Curve hints a Sept. stablecoin launch and Arbitrum completes its Nitro upgrade.This week, decentralized exchange (DEX) aggregator 1inch has announced that it will be airdropping Optimism ($OP) tokens to users who have made swaps via the 1inch wallet on the Optimism network. A total of 300,000 OP tokens will be given out in the retrospective airdrop, distributed equally to all qualifying wallets.  Curve Finance founder Michael Egorov stated during a community discussion that the protocol’s new stablecoin may launch as early as this month – the first hint of a release date for the token. The decentralized, over-collateralized crvUSD stablecoin was first mentioned in July, during the Redefine Tomorrow 2022 virtual cryptocurrency conference.  Ethereum Layer-2 scaling network Arbitrum has completed its upgrade to Arbitrum “Nitro”, reducing transaction costs and improving network speed. The network achieves the improvements via call data compression, as well as better compatibility with the Ethereum Virtual Machine (EVM).  The Ether market on lending protocol Compound has been frozen thanks to a bug in the code of a recent update. $800 million worth of ETH will remain stuck in the protocol for about a week, while governance attempts to pass a proposal to undo the upgrade. Withdrawals and liquidations are frozen, however deposits remain unaffected, according to the Compound team.   It’s an all-round exciting time this September, with a huge range of developments happening across the space – especially on Ethereum. Headlining the month’s events is obviously The Merge, targeting a mid-month completion of the transition to Proof-of-Stake (PoS). A growing number of protocols are clarifying their stance on a possible fork, with OpenSea becoming the latest major platform to formally commit to the PoS chain. Compound has accidentally locked up their users’ ETH right before Merge time with a faulty (and three-times audited) smart contract upgrade, while Aave is implementing a purposeful halt to ETH lending before the Merge, to prevent any hiccups. We also have Layer-2 networks continuing to flourish, as Arbitrum completes its Nitro upgrade and may soon resume its “Odyssey” program. Its closest competitor, Optimism, also continues to see significant activity, as well as excitement over the 1inch retroactive airdrop. Over on the protocol side, a very interesting game is playing out as two major protocols, Curve and Aave, come closer to launching their own stablecoins. In a stablecoin market rocked by controversy and failed pegs, we may have the perfect setting for these new tokens to take a significant market share. Definitely keep an eye out for crvUSD and GHO! Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.75% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesTop execs from Genesis and Galaxy are raising a $500 million fundOpenSea commits to 'solely supporting' NFTs on proof-of-stake Ethereum blockchainFireblocks launches Web3 Engine support on SolanaInflation in the eurozone just hit a fresh record high of 9.1%Stat BoxTotal Value Locked: $59.66B (down 4.7% since last week) DeFi Market Cap: $43.89B (down 5.7%) DEX Weekly Volume: $13B (down 7.1%) Bonus Reads[Vishal Chawla – TheBlock] – Babylon Finance to shutter protocol after losing $3.4 million in Rari hack [Ezra Reguerra – Cointelegraph] – Aave community proposes to temporarily suspend ETH lending before the Merge [Andrew Hayward – Decrypt] – Helium Developers Mull Migration of Crypto Wireless Network to Solana [Jacob Oliver – Crypto Briefing] – Ticketmaster Will Issue NFTs on Flow If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – August 26

Friday, August 26, 2022

This week, the Ethereum foundation confirms dates for the Merge, Coinbase announces liquid ETH staking, and Symbolic Capital raises $50M for "pioneering" Web3 apps.

This Week In DeFi – August 19

Monday, August 22, 2022

This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.

This Week In DeFi – August 12

Friday, August 12, 2022

This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.

This Week In DeFi – August 5

Friday, August 5, 2022

This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.

This Week In DeFi – July 29

Friday, July 29, 2022

This week, Variant raises $450M for two new crypto funds, Unstoppable Domains acquires unicorn status and Velodrome passes $100M in TVL on Optimism.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏