Coin Metrics' State of the Network: Issue 181

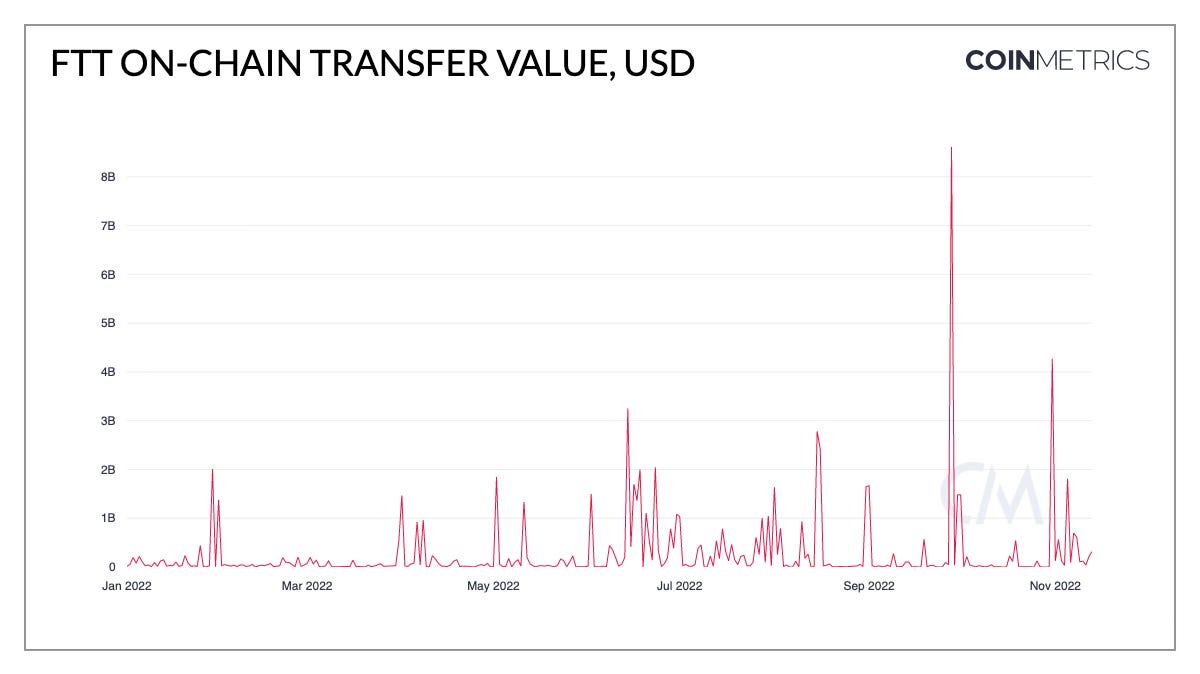

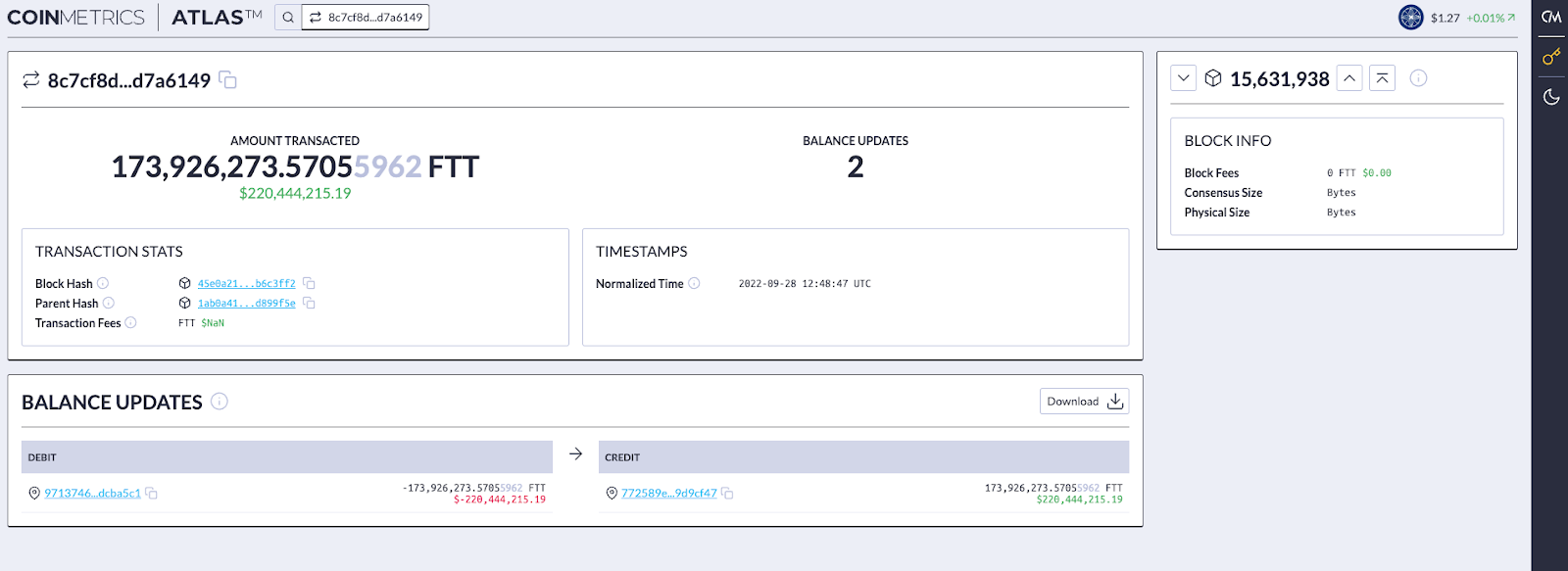

Get the best data-drive crypto insights and analysis every week. Using On-Chain Data to Investigate the Fall of FTXIn a shocking turn of events, FTX suffered an unexpected downfall. In this State of the Network issue, we use on-chain data to investigate the details surrounding FTX’s fall. The Fall of the FTX EmpireOn November 2nd, Coindesk published an article stating they had obtained a copy of Alameda Research’s balance sheet, which showed that it was holding billions of dollars worth of FTX’s FTT token. Alameda Research was a trading firm founded by Sam Bankman-Fried (SBF), also the CEO of FTX, formerly one of the largest exchanges in the world. Even though they were both founded by SBF, Alameda and FTX were theoretically supposed to be two separate entities with separate CEOs and balance sheets. However, the FTT token was issued and controlled by FTX, so questions began to circulate about how independent Alameda and FTX truly were. Then on November 6th, the CEO of Binance, who is commonly known as CZ, tweeted that “due to recent revelations that have came [sic] to light,” Binance would be liquidating the rest of the FTT they had on their books. Binance, the largest crypto exchange in the world by quite a margin, received roughly $2.1 billion of FTT as part of an investment exit in 2021. Despite assurances from SBF and from Alameda CEO Caroline Ellison that FTX was fully audited and that there was nothing to worry about, the market disagreed. By the night of November 7th, the price of FTT began to drop from above $22 to less than $16, even though Ellison had tweeted that Alameda would “happily buy” all of Binance’s FTT for $22 a token.  @cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22! By the morning of November 8th FTX stopped processing withdrawals. Then a little after 11 AM, SBF Tweeted a surprise announcement that Binance had signed a non-binding letter of intent to acquire FTX. Soon after, FTT price went into freefall, dropping below $5. The next day, Binance announced after only 24hrs of doing due diligence that they would not be going through with the acquisition. By the end of the week, FTX, FTX.US, and Alameda had all officially filed for Chapter 11 bankruptcy. Alameda’s Blow UpFTX at first appeared to fail out of nowhere. But as more details have come to light, it has become evident that FTX and Alameda were in trouble long before the collapse. For example, multiple reports have emerged that FTX was allegedly loaning customer funds to Alameda without customer consent. Furthermore, there are allegations that SBF may have had a “back door” in the FTX software that allowed him to move funds between the companies without alerting others. The details are still coming to light and will probably take months, if not longer, to fully emerge. But using on-chain data, we can start to put together some pieces of the puzzle by tracing Alameda’s public transactions on the blockchain. Source: Coin Metrics Network Data Using Coin Metrics ATLAS we discovered a large transfer of over $4B worth of the FTT token on September 28th. After looking into the transaction, the FTT apparently belonged to Alameda Research and was set to vest automatically to them after a lockup period. Although unusually large, this initial transaction was not immediately suspicious. Transfer from Alameda address to FTT Deployer Contract; Source: Coin Metrics ATLAS However, we also found another transaction that showed that after the tokens were automatically unlocked, Alameda almost immediately sent them to the FTT token deployer contract. This is highly unusual since deployer contracts are not typically used to receive large transfers. The FTT deployer contract is likely connected to FTX, considering FTX launched and managed the FTT token.  1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 This September 28th transaction may have been a roundabout way for Alameda to repay FTX for a large loan. In short, Alameda may have blown up in May or June 2022, along with the LUNA collapse and 3AC collapse (amongst others). However, FTX could have provided Alameda with a loan at the time to cover the losses. If this was the case, it’s unclear where this loan came from or which assets it included. Furthermore, there is currently no known on-chain evidence of such a loan, so if it did occur, it likely happened off-chain. It’s important to note that this theory is still speculative and unproven—it is based on on-chain activity—but there is still no definitive “smoking gun” proving FTX provided a loan to Alameda. But more and more evidence is starting to pile up. On November 10th, Reuters published an interview with former FTX executives where a transfer of the same size was mentioned:

Also, on the 10th, the Wall Street Journal published an article alleging Alameda Research owes FTX about $10 billion and that FTX extended loans to Alameda using customer deposits. On the 11th, Reuters reported that at least $1 billion of client funds were missing from FTX. Former Alameda CEO Caroline Ellison even reportedly confirmed the use of client funds in a meeting with Alameda employees:

Further complicating things, late Friday night hundreds of millions of dollars began to mysteriously flow out of FTX, leading to questions about whether the exchange had been hacked. To finish reading this issue click here.© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics' State of the Network: Issue 180

Tuesday, November 8, 2022

Tuesday, November 8th, 2022

Coin Metrics’ State of the Network: Issue 179

Tuesday, November 1, 2022

Tuesday, November 1st, 2022

Coin Metrics’ State of the Network: Issue 178

Tuesday, October 25, 2022

Tuesday, October 25th, 2022

Coin Metrics' State of the Network: Issue 177

Tuesday, October 18, 2022

Tuesday, October 18th, 2022

Coin Metrics' State of the Network: Issue 176

Tuesday, October 11, 2022

Tuesday, October 10th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏