Coin Metrics’ State of the Network: Issue 183

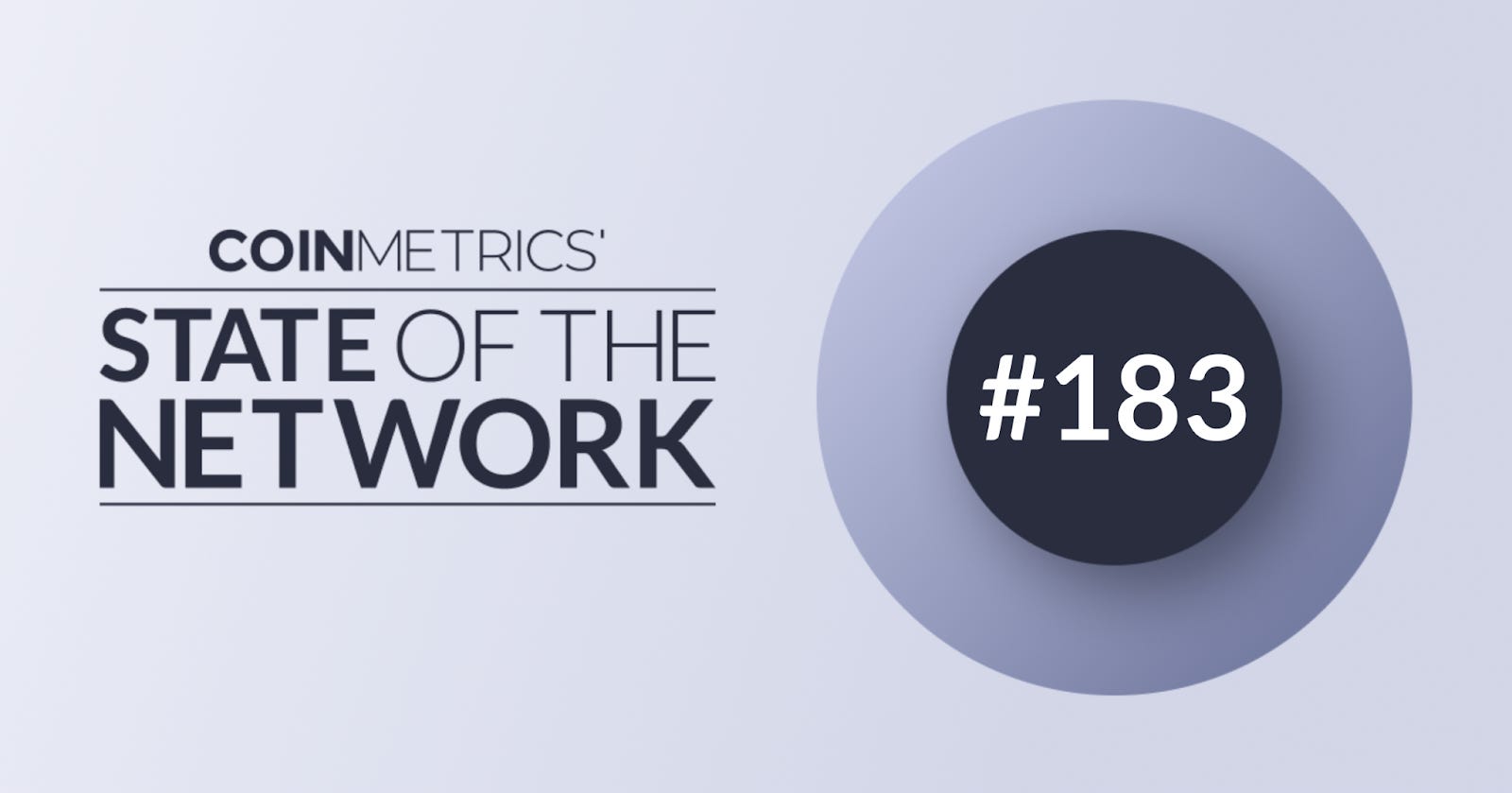

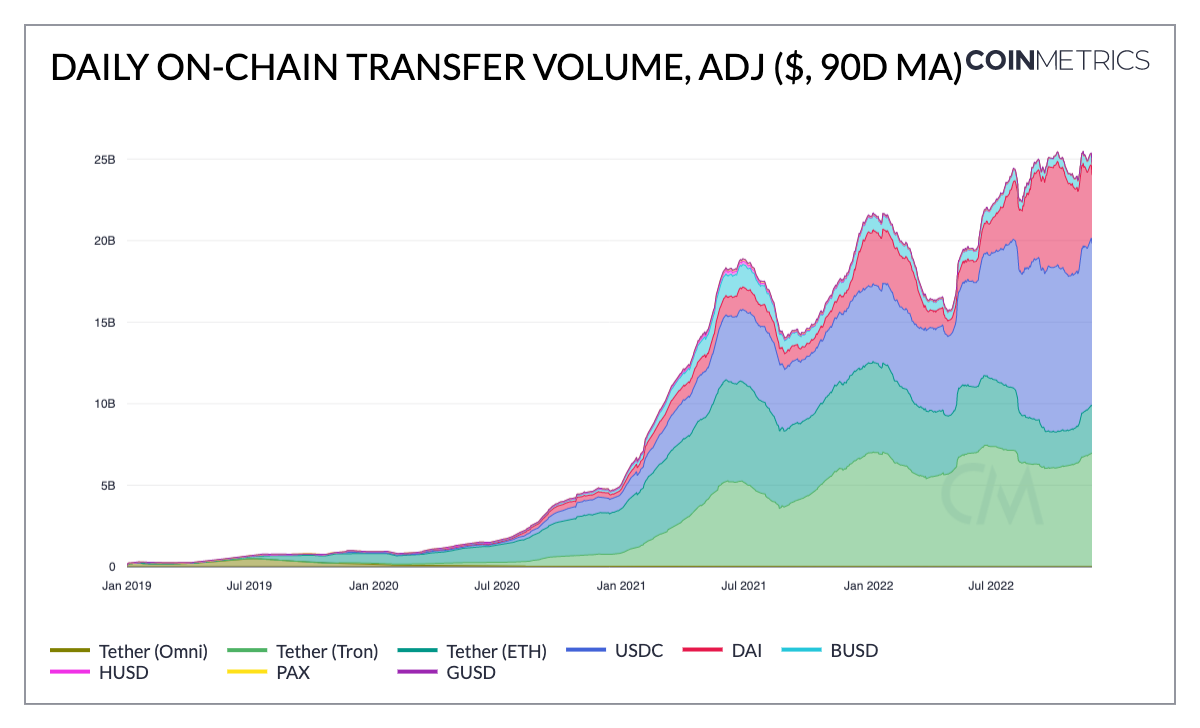

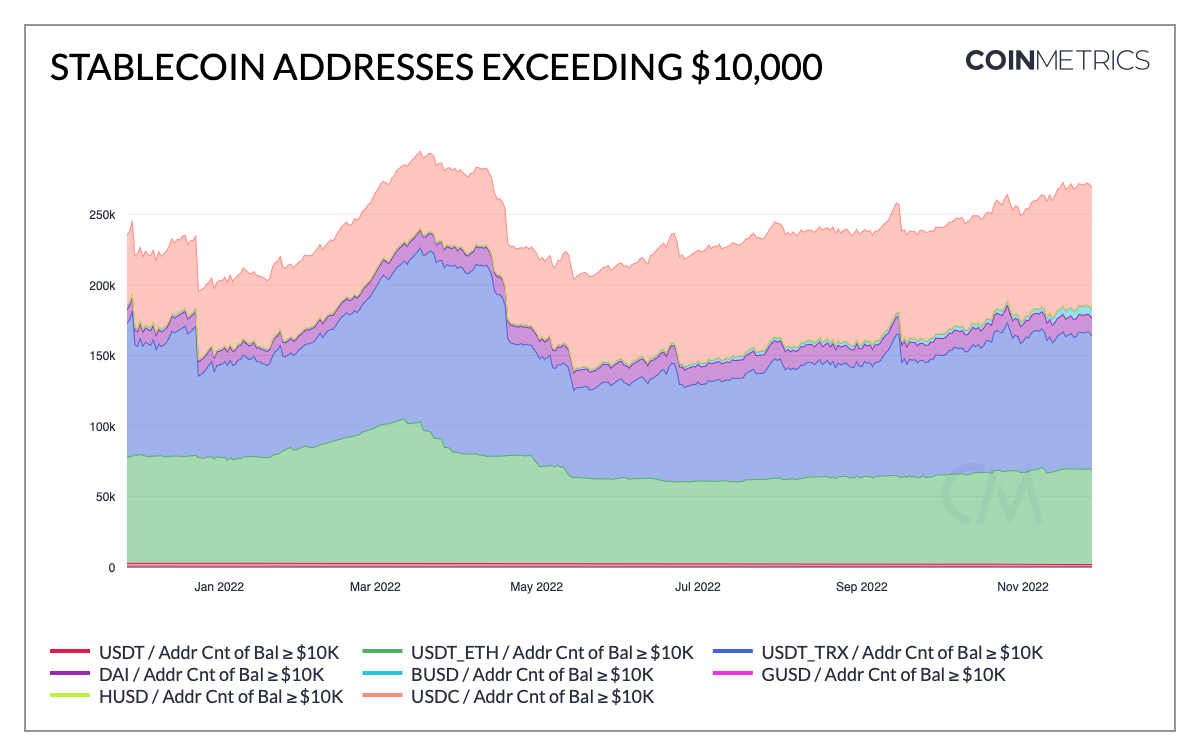

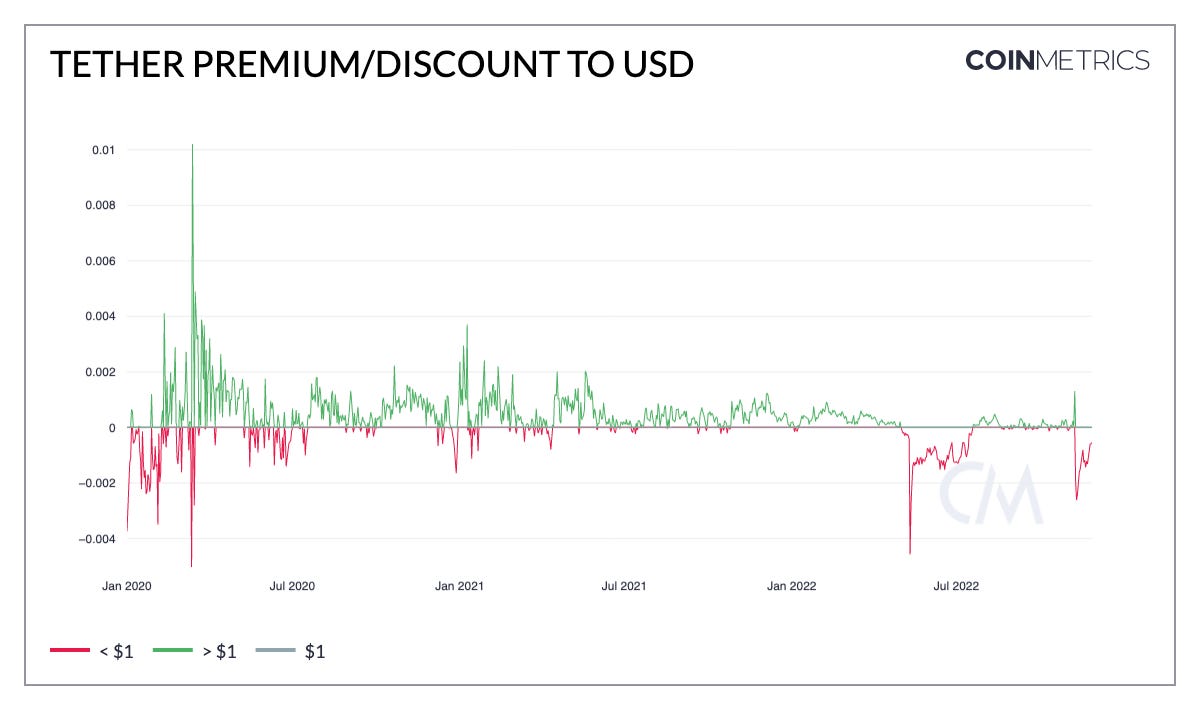

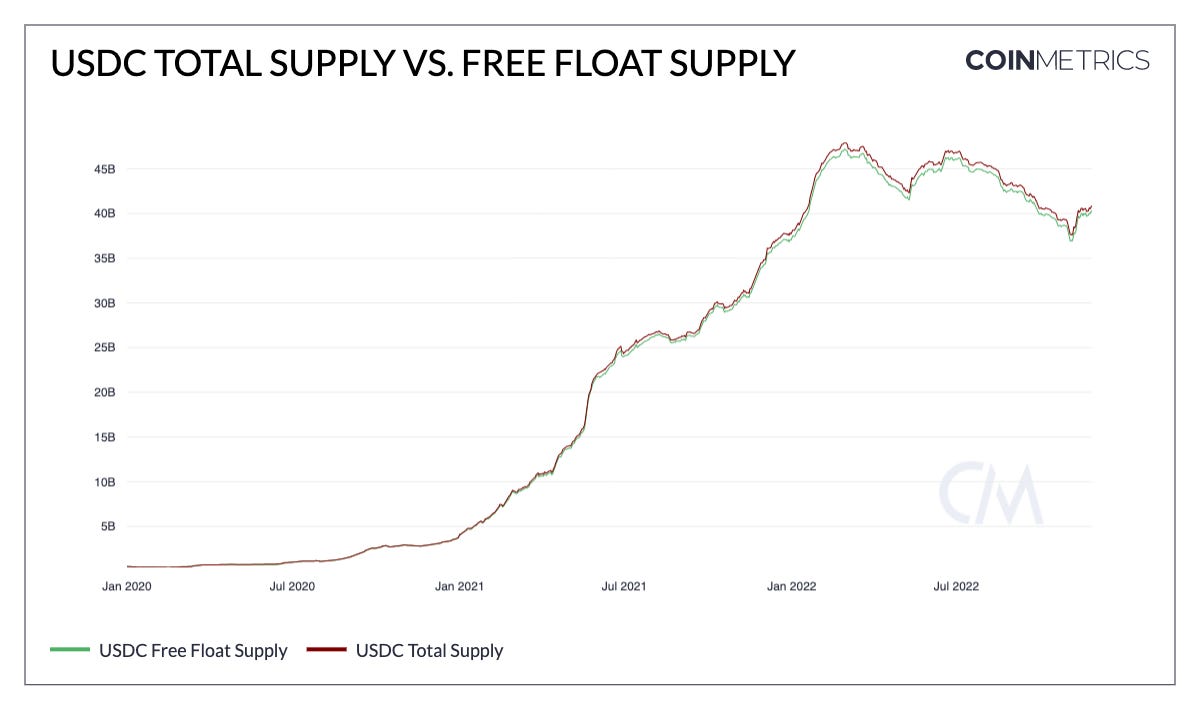

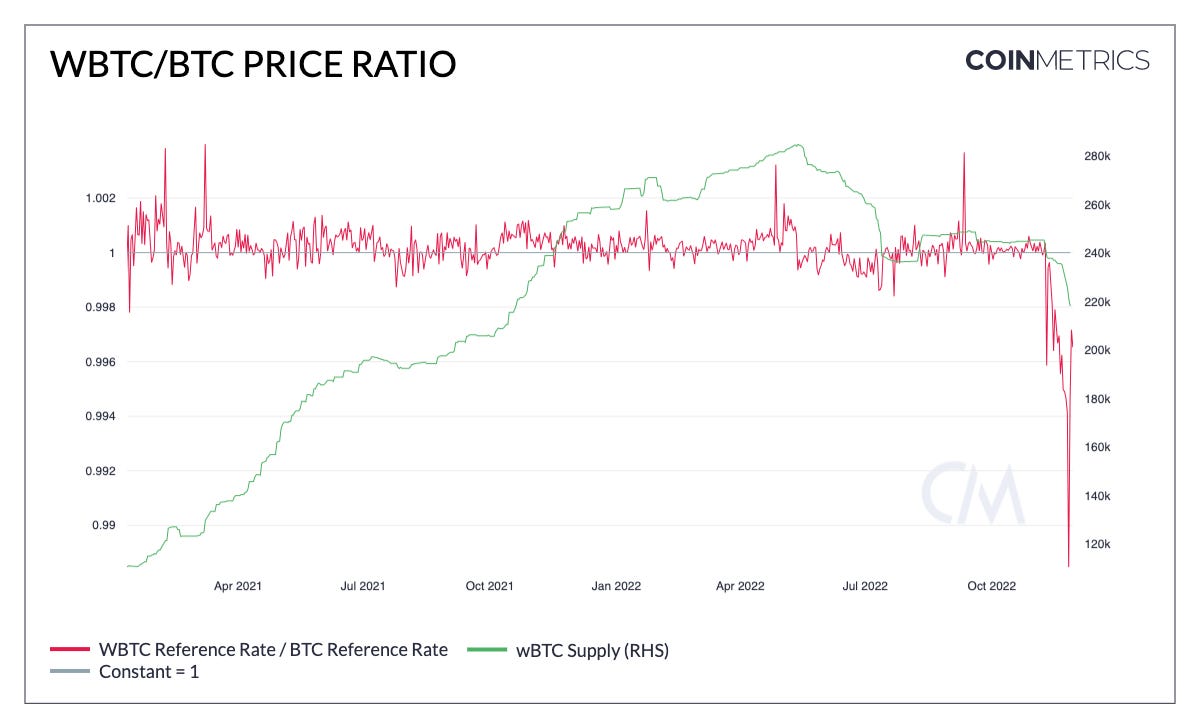

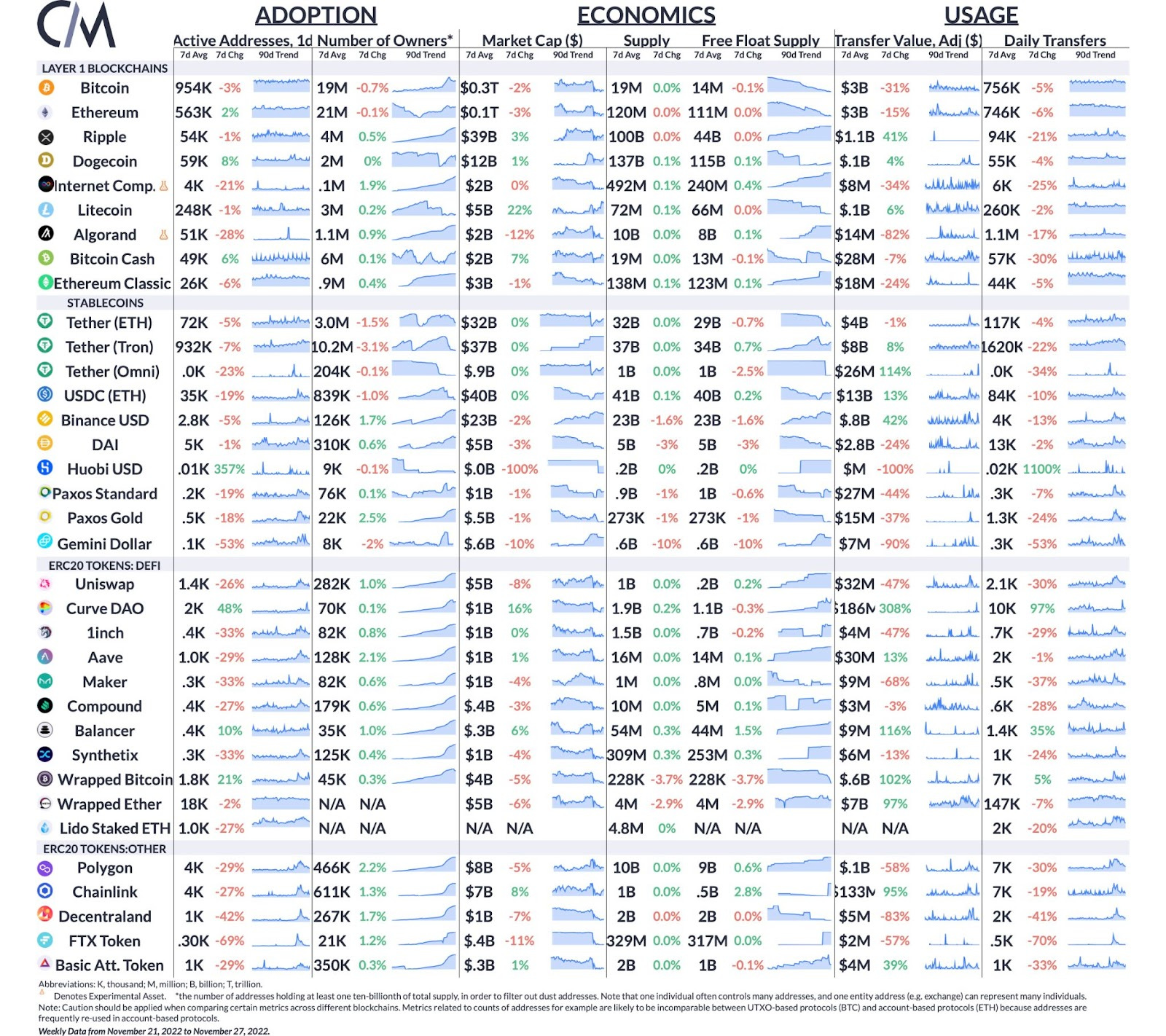

Get the best data-driven crypto insights and analysis every week: A Look at Stablecoins and Other On-Chain DerivativesBy Kyle Waters and Matías Andrade Crypto market participants continue to recalibrate following the abrupt shocks emanating from FTX’s woes. As we have covered in recent editions of State of the Network, the on-chain footprint of Alameda’s wallets stretched long and far across many crypto assets and blockchains. As a result, the impacts are vast and evolving. We believe one area of particular interest is stablecoins. Stablecoins are digital tokens issued on public blockchains that track an underlying asset, today, overwhelmingly the US Dollar. In the most popular fiat-backed model, issuers like USD Coin’s Circle hold reserves backing the tokens redeemable for the underlying dollar. Stablecoins came under serious scrutiny earlier this year after the vicious spiraling of the ‘algorithmic’ stablecoin Terra USD, but have continued to be a significant area of development in the digital assets industry. How has the stablecoin ecosystem held up in the wake of FTX’s collapse? AdoptionOne simple measure of adoption is value transferred on-chain. Using a relatively longer window of a 90-day moving average, daily value exchanged on blockchains with stablecoins is near all-time highs of $25B per day. About $20B of this is sourced from USDC (on Ethereum) and Tether (Ethereum and Tron) transfers. Source: Coin Metrics Network Data It’s also worth considering the role stablecoins played in permitting users to withdraw funds from exchanges to reduce their counterparty risk exposure. We can note that addresses holding an excess of $10,000 denominated in various stablecoins has increased in the last few months; USDC, in particular, has seen a significant increase since the beginning of November, from 76K to 86K addresses. Source: Coin Metrics Network Data Free Float Supply and RedemptionsCoin Metrics calculates a free float supply metric that better captures the liquid supply in circulation not held by treasuries or redemption accounts. This is especially important in the case of Tether, whose redemption model includes a treasury address where redeemed USDT is held. This USDT should not be considered part of circulating supply, so it is important to look at free float supply for an accurate assessment of supply trends. Since November 8th USDT supply (Ethereum, Tron, Omni) has decreased by about $4B from $67B to $63B. Source: Coin Metrics Network Data The redemptions come as the price of Tether dipped slightly below its $1 peg. This creates an arbitrage opportunity for certain larger market participants: they can buy USDT below $1 and redeem it at par. The rate of redemptions has not been as intense as spring of this year though, reflecting the less severe discount to the $1 peg. Source: Coin Metrics Network Data Meanwhile, the other fiat-backed stablecoin stalwart, USDC, has experienced a slight uptick in free float supply rising from $37B to $40B since November 8th. Source: Coin Metrics Network Data Looking to wBTCAlthough stablecoins are by far the on-chain derivatives with the greatest adoption, there are also “wrapped” assets, which are tokens that are used to interact with underlying assets that are not addressable from within a smart contract. Wrapped bitcoin (wBTC) is a derivative of bitcoin used in Ethereum that is managed by depositing BTC with an escrow custodian that issues wBTC tokens, making sure to keep a 1:1 correspondence between the two. Recently, the multi-sig address that is used to manage most of the wBTC funds was adjusted to remove inactive signatories (including FTX’s Blockfolio), going from 18 addresses to only 11, with eight signatures needed to approve transactions. Source: Coin Metrics Network Data Soon after the FTX fiasco, one of the main custodians of BTC backing wBTC, a company called BitGo, temporarily halted withdrawals, prompting the price of wBTC to deviate from that of the underlying BTC. The price of wBTC has since started to recover but remains below the BTC reference rate. wBTC supply has fallen has redemptions have accelerated. ConclusionAs both markets and participants look to learn and recover from recent events it is critical that we keep a close eye on the financial infrastructure that undergirds many of crypto’s most popular uses. Moreover, we can gather a lot of information by focusing on stablecoins as market participants endeavor to reduce their risk exposures and to safeguard their assets. To follow the stablecoin data used in this piece and explore our other on-chain metrics check out our free charting tool, correlation tool, and mobile apps. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro On-chain activity slowed as the dust settled a bit after FTX’s implosion. Most coins are still seeing an uptick in the number of owners, a likely result of users continuing to withdraw tokens from exchanges to self-custody wallets. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 182

Tuesday, November 22, 2022

Tuesday, November 22nd, 2022

Coin Metrics' State of the Network: Issue 181

Tuesday, November 15, 2022

Tuesday, November 15th, 2022

Coin Metrics' State of the Network: Issue 180

Tuesday, November 8, 2022

Tuesday, November 8th, 2022

Coin Metrics’ State of the Network: Issue 179

Tuesday, November 1, 2022

Tuesday, November 1st, 2022

Coin Metrics’ State of the Network: Issue 178

Tuesday, October 25, 2022

Tuesday, October 25th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏