On-chain analysis: Why is it wrong for Forbes to accuse Binance of "misappropriating 1.8 billion USDC"?

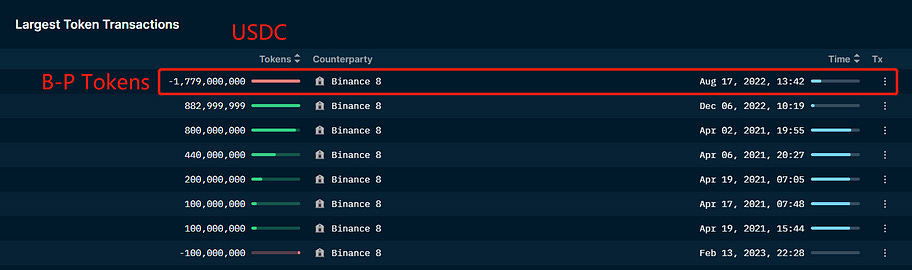

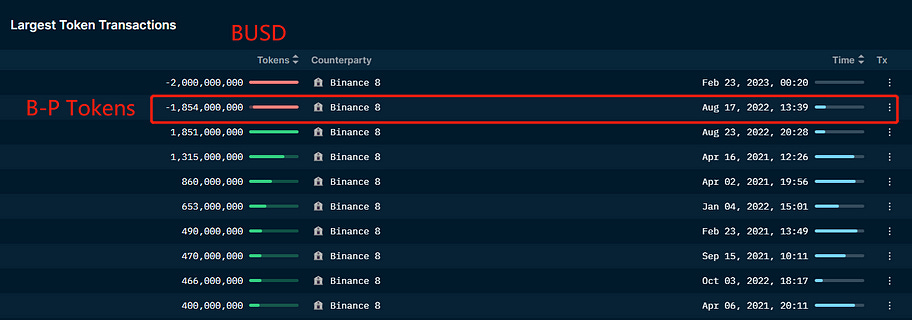

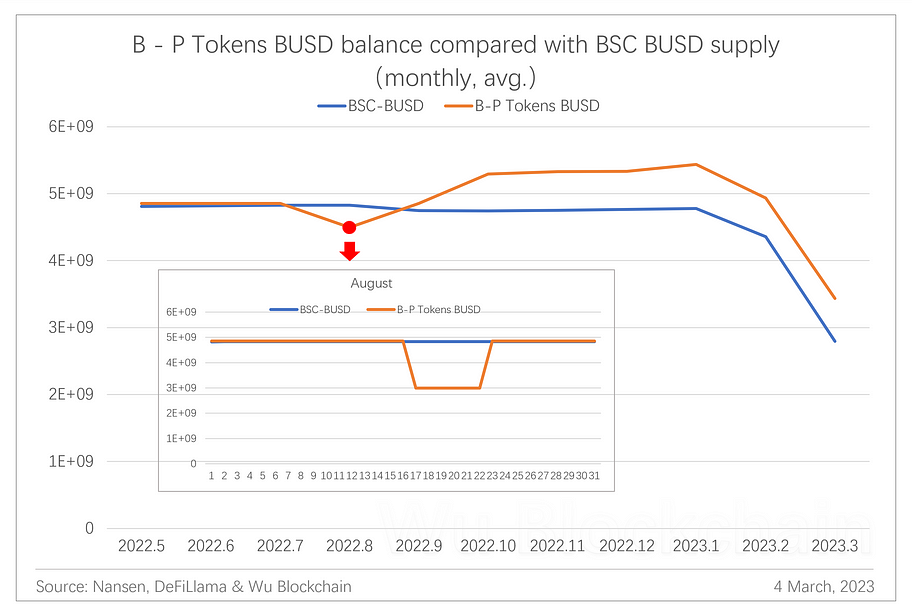

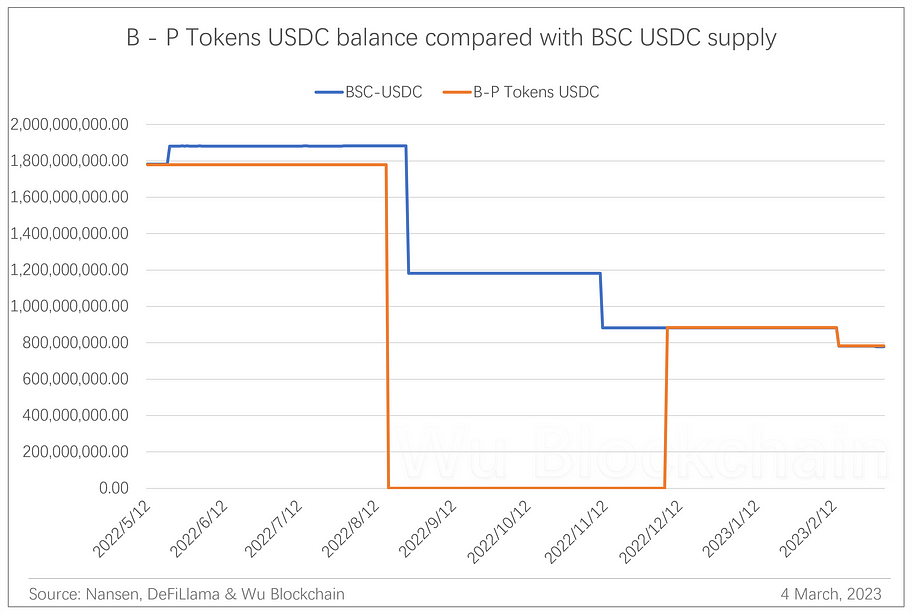

Author: @0xMavWisdom Forbes posted an article on Monday (February 27th) accusing Binance of quietly transferring $1.8 billion in stablecoin collateral to hedge funds including Alameda and Cumberland/DRW last year, and in doing so condemning Binance’s misappropriation of user assets. For a six-month-old statistic, Forbes’ timing of the article is also subtle, as just two weeks prior, Binance was also embroiled in controversy over BUSD. The article on the misappropriation of user assets apparently caused enough of a public outcry that Binance responded the next day, saying, “The institutions mentioned in the Forbes article are spontaneous transfers by institutional users; Binance has never misappropriated user funds, whether they are assets of centralized exchanges or collateral for B-token “. So what is the truth, this article will combine the on-chain data and address labels to restore it for you. Statement: This article has no interest relationship with the relevant parties in the article, nor has we communicated with Binance, Forbes and other relevant parties about this article. Forbes Article Core The central point of the lengthy Forbes article refers to last year’s $1.8 billion stablecoin, and that $1.8 billion is more than one. The first stablecoin is USDC, which refers to the transfer of 1.8 billion USDC from Binance-Peg Tokens (address) to Binance 8 at 13:42 on August 17, 2022, and later to Amber Group, Alameda, and Justin Sun via Binance 14 on the 24th. (1.8 billion is approximate, actual 1.779 billion) The second stablecoin is BUSD, which refers to the transfer of 1.8 billion BUSD from Binance-Peg Tokens to Binance 8 at 13:39 on August 17, 2022, and then retransferred back to Binance-Peg Tokens by Binance 8 on the 23rd. (1.8 billion is approximate, actual 1.854 billion) The point of contention is mainly on the first 1.8 billion USDC, so the focus will also be on this transaction. The second $1.8 billion BUSD flow was relatively straightforward, and eventually flowed back to its original position, and Forbes did not read much into the deal. In the analysis that follows, I speculate that the second $1.8 billion BUSD may be a companion to the first $1.8 billion USDC. Binance-Peg Tokens i.e. Binance: BSC-pegged Assets on Nansen, the former tag is from the Etherscan block browser and will also be referred to as B-P Tokens later, and are Ethereum assets by default. (tx: https://etherscan.io/tx/0x09f0c36b09d51f7207109132e3600a3fe928d3eb51fc28e25d92722e0421669d) (tx: https://etherscan.io/tx/0x92a093de270a1b86d4ac62cbfb50e2c897792ca6e3225385909030a1add8ce37) BUSD According to the label, theoretically, B-P Tokens addresses are assets issued on the native chain wrapped/pegged on BSC, such as the most classic and most debated for some time now, BUSD. BUSD is a stablecoin asset issued by Paxos on the Ethereum, and the BUSD in circulation on the BSC is an wrapped version of it. With a 1:1 pegging relationship, the amount of BUSD held by B-P Tokens addresses on Ethereum should theoretically be sufficient to fully cover the supply of BUSD on BSC at any given time. In practice, pegging is not real-time, and some deviation is normal, and will be rebalanced or updated periodically. The most recent time when the B-P Tokens BUSD balance was significantly lower than the BSC BUSD supply was between August 17 and 23 of last year, as a result of the 1.8 billion BUSD flow. At other times, B-P Tokens BUSD has always been approximately equal to or greater than BSC BUSD supply, and it is easy to see that the difference between the two has become relatively larger since last year’s $1.8 billion BUSD flow. In addition, from the POF reserve addresses disclosed by Binance in November last year, B-P Tokens is one of the key addresses of the Binance BUSD (Ethereum) reserve, i.e. the BUSD balance in the B-P Tokens addresses is not only wrapped to BSC BUSD (which is managed by Binance), but also a significant part of user assets. The movement of the 1.8 billion BUSD in the B-P Tokens addresses between August 17 and 23 did not cause any significant change in the supply of BUSD on the BSC, and if we look at it from this point of view, it is possible that this is just a deposit or withdrawal by an institutional user. Another possibility, which I will continue to explore below, returns first to the point of contention, USDC. USDC The role of USDC on B-P Tokens is similar. Circle does not issue native USDC on BSC, so the USDC circulating on BSC is actually an wrapped asset on the native issuing chain Ethereum. Therefore, the USDC on B-P Tokens is wrapped to the supply of USDC on BSC, so in theory, like BUSD, the balance of B-P Tokens USDC should cover the supply of BSC USDC. However, this is not the case. The USDC balance from the B-P Tokens address can be divided into several key nodes. One is before the transfer of 1.8 billion USDC from B-P Tokens to Binance 8. In the two or three months prior to this point in time, the B-P Tokens USDC balance was slightly less than the BSC USDC supply. Second, 1.8 billion USDC is transferred from B-P Tokens until December 6. Since the transfer of 1.8 billion USDC, the balance of B-P Tokens becomes 0 during this time period, but BSC USDC is still in circulation. Is this time unpegged? Not necessarily, in fact it is more likely that Binance has other addresses that are sufficient to cover the USDC assets in circulation on BSC, in other words there is another address or addresses to peg them. Third, from December 6 to the present, Binance 8 retransferred enough USDC assets to B-P Tokens to cover the BSC USDC supply, after which the B-P Tokens USDC balance was once again pegged to BSC USDC. In addition, although the B-P Tokens address was not part of the Binance POF disclosed in November as a USDC reserve address, B-P Tokens is one of the reserve addresses for USDT and BUSD, the two major stablecoins, so it is inferred that before Binance announced the removal of USDC, the situation for USDC at this address may have been similar to that of BUSD -existing as both a peg asset and a user asset. Unlike BUSD, the B-P Tokens address may have only served as one of the addresses that pegged the supply of BSC USDC, as BSC USDC was still in operation for a long time after the balance of that address’s USDC went to zero, and thus there may well have been another address or addresses that held a similar dual identity at some point in time. Therefore, given the lack of correlation between B-P Tokens USDC balance movements and BSC USDC supply, and the subsequent flow to institutions, it is more likely that institutional withdrawals were made. The Possible Truth There is actually no evidence that this $1.8 billion USDC transfer was an act of misappropriation of ordinary users’ assets; it is more likely a collective withdrawal by institutional users. So why would institutions do something similar en masse at this time? I think it’s likely that Binance had its partner institutions withdraw their USDCs first on the eve of the USDC removal. On September 5th of last year, Binance made an announcement about automatic conversion of USDC to BUSD and the removal of USDC pairs. It is worth noting that for USDC, Binance is not taking a direct sense of delisting, but rather converting USDC to BUSD, which could lead to problems such as insufficient collateral and insufficient BUSD reserves resulting from converting large USDC deposits of institutions to BUSD. It would be wise to let institutions withdraw first. The timing of the announcement, about half a month after August 17, was also appropriate, giving the institution plenty of time to consider and act. Also, looking back at the BUSD transfer, which took place around the same time gap, it is possible that Binance is preparing another hand in case there are really institutions willing to convert large amounts of USDC to BUSD and use other cold wallets to temporarily replace the peg BSC BUSD function. Perhaps after clarifying the attitude of the partner institutions, it was moved back to be used as a peg. From the USDC transfer path, B-P Tokens → Binance 8 → Binance 14, it is more likely that this is a cold wallet to hot wallet conversion process, which is Binance’s preparation for large institutional withdrawals of USDC. From the current perspective, Binance 14 is a user asset reserve address for USDC disclosed by Binance, and judging from the nature of the wallet and the historical balance, it is a hot wallet, not likely to be a peg for BSC USDC, and not as complex as the assets held by Binance 8. Therefore, it is reasonable that Binance 14, which is used only as a reserve of user assets, should be used as an outflow from it. I think Forbes is habitually misled by the definition of labels when it accuses large transfers of B-P Tokens assets as misappropriation. For example, the assets on the Binance-Peg Tokens address have multiple attributes and are not exclusively user assets; the main user assets on the B-P Tokens are USDT and BUSD. The user’s USDC assets are mainly composed of a total of 5 addresses such as Binance 14, 15, 16, etc. But on the other hand, this also requires the exchange to classify and use the addresses better. Binance-Peg Tokens(B-P Tokens):0x47ac0Fb4F2D84898e4D9E7b4DaB3C24507a6D503 Binance 8:0xF977814e90dA44bFA03b6295A0616a897441aceC Binance 14:0x28c6c06298d514db089934071355e5743bf21d60 This can be checked against the on-chain data and the POF address disclosed by Binance: https://www.binance.com/en/blog/community/our-commitment-to-transparency-2895840147147652626 Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekly project updates: Ethereum deploys account abstraction, Robinhood and Uniswap to launch wallet apps, ZigZag …

Saturday, March 4, 2023

1. ETH's weekly summary a. Ethereum developer: Goerli will be shut down eventually link Ethereum developer @TimBeiko tweeted to disclose the current state and future plans of the Ethereum test

VC monthly report: funding amount ended a four-month decline in February

Saturday, March 4, 2023

Author: WuBlockchain According to RootData statistics, in February, there were 120 public investment projects of crypto VC. The number increased 62% month-on-month (74 projects in January 2023) and

WuBlockchain Weekly:Silvergate fallout、Justin Sun bolstered Lido’s TVL、UK banks restrict cryptocurrencies and Top1…

Friday, March 3, 2023

Top10 News 1. Silvergate's weekly summary a. Silvergate may be poorly capitalized link Silvergate, a prominent crypto-friendly bank, couldn't file its annual financial report on time and told

Fore Elite Capital: How to do a compliant cryptocurrency fund in Hong Kong?

Friday, March 3, 2023

This article is an interview with Fore Elite Capital CFO Wing Tan Ask : Could you please provide some information about Fore Elite Capital's history, status, and future development plans? Wing Tan:

Underestimated Ambitions and Three Challenges: Unveiling the Hong Kong Cryptocurrency Consultation Paper

Thursday, March 2, 2023

Author:William, Special Researcher Editor: WuBlockchain On February 20, 2023, the Hong Kong SFC issued the “Consultation Paper” on cryptocurrency transactions, marking an important step taken by the

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏