Quick Update on SVB, Signature Bank Failures

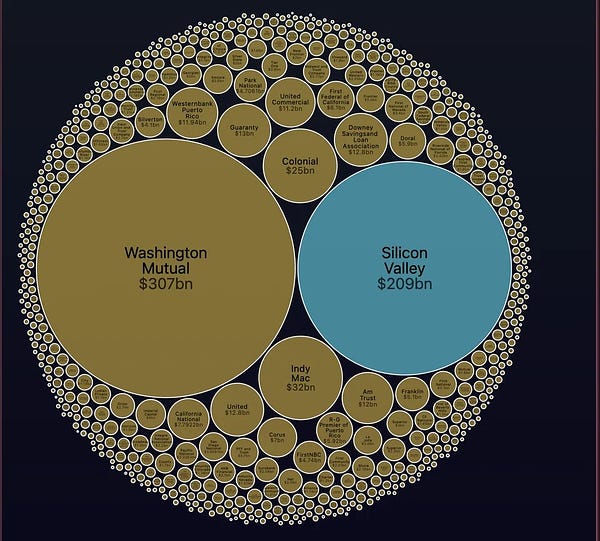

The economy is one big game of musical chairs. This week the music stopped. Let’s back up a little. As they say, the generals are always fighting the last war. The Federal Reserve kept interest rates low in the early 2000s in response to the Dot-com bubble and 9/11. Easy money makes people do stupid things. Banks started lending money to anyone and everyone, many of which were adjustable-rate mortgages (ARM). A massive Jenga tower of derivative securities based on these mortgages emerged. But we didn't find out about it until the Fed raised rates and took the easy money away. And the rest is history. If you thought that was easy money, wait until you hear what the Fed did after 2008. First, they lowered the Fed Funds rate to effectively zero. That means negative interest rates after inflation. That means YOU literally had to PAY the bank to keep your money. Then they injected trillions of free dollars into the economy by increasing its balance sheet to almost $5 trillion. Just when the Federal Reserve started increasing interest rates and taking back the money they printed, COVID hit. So they dropped the rates back to zero and increased the balance sheet to $9 trillion. And people started doing all kinds of stupid things with their easy money. Like buying shares in a company before they knew what it is (SPACs), or pumping billions of dollars into meme cryptocurrencies with no value, or blowing up the value of stocks that are losing money. Now the Fed is ripping the rug out from under the table by raising rates at the fastest pace since the 1980s and trimming its balance sheet. Eventually, something was going to break. What Happened?Silicon Valley Bank (SVB) is a regional bank in Santa Clara that provides banking services for Silicon Valley startups. They invested their short-term deposits in long-term Treasuries and mortgage-backed securities (MBS). These are supposedly risk-free assets. But when interest rates rise, their prices drop dramatically. It's not a problem if SVB doesn't sell the bonds. But when the stock market dropped and VC money dried up, startups were forced to withdraw their money from the bank, and SVB had to sell the bonds at a massive loss to cover the withdrawals. On Thursday, customers tried to withdraw $42 billion in deposits, almost a quarter of all deposits at the bank. That led to a massive bank run, and on Friday, the SVB failed and was taken over by the FDIC. It's the second-largest bank failure in history. What's NextTechnology, healthcare, and crypto startups like Roku and Circle had large portions of their cash assets at SVB. What happens to all these startups? Will lost deposits lead to bankruptcies or layoffs? Payroll is due this Wednesday.  Hi, I’m Lindsey. A bit about me:

- Ohio mother of 4

- I employ a team of 15 as a start-up founder & CEO of Strongsuit

- drive a used Honda Odessey

- husband works in manufacturing

- The financial future of my company, team and family are at risk w/ the collapse of SVB (1/23) The larger question is: will this spread to other financial institutions as it did with Bear Sterns and Lehman brothers in 2008? While I was writing this article, Signature Bank, a New York state-chartered commercial bank with roughly $118 billion in assets, was taken over by New York state regulators and placed in the hands of the FDIC. Will other banks fail in the coming days/weeks? If they do, how will the federal government respond? In 2008, Congress and the Fed controversially gave the financial sector massive taxpayer-funded bailouts. The venture capital community is arguing for the Fed to do it again, promising there will be a financial system collapse and mass layoffs if they don't.  .@DavidSacks says unlike the 2008 bailouts, Silicon Valley Bank stockholders, bondholders, and executive stock options should be wiped out, but the people and small businesses who deposited money must be protected so this contagion doesn't spread:

"Blaming the depositors in this… https://t.co/LaEtyLARkJ As of Sunday night, the FDIC is holding an auction for SVB, while Treasury Secretary Janet Yellen, Fed Chair Jerome Powell, and Federal Deposit Insurance Corp. Chair Martin Gruenberg announced in a joint statement that SVB and Signature Bank were considered systemic risks to the financial system, allowing them to insure deposits over $250,000. That might calm down depositors for now. But it will be controversial with the populists, who argue that the regulators are motivated by corruption and guaranteeing deposits leads to moral hazard.  By "depositors" he means his corporate friends, not you and not your version of a small business.

Here is a list of SVB depositors. Many you will know and others, like China Renaissance Fund and China Consumer Management Fund are the biggest depositors.

s3.documentcloud.org/documents/2370…  Mitt Romney @MittRomney  There’s something very ugly happening right now: VCs & startup execs who stand to lose their deposits at SVB are going *out of their way* to push a narrative that there’ll be a bank run on Monday if SVB depositors aren’t bailed out by the government. They’re yelling fire in the… https://t.co/6GYfGRczPk  If all bank deposits are now insured 100% by the US govt … what new moral hazards are we building into the system?

If there is zero risk to bank risk managers making lousy decisions, they can “bet the bank” for their annual bonus, knowing the US govt will cover them if wrong. If the US government successfully calms down the financial system, this week might just be a blip on the radar. But if they can't, it may be the start of the nasty recession we've been preparing for. This is the way. God bless and God bless America, -Jeff and Luke |

Older messages

The Practical Guide to Rebellion: Part 1

Sunday, March 5, 2023

The Main Street Way

One Way Out

Friday, February 17, 2023

How "Andor" Inspires Our Rebellion

What If Social Media Went Away?

Thursday, February 2, 2023

What's on the other side of the "twitch"?

Main Street = Lots and Lots of Elons

Sunday, January 29, 2023

Our collective wealth could crush the elites.

Starve an Elite, Feed a Village

Friday, January 20, 2023

Little changes, massive impact.

You Might Also Like

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news

Outperform AI

Monday, March 3, 2025

Computer jockeys everywhere are having their job security threatened by AI. To delay the machine takeover, create an AI-proof side hustle or business.

The One Question Jeff Bezos Says You Should Be Asking

Monday, March 3, 2025

“When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”