DeFi Rate - This Week In DeFi – June 9

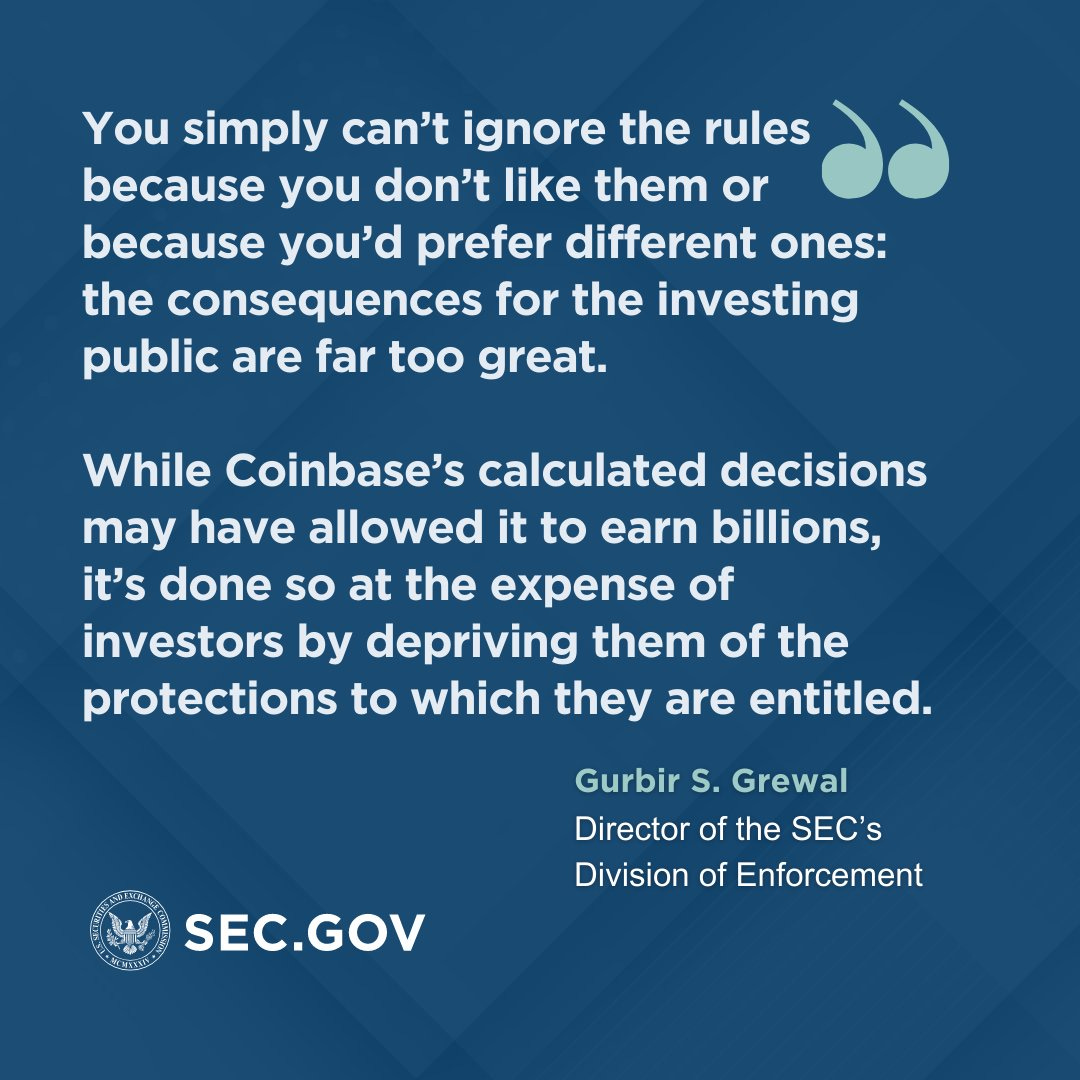

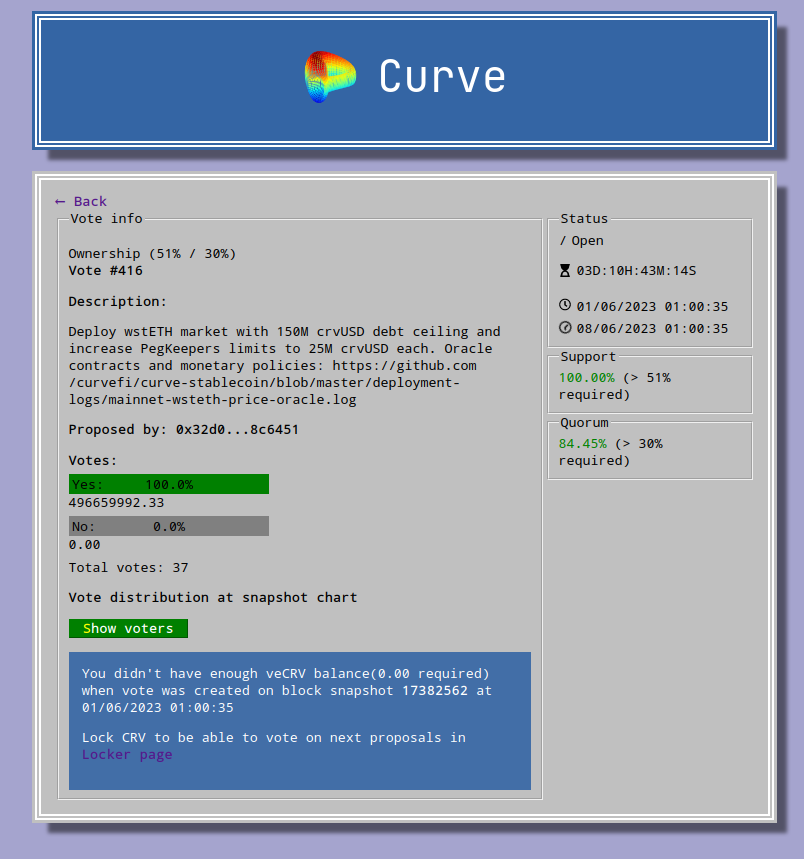

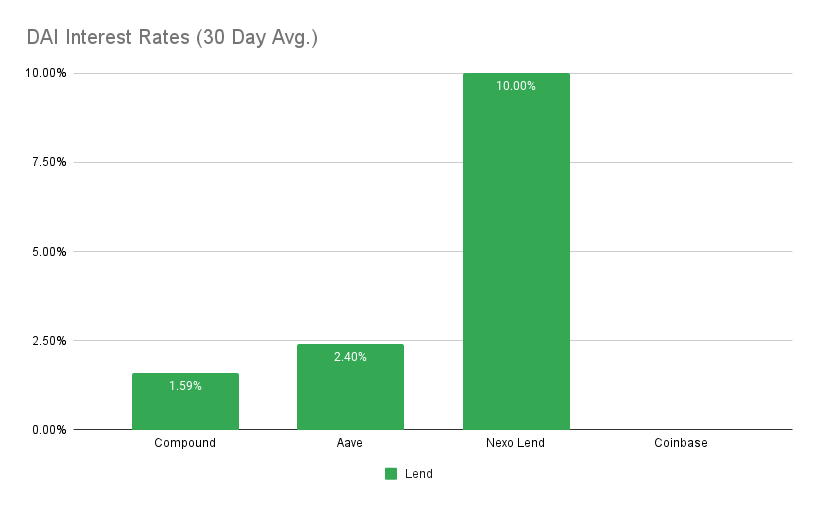

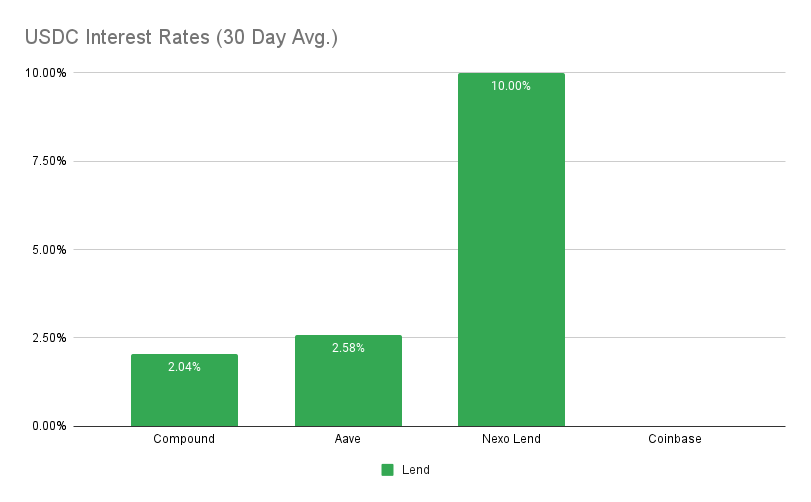

This Week In DeFi – June 9This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.To the DeFi Community, This week, the US Securities and Exchange Commission (SEC) has filed a lawsuit against crypto exchange Coinbase, claiming that its staking service qualifies as an investment contract under US law. SEC chair Gary Gensler stated that Coinbase did not register its staking-as-a-service program, depriving investors of necessary disclosure and protections. Additionally, the SEC argues that the tokens offered through the service are securities. Since the SEC’s action, there has been a notable increase in users unstaking their staked ether on the exchange. On-chain data reveals that approximately $75 million worth of Coinbase Staked Ether (cbETH) has been burned for redemption since the lawsuit was announced. https://twitter.com/brian_armstrong/status/1666129111025324035 Curve Finance has voted in favor of onboarding Lido's liquid staking token, stETH, as collateral for its crvUSD stablecoin. The proposal received unanimous support with a significant quorum of over 84% of the circulating supply participating in the vote. The inclusion of stETH increases the crvUSD debt ceiling by 15 times to $150 million. If crvUSD reaches this new limit, it would become the 13th-largest stablecoin globally. Currently, crvUSD users can only mint the stablecoin against deposits of Frax's staked liquid staking token (LST), sfrxETH, which has a $10 million debt limit. https://twitter.com/CurveFinance/status/1665362759918256131 Ethereum Name Service (ENS) is preparing to support a new web domain called .box, which will function like conventional internet domains and can be routed on web browsers. The .box domain is part of the My.Box project and will enable blockchain-based internet name services for Ethereum users, allowing domains to be used for both crypto and internet services such as email. Registrations and transfers of .box domains will take place on the Ethereum blockchain, and ownership will be represented by associated NFTs. The My.Box project is scheduled to go live in September and aims to simplify decentralized naming and promote the adoption of blockchain-native domains. https://twitter.com/nicksdjohnson/status/1666368619876327424 Atomic Wallet, a crypto wallet with 5 million users, has suffered a breach resulting in the loss of over $35 million in assets, with the potential for the damage to exceed $50 million as more reports of stolen assets emerge. On-chain investigator ZachXBT discovered the exploit and managed to recover over $1 million of the stolen funds for one victim. However, the details of the recovery process have not been disclosed due to ongoing risks. The company's response to the incident has faced criticism, with users contesting their claim that the last exploit transaction occurred over 40 hours ago. User compensation remains uncertain, as Atomic Wallet's terms and conditions state that the company is not obligated to compensate users for more than $50 in damages, leaving many users with significant losses and limited recourse for recovery. https://twitter.com/AtomicWallet/status/1664946301815910400 It’s been another bumpy week for centralized platforms, as the SEC files major lawsuits against exchange leaders Binance and Coinbase. The enforcement actions have sent DeFi activity soaring, as trading volumes increase and a surplus of users rush to remove their Ether from Coinbase’s staking service. Although it was somewhat expected (given the SEC’s previous comments and similar actions against platforms such as Kraken), the lawsuit is a huge blow to staking as a service. It may be a net positive for DeFi, as would-be Ethereum stakers will have to migrate to alternative services such as Lido or Rocket Pool – perhaps a first step into the DeFi world for many of them. Some other interesting developments involve decentralized websites and social media, as ENS expands to web domains with the My.box project and Lens raises $15 million for social media on the blockchain. These will both be fascinating to watch, given the increased censorship of traditional Web 2.0 platforms in recent times. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 2.6% APY Top StoriesSEC claims BNB and BUSD are securities, including major tokens SOL, ADA and MATICCircle obtains Major Payment Institution license in SingaporeSwift and Chainlink Will Test Connecting Over a Dozen Financial Institutions to Blockchain NetworksGenesis Bankruptcy Judge Extends Mediation Period Between Genesis, CreditorsStat BoxTotal Value Locked: $45.52B (down 2.4% since last week) DeFi Market Cap: $46.87B (down 1.6%) DEX Weekly Volume: $12.39B (up 85%) Bonus Reads[Michael McSweeney – The Block] – Optimism completes upgrade of its Layer 2 network [Tim Copeland – The Block] – Lens Protocol raises $15 million to boost decentralized social media [Tom Mitchell Hill – Cointelegraph] – SEC crackdown on Binance and Coinbase surge DeFi trading volumes 444% [Shaurya Malwa – CoinDesk] – Aave Lending Protocol Moves Closer to Launching GHO Stablecoin on Ethereum Mainnet This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – June 1

Friday, June 2, 2023

This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀

This Week In DeFi – May 26

Friday, May 26, 2023

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

This Week In DeFi – May 19

Friday, May 19, 2023

This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular

This Week In DeFi – May 12

Friday, May 12, 2023

This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customers

This Week In DeFi – May 5

Friday, May 5, 2023

This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏