DeFi Rate - This Week In DeFi – June 16

This Week In DeFi – June 16This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.To the DeFi Community, This week, leading stablecoin Tether (USDT) deviated minorly from its peg this week, also causing a heavy imbalance to Curve’s 3Pool – indicating a sudden exodus from the token. The move came as Tether attempted to front-run news from CoinDesk, who allegedly obtained the company’s quarterly financial reports from the New York Attorney General’s office. According to Bloomberg, the documents confirm that the company once held securities issued by Chinese companies as part of its reserves – information that was widely speculated at the time. USDT is still trading slightly off-peg at around $0.998 at the time of writing. https://twitter.com/paoloardoino/status/1669686254542155777 Uniswap Labs CEO Hayden Adams has outlined the vision for Uniswap V4, the next version of the Uniswap protocol. The draft code for V4 has been released and will be evaluated over the coming months, with new version offering greater customization through the use of "hooks" – plugins that allow developers to build pools with their own rules and functionality. V4 also introduces a more efficient architecture that reduces the cost of creating pools by 99% and eliminates the need to transfer tokens between different smart contracts. Uniswap V4 will coexist alongside V3 on the Ethereum blockchain, and its development and governance will be led by the Uniswap community. https://twitter.com/Uniswap/status/1668603580184502276

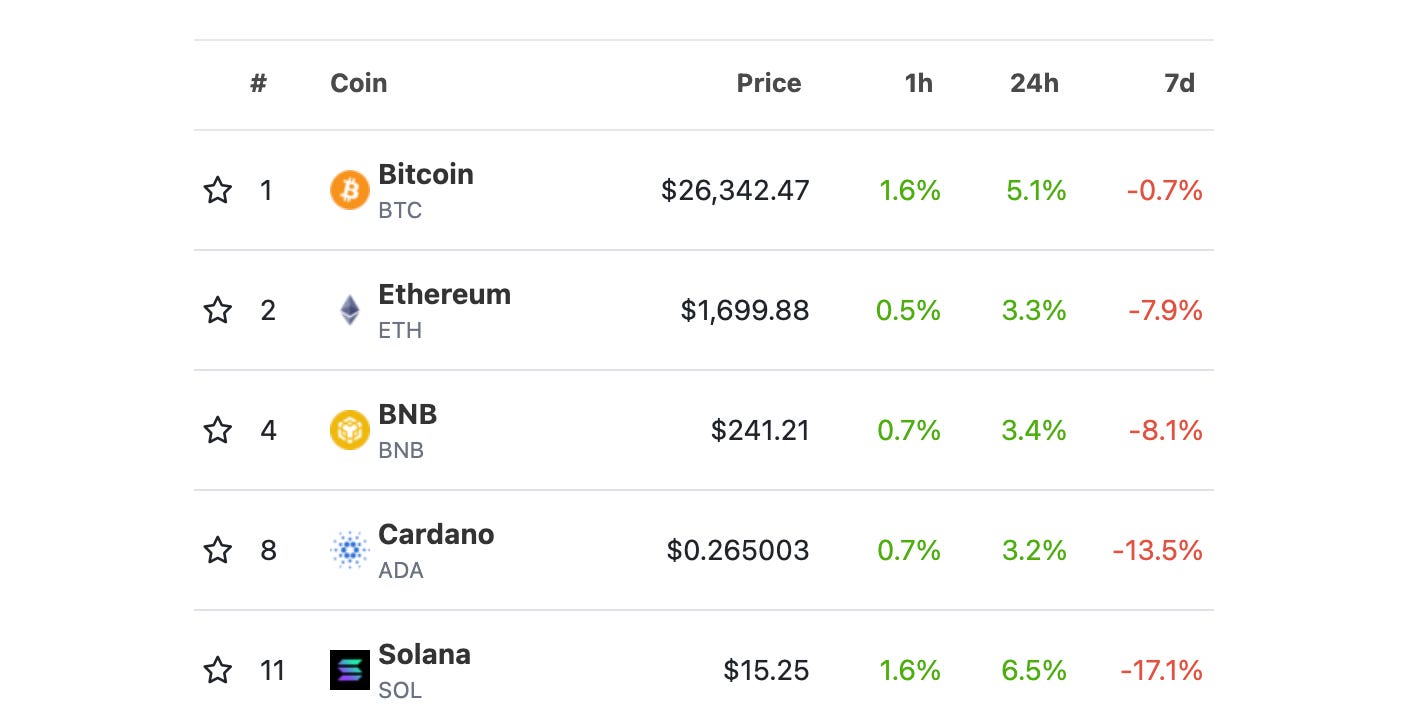

Frax Finance has revealed plans to launch its own Layer 2 blockchain, called Fraxchain. The network will focus on decentralized finance and will utilize a Layer 2 rollup model, publishing state roots to the Ethereum mainnet for security. Transaction fees on Fraxchain will be paid using the Frax stablecoin and Frax Ether, a liquid staking derivative. Fraxchain will also feature decentralized sequencers, which will be operated by entities chosen through governance voting, allowing for a more decentralized approach compared to other Layer 2 solutions. The chain is expected to be operational by the end of the year and will be governed by holders of Frax Shares (FXS) tokens. https://twitter.com/FlywheelDeFi/status/1669463865116209152 Curve Finance’s native CRV token has hit a one-year low, as reports arose regarding risky loans taken by founder Michael Egorov via the Aave protocol. According to LookOnChain, Egorov deposited 431 million CRV worth almost $250M across multiple lending platforms, borrowing more than $100M in stablecoins against the collateral. CRV faced a possible $107M liquidation on Aave if CRV fell below a price of $0.37 – prompting Ergov to return $1.35M in USDT to Aave to reduce his debt. His position accounts for 30% of the total CRV token supply. A controversial proposal was made to the Aave community that all CRV tokens on Aave v2 should be frozen, and the LTV ratio for CRV be adjusted to zero. https://twitter.com/gauntletnetwork/status/1669061394874920960 The SEC continues to be a thorn in crypto’s side this week, as the public comment period comes to a close on a recent proposal that may affect a majority of DeFi platforms. The proposal of concern includes an adjustment to the definition of “exchanges”, which may match DeFi protocols – potentially resulting in a blanket-ban of most protocols. In addition, the SEC also recently labelled most Layer-1 blockchain native tokens as securities, triggering a sell-off on those assets. Fortunately, innovation in the industry is still humming along nicely, with a variety of interesting developments:

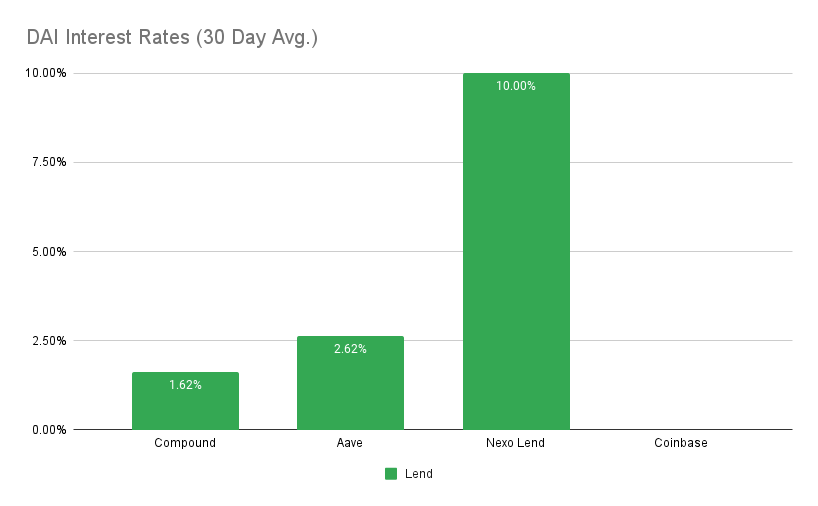

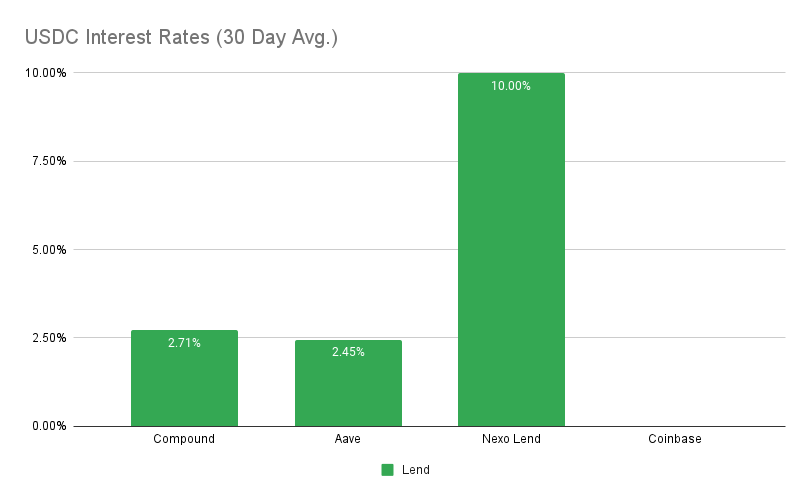

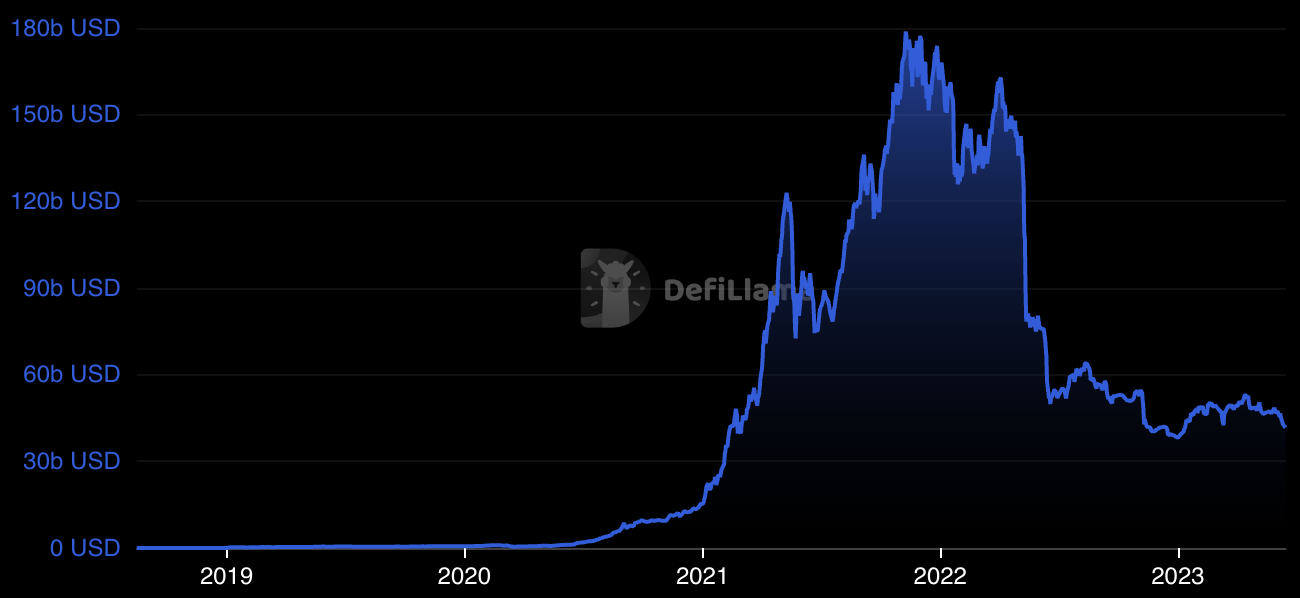

While market prices are reaching tough pain points for holders, development is looking strong for DeFi – providing fascinating new features and opportunities for those of us who are still active. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.6% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.7% APY Top StoriesU.S. SEC Out-of-Bounds in Dragging DeFi Into Proposed Exchange Rule, Industry SaysPolygon Unveils 2.0 RoadmapLayer 1 Tokens Crumble After SEC Calls Them SecuritiesMakerDAO Hikes DAI Savings Rate, Ousts Paxos Dollar, Curbs Gemini Dollar in ReserveStat BoxTotal Value Locked: $41.69B (down 8.4% since last week) DeFi Market Cap: $42.72B (down 8.9%) DEX Weekly Volume: $14.69B (up 16%) Bonus Reads[James Hunt – The Block] – Coinbase customers can now earn 4% USDC rewards despite SEC scrutiny [Nikhilesh De – CoinDesk] – Crypto Lender Abra Has Been Insolvent for Months, State Regulators Say [Sage D. Young – CoinDesk] – EigenLayer’s Restaking Smart Contracts Reach Max Limit on Same Day as Mainnet Launch, Pulling in $16M [James Hunt – The Block] – Gaming-focused Layer 3 Xai set to launch on Arbitrum This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – June 9

Monday, June 12, 2023

This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.

This Week In DeFi – June 1

Friday, June 2, 2023

This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀

This Week In DeFi – May 26

Friday, May 26, 2023

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

This Week In DeFi – May 19

Friday, May 19, 2023

This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular

This Week In DeFi – May 12

Friday, May 12, 2023

This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customers

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏