DeFi Rate - This Week In DeFi – June 23

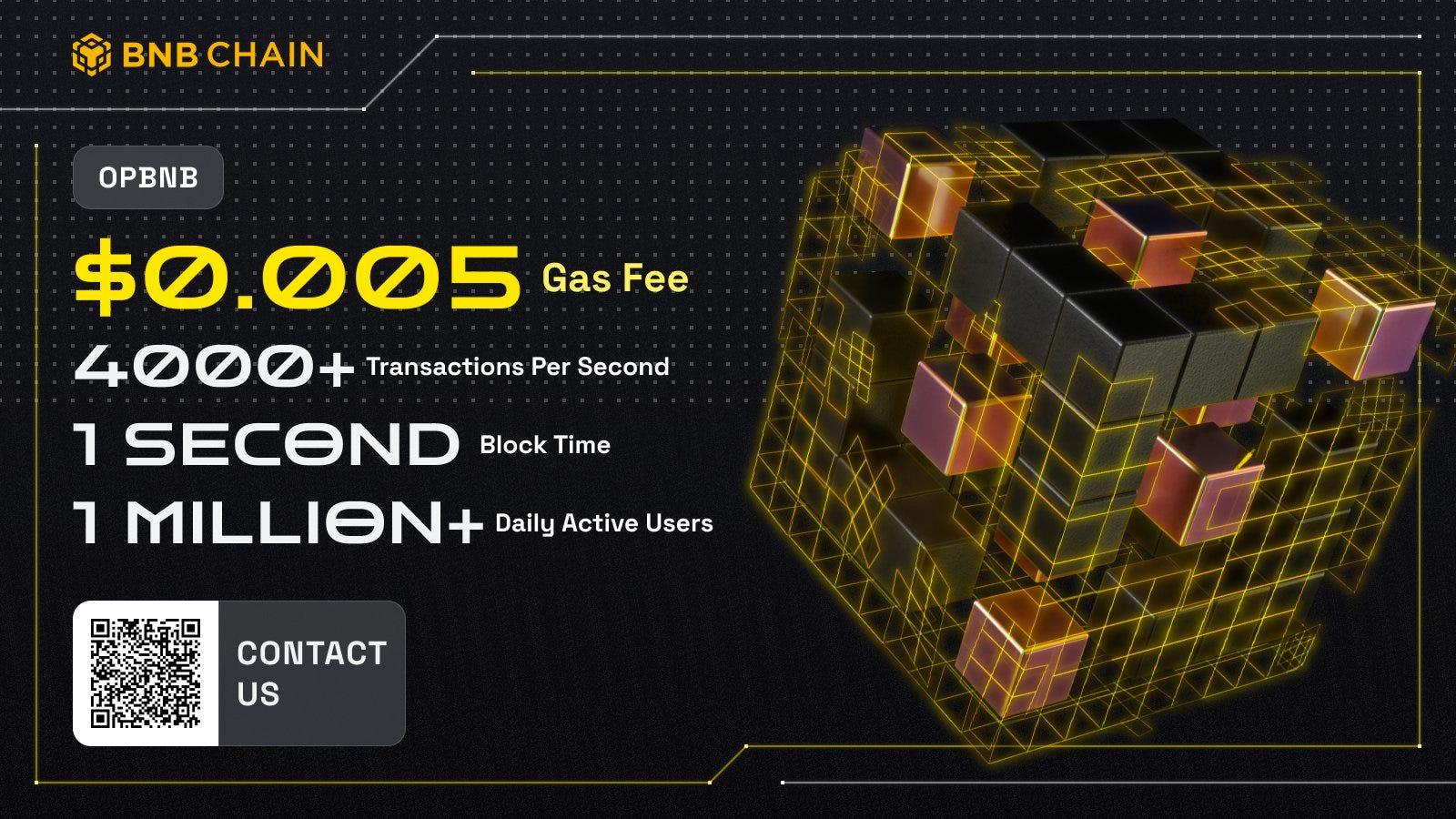

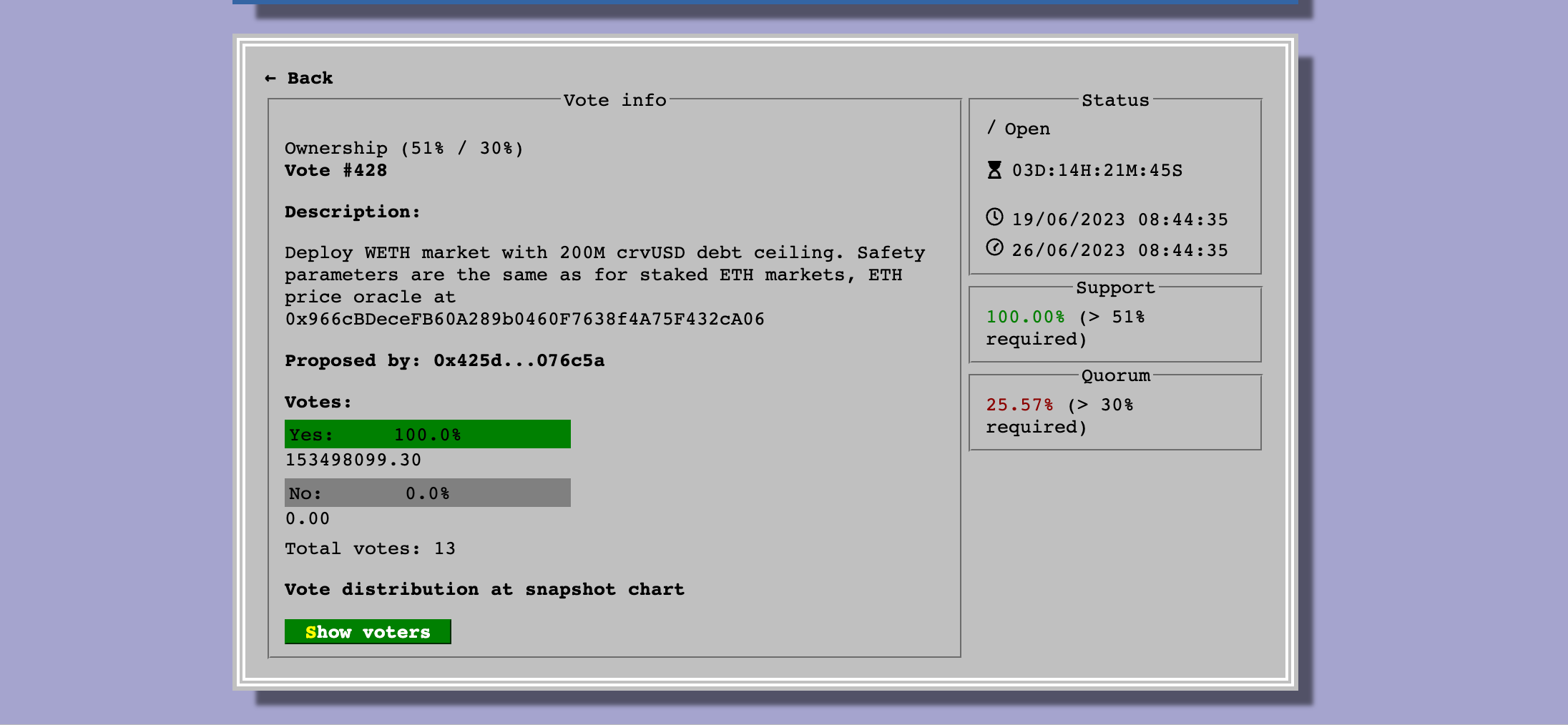

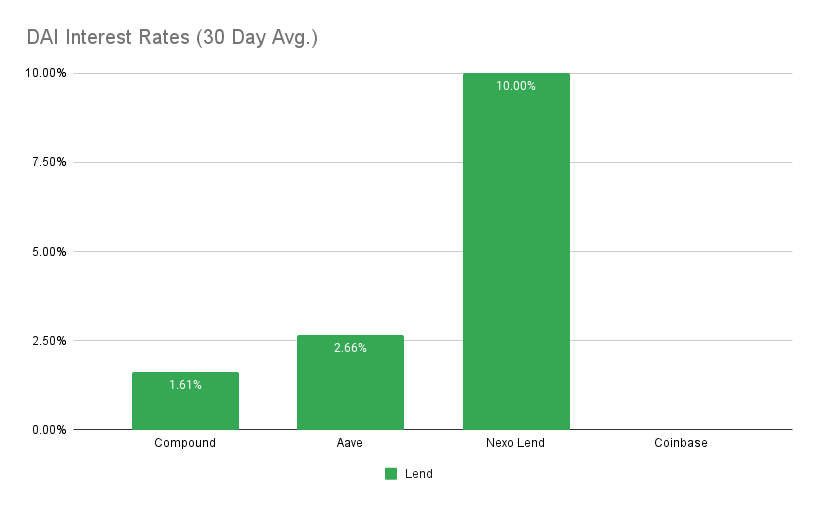

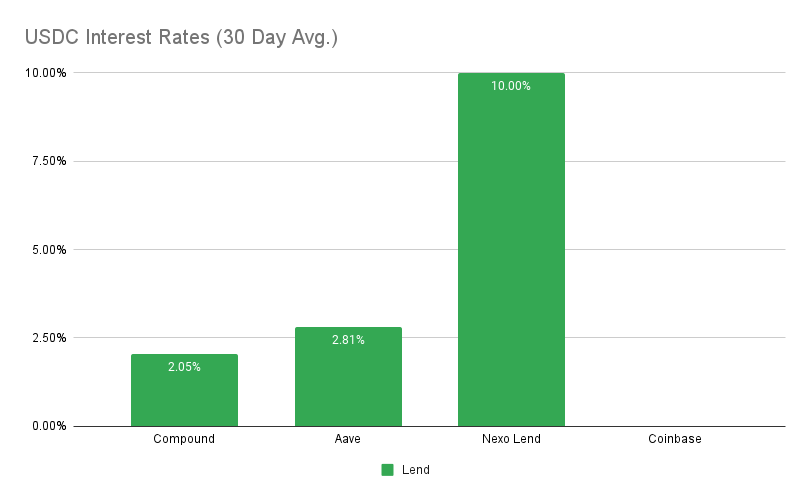

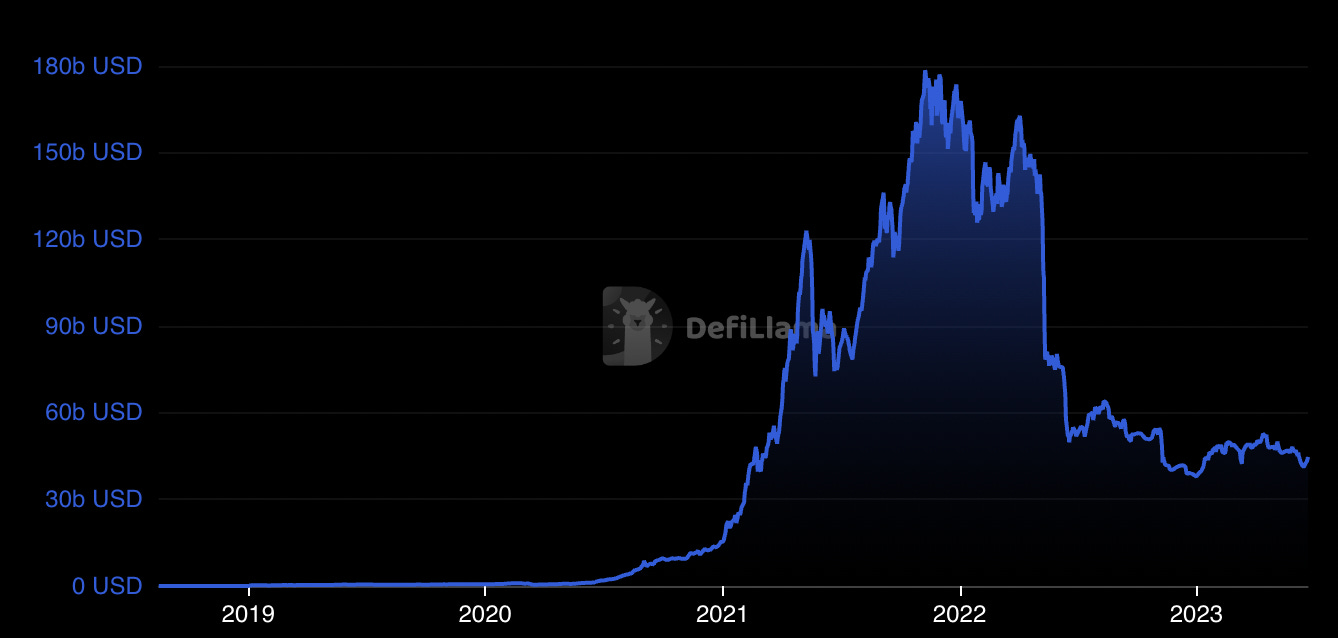

This Week In DeFi – June 23This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.To the DeFi Community, This week, BNB Chain has launched its “opBNB” testnet – a Layer-2 network based on Optimism's OP Stack. The developers estimate that the testnet will achieve speeds of 4,000 transactions per second at a cost of 0.005 cents per transaction. This is comparable to other scaling platforms such as Arbitrum, as well as twice as fast as BNB Chain. opBNB will be EVM-compatible, continuing to facilitate the easy migration of Ethereum-based applications to the BNB ecosystem. https://twitter.com/BNBCHAIN/status/1670783527485419521 Polygon developers have proposed transitioning their Proof of Stake (PoS) sidechain into a zero-knowledge-powered validium, similar to a rollup. The upgrade aims to enhance the network’s security and performance. Existing dApps would be able to operate without changes during the transition. If a consensus is easily reached, the upgrade could go live before Q1 2024. The proposal follows Polygon's plans to reorganize into a unified multichain ecosystem called Polygon 2.0, focusing on zero-knowledge scaling solutions. Polygon’s PoS Chain is the largest network in its ecosystem, processing 2.5 million transactions per day and having a total of $930 million in assets locked within its system. https://twitter.com/0xPolygonLabs/status/1671208777784209441 Ethereum core developers are considering increasing the maximum amount of staked Ether (ETH) required to become a validator from 32 ETH to 2048 ETH. The proposal aims to address the inflation of the validator set size while making the Ethereum network more efficient over time. Additionally, the proposal suggests auto-compounding validator rewards to allow validators to earn more money on their staked ETH. The current 32 ETH limit has led to a surge in validator addresses, with over 700,000 validators and a further 90,000 awaiting activation. The proposal has received mixed reactions from the crypto community, with concerns about potential centralization and skepticism about its benefits to the network. https://twitter.com/sassal0x/status/1670785867856871424 Curve Finance is currently voting on whether to accept Wrapped Ether (WETH) as collateral for its crvUSD stablecoin. If approved, users will be able to use WETH to mint up to 200 million crvUSD. WETH is tokenized Ether on the Ethereum blockchain, with its value pegged one-to-one to ETH. Currently, Curve accepts Wrapped Staked Ether and Staked Frax Ether as collateral for minting its stablecoin. The crvUSD stablecoin, similar to MakerDAO's DAI, is over-collateralized by supported crypto assets. Users can mint crvUSD stablecoins through over-collateralized loans on the Curve platform. https://twitter.com/chago0x/status/1670717571312631810 Although not DeFi, traditional financial institutions have all piled into the headlines at once this week – causing quite a stir. Investment behemoth Blackrock has applied for a spot Bitcoin exchange-traded fund (ETF), as have asset management firm WisdomTree and Invesco. If successful – which BlackRock appears to almost always be – the move could open the floodgates to spot Bitcoin investment on a never-before-seen scale. On top of ETF applications, Fidelity, Charles Schwab and Citadel have launched a cryptocurrency exchange called EDX Markets. The new exchange, which conveniently appeared right after a flurry of SEC enforcement actions against established crypto exchanges, will use financial intermediaries to facilitate trades, rather than custody customer funds. Turning to the actual DeFi side of things, zero-knowledge rollups appear to be gaining more and more popularity from users and developers alike. Polygon developers are proposing switching the network’s popular proof-of-stake platform to a zk-rollup mechnism, BNB Chain has launched its very own rendition of Optimism’s OP stack on testnet, and zkSync has reached half a billion dollars in total value locked – in a bear market. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.7% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.8% APY Top StoriesBlackrock’s spot Bitcoin ETF renews optimism, sparks wave of new filingsCrypto Exchange Backed by Fidelity, Schwab and Citadel Launches With Additional InvestorsCentral Banks Propose CBDC, Stablecoin Standards With Amazon, Grab Running TrialsFrance DeFi Paper is Latest Sign of Global Regulators Warming Up to CryptoStat BoxTotal Value Locked: $44.71B (up 7.2% since last week) DeFi Market Cap: $46.04B (up 7.8%) DEX Weekly Volume: $13.56B (down 7.7%) Bonus Reads[MK Manoylov – The Block] – MakerDAO purchases $700 million in Treasury bonds, grows holdings to $1.2 billion [Samuel Haig – The Defiant] – Optimism Unveils $40M Public Goods Funding Round [Judith BannermanQuist – Cointelegraph] – Binance to implement Lightning Network nodes for enhanced Bitcoin transactions [Omkar Godbole – CoinDesk] – Ethereum Layer 2 Network zkSync Era's Locked Value Surpasses $500M This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – June 16

Tuesday, June 20, 2023

This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.

This Week In DeFi – June 9

Monday, June 12, 2023

This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.

This Week In DeFi – June 1

Friday, June 2, 2023

This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀

This Week In DeFi – May 26

Friday, May 26, 2023

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

This Week In DeFi – May 19

Friday, May 19, 2023

This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏